Can the U.S. Economy Withstand Another Housing Market Breakdown?

Housing-Market / US Housing Sep 20, 2014 - 03:34 PM GMTBy: Sy_Harding

With the three fascinations of the week, the Fed’s FOMC statement, the separation vote in Scotland, and the Alibaba IPO, now history, will investors re-focus on the economy?

With the three fascinations of the week, the Fed’s FOMC statement, the separation vote in Scotland, and the Alibaba IPO, now history, will investors re-focus on the economy?

Given what the Fed actually said in its statement, and some recent economic reports, it might be a good idea.

Investors were anxious to judge how long the Fed will leave interest rates at low levels by whether or not it left the words “for a considerable time” in its FOMC statement.

They might be better counseled to focus on the fact that the Fed emphasized again that the timing will depend entirely on the economy, specifically mentioning its concern of “significant underutilization of labor resources” [a euphemism for unemployed workers], and that “the housing sector remains slow”. In fact, the San Francisco Fed said, “The public might not give enough weight to how dependent the Fed’s guidance is on incoming economic data.”

That said, as we all know, the two major driving forces of the economy, in both directions, are the housing and auto industries. Their products are the largest purchases most consumers make in their lifetimes. They also have the longest tails as far as driving sales, manufacturing, and services in numerous other sectors of the economy

Their problems led the way down into the Great Recession. They then led the way out, thanks to massive automaker and bank bailouts, and incentives to auto and home buyers.

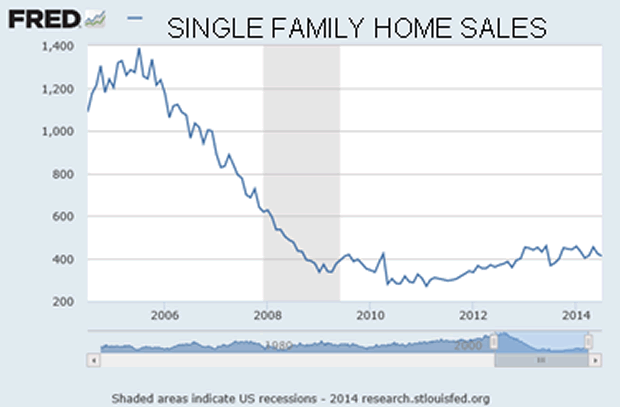

The problem is that while auto sales continued to recover almost all the way back to pre-recession levels, the housing recovery stalled more than a year ago.

When the weakness continued into the winter months, analysts explained it as a temporary weather-related pause that would result in a big ‘pent-up demand’ spike back up in the spring.

That did not happen, nor did the subsequent assurances work out that the spike back was merely delayed during the summer for one reason or another.

And now the outlook is worsening further, evidence mounting that housing is not only stalled, but potentially in the throes of another breakdown.

It’s not just that home sales are down from a year ago. It’s reports, like that of Thursday, that ‘new home starts’ plunged 14.4% in August, and permits for future starts fell 5.6%.

New home starts are even more important than home sales, particularly existing home sales. It is homes under construction that produce jobs and drive sales of construction materials, furniture, appliances, and services.

There has been evidence for some time that the slowdown is not a temporary situation.

It went almost unnoticed in 2013 when major banks closed substantial numbers of mortgage offices, and cut thousands of mortgage-related jobs, citing expectations of a substantial drop of as much as 40% in mortgage activity. That was well before the ‘weather-related’ winter slowdown. Those were not actions they would have taken if they expected a recovery within a reasonable time-frame. So far, they have been correct, and it is not encouraging that a year later the sharp decline in mortgage applications continues.

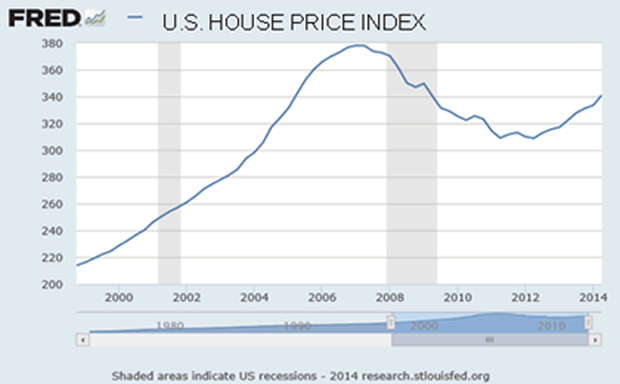

Speculators and real estate investors jumped in to take advantage of lower prices in 2011 and 2012, many paying cash. Now that prices have risen by double digits, they are not adding to their inventories, and some, mainly hedge funds, are rumored to be ready to sell to take profits.

That would only exacerbate an already troubling situation. Real buyers are just not there in sufficient numbers. The percentage of homes bought by first-time home buyers, the traditional driving force for the housing industry, is at a record low, and interest in home ownership versus renting is at a generational low.

Meanwhile, there are those who believe the bursting of the 2007 bubble did not get the job done (of bringing prices down to normal levels) before stimulus and low interest rates artificially lifted them again, and that housing is due at some point for another leg down.

These are Federal Reserve charts, so they are well aware of the situation and may even be understating their concern about the housing sector.

Given housing’s history of driving the economy in both directions, let’s hope next week’s reports on new and existing home sales improve the outlook.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.