U.S. Dollar: The Last Hurrah?

Currencies / US Dollar Sep 22, 2014 - 02:20 PM GMTBy: Ned_W_Schmidt

End of empire is a difficult time for two groups, investors and patriots. A hundred years ago the U.S. took the economic baton from England to become the most important economy in the world. No doubt some loyalists refused to recognize the shift that was taking place. From then on the world began to denominate economic activity in U.S. dollars. Holding British pounds might have been the loyal thing to do, but it was not a wise investment decision. Today, a similar situation exists for the dollar. Dollar-based investors may now be facing the "last hurrah" for the dollar, and should not ignore that possibility.

End of empire is a difficult time for two groups, investors and patriots. A hundred years ago the U.S. took the economic baton from England to become the most important economy in the world. No doubt some loyalists refused to recognize the shift that was taking place. From then on the world began to denominate economic activity in U.S. dollars. Holding British pounds might have been the loyal thing to do, but it was not a wise investment decision. Today, a similar situation exists for the dollar. Dollar-based investors may now be facing the "last hurrah" for the dollar, and should not ignore that possibility.

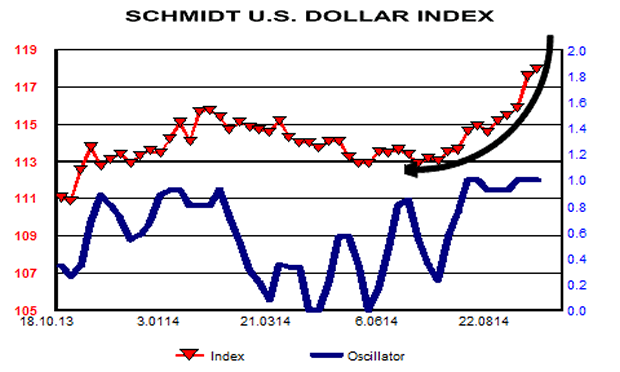

In the chart below is portrayed an index of the value of the U.S. dollar versus sixteen(16) important currencies. As such, it is more representative of the global value of the dollar than popular dollar indices which are generally poorly constructed. The widely used dollar index is composed of 77% European currencies. It has no African, South American, or Asian currency beyond the Japanese yen. The Chinese Renminbi is not included.

Our interest in this chart is the latest rally. That upward move in the index was created by two forces. First of those was Russian incursion into Ukraine. Second force was momentum traders that identified the shift and leaped on it. Rationalization, and it is nothing more than that, for most recent component of rally has been fantasy that the Federal Reserve has now become the only responsible monetary authority among the major currencies. And yes, the cow jumped over the moon.

Latest rally in this dollar index is one of the most dangerous of chart formations. Highlighted by the bold, black line is the parabolic pattern. In this pattern the rate of rise, or slope of the line, increases as the rally progresses. This type of market action is unnatural, and normally leads to a dramatic correction. That chart pattern suggests the U.S. dollar is poised for a fairly dramatic fall.

Source: ihs.com

The unnatural nature of this rally can be visualized by the act of throwing a ball into the air. The momentum of the ball declines as it rises, eventually turning negative. The ball then falls to ground, every time. In the case of the formation highlighted in the chart, the "ball" rises faster as it goes up. The speed of the rise, measured by the slope of the line, increases, and assumed to ever do so. That is not how the world works. We suggest you try it with a ball if you are a doubter.

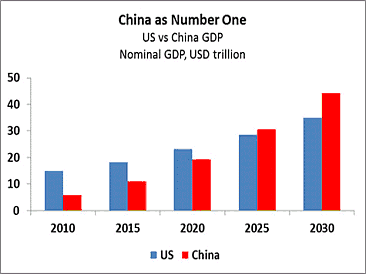

The pages of a calendar do turn. In the case of the current calendar, the pages are turning toward China. Some strong fundamental reasons exist for coming secular weakness in the U.S. dollar. The biggest one is China. IHS's recent long-term forecast for the U.S. and Chinese economies, shown in graph below, is an important reminder that China is to become the largest economy in the world. While the exact timing of the projection of that event, by 2025, might be off by a year or so, the inevitability of that event is not in doubt.

China's economic dominance will rise from the consumption miracle that has been in process for some time. The consumer base in China is continuing to expand due to ongoing urbanization in that nation, and improved economic conditions in the rural areas. The movement of consumers from a rural area to a city multiplies their lifetime incomes many times. That higher income will be spent, just as it is by consumers in any country.

China's consumption driven economy has already broadened that nation's impact on global trade.

In a recent article in Caixon ("RMB as Reserve Rebalancing the Global Financial System",September-,2014), Peter Wong noted the importance of Chinese trade in the world:

"In 2012, the last year for which statistics are available, China was the biggest trading partner for 124 countries as opposed to 76 for the United States."

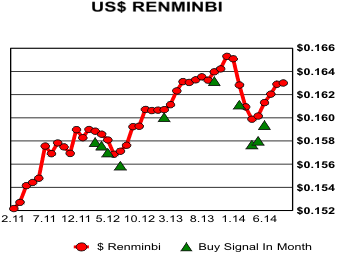

The reality of China coming to dominate world trade cannot be ignored. While on average the dollar dominates global trade settlement, at the margin the Chinese Renminbi is increasingly used to settle that trade. Nearly 20% of trade with China is now settled in Renminbi to avoid the cost of foreign currency conversion. The long-term shift to the Chinese Renminbi is evident in the rising value of that currency relative to the dollar in recent years, as shown in chart to right. Remember that the Renminbi is not included in the popular dollar index which means the dollar's performance is over stated by that index.

The public offering of shares of Alibaba(NYSE: BABA) has been accomplished with true gusto, and no clearer example of a mania, bubble, feeding frenzy, auction mania, etc. is possible. Actually, the English language lacks a word to adequately describe the euphoric market conditions fostering such demand. Gold may be an investor's only defense against this epoch Techo-Mania, as it is surely a terminal event.

BABA's offering is important as it confirms two factors, one of which will ultimately send the Renminbi higher and the dollar lower. First, the center of the investment world is moving to China from New York City. Second, China will likely dominate the technology world in the years ahead just as it will do so in the economic world. A derivative of that is the Renminbi will increasingly capture market share in the world of currencies.

Wong opened the article mentioned above by writing,

"If the account of the 20th century was written in dollars, the account of the 21st century will be bilingual, dollars and yuan."

We would modify only somewhat Wong's conclusion. Due to distrust of governments, the currencies of the 21st century will include Gold more so than in near a hundred years. With the dollar's global role declining, money will seek out some alternative to it. But, investors may be very reluctant to fully embrace the Chinese currency. That reluctance will simply increase the importance of Gold.

Ned W. Schmidt,CFA is publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food Super Cycle, and The Value View Gold Report, a monthly analysis of the true alternative currency. To contract Ned or to learn more, use either of these links: www.agrifoodvalueview.com or www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.