Bitcoin Price $500 as Current Downside Barrier

Currencies / Bitcoin Aug 29, 2014 - 06:20 PM GMTBy: Mike_McAra

Briefly: we support long speculative positions in Bitcoin, stop-loss at $440, take-profit at $620.

Briefly: we support long speculative positions in Bitcoin, stop-loss at $440, take-profit at $620.

Simon Fraser University has become the first such Canadian tertiary education institution to accept donations in Bitcoin, the university reported:

Simon Fraser University is the first Canadian post-secondary school to accept donations in Bitcoin, a digital currency that can be exchanged electronically.

And SFU alumnus Scott Nelson and Simon Fraser Bitcoin Club president Mike Yeung are the university’s first Bitcoin donors, contributing the cash equivalent of $6,000.

“We are embracing Bitcoin because it is innovative, open source, entrepreneurial and fits well with SFU's mission to engage the world,” says Yeung, who hopes his donation will be used by students to spark conversations on how non-profits in developing areas can use the virtual currency.

“Bitcoin can be moulded in ways that can benefit people (in every part of the globe and every segment of society) in many ways,” adds Yeung, who is also the founder and CEO of Saftonhouse Consulting Group. “And those benefits can only be realized when Bitcoin is driven by community efforts and the passion of those with vision and determination – the very traits that SFU breeds and supports.”

The university is yet another institution accepting Bitcoin, this time as donations, not as payment for goods or services. This shows us that Bitcoin is gradually transpiring not only into the world of retailers but also into other forms of activity, donations for educational purposes being only one example.

We’re obviously still early on the road to Bitcoin adoption – SFU is, after all, the first university in Canada to accept the cryptocurrency – but, as we have numerously expressed, this is precisely where the opportunity with Bitcoin lies. The currency is still in the early stages of possibly redefining the payment systems we know.

For now, we’ll focus on the charts.

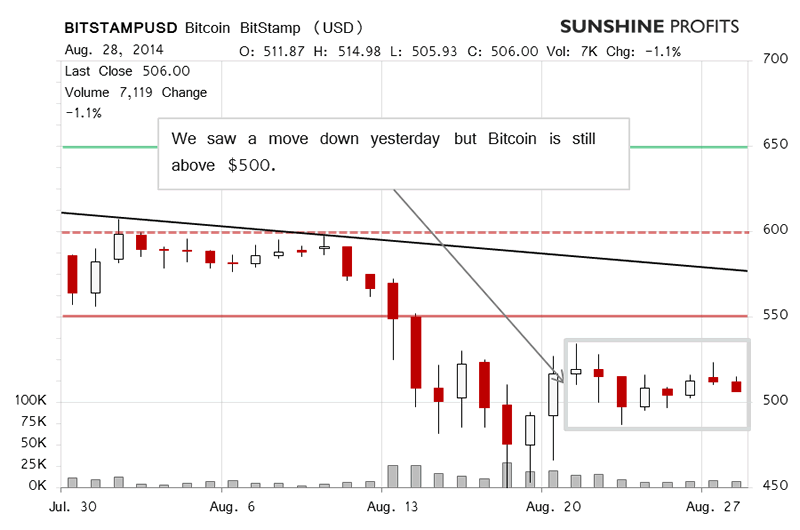

On BitStamp, we saw a move down yesterday. This was a second day of depreciation. Such a situation might naturally evoke the question whether anything has actually changed as far as the short-term outlook. This is the question our readers probably ask themselves and we understand where it’s coming from and also ask ourselves similar questions and check them against the current market conditions to arrive at conclusions. Today is no different and we provide you with our opinion on where the market is headed.

The move yesterday itself was nothing special as far as its strength, percentagewise and volume-wise, is concerned. It was a day of depreciation but nothing more. Very much like what happened on the day before yesterday. Let’s refer to the commentary we posted yesterday:

On BitStamp, we saw a move down yesterday on increased volume, but not increased enough to make it significant.

(…)

Today, we’ve also seen a move down but the volume hasn’t been exactly strong (…). Bitcoin hasn’t gone below $500 and the short-term outlook remains unchanged in our opinion, just as was the case yesterday.

Looking at this comment and what’s happened recently, you’ll certainly see that Bitcoin has been trading in a rather narrow range in the last couple of days (grey rectangle in the chart). For the most part of the consolidation, Bitcoin’s been trading between $500 and $550. The action today (this is written at 11:30 a.m. ET) hasn’t brought the currency outside of this range. Based on that, the current outlook remains unchanged.

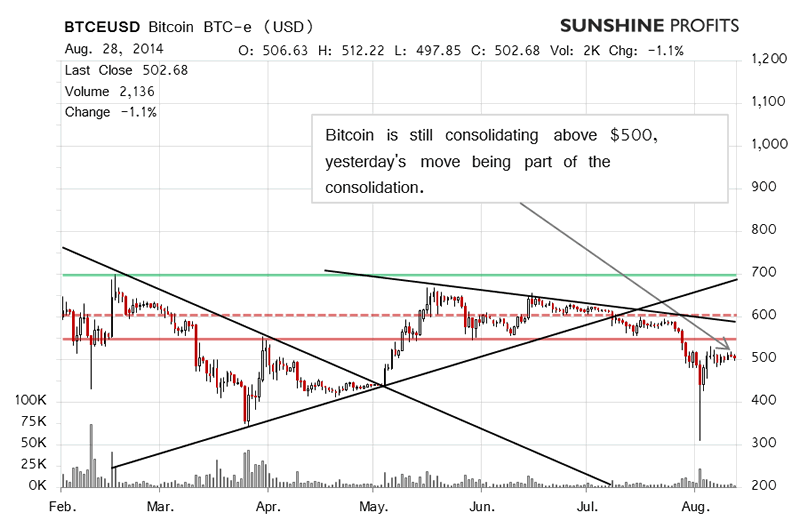

On the long-term BTC-e chart, there are no apparent changes but the consolidation around $500 is getting all the more visible. In recent days, Bitcoin has frequently tested $500 (on each day since Aug. 22 except last Wednesday) but hasn’t stayed below this level long enough to make the outlook bearish.

The volume levels are depressed which might suggest that we’re going through a period of relative calmness but, as usually, this might only be calm before the storm. Currently, we’re still below the medium-term tend line (upward sloped black line in the chart) but above the long-term trend line (negatively sloped line starting at the left vertical line). In light of the recent rebound from around $300 and the fact that the currency is holding up above $500, it seems that Bitcoin might return to $550, and afterwards to the recent trend line (downward sloping black line ending around $600). While this is not certain, a bet on higher prices seems worth a shot at this time.

Summing up, in our opinion long speculative positions are the way to go now.

Trading position (short-term, our opinion): long, stop-loss at $440, take-profit at $620.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.