FX Majors Look For Correction - Elliott Wave Analysis

Currencies / Forex Trading May 22, 2014 - 12:01 PM GMTBy: Gregor_Horvat

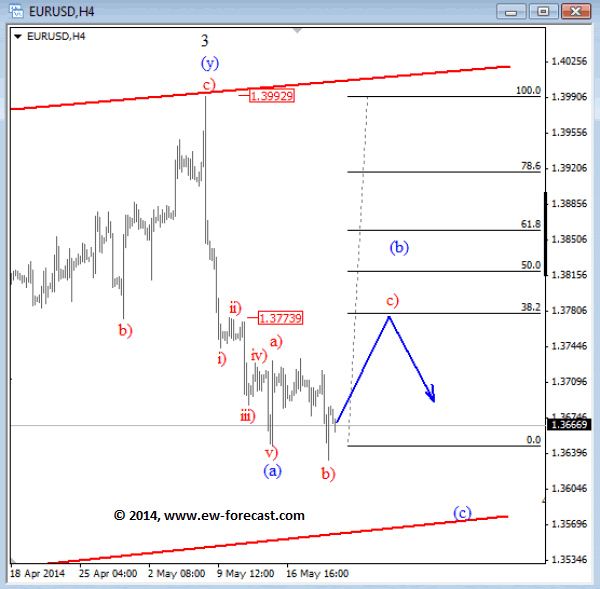

EURUSD

EURUSD

EURUSD fell to a new swing low but that does not mean that wave (b) correction is already completed. Corrections after such a sharp fall liek we have seen from 1.3992 are usually more complex and they will tend to retrace for around 38.2%. That's now the case on the EURUSD yet, so we assume that wave (b) is still unfolding as irregular correction. Ideally, we will see an expanded flat with 1.3770 yet to come before market turns down for (c).

EURUSD 4h Elliott Wave Analysis

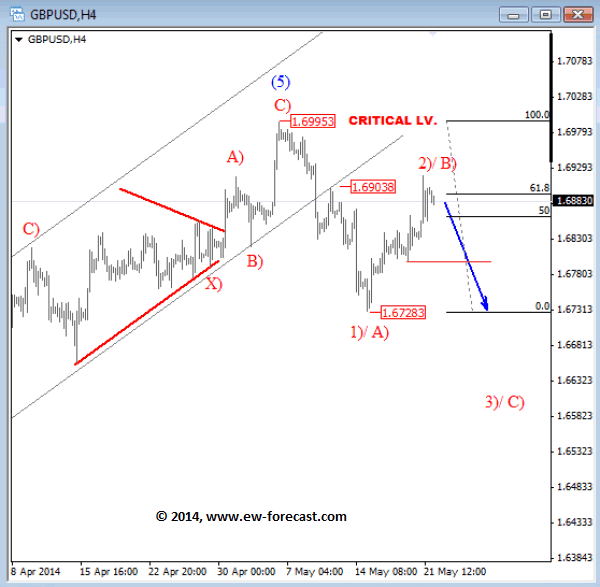

GBPUSD

GBPUSD has recovered nicely in the last couple of days in three waves after a completed five waves of decline from 1.6995 or 1.6728. Pair reached our mentioned levels around 1.6900 where current recovery may slows down. For a bearish confirmation we need a reversal back to 1.6800 that will make room for further weakness down in wave 3)/C) towards 1.6600.

GBPUSD 4h Elliott Wave Analysis

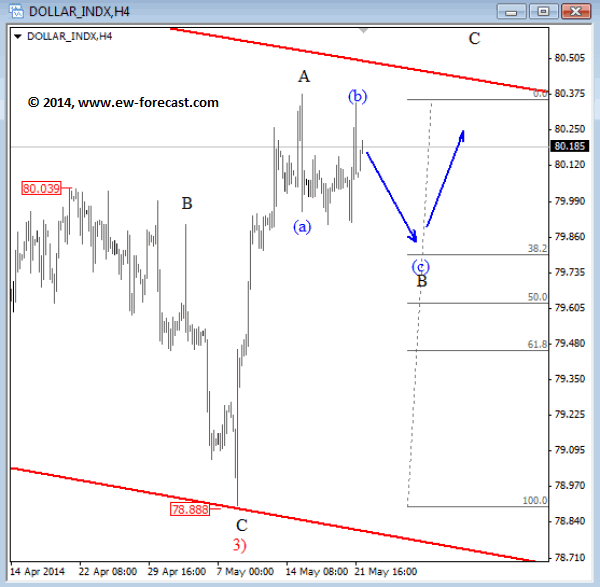

USDCHF

USDCHF spiked above 0.8952 last week but upside seems to be limited around 0.9860. In fact, we are tracking a flat correction of a larger degree with wave C now close to completion. From minimum perspective view, even if pair has turned bullish on May 08 we still expect three waves down from around current levels, so ideally price will retrace back to 0.8840/70 zone next week.

USDCHF 4h Elliott Wave Analysis

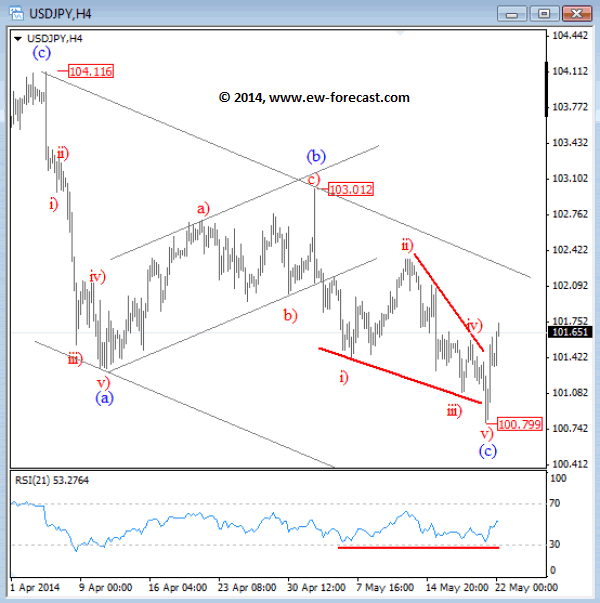

USDJPY

USDJPY reversed sharply to the upside yesterday from around 100.80 where we think that pair found a temporary low. The reason is slow and overlaping price action at the late stage of recent declines that looks like an ending diagonal placed in wave (c) position, final leg of a three wave fall from 104.11. Therefore, we suspect that USDJPY is trapped in some bigger corrective price action and that pair will continue sideways or even slightly higher in the next couple of days.

USDJPY 4h Elliott Wave Analysis

Written by www.ew-forecast.com | Try our 7 Days Free Trial Here

Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power.

Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders.

He was working for Capital Forex Group and TheLFB.com. His featured articles have been published in: Thestreet.com, Action forex, Forex TV, Istockanalyst, ForexFactory, Fxtraders.eu. He mostly focuses on currencies, gold, oil, and some major US indices.

© 2014 Copyright Gregor Horvat - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.