Non-Farm Payrolls- Lies, damned lies and statistics

Stock-Markets / Financial Markets May 03, 2008 - 07:08 AM GMT The quote has been attributed to Benjamin Disraeli and popularized by Mark Twain. It could be applied to today's Employment Report . The press headline reads, “ Nonfarm payrolls down 20,000; unemployment rate unexpectedly falls.” Folks, these numbers have been massaged to get the “right” outcome.

The quote has been attributed to Benjamin Disraeli and popularized by Mark Twain. It could be applied to today's Employment Report . The press headline reads, “ Nonfarm payrolls down 20,000; unemployment rate unexpectedly falls.” Folks, these numbers have been massaged to get the “right” outcome.

For example, in April, the number of persons working part time for economic reasons increased by 306,000 to 5.2 million. This level was 849,000 higher than in April 2007. These individuals indicated that they were working part time because their hours had been cut back or because they were unable to find a full-time job. 5.2 million workers comprise 3.8% of the alleged workforce.

Another example is the CES Birth/Death Model , which added 267.000 fictitious jobs to the employment data. The reason I say fictitious is the way they are distributed. For example, the model suggests that 83,000 jobs were added in Leisure and Hospitality, 72,000 jobs were added to Professional and Business Services and 45,000 jobs were added to the Construction Sector.

The last example is the most damning evidence yet of the state of our jobs market, called “ Alternative measures of labor underutilization .” Total unemployed, plus all marginally attached workers, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all marginally attached workers rose from 9.1% to 9.2% in April.

Does that give you any confidence in the headline numbers on our employment situation?

Avoiding a banking panic?

The Fed said it was boosting the amount of emergency reserves it supplies to U.S. banks to $150 billion in May, from the $100 billion it supplied in April. The Fed took this action and several other moves to boost credit in coordination with the European Central Bank and the Swiss National Bank.

" In view of the persistent liquidity pressures in some term funding markets, the European Central Bank, the Federal Reserve and the Swiss National Bank are announcing an expansion of their liquidity measures," the Fed said in a statement. The Federal Reserve, along with other central banks, said Friday that it was increasing the funding it is providing to banks and announced that, for the first time, it was willing to accept bonds backed by auto loans and credit cards.

Isn't this causing a moral hazard in which more and more institutions will ask for a bailout?

A breakout …or a false break?

The stock market surrendered its early gains after the “better than expected” jobs report. My Groundhog Day analysis last Friday hit the nail on the head. It took an entire week for the S&P 500 to break out above its resistance line. Today's action suggests that it may not be able to keep to the “high road.”

Don't buy I-bonds, if you want a guaranteed yield.

The Treasury Department released the new rate on I bonds yesterday. If you bought an I bond before yesterday, you'll get a better return on the investment over time. But if you're still waiting to buy, well, you might not want an I bond at all now .

The Treasury Department released the new rate on I bonds yesterday. If you bought an I bond before yesterday, you'll get a better return on the investment over time. But if you're still waiting to buy, well, you might not want an I bond at all now .

The rate on new I bonds for the next six months is an annualized 4.84 percent. Not bad, you might think. But that's purely the inflation component. The fixed rate on new bonds is 0.00 percent.

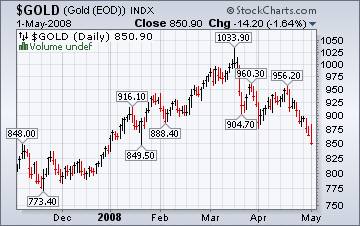

A bear market in gold?

Gold futures climbed as much as $9 an ounce Friday, with the metals contract recovering some of the previous session's lost ground even as the dollar jumped following a report showing that the U.S. labor market was not as weak as expected in April.

Gold futures climbed as much as $9 an ounce Friday, with the metals contract recovering some of the previous session's lost ground even as the dollar jumped following a report showing that the U.S. labor market was not as weak as expected in April.

A $9.00 rise in the price of gold is not going to make up the recent 106- point loss in value. It is now due for a rally and this may be an opportune time to lighten your position in gold.

Nikkei climbing out of the hole?

TOKYO, May 2 ( Reuters ) - Japan's Nikkei stock average rose more than 2 percent on Friday to its highest close in nearly four months, buoyed by exporters such as Advantest Corp (6857.T: Quote , Profile , Research ) on a softer yen and a rally on Wall Street amid growing optimism about the U.S. economy.

TOKYO, May 2 ( Reuters ) - Japan's Nikkei stock average rose more than 2 percent on Friday to its highest close in nearly four months, buoyed by exporters such as Advantest Corp (6857.T: Quote , Profile , Research ) on a softer yen and a rally on Wall Street amid growing optimism about the U.S. economy.

