Mafia Boss Claims Stocks A Bubble, Buy Physical Gold and Silver

Stock-Markets / Financial Markets 2014 Aug 21, 2014 - 04:13 PM GMTBy: GoldCore

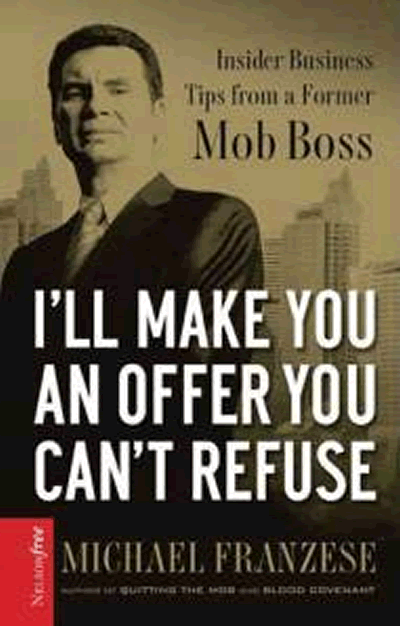

Michael Franzese, the former powerful mafia boss turned motivational speaker and author, warned on CNBC that stocks are a bubble, Wall Street is crooked and advised people to own physical gold and silver bars.

Michael Franzese, the former powerful mafia boss turned motivational speaker and author, warned on CNBC that stocks are a bubble, Wall Street is crooked and advised people to own physical gold and silver bars.

Asked for his “top investment tips,” Franzese told CNBC:

“I did a lot of things at times with people on Wall Street and I don’t trust them … that is the bottom line … a lot of [Wall Street] guys are shady and they did shady things with me and I don’t trust them. And I don’t like other people that I don’t know really well taking care of my money. I think that I can do it better.”

Regarding stocks he said “he thinks there is a bubble there and when it bursts it is not going to be good.”

He said he would not invest in gold ETFs, rather he owns physical bars:

“No matter what, it’s [gold bullion bars] always going to have a value and there will always be something there.”

“Unlike stocks, where in our country, you go to sleep, everyone tells you everything is wonderful, you wake up and everything is gone. We have experienced that. Fortunately, I wasn’t invested at the time.”

The interviewer asks “it sounds like you are bracing for Armageddon?”

Franzese says “Well I don’t think so … that’s been my experience and I have done that successfully and like I said I always have something to hold onto.”

Regarding diversification, he agrees with diversification but says you need to have knowledge and understand what you are investing in and not allow others to pick investments for you.

The Colombo crime family’s former boss – Michael Franzese – says even he doesn’t trust Wall Street.

Franzese – played by Joseph Bono in the 1990 Martin Scorsese movie “Goodfellas” – spent 10 years in prison after he was convicted on federal racketeering charges.

When he was 35, Franzese ranked number 8 on Fortune Magazine’s list of the 50 most wealthy and powerful mafia bosses. 44 of those on the list are now dead, and three are doing life in prison without parole. He reportedly raked in up to $8 million a week. Franzese is the only surviving high-ranking member of a major crime family to publicly walk away and refuse protective custody.

He also said that what made him turn over a new leaf was the love of a good woman who is now his wife of 29 years.

Bullion banks have been found to be charging “storage fees” to store gold bullion … without having the bullion in storage. They also offer unallocated gold accounts where there is not the ounce-for-ounce backing of clients’ purchases - meaning that the same gold is pledged to numerous people.

Owning physical gold coins and bars, rather than paper gold or gold owned via a digital platform, remains the safest way to own gold.

TODAY'S MARKET UPDATE

Today’s AM fix was USD 1,280.50, EUR 965.03 and GBP 772.32 per ounce. Yesterday’s AM fix was USD 1,294.50, EUR 973.75 and GBP 777.76 per ounce.

Gold and silver were mixed yesterday - gold fell $4.80 to $1,291.10 and silver rose 1 cent to $19.50 per ounce.

Gold in U.S. Dollars - 2 Years (Thomson Reuters)

Gold traded marginally higher in trade in London after gold in Singapore fell to as low as $1,278/oz. Gold has fallen below its 50, 100 and 200-day moving averages. Support is at the June lows at $1,242/oz which it may test in the coming days.

Silver for immediate delivery fell another 1.2% to $19.33 an ounce. Support for silver is at $18.70/oz.

Spot platinum fell 0.15% to $1,424 an ounce, while palladium bucked the trend and was 0.6% higher at $876 an ounce.

Gold futures trading volumes have fallen again and are a very large 74% below the average for the past 100 days in London according to Bloomberg data. Traders with hedge funds and banks remain on vacation and therefore the move lower may be a typical low volume head fake.

As we warned yesterday, gold is at risk of further weakness this week and next before gold’s seasonal sweet spot begins in September with the Indian wedding and festival season coming up.

Geopolitical risk remains high but has yet to impact prices. Economic war with Russia appears to be deepening.

Russia intensified scrutiny of McDonald's restaurants today. The state food safety watchdog began unscheduled checks in several Russian regions, a day after four branches in Moscow were shut down by the same agency. The food safety agency cited breaches of sanitary rules by restaurants in the fast food chain. The agency denied that its actions were politically motivated.

The action came after Moscow and the West imposed tit-for-tat sanctions over the conflict in Ukraine. An economic eye for an economic eye will leave us all economically blind and impoverished.

Inform yourself of the 7 Key Gold Storage Must Haves here.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.