Can China's Central Planners Revive China’s Economic Miracle?

Economics / China Economy Jun 10, 2014 - 12:18 PM GMTBy: John_Mauldin

For years, when asked whether I thought China would experience a hard landing, I would simply answer, “I don't understand China. Making a prediction would be pretending that I did, so I can’t.” The problem is that today China is the most significant macroeconomic wildcard in the global economy. To understand both the risks and the potentials for the future you have to reach some understanding of what is happening in China today. Last week we started a two-part series on what my young associate Worth Wray and I feel is the significant systemic risk that China poses to global growth.

For years, when asked whether I thought China would experience a hard landing, I would simply answer, “I don't understand China. Making a prediction would be pretending that I did, so I can’t.” The problem is that today China is the most significant macroeconomic wildcard in the global economy. To understand both the risks and the potentials for the future you have to reach some understanding of what is happening in China today. Last week we started a two-part series on what my young associate Worth Wray and I feel is the significant systemic risk that China poses to global growth.

The first thing in my inbox this morning here in Tuscany was a note from a friend about the growing scandal in Quingdao. For a long time many of us have known that there has been “double counting” in the commodities trade sector in China, where local “entrepreneurs” create multiple warehouse receipts on which to borrow money cheaply, and then invest in what are essentially subprime securities that pay higher rates. Everyone “knows” that the government is not going to let anyone lose money on investments, so what could possibly go wrong? It turns out that Chinese warehouse officials are now emigrating in significant numbers to parts unknown around the world, armed with only their passports and whatever money they made through producing such bogus receipts. My sources suggest that the size of the problem is approaching $1.3 billion (far greater than the number being bandied about in public reports). Since one of the guiding principles operative in any scandal is that there is never just one cockroach, I expect the ultimate losses to be far larger. And it appears that the People’s Bank of China is finally going to let people lose money on these fraudulent schemes. Good for them. But to suggest there is no risk in cleaning up corruption and fraud misses the point of our own subprime crisis. In a world where global economic trade and international banks are so intricately linked, trying to determine the actual risk to the system is difficult. And as I will note in my “final thoughts” section, corruption is a very real issue.

We are going to try gamely to finish with China today, having left at least three or four letters worth of copy on the editing floor. There is just so much information and misinformation to cover. I’m going to turn it over to Worth and then follow up with a few final thoughts of my own. (Please note that this letter will print exceptionally long as there are a number of charts and other graphics.) Now let’s do a deep dive into part two.

Can Central Planners Revive China’s Economic Miracle?

By Worth Wray

In my Thoughts from the Frontline debut this past March (“China’s Minsky Moment?”), I highlighted the massive bubble in Chinese private-sector debt and explored the near-term prospects for either (1) a reform-induced slowdown or (2) a crisis-induced recession. Unfortunately, it was not an easy or straightforward analysis, considering the glaring inconsistencies between “official” state-compiled data and more concrete measures of all real economic activity, which is why I suggested that China is simultaneously the most important and most misunderstood economic force in the world today.

With the stakes now higher than ever, I returned to Asia’s “miracle” last week (“Looking at the Middle Kingdom with Fresh Eyes”) and probed deeper into the shadows (including China’s shadow banks) with the help of my new friend Leland Miller and a few illuminating excerpts from his Q1 2014 China Beige Book (the largest and most comprehensive survey series ever conducted on a closed or semi-closed economy).

Pulling back the Bamboo Curtain, Leland’s data revealed aspects of the Chinese economy that John and I could have only guessed at before, giving us a rare opportunity to explore regional contrasts in Chinese economic activity, to survey the modest (but still insufficient) rebalancing among sectors, and to identify a series of pressure points within the credit markets that suggest last summer’s interbank volatility may return in 2014.

Unfortunately, Leland’s key insights confirmed our fears that China’s consumption-repressing, debt-fueled, investment-led growth model is slowing down and starting to sputter… but not collapsing (at least not yet).

What happens next – with huge implications for global markets – depends largely on the economic wisdom and political resolve of China’s central planners, who must find a way to gradually deleverage overextended regional governments and investment-intensive sectors while also rebalancing the national economy toward a consumption-driven growth model.

Finessing the challenges will require not just one but a series of miracles.

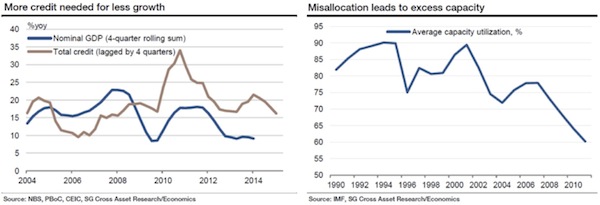

Like Every Other Investment-Driven Growth “Miracle”

After 34 years of booming economic growth averaging over 9% per year (the longest sustained period of rapid economic growth in human history), China’s credit-fueled, investment-driven growth model is exhausted and increasingly unstable. As you can see in the chart below, the Middle Kingdom’s credit boom is well past the point of diminishing marginal returns; and no one can deny that the misallocation is widespread, with capacity utilization now below 60%. (I should also note that Societe Generale’s Wei Yao has consistently published some of the best research on China in recent quarters; personally, I won’t be surprised to see her vault to rock-star status as the People’s Republic decelerates.)

