Bitcoin Market Provides Clues for Investors

Currencies / Bitcoin Aug 26, 2014 - 05:29 PM GMTBy: Mike_McAra

Briefly: we support long speculative positions in the Bitcoin market, stop-loss at $440, take-profit at $620.

Briefly: we support long speculative positions in the Bitcoin market, stop-loss at $440, take-profit at $620.

The Chamber of Digital Commerce (CDC), an initiative to promote digital currencies, has moved to form a political action committee to support Bitcoin, the Hill reported:

The Chamber of Digital Commerce, a month-old trade group for digital currencies and assets like bitcoin, registered a political spending group with the Federal Election Commission this month, according to recently disclosed documents.

The group is still in its infancy and has no immediate plans to support individual candidates, CEO Perianne Boring told The Hill. Still, formation of the PAC is a sign of increasing maturity for bitcoin and a signal that politicians could face political pressure to support virtual currencies.

“We’re in the very earliest stages of setting up,” Boring told The Hill on Monday.

“We haven’t really decided exactly what we’re doing. We’re just being prepared for next year, is really what we’re doing. “

This is a further sign of developments in the Bitcoin community. While the CDC is not really sure what it’s doing, the fact that a PAC is being formed shows that the Bitcoin initiative is more than a passing fad. This is also a sign that in the future, Bitcoin might have a chance of being treated seriously by politicians. It seems that the first steps have just been taken.

For now, let’s turn to the charts.

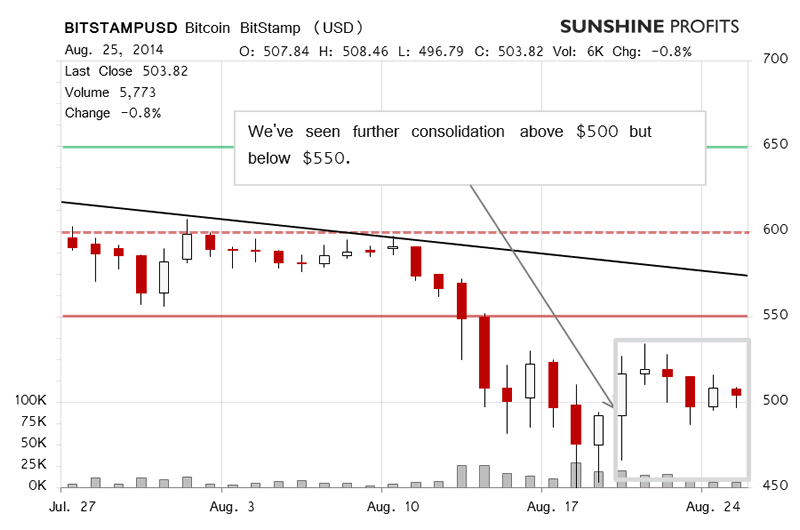

Bitcoin went down on BitStamp yesterday but the move wasn’t strong and the volume didn’t support it. A day of depreciation made us wonder whether the case for Bitcoin was still bullish. This is probably the same thought you’re considering. We provide our answer in the paragraphs to follow.

Quoting from yesterday’s alert:

Compared with Friday, the situation is less favorable for a move up today but the environment hasn’t changed enough to suggest a short-term move down just now. In this light, our commentary from Friday remains unchanged in that the outcome we’re betting on still would be a move up.

The action later in the day didn’t actually provide evidence to the contrary. Today (this is written after 11:00 a.m. ET), the move has been up, stronger than yesterday. The volume might end up being higher than yesterday but it isn’t strong by itself.

Overall, the move looks like a bounce up from $500 but it doesn’t necessarily suggest that a new rally has visibly begun.

Recall what we wrote about BTC-e yesterday:

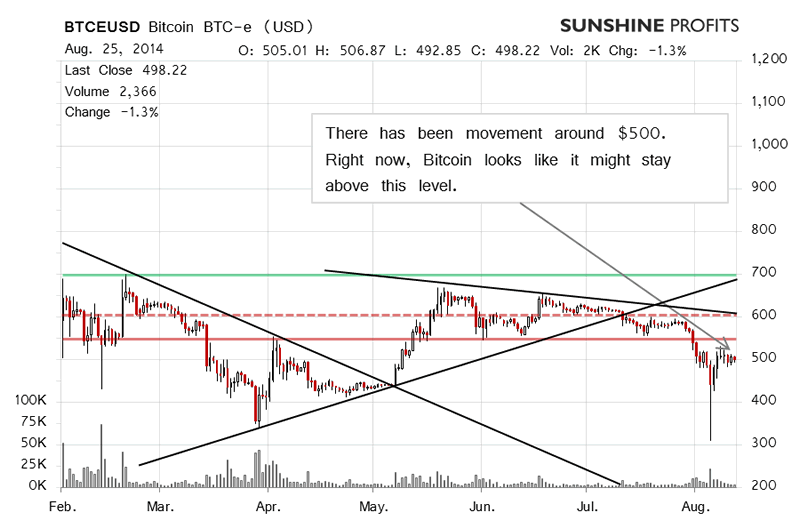

The consolidation is below $550 which looks bearish at first. On the other hand, the moves haven’t actually brought Bitcoin back below $500. If the most recent move has been down, the volume doesn’t support such action. Because of this, it doesn’t seem that the action is about to pick up and bring Bitcoin south.

The mixture of relatively weak moves down intertwined with appreciation and of low volume suggests a possibility that the depreciation we saw over the weekend isn’t really representative of the direction in which the market is headed.

What might be concerning is the fact that Bitcoin has now been below the medium-term trend and also below $550 for some time. This means that a move down is still possible but we’re not seeing signs of such a move at present. Our stop is in place at $440 to shield you from depreciation.

The fact that we haven’t seen a move below $500 suggests that the local bottom might already be in.

On the long-term BTC-e chart, we haven’t seen much change since yesterday. If anything, the move up further suggests that the local bottom might already be behind us and the fact that Bitcoin is moving away from $500 might be an indication that we might see a more powerful rally in the weeks to come. To answer the question from earlier in the this alert, the situation has now slightly improved and our bet is still on a move up.

Summing up, in our opinion speculative long positions might be the way to go now.

Trading position (short-term, our opinion): long, stop-loss at $440, take-profit at $620.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.