Bitcoin Price at Crossroads

Currencies / Bitcoin Jun 24, 2014 - 09:04 PM GMTBy: Mike_McAra

Briefly: we don’t support any short-term positions in the Bitcoin market now.

Briefly: we don’t support any short-term positions in the Bitcoin market now.

The law landscape is changing for Bitcoin with almost every week. Now, the authorities in California have passed a bill to address the unclear legal standing of the currency, Reuters reported:

California lawmakers on Monday approved a measure making it easier to use alternative currencies including Bitcoin, even as the failed Tokyo based bitcoin exchange, Mt Gox, moved forward into bankruptcy protection.

The bill would repeal what backers said was an outdated law prohibiting commerce using anything but U.S. currency.

“This bill is intended to fine-tune current law to address Californians’ payment habits in the mobile and digital fields,” said the bill's author, Democratic Assemblyman Roger Dickinson in a press release.

He cited the popularity of Bitcoin, and said even gift cards and reward points from retailers could be considered illegal under the current law.

"In an era of evolving payment methods, from Amazon coins to Starbucks Stars, it is impractical to ignore the growing use of cash alternatives," Dickinson said.

The bill is still pending approval of the California Governor.

The fact that the use of Bitcoin is becoming regulated by law is generally positive. New laws in place might help avoid blunders like Mt. Gox from happening all over again in the future. But there’s also one more aspect that makes the new regulations possibly favorable for the currency. Lack of regulation prevents businesses from adopting Bitcoin since companies don’t want to take actions which could possibly break the law. Without proper regulations in place, companies tend to tread particularly lightly since legal cost can be high. On the other hand, with clear regulations in place, the possible Bitcoin users can assess the benefits and costs of using the currency and decide what to do.

The move by California lawmakers is yet another law proposed in the latest months. While the regulation of the Bitcoin market might cause fears that Bitcoin will lose some of its independent character, it is also an opportunity to bring Bitcoin closer to the wide audience.

Now, let’s focus on the charts.

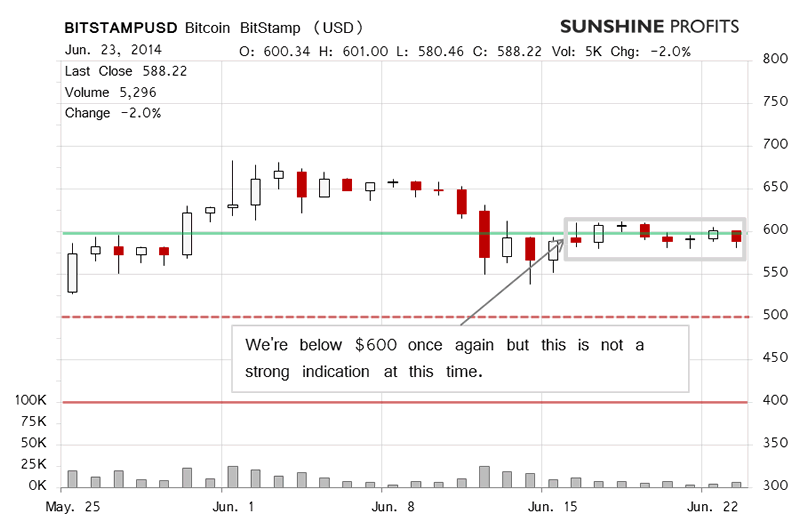

We haven’t seen any significant moves on BitStamp. Because of that, our previous comments remain up to date:

On BitStamp we’ve seen more of the same – Bitcoin is going up and down close to $600 (solid green line on the chart) without breaking above or below this level decidedly. The volume is relatively weak which confirms the lack of momentum.

(…)

We’re on the lookout for moves on significant volume – they could determine the direction of the next big move.

The moves of yesterday and today haven’t changed much (this is written before 10:30 a.m. EDT). We’re still betting on a short-term move down or a continuation of the pause being followed by more appreciation.

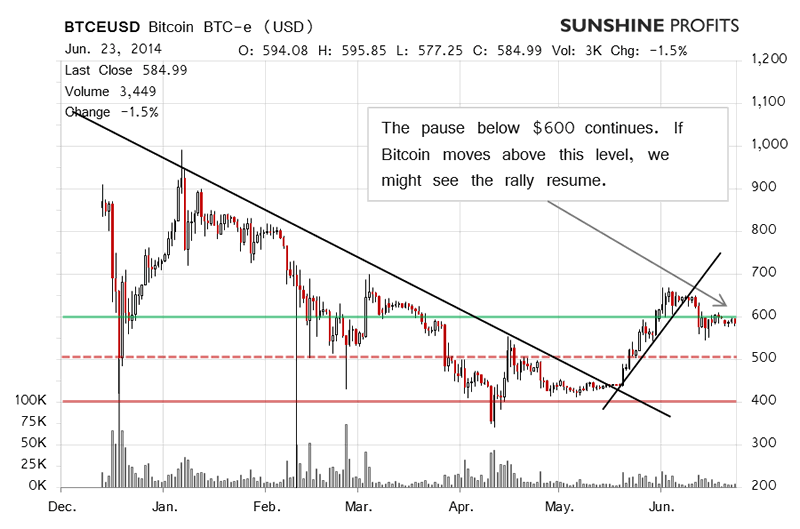

On the long-term BTC-e chart we haven’t seen much change and, consequently, what we wrote yesterday is still up-to-date:

(…) we continue to see an interesting conjunction of events. We’re witnessing a possible change in the long-term trend as shown by the significant move away from the downtrend (marked by the declining black line). This could be bullish for the long term.

At the same time, we’re also possibly seeing a short-term uptrend being broken as displayed by the upward-sloping short-term trend line. This corresponds to the picture we have painted previously – we might be currently seeing a pause or a correction before the move up resumes.

At present, we’re still seeing the mentioned pause. There has been no breakdown below $600, the volume is still relatively weak. Unless we see a more decisive move above or below this level, the short-term outlook will remain tense.

Summing up, in our opinion no short-term positions should be held now.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.