Source: Wei Yao & Claire Huang, “SG Guide to China Reform.” Societe Generale Research, May 14, 2014.

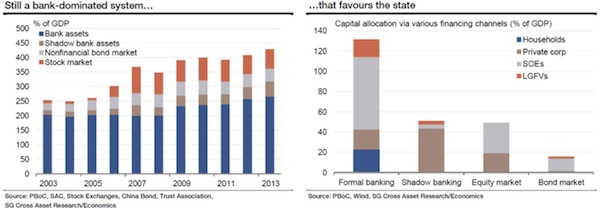

Moreover, state-perpetuated distortions in the cost and availability of financing are (1) funneling huge amounts of capital toward increasingly unproductive, state-directed investments, and (2) pushing household and private business borrowers into the shadows, where the burden of substantially higher interest rates drags on household consumption.

Source: Wei Yao & Claire Huang, “SG Guide to China Reform.” Societe Generale Research, May 14, 2014.

It doesn’t require much imagination to connect the dots. Structural distortions in Chinese financial markets are a major cause of debt-fueled overinvestment; and without sweeping structural reforms (along with a major crackdown on corruption at all levels of government), captive capital will continue to flow toward unproductive investments, capacity utilization will continue to fall, and China’s investment boom will continue its march toward a mega Minsky moment.

This kind of structural distortion is a classic symptom of an overextended investment boom and a warning sign that rebalancing – whether it’s induced by voluntary reforms or an involuntary debt crisis – will not be easy. The critical adjustments – gradual deleveraging and structural rebalancing – will require a greater slowdown in economic growth and a sharper fall in still-bubbly asset prices than China’s policymakers are letting on.

“This is not an easy task,” The Daily Telegraph’s Ambrose Evans Pritchard says, in a truly brilliant article published this week, “not least because land sales and taxes make up 39% of state revenue in China, and the property sector employs 20% of workers one way or another. It is clearly a bubble of epic proportions and already losing air. Mao Daqing from Vanke – China’s top developer – says total land value in Beijing has been bid up to such extremes that is on paper worth 61.6pc of America’s GDP. The figure was 63.3pc for Tokyo at the peak of the bubble in 1990.” Yikes.

As Peking University professor Michael Pettis explains in his 2013 book, Avoiding the Fall: China’s Economic Restructuring, “Every country that has followed a consumption-repressing, investment-driven growth model like China’s has ended with an unsustainable debt burden caused by wasted debt-financed investment. This has always led to either a debt crisis or a lost decade of very low growth.”

China’s “miracle” is no different from any other investment-driven growth binge where high levels of leverage (directly or indirectly paid for by the household sector), combined with high levels of fixed investment, eventually result in excessive and unsustainable debt loads. Pettis elaborates:

While these policies can generate tremendous growth early on, they also lead inexorably to deep imbalances. As demonstrated by the history of every investment-driven growth miracle, including that of Brazil, high levels of state-directed subsidized investment run an increasing risk of being misallocated, and the longer this goes on the more wealth is likely to be destroyed even as the economy posts high GDP growth rates. Eventually the imbalances this misallocation created have to be resolved and the wealth destruction has to be recognized. What’s more, with such heavy distortions imposed and maintained by the central government, there is no easy way for the economy to adjust on its own…. [Furthermore], Beijing [will] not be able to raise the consumption share of GDP without abandoning the investment-driven growth model altogether.

In other words, the world’s second largest economy is approaching its debt limit and the end of the line for investment-led growth… but China’s financial system is structurally designed to prevent capital from flowing freely toward more productive uses. One way or another, the world’s largest contributor to global economic growth must slow down – either because Beijing has the foresight, resolve, and political capital to pursue aggressive economic and financial market reforms or because party elites fail to address the country’s structural imbalances and policy-induced distortions before the credit bubble pops. “Debt,” Pettis explains, “as we will learn over the next few years in China, has always been the Achilles’ heel of the investment-driven growth model…”

Which Way to Sustainable Growth?

Among the various reforms set forth in last November’s Communist Party Third Plenum, ranging from financial liberalization to a crackdown on corruption and pollution, the most challenging is the gradual deleveraging of the Chinese economy while simultaneously rebalancing the national economy toward a more sustainable, consumption-driven growth model.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.