Bitcoin New Rally Might Be Close

Commodities / Bitcoin Jun 27, 2014 - 06:04 PM GMTBy: Mike_McAra

Briefly: we don’t support any short-term positions in the market.

Briefly: we don’t support any short-term positions in the market.

Mark Karpeles, CEO of the now defunct exchange Mt. Gox gave a first interview since the announcement of the bankruptcy of his company, the Wall Street Journal reported:

"As the company head, my mission was to protect customers and employees," Mr. Karpelès said in the interview, his first with media since a Feb. 28 news conference to announce the exchange's bankruptcy filing. "I'm deeply sorry. I'm frustrated with myself."

(…)

"The weakest point of my company was management," said Mr. Karpelès, who was the sole executive of the company. "I failed to lay out appropriate corporate structures."

Mr. Karpelès says he would prefer for someone to take over the exchange and that there are several groups interested.

Mr. Karpelès suggested he is concerned that one such plan, backed by child-actor-turned-entrepreneur Brock Pierce has proposed using Mt. Gox customer money to rehabilitate the exchange.

"To begin with, remaining customer money should not be touched," he said.

At the moment Karpeles’ words don’t have much weight, though. Not only because of the failure of his exchange but also because of the fact that it is really up to the Japanese court what to do with the company. According to the decision of the court, Mt. Gox is to be liquidated but it seems possible that this could be reversed and that the firm could be taken over by outside investors such as the group with Pierce in its ranks.

Which actually turns out to be the final decision, liquidation or revival, is a matter of the future, and we will surely be on the lookout for news on that topic.

For now, let’s take a look at the charts.

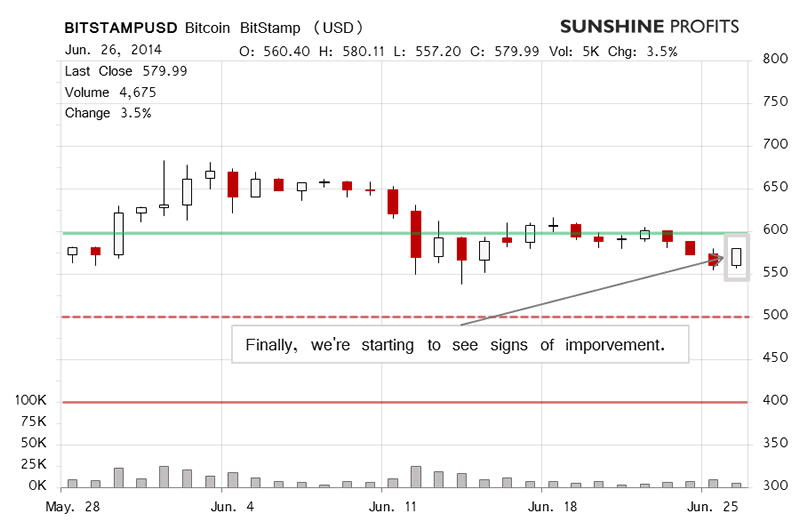

On the BitStamp chart, we see that Bitcoin moved up yesterday. The volume was weak which didn’t make the session particularly significant but a partial recovery of the recent losses was definitely a development more bullish than not.

Today, we’ve seen more appreciation (this is written around 11:45 a.m. EDT). This, and the increased volume, are both bullish signs for the short-term. On the other hand, the $600 level (green solid line on the chart) has not been touched, and this makes what we wrote yesterday still valid:

(…) we’re far from being excessively optimistic just now.

The move might be an indication of the end of the consolidation but this would be only confirmed by a move above $600. Based on that, it might be best to hold off with betting on higher prices, in our opinion.

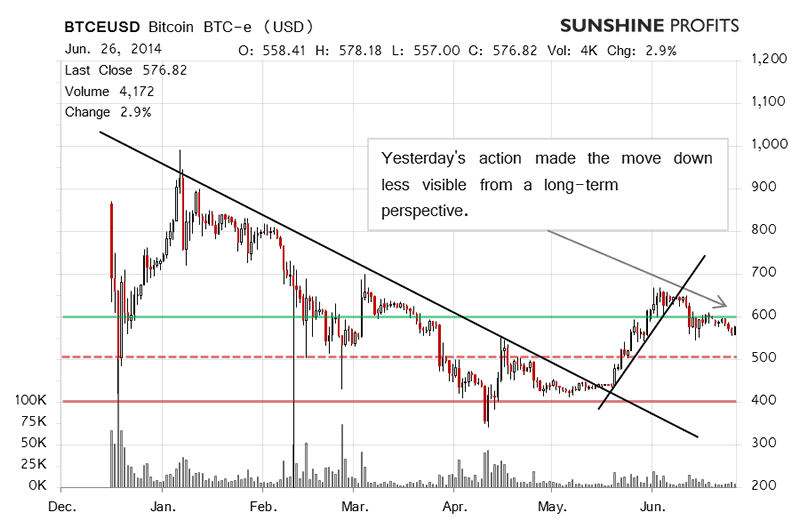

On the long-term BTC-e chart, the situation hasn’t changed much and it remains tense. We are after a possible long-term breakout and a possible short-term breakdown. In this situation more declines seem possible but they might be followed by even more appreciation. A move above $600 could be a game changer for the short term. Our final remark from yesterday is still up to date:

We’re still betting on a move up to follow the current period of consolidation. The timing is not necessarily clear, though.

We’re now closer to $600 than we were yesterday which might make a move above $600 more likely but this is not a sure bet at this moment.

Yesterday, and on the day before, we wrote that we would give you our opinion on strategy to which might play out well next week, and so here we are.

The first option is based on the appreciation scenario. If Bitcoin goes above $600 and stays there for three days or if Bitcoin goes above $600 and then above $650 within these three days, going long might be the way to go with a stop-loss at $550. This is our opinion.

The second option is based on the depreciation scenario. If Bitcoin goes below $500 and then returns above this level and stays above it for three days or if Bitcoin returns above $500 and then above $550 within these three days, it might be profitable to go long with a stop-loss at $470 and a take-profit level at $600. Again, this is our opinion.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market for now.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.