Are Stock Market Valuations Really Too High?

Stock-Markets / Stock Market Valuations May 11, 2014 - 06:11 PM GMTBy: John_Mauldin

The older I get and the more I research and study, the more convinced I become that one of the more important traits of a good investor or businessman is not simply to come up with the right answer but to be able to ask the right question. The questions we ask often reveal the biases in our thinking, and we are all prone to what behavioral psychologists call confirmation bias: we tend to look for (and thus to see, and to ask about) things that confirm our current thinking.

The older I get and the more I research and study, the more convinced I become that one of the more important traits of a good investor or businessman is not simply to come up with the right answer but to be able to ask the right question. The questions we ask often reveal the biases in our thinking, and we are all prone to what behavioral psychologists call confirmation bias: we tend to look for (and thus to see, and to ask about) things that confirm our current thinking.

I try to spend a significant part of my time researching and thinking about things that will tell me why my current belief system is wrong, testing my opinions against the ideas of others, some of whom are genuine outliers.

I have done quite a number of media interviews and question-and-answer sessions with audiences in the past few months, and one question keeps coming up: “Are valuations too high?” In this week’s letter we’re going to try to look at the various answers (orthodox and not) one could come up with to answer that basic question, and then we’ll look at market conditions in general. This letter may print a little longer as there are going to be a lot of charts.

I am back in Dallas today, getting ready to leave Monday for San Diego and my Strategic Investment Conference. I’m really excited about the array of speakers we have this year. We’re going to share the conference with you in a different way this year. My associate Worth Wray and I are going to do a brief summary of the speakers’ presentations every day and send that out as a short Thoughts from the Frontline for four days running. Plus, for those who are interested in my more immediate reactions, I suggest you follow me on Twitter. There are still a few spots available at the conference, as we have expanded the venue, and if you would like to see who is speaking or maybe decide to show up at the last minute (which you should), just follow this link. Now let’s jump into the letter.

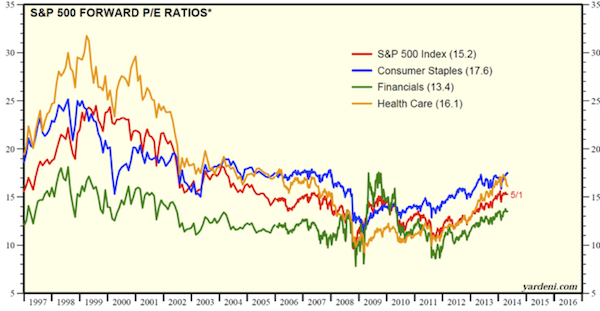

First, let’s examine three ways to look at stock market valuations for the S&P 500. The first is the Shiller P/E ratio, which is a ten-year smoothed curve that in theory takes away some of the volatility caused by recessions. If this metric is your standard, I think you would conclude that stocks are expensive and getting close to the danger zone, if not already in it. Only by the standards of the 2000 tech bubble and the year 1929 do you find higher normalized P/E ratios.

But if you look at the 12-month trailing P/E ratio, you could easily conclude that stocks are moderately expensive but not yet in bubble territory.

And yet again, if you look at the 12-month forward P/E ratio, it might be easy to conclude that stocks are fairly, even cheaply priced.

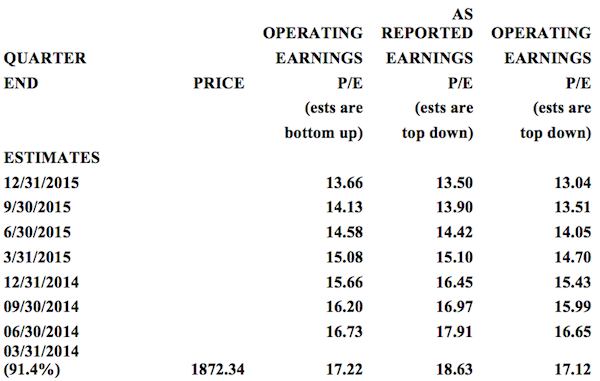

Earnings are projected to grow rather significantly. Let’s visit our old friend the S&P 500 Earnings and Estimate Report, produced by Howard Silverblatt (it’s a treasure trove of data, and it opens in Excel here.

I copied and pasted below just the material relevant for our purposes. Basically, you can see that using the consensus estimate for as-reported earnings would result in a relatively low price-to-earnings ratio of 13.5 at today’s S&P 500 price. If you think valuations will be higher than 13.5 at the end of 2015, then you probably want to be a buyer of stocks. (Again, you data junkies can see far more data in the full report.)

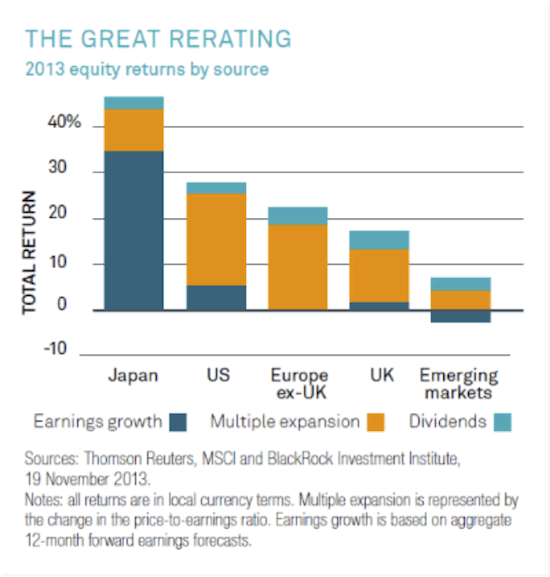

But this interpretation begs a question: How much of 2013 equity returns were due to actual earnings growth and how much were due to people’s being willing to pay more for a dollar’s worth of earnings? Good question. It turns out that the bulk of market growth in 2013 came from multiple expansion in the US, Europe, and United Kingdom. Apparently, we think (at least those who are investing in the stock market think) that the good times are going to continue to roll.

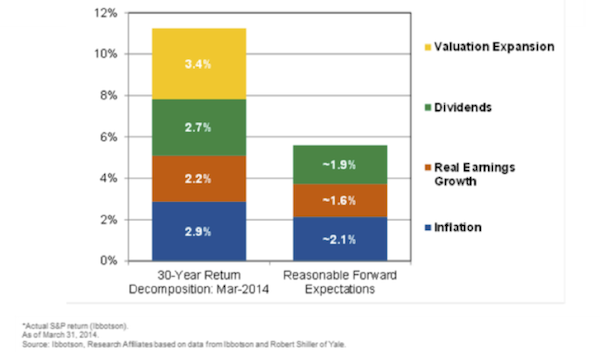

The chart above shows the breakdown of 2013 return drivers in global markets, but this next chart, from my friend Rob Arnott, shows that roughly 30% of large-cap US equity (S&P 500) returns over the last 30 years have come from multiple expansion; and recently, rising P/E has accounted for the vast majority of stock returns in the face of flat earnings.

What kind of returns can we expect from today’s valuations? There are two ways we can look at it. One way is by looking at expected returns from current valuations, which is how Jeremy Grantham of GMO regularly does it. The following chart shows his projections for the average annual real return over the next seven years.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.