Northern Metals Boom Will Give More Than 10 Times the Returns of S&P 500

Commodities / Gold and Silver Stocks 2014 Aug 06, 2014 - 12:35 PM GMTBy: Money_Morning

Peter Krauth writes: Junior miners can be among the most speculative, most volatile stocks on earth.

Peter Krauth writes: Junior miners can be among the most speculative, most volatile stocks on earth.

They boom, bust, and repeat. Only they do this with more extreme swings than most any other market.

The Nasdaq Composite for example, home to tech and biotech stocks alike, is up by nearly 120% over the past five years, while junior miners doubled... but then gave it all back.

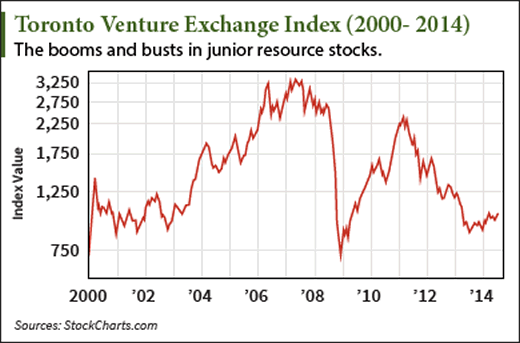

In the last three years, junior miners have, as a group, lost about 58%, while the S&P 500 is up 52%.

But it's looking increasingly like we're entering a brand new boom phase, with junior gold miners up as much as 45.8% this year - with a lot more in store...

Past Their Trough, These Picks Are Poised to Surge

In order to gauge the junior mining sector, most observers will track the performance of the S&P/TSX Venture Composite Index (Toronto Venture Exchange, TSXV). That's because its combined market cap is over $40 billion, and consists of 48% mining and 29% energy sector junior companies.

On the right, you can see how the Toronto Venture Index looks since the secular resource bull market began around 2000.

Anyone looking at this chart can clearly see the sector go through booms, then busts, and start all over again. As of the beginning of 2014, the TSXV looks to be in an uptrend for a brand new boom phase.

But right now a particular subsector of this index, the junior gold miners, appears especially primed to boom.

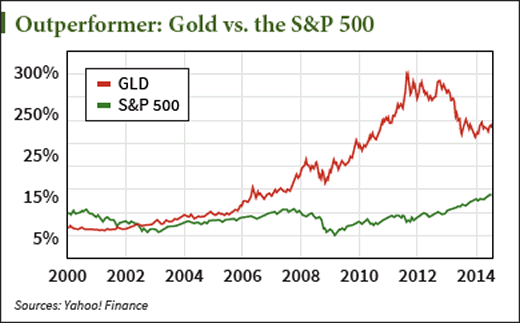

Over the last 15 years, gold is up 360%, while the S&P has gained a measly 35%. That's more than 10 times the return from stocks, just in gold alone.

Have a look at the chart at left

In fact, gold prices were actually up 573% when they peaked in September 2011. Since then we've been through a protracted correction, with gold off about 32% after likely having bottomed a bit below that level last year.

The Junior Miners Will Eclipse Their Big Brothers

And gold itself looks set to head higher. Seasonally, fall and winter are the strongest times of the year for price gains.

What's more, gold's 50-day moving average recently pushed above the 200-day moving average, completing what's known in technical analysis as a bullish golden cross.

As well, gold is trading around $1,300 which seems to be providing support. Both the 50-day and 200-day moving average prices have acted as a magnet in the gold price forming a bottom.

Gold has also completed a drawn-out head and shoulders pattern which began in July last year, another bullish signal.

The next target for gold is around the $1,380 level, which it touched but reversed from in mid-March. If it can close above that level and sustain it, the next target will be $1,425 followed by $1,475, and finally around $1,600, a level it may reach late this year or early next.

And higher gold prices will draw a lot of attention to one special group of stocks: junior gold miners.

As you can see in this chart, junior gold miners have outperformed their brethren gold miners since the beginning of 2014.

This is where the major opportunity lies.

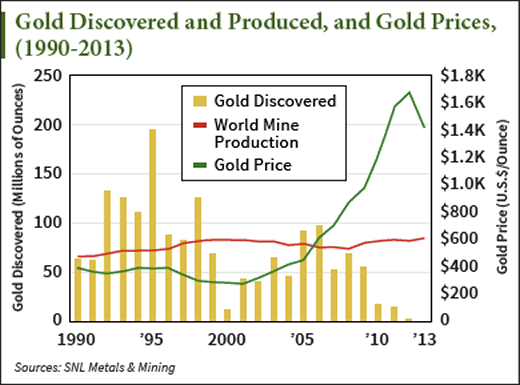

Here's one of the most important reasons to gain exposure to junior gold equities: we're running out of discoveries, but production is climbing. I'm not kidding.

One more chart to do the talking.gold and the S&P 500

Where will new discoveries come from?

Certainly not from senior gold producers.

They're slashing budgets (exploration is often first to get axed) in order to keep overall costs down to turn just a razor thin profit.

After a surge in discoveries starting in 2000 which peaked in 2006, much less gold is being found. 2012 and 2013 levels are practically nil.

Yet junior gold explorers are where most future gold resources will come from. And that's going to make them a lot more attractive.

So consider gaining exposure to this sector through some higher quality names.

Timmins Gold Corp (TSE: TMM) is a $250 million miner with profitable operations in Mexico with the San Francisco Gold mine. It's unhedged and has a low all-in sustaining production cost per ounce of just $872 (one of the industry's lowest). TMM also has accomplished tremendous production growth from just 47,000 ounces in 2010 to 120,000 ounces last year, while increasing reserves by 170% since 2008, despite dramatically growing production. And management understands the importance of discovery, so continues to fund exploration.

Integra Gold Corp. (CVE: ICG) is a nanocap at $28 million, but could turn out to be a high flyer. Its flagship is the Lamaque Gold Project located in Quebec, Canada, one of the safest and highest-rated mining jurisdictions in the world. Lamaque boasts over 750,000 ounces of indicated resources (mostly within 600 meters vertical) and 293,000 ounces of inferred resources at 3.0 g/t cutoff grades. It's also located less than 500 meters from two world class historical mines that produced over 9 million ounces of high grade gold. There's an ongoing 24,000+ meter drill program aimed at better defining and expanding a high-grade zone.

As I mentioned, these stocks are volatile. Consider using a tighter than usual trailing stop, and widening it over time.

The last three years have been bust for junior miners. The TSXV is down 58% while the S&P 500 us up 52%. But neither trend will last forever.

With as much as a 45% gain for junior gold miners earlier this year, it's looking like boom times are back.

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.