Another article further states that investors “chased gains” in the market. It is clear that speculative fever is back among Japanese investors. Shouldn't it be, “Buy low and sell high?”

The Shanghai rally nearing an end.

April 30 ( Bloomberg ) -- China's stocks rose to the highest in more than five weeks, led by banks, as higher earnings helped counter concern that government measures to quell inflation will hurt profits.

Last week I suggested that the Shanghai Index was due for a technical bounce. It now appears that the bounce is nearing its end. Let's see what next week's report brings.

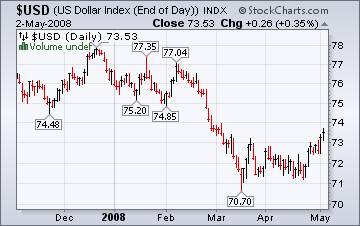

Does the dollar have enough of a base to sustain a further rally?

May 2 ( Bloomberg ) -- The dollar rose to a five-week high against the euro after a government report showed U.S. employers eliminated fewer jobs in April than forecast, indicating the labor market is weathering the economic slowdown.

May 2 ( Bloomberg ) -- The dollar rose to a five-week high against the euro after a government report showed U.S. employers eliminated fewer jobs in April than forecast, indicating the labor market is weathering the economic slowdown.

It looks to me like the Dollar has built a base on which it can rally higher. First, however, it needs to retest this rally before going higher.

An excerpt of a report from Charles Schwab & Co.

As the Federal Reserve continues to slash short-term interest rates , falling mortgage rates shouldn't be far behind, right? Unfortunately, no. While home equity loan rates (which are adjustable and follow short-term rates) have fallen, mortgage rates haven't dropped in line with the Fed rate cuts—and in some cases, they've increased! Indeed, we believe mortgage rates will likely remain relatively high as the current market disruptions continue.

As the Federal Reserve continues to slash short-term interest rates , falling mortgage rates shouldn't be far behind, right? Unfortunately, no. While home equity loan rates (which are adjustable and follow short-term rates) have fallen, mortgage rates haven't dropped in line with the Fed rate cuts—and in some cases, they've increased! Indeed, we believe mortgage rates will likely remain relatively high as the current market disruptions continue.

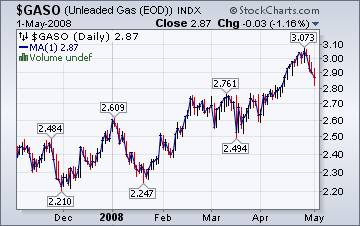

A welcome change in gasoline prices!

As lawmakers and presidential candidates offer a number of proposals to lower pump prices, they should keep in mind that past laws and regulations have made matters worse. Washington ought to eliminate these mistakes rather than repeat them.

The Energy Information Administration's This Week In Petroleum tells us that Gasoline inventories built to unusually high levels in early 2008, indicating an excess of supply relative to consumption. Fundamentally, this drop in prices is overdue. Let's hope that this is a start of a new trend in prices at the pump.

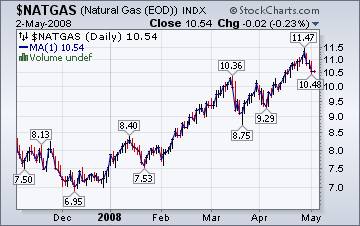

Could we be at the top in Natural Gas?

The Natural Gas Weekly Update claims that the elevated prices in natural gas have followed the spike in the price of other fuels. So, it seems a bit redundant to see two similar charts.

The Natural Gas Weekly Update claims that the elevated prices in natural gas have followed the spike in the price of other fuels. So, it seems a bit redundant to see two similar charts.

However, these two commodities affect us in different ways. Natural gas is important for our physical comfort (heating and cooling). But it is also a very important ingredient in fertilizers and a major input in the manufacturing process. There are multiple reports suggesting higher prices. A slowdown in the economy will have a decided effect on the future prices of natural gas.

Sell in May and go away?

Sy Harding does a great job of keeping on the right side of the market. For now, he says that things look good in the market, but it doesn't pay to be too complacent!

" It's that time again. Twice a year, in the fall and again in the spring, I remind you of the market's amazing seasonal pattern.

The market tends to make most of its gains each year in a ‘favorable season' that begins in the fall and ends in the spring, and to experience most of its serious corrections, bear markets, and crashes in the opposite ‘unfavorable season' that begins in the spring and ends in the fall.”

It pays to be watchful .

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

I am now a regular guest on www.yorba.tv every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.