GDP Collapse, Stocks Explosive Divergence Between Volume and Price, Peak Leverage?

Stock-Markets / Financial Markets Jun 27, 2014 - 02:39 PM GMTBy: Ty_Andros

This week has not been sleepy when it comes to the news. It feels like a firecracker out there just waiting for a match in my opinion. There have been too many issues to cover them all but here are a few TedBits for you:

This week has not been sleepy when it comes to the news. It feels like a firecracker out there just waiting for a match in my opinion. There have been too many issues to cover them all but here are a few TedBits for you:

- Surrender

- GDP collapse

- Explosive divergence between volume and price

- MORAL HAZARD written large

- Leverage peak in stocks?

- SOME People aren't DUMB

- EU elites pull another FAST ONE

Surrender

One hundred years ago this week World War I commenced and the specter of World War III is at our doorstep. Secretary of State John Kerry unilaterally surrendered to ISIS in Iraq by stating unequivocally to regional powers that the conflict will not be solved by military means. The very idea that ISIS will sit down at any table and peacefully resolve any issues is a fairytale. The ISLAMIC Caliphate is on a mission from GOD and will not be dealing with infidels in any manner other than their demise or the threat of their own demise. It is as simple as that. As I have said previously: World War III has commenced, it just hasn't been publically admitted yet. Kerry's statements are the height of irresponsibility to the American people.

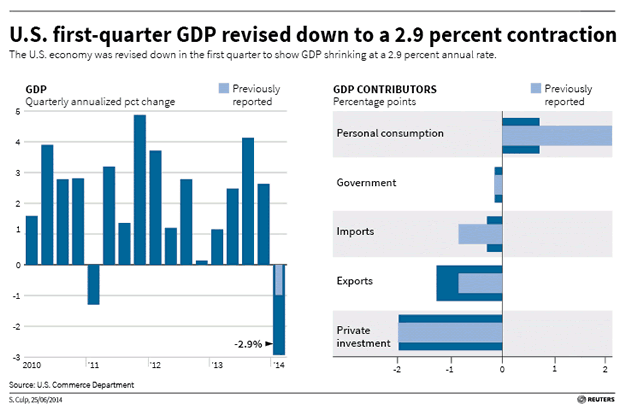

GDP collapse

Yesterday's revision to GDP was a nightmare on Main Street both on the headline number and internally looking at its components. Originally called at up 2%, then the first report of up .1%, first revision was down 1% and this revision taking it to down 2.9%. We were told over and over it was the weather. NOPE.

Look closely at the HORROR show the revision has been. It was a collapse in healthcare spending as a result of OBAMACARE (healthcare spending down over 6%), a collapse in private investment, a surge in imports (surge in liabilities) and a collapse in exports (collapse in income and sales). FOUR knock out blows to Keynesian linear thinking and highly questionable projections of a recovering economy. The economy is real terms is not recovering, in nominal terms the piles of debt and leverage keep expanding and then called GROWTH.

This is tens of billions of dollars economic activity that has disappeared. It foreshadows the coming bailout of the health insurance industry as its business is collapsing from the GOVERNMENT MANDATED policy cancellations in 2013 that HAVE NEVER RETURNED. Obamacare is higher priced and delivers much less services. Private sector investment will not return as there is no reward for doing so. Why would a company or individual invest when there is no INCOME GROWTH after real inflation? Incomes and revenues must rise for investment to become attractive. It's why M&A is on FIRE, it is easy to buy existing business and customers rather than BUILD NEW ONES. Why would an entrepreneur risk his hard earned dollars, blood, sweat and tears to get to a level of success over $250,000 dollars a year when he or she can expect the taxman to confiscate it as soon as he reaches success? Washington has removed the incentives to produce. We are its vassals not its master.

Add to this, Dodd Frank restricting credit to the private sector, mandated health care benefits, EPA attacks on affordable energy and the hoax of climate change, the affordable care act and its 20 new taxes, runaway regulations of the small business sectors. Most readers don't understand the damage done by the regulators. As Cicero once said:

"The more corrupt the state the more it legislates."

You can extend that to regulation which is a result of the laws. This administration learned its craft at the knee of Richard Daly and the Chicago style of POLITICS. Everything in the United States has been on sale to the highest bidder for the last 6 years since the chosen one was elected in 2008 with supermajorities in Congress. Pay the right price and that business becomes the turf of the crony capitalist who PAID UP. The regulations regulate the demand to their cronies and place impossible hurdles in the path of the entrepreneurs who wish to knock off the crony's by providing more for less. People aren't stupid contrary to Washington's belief. They can spend their money, choose what's right for themselves and their families in a far wiser manner than a bureaucrat or would be mandarin in the District of Corruption.

So they try and pass a law or regulation removing your ability to choose for yourself. It is an epidemic of INCONSTITUTIONAL government.

