Two Scenarios for Bitcoin

Currencies / Bitcoin May 24, 2014 - 01:35 PM GMTBy: Mike_McAra

Cutting right to the chase: we don't support any short-term positions in the Bitcoin market at the moment.

Cutting right to the chase: we don't support any short-term positions in the Bitcoin market at the moment.

Forbes' Kashmir Hill posted an article yesterday in which she discusses the possibility of sending bitcoins to people living in emerging markets:

Earlier this week, many in the Bitcoin community got very excited about a short film that demonstrates a promising use for Bitcoin. Ronah, a Ugandan woman who emigrated to Brookline, Massachusetts in 2011, regularly sends tuition money to her 20-year-old brother, Ronald, who is studying accounting and finance in Kampala. (...)

(...)

And it works beautifully in the video. (...) Except it is still a system dependent on intermediaries. Until every business takes bitcoin, people need to change their bitcoin into the local currency. I checked up with Ronald by Facebook to see how that's going, and it turns out that it's not going so well.

The short documentary breezes over who helps Ronald exchange his BTC for shillings. "It was a guy, downtown doing mobile money business," says Ronald by Facebook. He sold bitcoin to the guy twice. "Though after a couple of days, I went back to the same guy but I found he had closed. Then this girl who used to work with him told me he had better things to do and that he did not have a lot of customers. And the lady told me he used part of the employer's money in his bitcoin deals and when the boss [realized] that the guy was using his money in his personal deals, he fired him."

As easy as sending money to whoever you wish to might be, exchanging bitcoins for the local currency may prove to be painful. The benefits resulting from seamless transfers of funds from one Bitcoin wallet to another might be denied by the mere fact that it may not be too easy to find somebody who would be willing to accept your bitcoins.

This is actually one of the most pronounced obstacles the whole system will have to overcome. The more the currency becomes known and accepted all around the world, the less such problems one would encounter. But the number of users is dependent on how problematic the transactions are. If Bitcoin manages to attract more users in emerging countries, the network effects could prevail and the system would become viable as a money transfer method there.

For now, let's turn our attention to the charts.

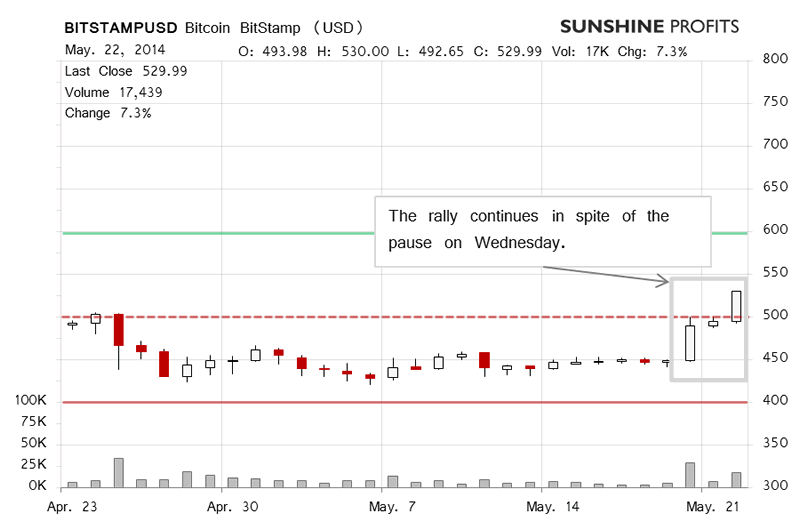

Yesterday was a day of strong appreciation and the first day since Apr. 24 with a daily close above $500 (dashed red line on the chart above). The move up was confirmed in volume. The bullish short-term implications of the price/volume action were, however, weakened by the possibility of a reversal which seemed only natural after a period of strong moves up.

Today we've seen more volatile trading (this is written around 11:00 a.m. EDT), the volume has been strong and Bitcoin has gone 1.1% up. Possibly, the most important part is the fact that there's been volatility and the ups and downs have been more salient than yesterday. This "stormy weather" points to the possibility that there's not only buying power. Depending on how today ends this might be a strong indication of a possible reversal.

If you recall, yesterday we wrote:

At this point we consider two scenarios. In the first one Bitcoin fails to close above $500 for more than just one day. In this case, we would expect the currency to go up and down for some time around $500 and then decline. The second scenario entails the currency closing visibly above $500 or closing above this level for more than just one day. If this happens, we will expect Bitcoin to stay above $500 for a longer period of time but not necessarily go up again soon.

We've so far seen one daily close above $500 so which scenario is actually unfolding would be largely debatable. We'll know more after today's close but it seems as though Bitcoin will actualy stay above $500. If this is actually the case (we're still far from the end of the day), we'll bet on the currency staying above this level for some time before possibly taking a dive.

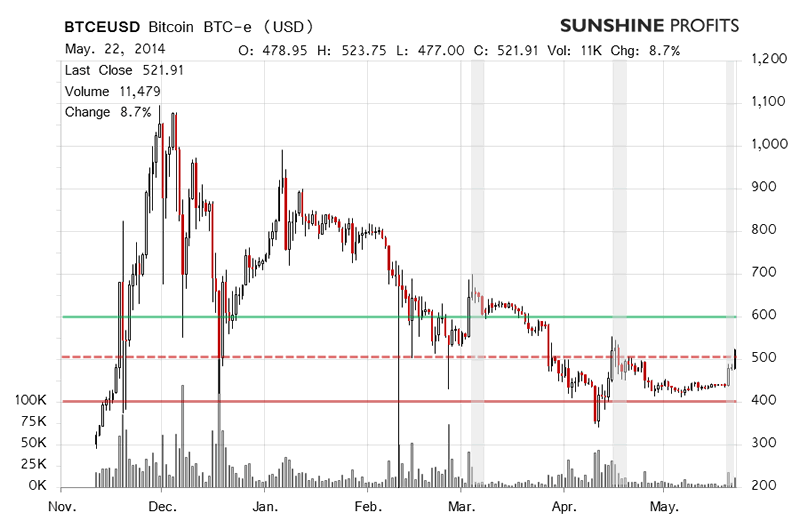

Let's take a look at a long-term chart for BTC-e.

Once again, cases from the recent past similar, in our opinion, to the current action in the market are highlighted in grey. Just as in March and April, Bitcoin has now broke above a psychological barrier, the same as in April. In both past cases the break out was finally followed by more declines. In March Bitcoin managed to stay above $600 (solid green line in the chart) and the decline was delayed. In April, the move above $500 was denied, Bitcoin drifted sideways and declined.

Right now it seems that Bitcoin might manage to stay above $500 at this time which would suggest a period of prolonged trading above this level and a stronger decline afterwards. We'll have to wait at least until the end of day to know whether this is actually the case. It might also be that Bitcoin will drop strongly in the next day or two which would in turn suggest a shorter period of up and down movement below $500 and a slightly less pronounced decline.

One way or another, it seems that the best course of action right now is to wait for the outcome today before entering any kind of short-term positions.

Summing up, in our opinion no short-term positions should be kept in the market at this point.

Trading position (short-term, our opinion): no positions. If Bitcoin stays above $500 we might see a period of trading above this level before more declines follow.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.