Inevitability of Financial Bubbles

Stock-Markets / Liquidity Bubble Jul 02, 2014 - 02:12 PM GMTBy: BATR

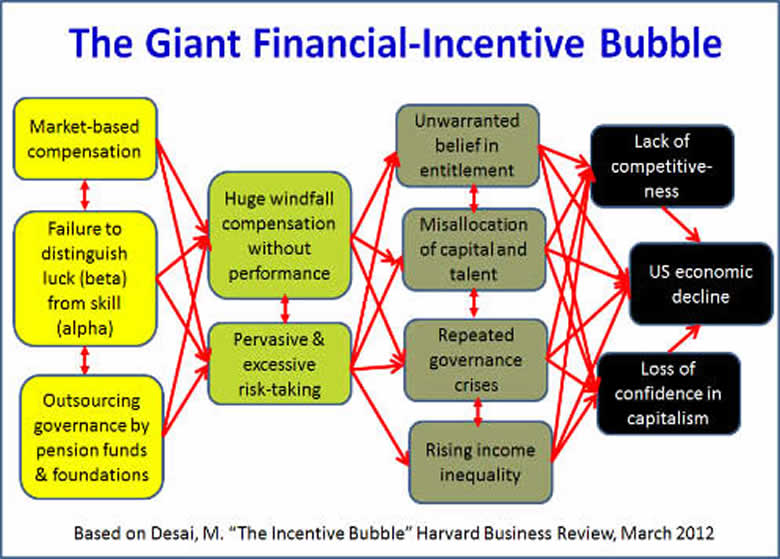

Financial instruments are inventions of gnomes from investment houses and exchanges. There is nothing intrinsic about profitability or guarantee that over time such transactions will be rewarding. Much like the games played at a casino, the baccarat banks that run the betting sport and wheel of fortune, are running the odds in their favor. If only the payoff was similar to the gambling den probability, the consistency of indulgence might be worth the risk. However, the systemic incentivisations within the markets themselves are designed to reflect little of economic proportion to actual trading results. Just look how the financial firms compensate their traders to substantiate that the underlying security of the "so called" investment, which bears little resemblance to quoted pricing.

Financial instruments are inventions of gnomes from investment houses and exchanges. There is nothing intrinsic about profitability or guarantee that over time such transactions will be rewarding. Much like the games played at a casino, the baccarat banks that run the betting sport and wheel of fortune, are running the odds in their favor. If only the payoff was similar to the gambling den probability, the consistency of indulgence might be worth the risk. However, the systemic incentivisations within the markets themselves are designed to reflect little of economic proportion to actual trading results. Just look how the financial firms compensate their traders to substantiate that the underlying security of the "so called" investment, which bears little resemblance to quoted pricing.

"Investors, desperate to earn returns when official interest rates are at or near record lows, have been driving up the prices of stocks and other assets with little regard for risk, the Bank for International Settlements in Basel, Switzerland, said in its annual report published on Sunday.The overall, somewhat gloomy message from the central bankers was that the world is drunk on easy money and has already forgotten the lessons of recent years."

"There are many reasons to read the full report cover to cover, but perhaps the most prominent one is that, once again, the Bank of International Settlements has merely compiled a book report of all Zero Hedge posts not only over the past year, but since our inception.

Just because every single previous central-bank inflated bubble has always burst, resulting in tears for most (if not those who precipitated the crash and managed to load up on liquidating hard assets at firesale prices) this time will be different."

Of course knowing and taking advantage of this difference is the subject of nearly all financial newsletters. Most attempt to forecast the timing of this "mother of all bubbles". What to do to survive the aftermath fallout is an entirely different question. However, the sinister forces of international finance have no such problem, since they operate the money flow spigot and have virtually turned the investment game upside down under a zero interest rate environment.

Notwithstanding, the imminent risk and busting of these examples, the really big one, known only to the inside track of central bankers and their respective ownership financial institutions, is yet to be revealed."Even though other post-2009 bubbles such as China and U.S. higher education have not popped yet and the precise timing of their popping is unknowable (aside from knowing that it is too close for comfort), anyone with a modicum of critical thinking skills knows how they will end. Total outstanding U.S. student loans have quadrupled to $1.2 trillion in the past decade, while China’s total domestic credit more than doubled to $23 trillion from $9 trillion in 2008. The belief that it is wrong to have been warning about these bubbles even though they may not pop for several more years is simply ludicrous."

"Yet the most important lesson of financial history is that sooner or later every bubble bursts; sooner or later the bearish sellers outnumber the bullish buyers; sooner or later greed flips into fear."

While technically, this theory may provide countless cases, missing is the ultimate fact that the forces behind the enormous flow of instant capital creation, from the infusion of additional and unlimited reserves, is the true power that operates and overwhelms disjointed overextended markets.

The phrase that the savvy investor will 'Buy When There's Blood In The Streets', is attributive to Baron Nathan Rothschild, but this practice originated in the deep recesses of ancient history. The ability to incite and cause panics that trigger selloffs in financial instruments is the surest way to manipulate markets for guarantee gains. Now that the financial markets have entered the

The bubble that looms over the international markets bears a distinct label, made in the USA. Even so, the when, where and what will initiate the next great depression crisis will be decided by the same banksters and globalist finance speculators, who deal off the bottom from their deck of marked cards.

The inept and excessive political policies that cause a catastrophic culture of deficit spending are set in motion by the very elements that profit from their control over debt created money. As long as the prime motive of financial gain, from busting financial bubbles is their goal, the cycle would simply repeat itself, using a different market as ground zero.

However, the stakes are raised and the end of the prevailing betting house is ripe for an ultra facelift, since the common public is broke. Worldwide default towers above all financial markets as inevitable. Popping a few more bubbles will just set the stage for a total global financial reset.

James Hall - July 2, 2014

Source: http://batr.org/negotium/070214.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2014 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.