The world is unraveling at an astonishing pace. Today I will call it chart porn day. That is a day when we look at charts. Make brief comments and thoughts about them and move on to the next thought and chart.

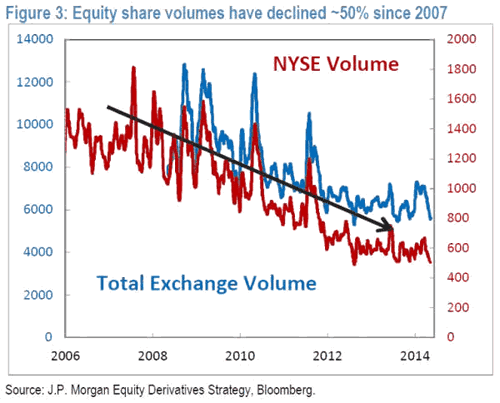

Explosive divergence between volume and price

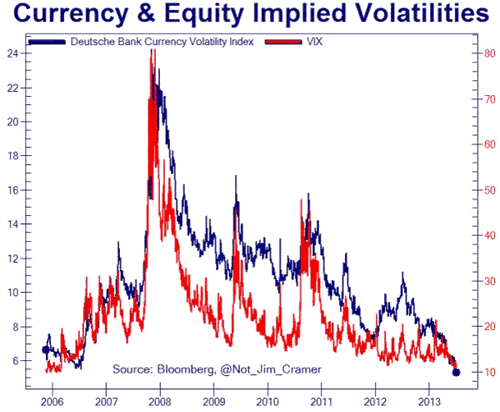

The first chart is brought to us by www.Zerohedge.com and it is an overlay of the vix gauge which has become totally disconnected from an perception of risk by options writers and investors complacency levels about negative events impacting the stock market such as the rise of the caliphate in Iraq;

Talk about a bear market in trading volume since the peak before the financial crisis commenced. It should also be noted that as bad as the collapse in participation has been in reality it is much worse as High Frequency traders account for 50 to 70% of the trading on any particular day. I promise you that if the markets start to crash those programs will stop trading and liquidity will be reduced accordingly (50 to 70%). A mighty small door for weak handed investors that have entered late to exit. It doesn't matter whether it is the bond markets or stocks the exits in event of a moment of panic appears very very small to me.

MORAL HAZARD written large

Moral Hazard and Complacency is at epidemic levels. Investors and Markets are TOTALLY DISCONNECTED from reality and potential risks in the global markets. They believe central banks will do anything NECCESARY to support asset values and stock markets. It is actually a correct assumption in my opinion. This is why the Middle East and ISIS taking over IRAQ dealt no blows to the markets? Let's keep in mind that between the Federal Reserve and the Bank of Japan 110,000 million dollars is being printed each MONTH. QE is, has and will be the dominant investment theme for the foreseeable future from one central bank or another.

"The best way to destroy the capitalist system is to debauch the currency. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. The process engages all of the hidden forces of economic law on the side of destruction, and does it in a manner that not one man in a million can diagnose." - John Maynard Keynes, 1920

The BIS has reported that Thirty Trillion dollars of new debt (30 million million) has been created since the Global Financial Crisis struck in 2008 and this is a picture of it in ACTION. Powerful medicine for insolvent sovereigns, financial and mortgage markets and that money now sits in accounts around the world looking for YIELD and opportunity. All in short supply in a world where growth is OUTLAWED by socialist governments disguised as DEMOCRACY.

The Federal Reserve has gone to great lengths over the last 3 years EMPHASIZING that financial system stability is firmly one of their mandates along with unemployment and inflation. We inhabit asset backed economies with Reserveless banking systems. A move similar to 2008 will BANKRUPT the biggest financial players in banking, institutions, pensions and insurance. This anomaly and perception of a goldilocks economy and market will get eaten by the three bears before this latest episode in runaway leverage resolves itself. When this leverage fails.... THEY WILL PRINT THE MONEY.

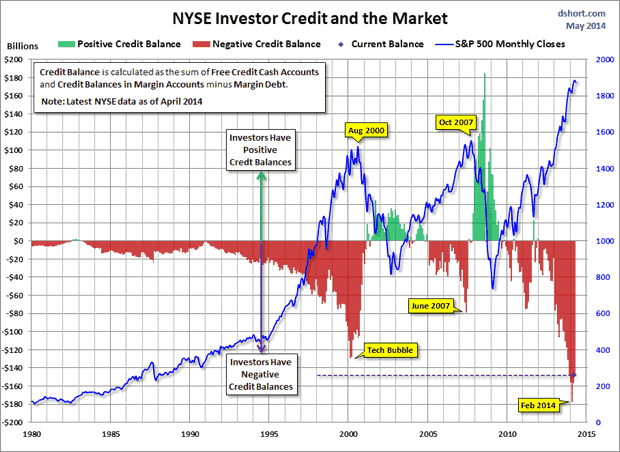

Leverage peak in stocks?

