US Dollar is Extreme

Currencies / US Dollar Oct 07, 2014 - 09:34 AM GMTBy: Gary_Tanashian

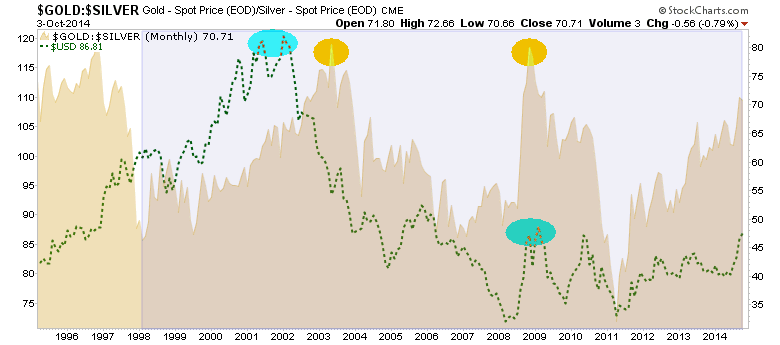

Using Tom McCellan’s article discussing a “blow off” move in the US dollar and its very bearish net short position by commercial traders as a starting point, I would like to talk about the USD and gold and how they each fit in to the global macro backdrop. We could add silver into the mix as well because its failure in relation to gold (ref. the gold-silver ratio’s breakout last week) is the other horseman (joining Uncle Buck) that would indicate a changing macro. Here’s the McClellan piece:

Using Tom McCellan’s article discussing a “blow off” move in the US dollar and its very bearish net short position by commercial traders as a starting point, I would like to talk about the USD and gold and how they each fit in to the global macro backdrop. We could add silver into the mix as well because its failure in relation to gold (ref. the gold-silver ratio’s breakout last week) is the other horseman (joining Uncle Buck) that would indicate a changing macro. Here’s the McClellan piece:

Commercials Betting on Big Dollar Downturn

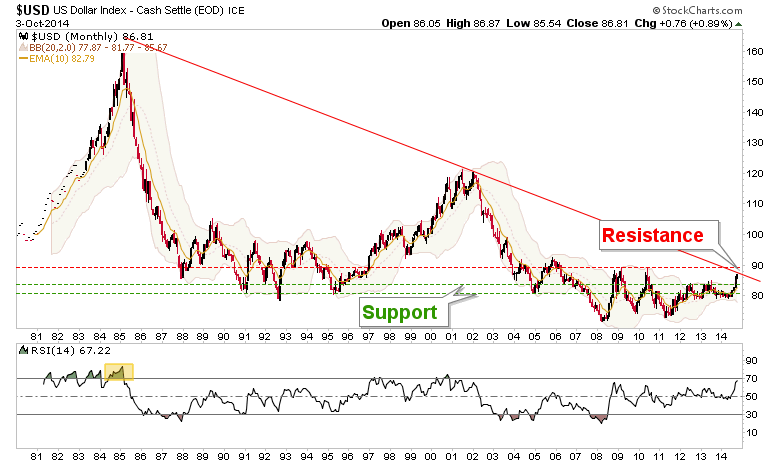

First I would question the term “blow off” when talking about the USD. Markets that have come off of long term basing patterns and broken above resistance with plenty of overhead resistance still to come have not blown off. A blow off is Nasdaq 2000, Uranium 2007, Crude Oil 2008, Silver 2011, etc.

Reviewing the monthly chart below, we see nothing of the sort currently when considering a “blow off” move in USD. What we see is a currency that made its real blow off move in 1985 to climax the Volcker interest rate hiking regime.

There is no blow off in USD. What there is is a savage upward move that we charted all along from its birth to its now mature and hysterical potential pivot point.

USD appears to be rising in response to a narrative taking shape about Fed Funds rate hikes by mid-2015. This is brought about by the strong economic performance that has taken place since we clearly anticipated it in early 2013. Let’s not over complicate this. The currency’s strength and associated rate hike talk are in play because of economic performance, which has been good in key areas like relatively high-paying manufacturing and generally with the improved employment (and unemployment) data.

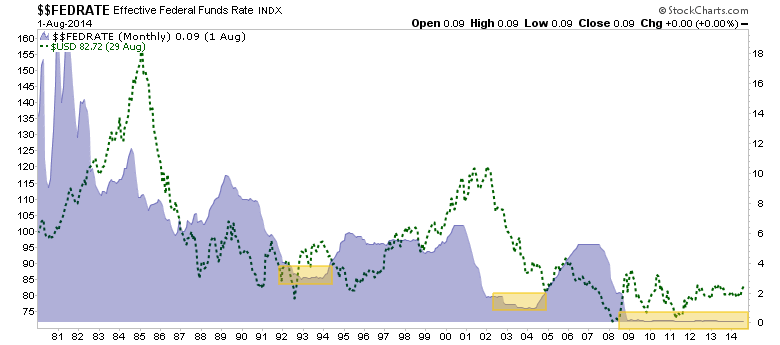

The chart below shows a disjointed but mostly positive correlation over 3-plus decades between the Fed Funds rate and USD. The little hook upward at the end of the green dotted line is not a blow off is it? No, it is a projection by the market that the Fed will be compelled to raise interest rates because of economic strength and their own stated targets for employment (currently 5.9% unemployment).

