Gold And Silver - Rally Or Not? War Or Not? Probably Not For Both

Commodities / Gold and Silver 2014 May 10, 2014 - 11:41 AM GMTBy: Michael_Noonan

The elites want war. Will they get war?

The elites want war. Will they get war?

In the past, it was a slam dunk. There was no nation strong enough to oppose the elite's weapons of mass destruction, aka debt and the US military. How things have changed. The failed Western banking system is way past its expiration date. All the elites horses and all the elites men can never put back this broken derivative mess again.

War has always been the go-to tactic for the Rothschild-driven control-the-world- mentality. From the spawned chaos arising from their carefully chosen plan[s] for instigating war[s], not only would they ultimately prevail in their sick objective of manic control, they would make a ton of money and grow their operations even more.

How have things changed?

West v East. Get ready for a RRRUUUUMMMMBLE. In the West corner, representing a broken banking system, a democracy-gone-wild, turned Fascist, a spy-driven network of governments running on fiat exhaust fumes is none other than the elite-propped community-organizer-turned-teleprompter-reading US president, dispenser of unlimited amounts of fiat, lies, and elite evangelism, BarACK HuSAIN OoooBOMBA!

In the East corner, fresh from rebuilding a West-led breaking of its government is former KGB head, [a different kind of community organizer], President, Prime Minister and President again, accumulator of gold and lord over vast amounts of natural resources, deals made with China on promoting growth, and BRICS member, Vlaaaadimirrrr PUuuuutin.

Previously, the elites have always remained unopposed. The days of ransack a nation, grab its gold and gain control of its paper currency are over. [Maybe not so much, given what the US-led insurgents did to Ukraine gold and financial holdings, both gone, never to be seen again.]

Like any parasite that is allowed to go unchecked, it will eventually consume its host. The US has been consumed and its fiat carcass is going to be left for Third World dealings, but do not tell its US citizens. The elite-controlled US media has been silent on these kinds of nation-destroying events and wants to surprise everyone about their unacknowledged, decaying, Orwellian existence.

Now, the East has been growing into a financial powerhouse, not without their own problems, but the Eastern nations have been tending to their growth areas, developing trade relations and cultivating their natural resources, migrating themselves into their BRICS alliance. In addition to BRICS, there are parts of Central and South America, those areas in Obama's backyard he has chosen to ignore and [mis]place his elite-dictated focus on "more important" areas for which he has no business in meddling, like Egypt, Libya, Syria, and now Ukraine.

Why Ukraine, why now? [Not so]Simple. The elites have been miscalculating and misfiring their waning powers, still very much formidable, but nations are becoming less willing accomplices. Egypt, failed. Libya, a victory because Ghaddafi's gold was "repatriated" back to the NY Fed, albeit temporarily, because it eventually then made its way to Switzerland for recasting for its ultimate destination: China. Syria, another failure as Putin outmaneuvered and embarrassed the inexperienced and political lightweight Obama.

The elites are running out of time and options, [the latter is not to be confused with the soon-to-be-morphing-into-a-death-spiral derivatives]. They are not stupid by any stretch of imagination, but they know a losing hand when they see one. The best the elites can hope for is to keep kicking the fiat time-bomb can down the road to let the next elite generation-D handle it. ["D" for Disaster]

The world is watching the elite-inspired stick-poking of the Russian Bear Putin, as the West threatens Russia with its NATO-backing military might, [possibly fraying] and NATO nations [now questionably]backing that previously unfailing military trump card. Russia is a problem for survival of the Fascist New World Order dream, and it must be checked and weakened, at all costs. That is the purpose of interfering with Ukraine.

Poland has allowed US military forces to operate in its country. Stupid Poland, but partially forgiven for its historically negative relations with Russia and Ukraine, but decidedly more with Russia. Poland's sovereign memory is still scarred by bloody and brutal wars. Western Ukraine used to be eastern Poland. The aftermath is, despite the devastating history between the two nations, and partly because of it, Poland and Ukraine have rekindled their mutual historic ties and bonds. Both dislike Russia, so Poland may stay in the NATO fold.

The rest of Europe may not. Mention was made last week about the economic ties between much of Europe and Russia. [See Elites Want War. Front Man Obama Pushing Hard]. Europe stands to suffer financially, economically and could be left out in the cold, literally, if Putin decides to say "Thank you" to Europe, a more polite way of using a four-letter word, instead, but the impact will be the same: no natural gas supplies or certainly at far higher costs. Putin to Europe: "You want the United States? You can have the United States."

Putin learned that tactic from Obama when Obama lied to American citizens by saying, re ObamaCare: "You want your health insurance? You can keep your health insurance." Now, millions of Americans are without any health insurance. Take heed Europe.