Margin debt has always peaked before major market tops and we are now into month five since the margin peak was seen. This chart was done by www.dshort.com;

Using data compiled by Lance Roberts of STA wealth advisors. Lance and Doug are some of the finest chart makers on the web and their work must always be kept in mind. Both are Keynesians and accept official numbers as accurate. The message at this time; be afraid, be very afraid. We are positioned out on a limb rarely seen in history and more extreme then the times preceding the last two crashes in 2000 and 2008. Do you really think it is different this time? Janet Yellen has yet to be challenged as the last several New fed chairs have. It is her turn for a trial by FIRE. Keep in mind the collapse in REAL TRADING volume shown above. The exits are quite SMALL..... Don't yell fire in the theatre.

SOME People aren't DUMB

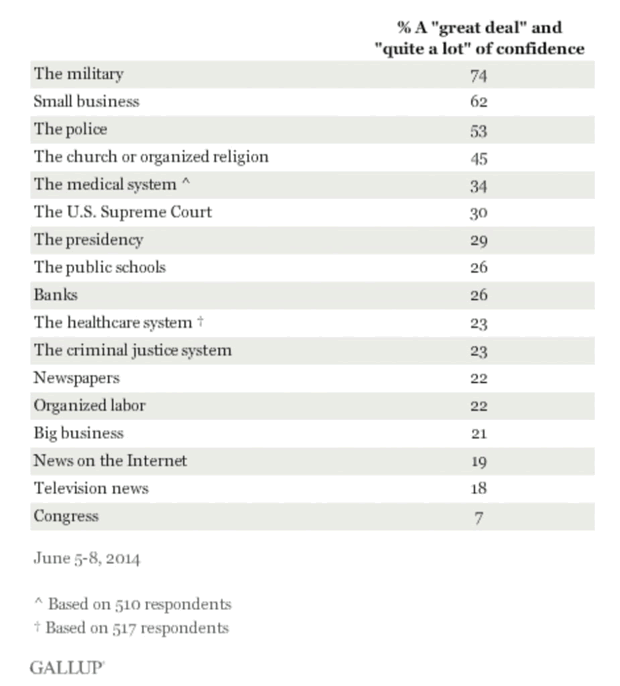

The Gallup polling group has recently released an updated poll outlining just who people do and don't have confidence in and the results are predictable, and signal the great disconnect between the elites which CONTROL our country and society and those that SERVE it. This poll gives me great HOPE! The public has nailed it:

Those are all time lows for the scoundrels in Washington DC (district of corruption). Right behind them are the scoundrels in the main stream media who have completely betrayed their responsibility to report on critical issues and keep the public informed. News on the internet I have to disagree with as I believe the internet news is covering the issues that are blacked out by the main stream media. To me the internet is a great big plus in exposing the bad boys and creating the means for the public to unite against them without being impeded by them. Social media I DESPISE, ultimately it is poison and is the modern version of bread and circuses of ancient Rome. It is not social, it is anti-social in my opinion. Then we see CRONY CAPITALISTS and BIG LABOR, both ENEMIES of the public at large. In a capitalist economy the bottom line is more goods and service for less money. When those two groups are involved it is exactly the OPPOSITE: less goods and services for more money. Look at all the groups at the bottom of the list. These people know who the bad guys are. Banks and public schools: one creates debt slaves of us all and the other dumbing down the population so they can be victims of the system the elites have created.

The most trusted groups are under constant attack from those least trusted. The administration is completely aligned AGAINST small business, the military and the church. The police I will withhold comment on as I believe they have been DEEPLY compromised by the group at the bottom. Look no further than the Boston bombing when local police imposed MARTIAL LAW on the city of Boston. Thai is a glimpse of what has been PUT IN PLACE. Do they serve the public they are sworn to protect or central GOVERNMENT that no longer does so? Regardless of what the headlines say social unrest lays directly ahead. The group at the bottom will both restore freedoms and allow people to prosper OUTSIDE their grasp or be DETHRONED!

