Bitcoin Price Move Down Possibly Dying Out

Currencies / Bitcoin Jul 08, 2014 - 03:24 PM GMTBy: Mike_McAra

In not too many words: we still think long speculative positions might become profitable, stop-loss at $550.

In not too many words: we still think long speculative positions might become profitable, stop-loss at $550.

Tim Draper, founder of the venture capital firm Draper Fisher Jurvetson, and at the same time the person who bought bitcoins seized from Silk Row, spoke to CNBC on Monday and offered his views on the cryptocurrency:

“The bitcoin world is this new ecosystem where it doesn't cost that much to start a new bitcoin company, it doesn't cost much to start owning bitcoin either, and it is a much more efficient way of moving money around the world,” Draper said (…).

(…)

Draper also said investors should have some bitcoin in their investment portfolios.

The price of bitcoin on exchanges where it is traded has fluctuated, sometimes dramatically. Overall, though, Draper is confident the currency will trend upward; there is a limited amount of bitcoin and people are using it more and more, he said.

(…)

"Bitcoin is a great alternative for some of these economies where inflation really saps the strength of a country's economy," Draper said. "I expect Pagos in Argentina, Pagatech in Africa, and in Mexico Coincove—all these companies will really thrive because people in those countries are not as confident in their own governments' fiat currency."

While we don’t expect Bitcoin to replace national currencies even in troubled countries such as Argentina, Draper makes an important point as far as investors’ portfolios are concerned. Namely, it might be profitable to hold a limited amount of the cryptocurrency in one’s portfolio. If not for the expected appreciation of Bitcoin, then for diversification purposes.

Another important point is that Bitcoin is actually becoming more popular and more used. We’re not absolutely sure that the cap on the amount of bitcoins in circulation will not be lifted in the future, it is definitely a positive sign that Bitcoin is being increasingly spoken and written of. We still think that a lot of improvement has to be made before the currency becomes attractive to mainstream users but the process seems to have already started.

For now, let’s take a look at the charts.

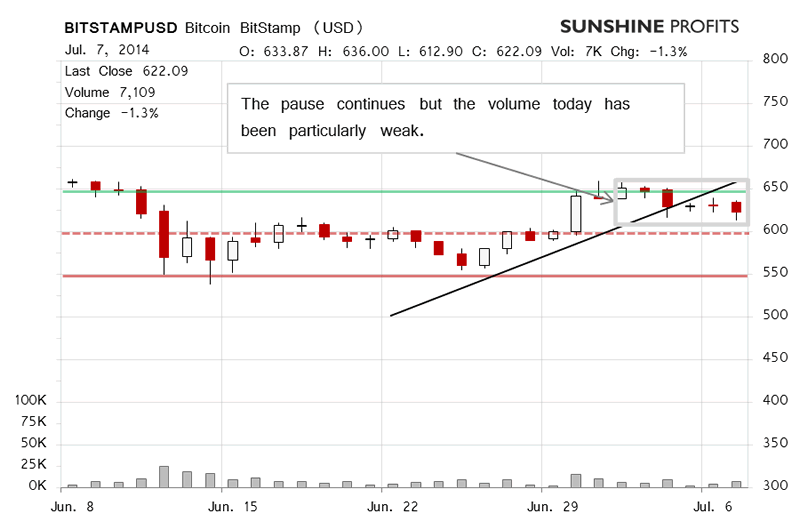

On BitStamp, Bitcoin went down 1.3% yesterday on increased volume but the overall figure of bitcoins traded was not relatively high. This was in line with our yesterday’s remarks on the possible moves in Bitcoin:

(…) Bitcoin might be ready for the next move up but that the move might be preceded by a little more consolidation or even declines. In this tricky environment it, nevertheless, seems that long speculative positions might still be the way to go since the downside might be limited by $600 (…). Additionally, the low volume of the recent decline seems to suggest that the rally might continue in the next days or weeks.

Let’s focus on the volume for one moment. Today’s move has taken on visibly weak volume (this is written before 7:30 a.m. EDT) and it hasn’t really pushed Bitcoin in any direction. Such a situation suggests that a turnaround might be just around the corner. Based on that, the short-term outlook seems to be bullish.

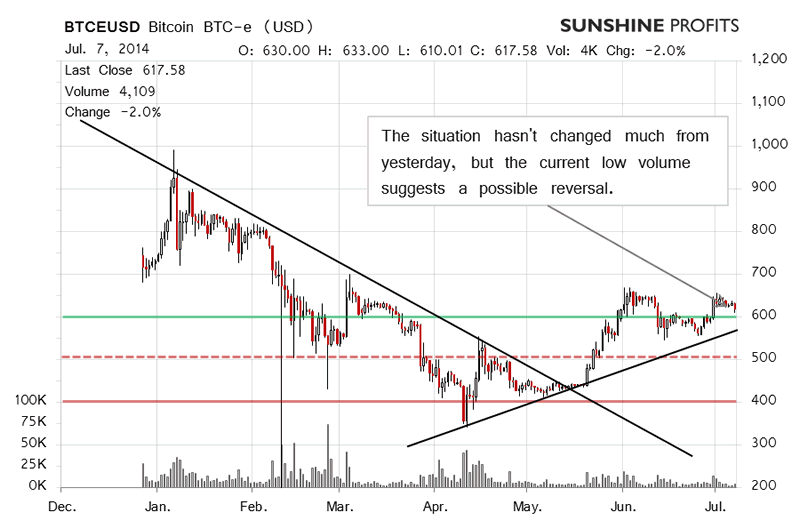

On the long-term BTC-e chart, the long-term downtrend seems to have been broken while the medium-term trend remains up. This creates a possibly bullish environment for the near and more distant future.

Additionally, the recent move down and the current levels of volume make the short-term outlook bullish as well. In these circumstances, long speculative positions seem the way to go at this moment. We’re now waiting for the rebound.

Summing up, in our opinion speculative long positions might become profitable.

Trading position (short-term, our opinion): long, stop-loss at $550.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.