Germany could play a leadership role, or more of one were it not for Angela Merkel. There is growing unrest in Germany, a smart nation currently being led by a not so smart Chancellor, too slow in recognizing the shifting balance of powers that are increasingly against any U S Third Reich mentality. The German business community is not about to let their political leaders destroy that nation from within, as Reagan, Bush Clinton, Bush, and Obama have in the elite Fascist-entrenched US.

As Germany goes, so goes the rest of Europe, and if Germany balks at taking a leadership role, which means severing its umbilical relations with the US, smaller nations will bolt to the BRICS side as a last resort move in a desperate attempt at self-sovereign preservation. In the end, Germany will likely turn to the East and forsake the insidious ways of the West. It is too great a nation to allow itself to become so marginalized by the US, even though it was the incubator for the Rothschild rise to world dominance and the genesis of all that is wrong in the world, today.

The upshot is, for as hard as Obama has been beating the drums of war, sending over military troops, "advisors," and war ships, the tides of change may have left the US military threat real, but with less ability to follow through. Russia will be backed by China, India, and other nations building both gold reserves and a business infrastructure designed toward financial stability and growth. When you throw in the fact that the European nations may draw a financial and economic line they will not cross, the US will become totally isolated, save Poland and a few other sycophant nations that do not have any significant bearing, [hear that UK?].

For these reasons, war may not be as looming as it appears should, as the German businessmen suggest, "common sense prevail." Based on the lack of PMs response to the ongoing potential for war, smart money does not seem overly concerned.

The ever fraying Paper Tiger,[ironic that it comes from China, zhilaohu ()], may be meeting its Ukrainian Waterloo. Instead of being provoked into war, Putin is remaining in the background, knowing that IMF promised loans will wreck Western Ukraine, and that all Eastern eyes are watching the eventually disastrous outcome that will have the Ukrainians scrambling back into its Russian sphere.

Like Iraq, Afghanistan, Egypt, Libya, wherever "democracy" is spread, like a plague, the results are a country left in ruin. Poor Ukrainian citizens for listening to the siren call of the Financial [We-will-gut-your-country] West, for it has already been faring poorly for them.

If you have gold and silver, you have the best odds of surviving the impending collapse of the United States as we all know it. It will be sad for Americans, just as it is unfortunate for Ukrainians, Cypriots, Greeks, Irish, Spanish citizens, all suffering for the sins of their governments. All take pride in their national heritage. Our point is that national pride is separate and distinct from the governments that run [ruin] it for The People.

The die is cast. The US dollar will die. Much of the rest of the world will move on and recover. The United States will not. Its de facto government has misled The People for well over 100 years. Few in the United States have any idea of what is to come. Some will be better prepared than most, and those who are better prepared are the owners of gold and silver.

The purpose of this article, and recent ones on this topic, is how the prices for gold and silver will not by rallying significantly until the resolve of the devolving West plays out, or at least that of the increasingly dysfunctional de facto federal government, vastly different and distinct from the people living within the country.

It is silly for anyone to lament over the higher prices paid for acquiring what gold and silver they have. Price is irrelevant. How many times must this be said? Each day brings us closer to the consequences of a Federal Reserve-dictated government that overspent and misled the world, not just its citizens.

Those who choose to remain within the banking system do so at their own peril. Those who say, "What other choice do I have?" have chosen not to make an alternative one, for they are not willing to think for themselves. If they were to be a part of a herd mentality, which they are, and could see the herd heading for a cliff that leads to certain financial death, would seeing the inevitable results of not leaving the path of the herd prompt them to make a different choice, or would they continue to say, "What choice do I have, I am going to go over the cliff with everyone else."?

Hard to understand people who choose not to choose.

One choice that is essential is the ongoing purchase of the physical metals at these absurdly low prices, unlikely to be seen again for several generations to follow. We are all on the cusp of historical changes that will alter the geopolitical landscape for the next several decades. To be concerned about where price is for the physical makes little sense. What makes the most sense is to be amply prepared for what is certain to come.

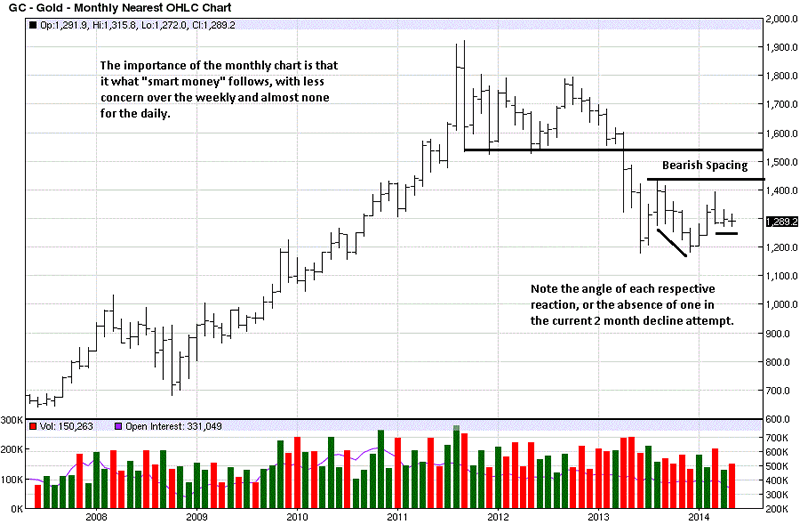

Our take on the charts for gold and silver:

