WaMu's Suspect Mortgage Pool- Fallout from Liar Loans Continues

Housing-Market / US Housing May 07, 2008 - 07:22 AM GMTBy: Mike_Shedlock

I have been tracking a particular Washington Mutual (WM) Alt-A mortgage pool for several months. The pool is known as WMALT 2007-0C1.

I have been tracking a particular Washington Mutual (WM) Alt-A mortgage pool for several months. The pool is known as WMALT 2007-0C1.

In Evidence of "Walking Away" In WaMu Mortgage Pool , I wrote about data January.

The February update was WaMu Alt-A Pool Revisited .

The March update was called WaMu Alt-A Pool Deteriorates Further .

This is the April Update

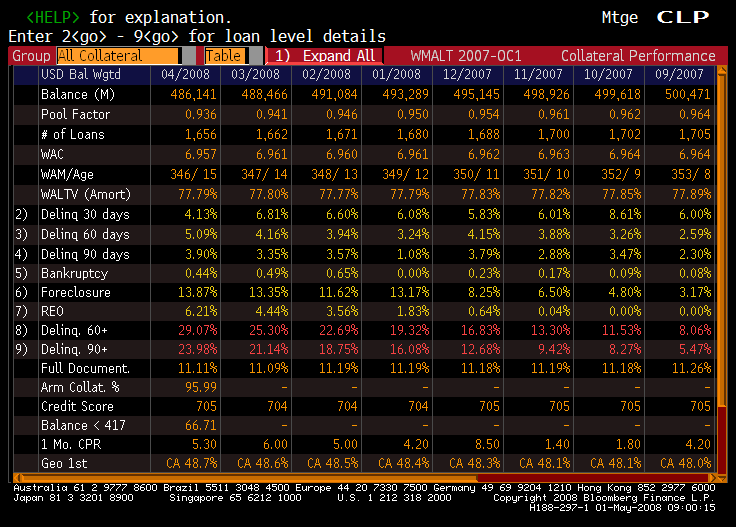

WMALT 2007-0C1 April Picture

January Pool Stats

- 19.3% 60 day delinquent or worse

- 13.15% Foreclosure

- 1.83% REO

- 22.69% 60 day delinquent or worse

- 11.62% Foreclosure

- 3.56% REO

- 25.3% 60 day delinquent or worse

- 13.35% Foreclosure

- 4.44% REO

- 29.07% 60 day delinquent or worse

- 13.87% Foreclosure

- 6.21% REO

Note the above progression. This cesspool from May of 2007, was 92.6% originally rated AAA, even though loans had full doc only 11% of the time. In one year, the pool was 29.07% 60-day delinquent or worse. Of that, 13.87% is in foreclosure and 6.21% is bank owned real estate.

The problem should be clear. In no way shape or form, should any package of liar loans been rated AAA.

Thanks to "CS", "YV" and several others for emailing me the latest chart. Chris Puplava at Financial Sense went one further and sent in the following charts to consider.

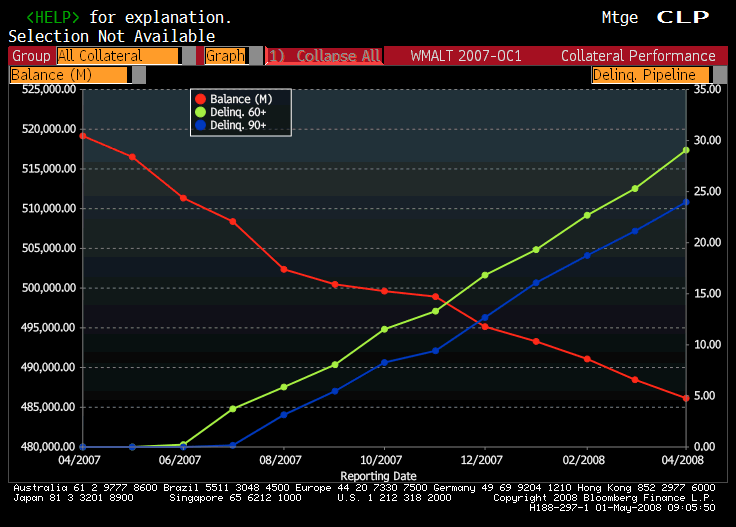

Pool Balance vs. 60 Day or worse Delinquencies

Pool balance is left scale (red)

