Apple Stock to Reach a $1 Trillion Market Cap by 2018

Companies / Apple Sep 03, 2014 - 04:42 PM GMTBy: Money_Morning

As incredible as it seems, Apple Inc. (Nasdaq: AAPL) is on track to become America's first $1 trillion company by 2018.

As incredible as it seems, Apple Inc. (Nasdaq: AAPL) is on track to become America's first $1 trillion company by 2018.

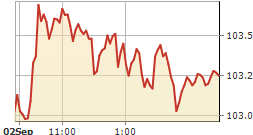

That means the Apple stock price will need to get to about $167 a share, a fair distance from its current $102.50 a share and market cap of about $613.5 billion.

But given the trajectory of its current businesses, as well as the additive punch of several new areas Apple will soon enter, a market cap of $1 trillion is a very attainable target. Lately AAPL stock been on the move; just this morning (Friday) it set a 52-week high of $102.90.

It would set a mark in the corporate world that few companies have ever come close to reaching.

The Rarely Seen $1 Trillion Market Cap Milestone

Apple itself reached a peak valuation of about $657.8 billion back in September of 2012, when AAPL stock hit its pre-split high of $702 a share.

The next closest was Apple rival Microsoft Corp. (Nasdaq: MSFT) which hit a market cap of $616 billion in 1999, at the peak of the dot-com bubble. Some argue Microsoft holds the U.S. crown if you account for inflation, which would put its 2014 equivalent at about $875 billion.

But sticking with nominal values, only one company in the world ever hit the magic $1 trillion mark - PetroChina Company Ltd. (NYSE ADR: PTR), which managed it briefly in its debut on the Shanghai stock exchange in 2007.

When its stock price tripled that day, PetroChina had a market cap of $1.2 trillion - but the shares almost immediately started falling. Since then its valuation has dropped to under $300 billion.

All this shows how excruciatingly difficult it is for any company to reach the $1 trillion mark.

But Apple can do it, and almost certainly will.

When you break it down, the company's businesses are more than capable of generating the profits required to get the AAPL stock price where it needs to be - just look at these numbers...

Apple Stock Will Be Driven by Businesses Old and New

Before we get to how Apple's businesses will push the company to a $1 trillion valuation, let's look at the numbers Apple needs to hit to get it there. (Note: I'm going to set aside Apple's ongoing stock buyback program for consistency's sake.)

For the past twelve months, Apple's earnings per share are $5.96. To get to the target AAPL stock price of $167, the company will need to add about $4 per share in earnings. An EPS of $10 and a P/E multiple of about 17 - right where it is now - gets the Apple stock price to $167.

An EPS of $10 translates to about $24 billion in additional profit, and yes, that's a mountain of money. For perspective, Microsoft's total profit for its most recent fiscal year was $22.07 billion.

And yet, it's completely feasible.

It breaks down to about $1 in additional EPS per year. AAPL is already expected to hit that target in 2015, with analysts currently projecting next year's EPS at $7.05.

Here's how Apple gets the profit it needs by 2018 to reach a $1 trillion market cap:

- The iPhone: Hand-wringing over the slowing growth in iPhone sales has been overblown. The law of large numbers dictates that Apple won't see 100% annual growth in iPhone sales ever again, but growth will remain steady. Research firm IDC projects that AAPL will sell 63.3 million more iPhones in 2018 than it does in 2014. Assuming profit margins stay about the same, such an increase will yield about $8.9 billion in additional annual net income by 2018.

- The iTunes Store/Software and Services: This previously quiet corner of Apple's empire is about to become a major contributor to the bottom line. Macquarie Capital projects that profits from this segment will explode from $10.95 billion this year to $19.12 billion in 2018, when it will account for a third of Apple's total profits. That's good for another $8.17 billion in annual net income.

- Wearable Tech: It's almost certain we'll see the rumored iWatch this fall - possibly as early as Sept. 9, when the iPhone 6 is expected to be unveiled. Morgan Stanley analyst Katy Huberty has said that Apple could sell between 30 million and 60 million iWatches in its first year, with margins in excess of 40%. Assuming a sales price of $200 and 45 million iWatches sold, that would yield about $2 billion in profit in 2015. The wearable tech market is brand new and is expected to grow rapidly over the next several years, so by 2018 Apple should be wringing about $4 billion in annual net income from the iWatch and its successors.

- The Internet of Things: As a tech titan with an already powerful ecosystem, Apple is well-positioned to profit from the Internet of Things, a shorthand term for the idea that wireless networks and sensors will allow not just devices, but our cars, clothes, and home appliances to communicate. Wearable tech is a subset of this, but the Internet of Things is much, much bigger. Apple's iBeacon technology, which beams data to people's smartphones while they shop in a store, is one example. And the next version of the iPhone operating system, iOS 8, will have health-monitoring features as well as an app to monitor and control your home. IDC says the market for such solutions will grow to $7.1 trillion by 2020. That should put it at about $5 trillion in 2018. Even if Apple gets just two-tenths of a percent of that, it will be worth $10 billion in revenue and another $2.2 billion in net annual income.

- Payments: Apple is said to be working on a mobile payments system that would utilize the iPhone's Touch ID technology. To make it happen, AAPL is talking to credit card companies like Visa Inc. (NYSE: V). If Apple succeeds in becoming a payments middleman, it could rake in an extra $500 million a year in fees.

All that brings us to just under $24 billion - but this scenario could actually turn out to be conservative.

For one thing, it's possible that Apple will enter another new product category over the next four years, such as television, that would be accretive to earnings.

AAPL stock could also rise faster if the company's gross margins start to rise, which tends to nudge up a company's P/E ratio. At 17, Apple's P/E is already well below the tech industry average of 26.

And Apple's margins have an excellent chance of rising over the next few years. That's because the iTunes Store/software and services segment has margins of about 77%, much higher than even the iPhone's. As that segment becomes a bigger factor in Apple's earnings, it will pull up the overall margins.

So if Apple's P/E rises just to 18.5, the EPS need only rise to $9 a share to reach the target AAPL stock price of $167 required to hit a $1 trillion valuation.

In fact, if the P/E rises, AAPL stock could hit the target well before 2018.

Somewhere, Steve Jobs is smiling.

For updates on Apple stock and other technology news, follow me on Twitter ;@DavidGZeiler.

UP NEXT: For much of this year, Money Morning Defense & Tech Specialist Michael Robinson has been calling for Apple stock to hit $1,000 a share within 24 months. Of course, now that AAPL stock has split 7-to-1, his target price is a much less round $142.85. Here's why Robinson is so incredibly bullish on AAPL right now...

Source : http://moneymorning.com/2014/08/29/apple-stock-to-reach-a-1-trillion-market-cap-by-2018/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.