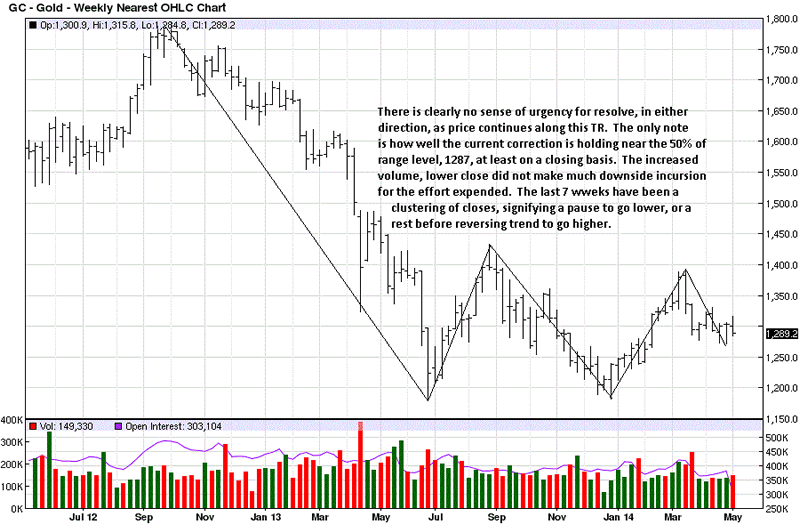

The monthly chart is just 1/3 of the way through, but it is always worth having awareness of it for context. There is still a lot that bulls must overcome once a low is confirmed. The comparison between the two most recent corrections is an interesting one. So far, price has not made much progress to the downside, especially after the sharp volume increase on the decline three weeks ago. The lack of any lower follow-through is worth noting.

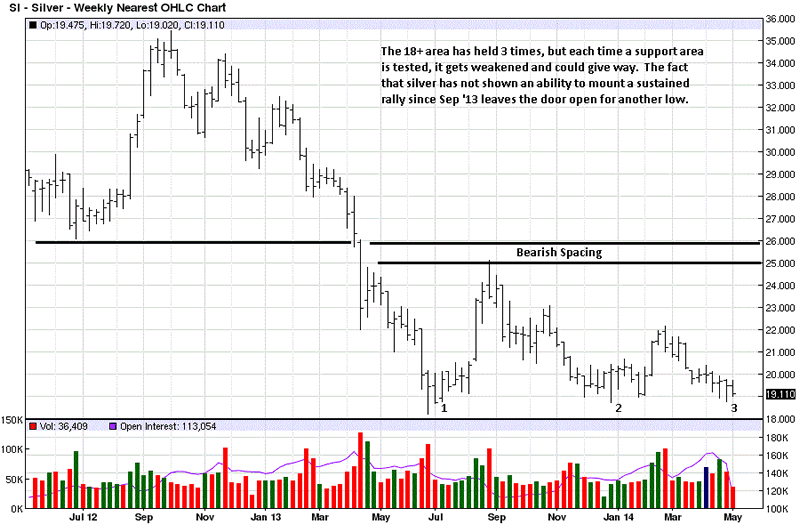

There is symmetry between the monthly and weekly evidenced by price moving laterally over the past seven weeks. Except for a higher close, five weeks ago, there is a clustering of closes. This is the market engaging in a resting spell before continuing lower, or in preparation for a turn to go higher.

What is important to realize is that one need not guess in which direction price will go, but, instead, be prepared for either event and follow the market once it declares its intent.

