Gold Stocks Stealth Rally

Commodities / Gold and Silver 2014 Oct 02, 2014 - 09:18 AM GMTBy: Gary_Tanashian

Well, the headlines are rightfully bearish for gold, silver and the major precious metals stock indexes, ETFs and senior gold miners. The technical damage is real. Today's burst could be and probably is just short covering. [edit; post was mostly written before the end of day flop]

Well, the headlines are rightfully bearish for gold, silver and the major precious metals stock indexes, ETFs and senior gold miners. The technical damage is real. Today's burst could be and probably is just short covering. [edit; post was mostly written before the end of day flop]

But improbably enough, there is a stealth uptrend going on in certain royalties, miners, developers and explorers. Believe me, if you could hear me talk instead of write you would not hear anything resembling desperation in my tone. That is because I have worked hard during this bear market to manage risk, stay strong and out of the bear's way. So I am not talking any sort of a book here other than my biggest picture view (an economic contraction environment that ultimately benefits the counter cyclical gold sector), which could still be out on the horizon.

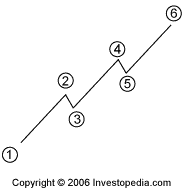

Don't take my word for it, here's Investopedia's definition of an uptrend:

"Describes the price movement of a financial asset when the overall direction is upward. A formal uptrend is when each successive peak and trough is higher than the ones found earlier in the trend."

Graphic : Investopedia

Complicated it's not.

The following charts are what they are (in up trends), and considering that legions of gold bugs have now sworn off the promoters and puked up gold for good, the time is nearing that this sector will again be investment worthy. At the very least, NFTRH for one is going to point out positives along with the ample negatives. Just so we keep a level playing field and an unbiased viewpoint.

We reviewed a condition on HUI's weekly chart in an update the other day for instance. It's a lower probability thing, but if it were to manifest it would rip the shorts' heads off. Picture it, they'd be running around headless, bumping into each other, falling down, getting up again, until they realize they too are dead from shorting something that everybody already knew was left for dead... except for who ever has been buying these charts since last year.

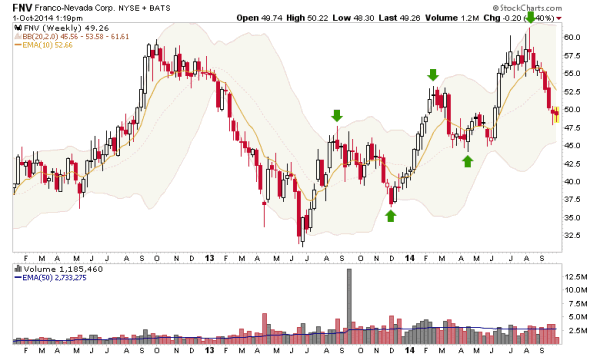

Franco Nevada

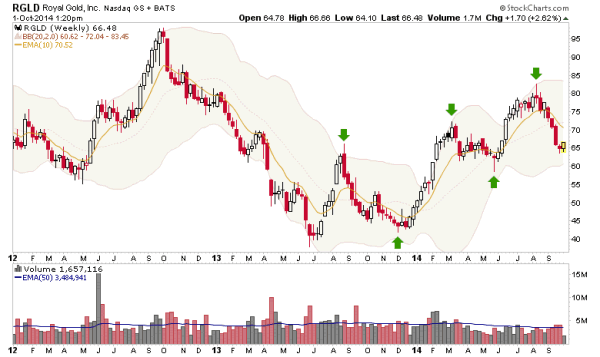

Royal Gold

Kirkland Lake Gold

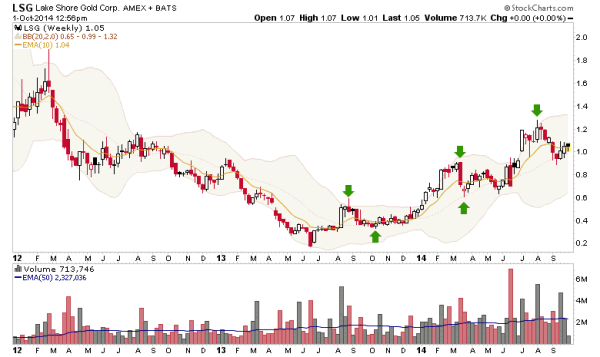

Lake Short Gold

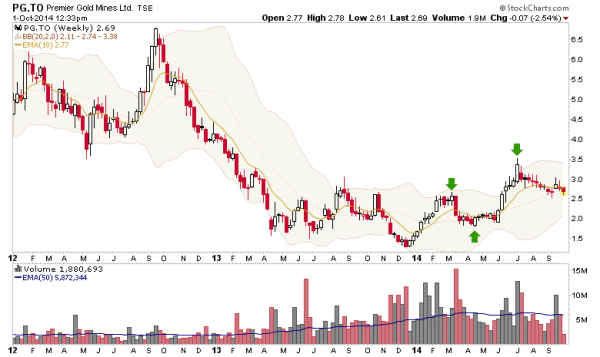

Premier Gold

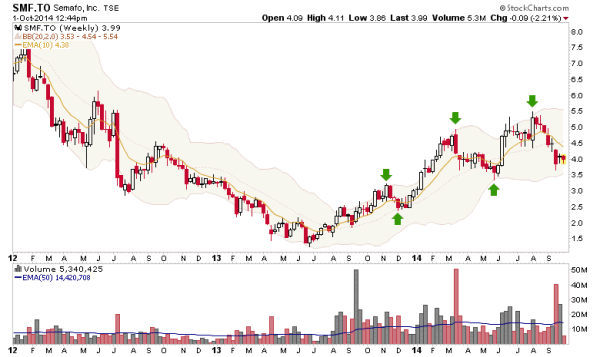

Semafo

Rio Alto Mining

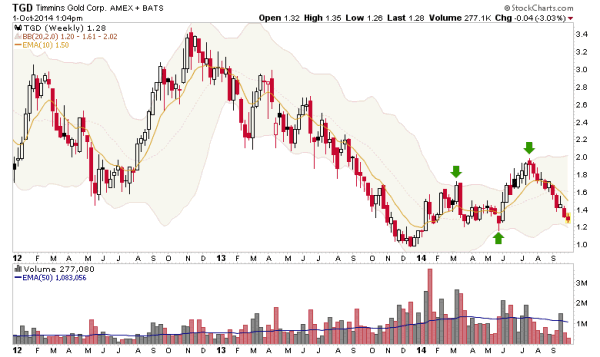

Timmins Gold (a little wobbly, but still...)

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart/trade ideas!

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.