Delinquencies 60 day or worse is right scale (green)

Delinquencies 90 day or worse is right scale (blue)

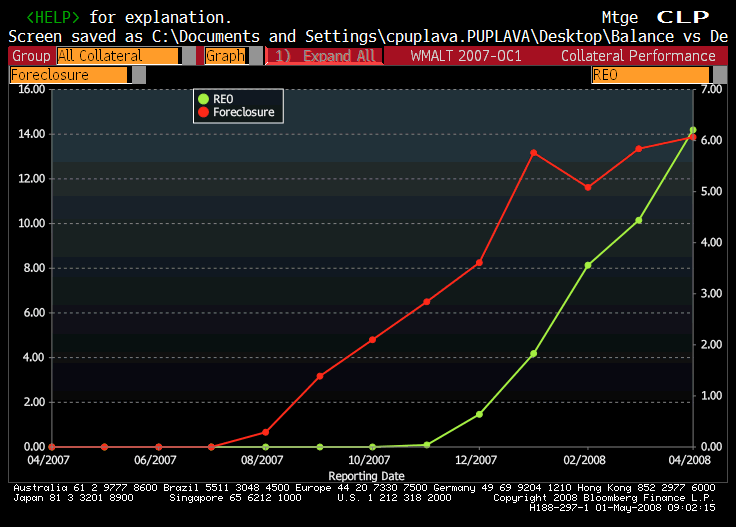

REOs vs. Foreclosures

Thanks for those charts Chris!

REOs Rising Faster Than Foreclosures

The above image is particularly interesting. Are banks so loaded to the gills in REOs they are reluctant to start more foreclosures? If so, people are now living in their homes for free. There have been various media reports of this happening.

As bad as that sounds, from a bank perspective that is better than having a house sit there to become infested by vermin, rats, bees, mold etc. I spoke on the phone with Mike Morgan this morning and he tells me the latter is happening right now in Florida. Some homes are so infested with mold they are a health hazard and have to be bulldozed down. Total loss to the lender is 100%, perhaps greater if they have to pay to clean up the mess!

This Alt-A pool may not be indicative of all Alt-A pools but it likely indicative of what is happening to liar loan Alt-A pools in California and Florida. Furthermore, I believe all Alt-A pools (because that is where the bulk of the liar loans and option ARMs are hidden), are extremely suspect.

Just yesterday it was reported that Bank of America (BAC) is reconsidering its deal with Countrywide Financial (CFC). I talked about this yesterday in Countrywide Shares Worthless?

Professor Sedacca commented " Buried in the $2 billion investment Bank of America (BAC) made in CFC was the fact that BAC has 'last look' to buy the company. That was the main reason for that deal, me thinks. So I imagine common shareholders get little if anything, preferred holders get potentially wiped out and some subordinated debt holders could get smoked as well. The same could be said for Washington Mutual(WM). "

Indeed. And if Bank of America is investigating Countrywide Alt-A pools that look anything like the above, they cannot possibly be liking what they see.

Meanwhile Bernanke Urges Action to Slow Foreclosures . Inquiring minds may wish to open that link to see a series of charts from Bernanke's perspective. The Fed is clearly spooked, and rightfully so. However, the Fed is powerless to halt changing attitudes towards walking away and it is a moral hazard to even attempt to do so at taxpayer expense.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance, low volatility, regardless of market direction. Visit http://www.sitkapacific.com/ to learn more about wealth management for investors seeking strong performance with low volatility. You are currently viewing my global economics blog which has commentary 7-10 times a week. I am a "professor" on Minyanville. My Minyanville Profile can be viewed at: http://www.minyanville.com/gazette/bios.htm?bio=87 I do weekly live radio on KFNX the Charles Goyette show every Wednesday. When not writing about stocks or the economy I spends a great deal of time on photography. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at www.michaelshedlock.com.

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.