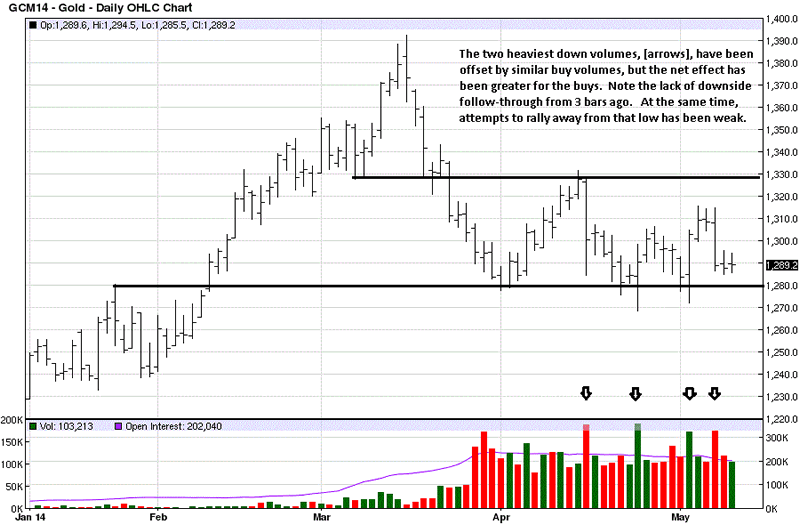

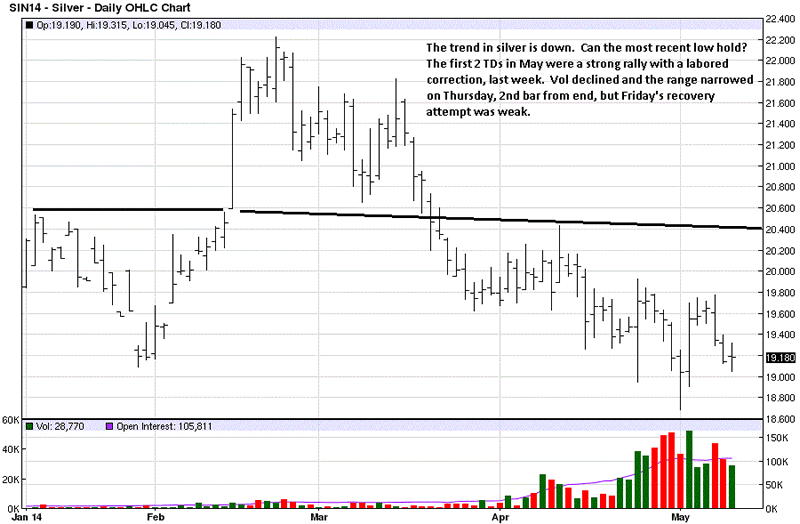

The daily provides greater detail but does not provide any definitive clue for the next directional move. The volume activity within the TR has a slight edge for buyers, but the weak effort of the last two TDs in a weak response to the wide range decline preceding, is not encouraging. Price could still rally, next week, but as developing market activity stands, price could as easily work lower.

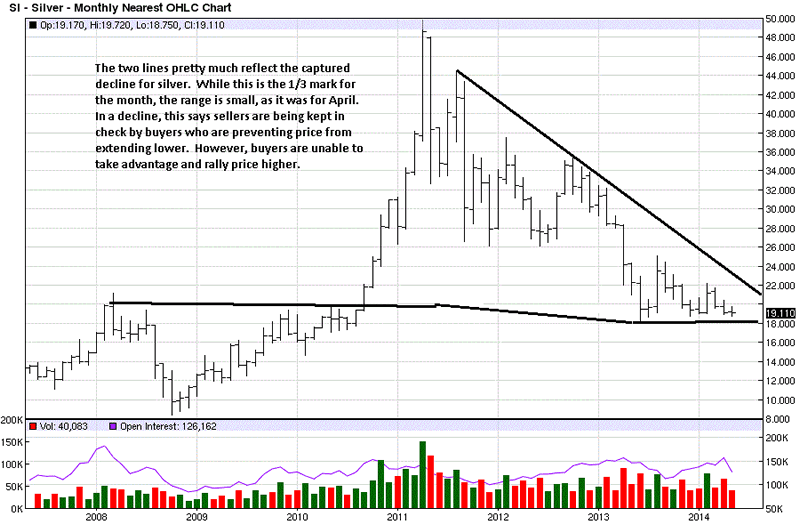

The trend is down and in an area of support. The trend carries the greater weight. There is no evidence of strength in the silver market, at this time. It is a great opportunity to accumulate more physical at incredibly low, suppressed low prices., but that is all.

Lacking anything definitive for taking a long position in futures, it is worth mentioning that the more times a support or resistance area is tested, said support or resistance is weakened, and there is always the potential for another low in silver. In some ways, it makes sense for it would wipe out and demoralize a lot of longs, even physical holders who should not even care where the temporary price of silver is.

This is not to say the either silver or gold could begin the early stages of a strong rally campaign, next week, next month, next year. Knowing when really does not matter if one is prepared for events as they unfold. The "WHEN" that eludes almost everyone will occur when price is ready to move, and not a day sooner. That is how markets work.

No matter how many times one looks, there is very little in the way of evidence that says silver is about ready to take off. Quite the contrary, for silver continues to make lower highs and lower lows. When it comes to what one would like to see happen, and what is actually happening, it is only the latter that counts.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.