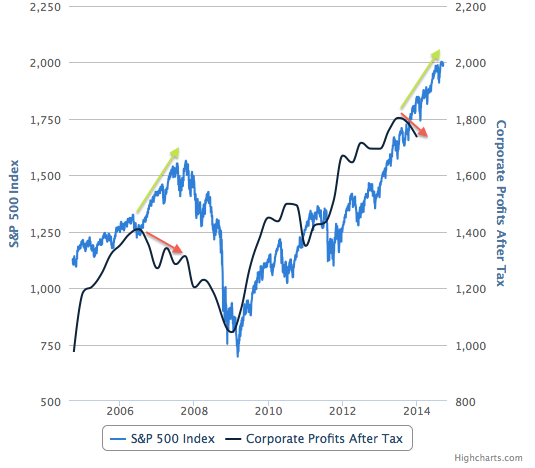

Since we know full well that it was policy that created this phase of strength, the stock market, with its most recent in a string of corrective mini-blips, seems to be working a narrative that says a withdrawal of that policy (ZIRP) would be a bad thing for stocks. Our oft-shown S&P 500/ZIRP/Money Supply and S&P 500/Corporate Profits charts agree wholeheartedly.

The chart above states that it has been policy and policy alone (in the form of the nearly 6 year old ZIRP, along with QE’s 1, 2 & 3) that has driven the economy and along with it, money supply and asset market speculation. The chart below states that corporate earnings may have begun to stall slightly in conjunction with a firming and now impulsively strong US dollar.

But our theme has been that the US dollar and the Gold-Silver Ratio (GSR) are running mates, the two horsemen that would change the macro. The precious metals are declining hard along with the commodity complex and inflation expectations in general. People not willing or able to make macro interpretations are getting lost in a ‘where’s the inflation???’ hysteria.

But the macro theme is that it is moves like this that bring turning points. These turning points are not always what inflationists – probably champing at the bit to get back on the soap box again – want to see. The ‘inflatables’ have been wiped out by the rise in the GSR and with the USD finally making a move as well, the economy is at risk because policy is no longer serving to do what it set out to do to begin with, which is to compromise the currency in favor of assets.

Certain gold bugs are calling ‘crash’ now [in gold] and the ones who have called so many bottoms they would look ridiculous getting on the ‘gold to sub-1000’ train, have simply gone quiet. Imagine that, a quiet gold bug. Well, it’s happening. Most of the loud ones now are the ones trying to be square with the bearish backdrop.

Being a former life-long (to 2012) manufacturing guy that is the area I’ll continue to keep the pulse on. US manufacturing has experienced a re-shoring mini boom as the ‘China outsource’ play had many holes in it from quality and service perspectives even before I left the sector.

The people working the 1990’s theme that we are a consumer driven economy (with all our manufacturing outsourced) and our ‘King Dollar’ will allow us to consume our way to prosperity at the expense of the rest of the world no longer holds water. The public (i.e. consumers) has disproportionately not participated in this economic rebound.

Further, the strength in the USD takes aim directly at manufacturing *, which is a sector with relatively good wages. Combined with the message of the GSR’s global liquidity drainage along with various global markets on the wane, the US economy and its stock markets do not want to see a perpetually strong domestic currency.

Going back to the McCellan article and indeed all of our data presented to date showing an over loved US dollar, despised Euro, bombed out commodities and precious metals all at extremes, it may be time for a rebound in the ‘inflation trade’, with the USD resuming its role as an anti-asset foil. But the US dollar is bullish based on its impulsive move up from a basing pattern. With respect to the interim, let’s review the potential for a rebound in the anti-USD trade… [which is exactly what NFTRH 311 went on to do, along with much more analysis covering precious metals, US and global stock markets, etc.]

* Here again for public readers I’ll note that we (NFTRH) were a lone voice in early 2013 when noting the Semiconductor Capital Equipment ramp up and its positive implications on future manufacturing reports (ISM) and later, employment and the general economy. I feel I should reaffirm this not to look like a smart guy (well, that never hurts ![]() since I’ll make my share of screw ups too), but to give validity beyond what can be construed as a perma bear view when noting negative implications for the economy.

since I’ll make my share of screw ups too), but to give validity beyond what can be construed as a perma bear view when noting negative implications for the economy.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart/trade ideas!

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.