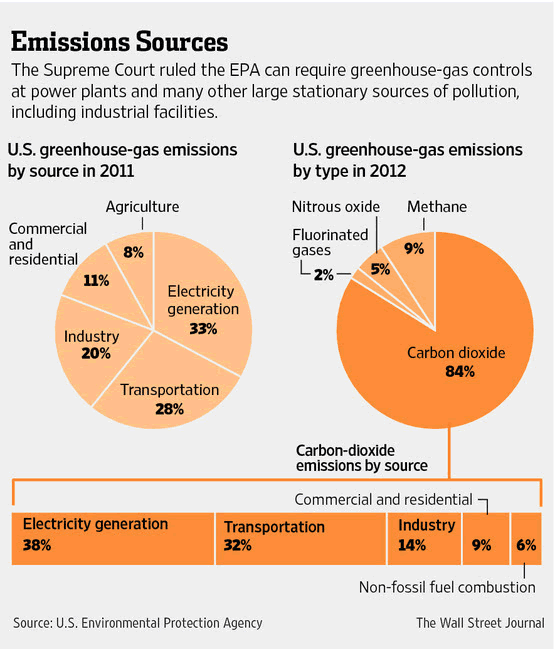

EPA overreach and the Supreme Court

The Supreme Court yesterday stopped a large expansion of the EPA'S regulatory overreach but left in place existing expansions from the last 6 years GARANTEEING skyrocketing electric prices. The recent new EPA rules are the administration's attempt to create laws without the support of congress. Check out this video of the president before he was elected in a rare moment of candor:

Who remains affected by his insanity?

The recent rule changes will dramatically escalate prices, rolling blackouts can be expected as coal powered electricity is OUTLAWED by EPA DECREE. Once in motion these regs will take on a life of their own. Where are our elected representatives? They stand in line for the campaign contributions while doing nothing to stop this UNCONSTITUTIONAL POWER GRAB!

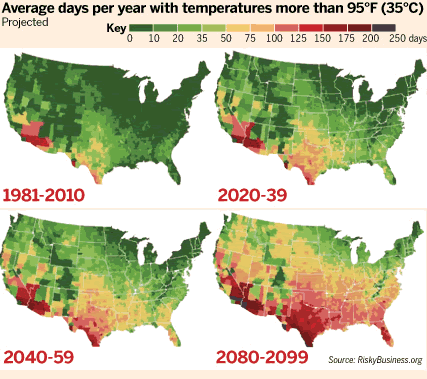

Supporting them is another group of socialists in disguise and a predictable group of PREDATORS: Hank Paulson, Robert Rubin, Michael Bloomberg and Tom Steyer. FEAR PEDDLERS, we must do this to SAVE YOU. Their group calling themselves the RISKY BUSINESS report published the latest propaganda piece for the taxman in disguise. A group consisting of crony capitalists and politicians aligned against your freedom and prosperity to line their pockets with the money you will pay to prevent the HOAX of human caused climate change.

Here is there projection of the climate in America over the next 90 years based upon their MODELS:

They want to control location of facilities, create flood defenses and sell insurance to you and paid by you to themselves, crony capitalists of the worst sort. These people are politically correct and practically incorrect giving the intellectual underpinnings for morally corrupt politicians to SCREW YOU! Energy and electric prices are set to SKYROCKET and the president is keeping a campaign promise....

EU elites pull another FAST ONE

Most people don't understand what the EU project is. It is a exercise in unaccountable government and imposition of socialism disguised as a blessing by the main stream media, crony capitalists, trade unions and public servants. The presidency of the EU is subject to heated debate as the UK wants to prevent arch federalist Jean Claude Juncker from ascending to power without the consent of the governed.

It is an inside job lead by Angela Merkel of Germany and Francois Hollande of France.

Cameron is in the hot seat as the UKIP independence party cleaned his and labours clock in recent European parliamentary elections. Powerful shots across the bows of politicians who bow to Brussels rather than look after the interests of the British people.

"The Brits remain allergic to the idea of political union in Europe, believing that democratic legitimacy is rooted in the nation-state. The German political establishment - particularly on the centre-left - remains wedded to ever closer political union for Europe." - Gideon Rachman

EU commissars have placed the financial community in London firmly in their sites. Instituting laws and regulations which will FORCE banking business from the city to EUROPEAN capitals. All without one bit of input from the citizens of the UK or any other EU government they issue decrees to. Can you say unaccountable bureaucrats/politicians/government? Loss of Freedom? Confiscation of income one way or another? Controlled by shadowy elites... This RAILROADING of Juncker into the leading role of the federalists is occurring as you read this.

In closing: Whenever you see or hear the word DEMOCRACY used by politicians substitute the word socialism/communism and then you can understand the REAL meaning of their words. Total dominance by central governments is the end zone for these would be socialists. Quoting Lady Thatcher:

Socialists cry "Power to the people", and raise the clenched fist as they say it. We all know what they really mean -- power over people, power to the State."

That is the dirty little secret of progressives throughout the developed world. They say they are for you, no, they are for power over you. Government controlling every part of your lives especially YOUR MONEY. Totalitarians in drag.

See you next week, Ty

Did you like this post? They are posted daily at www.tedbits.com our new blog or get them directly into your inbox along with the TedBits commentary, the Economic and Financial NO SPIN zone. Subscriptions are free HERE

By Ty Andros

TraderView

Copyright © 2014 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.