Bitcoin Price Continuation of a Move up

Currencies / Bitcoin Aug 23, 2014 - 12:41 PM GMTBy: Mike_McAra

Cutting right to the chase: we support long speculative positions, stop-loss at $440, take-profit at $620.

Cutting right to the chase: we support long speculative positions, stop-loss at $440, take-profit at $620.

A recent report by Wedbush Securities considers the effects volatility might have on the Bitcoin market:

We see investing and trading bitcoin as one of the first major applications of crypto currency and believe increased investment and trading activity is helping create the payment network infrastructure and monetary base that will facilitate increased economic activity in the future.

(...)

(...) volatility in the price of bitcoin may not go away anytime soon, as the potential for bitcoin is being constantly measured by the market in light of rapid technology development and unpredictable regulatory constraints. However, we do not believe this volatility, in itself, will impede the growth of bitcoin technology and ecosystem.

We believe traders value volatility as they continue to gravitate to bitcoin trading as an active 24/7 market uncorrelated with other asset class returns. The connection between volatility and trading volumes is well established in equities (page 3) and is beginning to emerge in bitcoin trading.

(...)

Volatility in the price of bitcoin should not impede retailer acceptance of bitcoin, in our opinion, as merchants and payment processors are entirely shielded, and we expect consumers will be shielded in the future.

The remarks on the impact of volatility on future Bitcoin adoption seem insightful. The fact that Bitcoin is not correlated with other assets like stocks or bonds might make it valuable for investors since it provides diversification benefits. This could increase the trading volume in the future as further investors and finance professionals enter the market.

The comments on volatility not being a significant threat to Bitcoin becoming a widespread payment system also seem accurate. Retailers like Dell have entered into agreements with Bitcoin startups to lock in the exchange rate applied to transactions. In the future, we would expect more startups working on similar solutions, possibly not only for retailers but also for customers.

Let's turn to the charts.

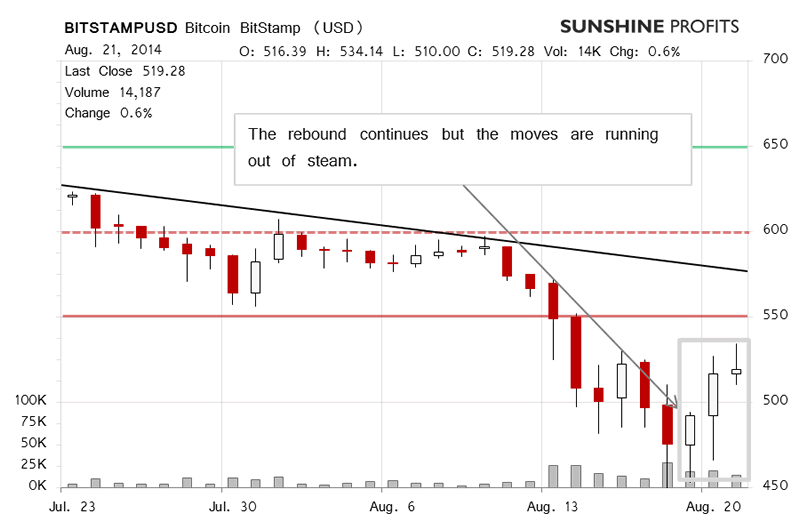

On BitStamp, we saw a move up yesterday but the appreciation was subsequently erased and Bitcoin ended the day where it had started it. The volume was down from the day before yesterday but not necessarily weak.

Yesterday, we wrote:

On BitStamp, we saw another move up yesterday, approximately 5.0% up. The volume was relatively high, lower than during the final part of the recent decline but still relatively significant.

Does this mean that we're actually seeing a reversal now? Our answer will follow in the course of this commentary.

(...)

It has actually turned out so far that the move is not spurious (this is written around 8:15 a.m. ET). Bitcoin has gone up some more and is now trading around $525. The volume is down compared with yesterday but it isn't actually weak. Based on a move above $500 yesterday and the action today, the short-term outlook seems to have improved.

Today, Bitcoin went down in the early hours today but has recovered these losses (this is written around 11:45 a.m. ET). The volume might be down from yesterday (the day is not over yet) but is not insignificant. The current situation seems not to change much in the short-term outlook. If anything, the daily reversal today suggests more strength than the move yesterday.

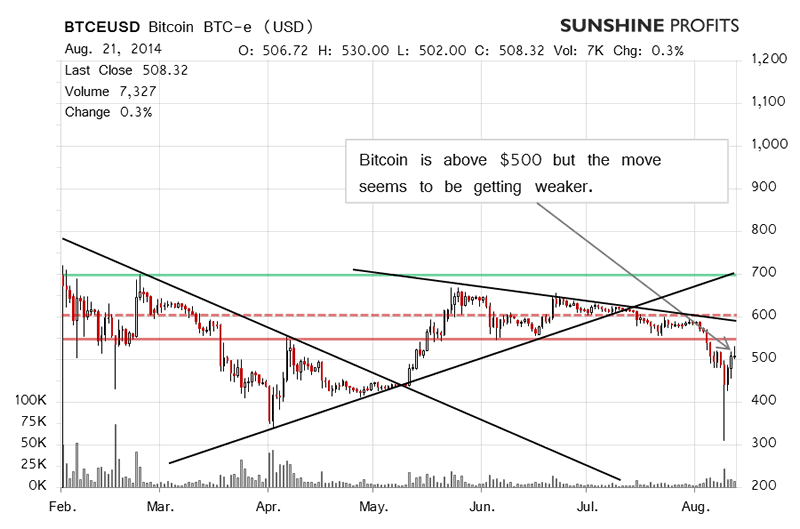

On the long-term BTC-e chart, we see little change but the move to $550 is now visible. Whether this move will be completed remains to be seen.

Yesterday, we wrote:

It would seem that the action up has become stronger now. It is still not very strong, but strong enough, in our opinion, to bet on a move further up at this time.

Today, we've seen a daily reversal on BTC-e just as we have on BitStamp. The volume might not be up but the move still seems in place. If the move was strong enough yesterday, it seems even more pronounced today because of the daily reversal. Consequently, the short-term outlook remains bullish.

Summing up, in our opinion long speculative positions might be the way to go now.

Trading position (short-term, our opinion): long, stop-loss at $440, take-profit at $620.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.