Bitcoin Price Short-term Bottom Not Far Away?

Currencies / Bitcoin Oct 07, 2014 - 03:10 PM GMTBy: Mike_McAra

In not too many words: no speculative positions.

In not too many words: no speculative positions.

"Buy when there's blood in the streets," or so the saying goes. And we're starting to catch first whiffs of "blood," if not streaks of it in the media coverage. There's been a marked increase in articles that focus on "Bitcoin going under $300" or ones exploring the idea that it might be all over for the currency. We read on Quartz:

People are starting to notice: The bad boy of the digital currency world is losing its mojo.

Which is to say, bitcoin prices in US dollars have been heading south, hovering at just under $350 after peaking at more than $1,100 just a year ago. At one point, bitcoin was the worst performer of nearly any asset class.

It's not a coincidence, either, that bitcoin hasn't really been in the news of late, as the currency was during last year's explosion. The crypto-currency is remarkably sensitive to media coverage, and one of the main dynamics of its rise has been the hype cycle of successive rounds of excited investors piling into the currency, much to the benefit of early adopters.

But the last point might also point in a different direction. There definitely seems to be more negative coverage of late than it was only a couple weeks ago. Arguably, this still is not exactly the panic and widespread dismissal one might expect near major bottoms. But it seems that the stories about Bitcoin might have changed tack from focusing on venture capital investments and security issues to commenting on the lackluster performance this year.

There are still no headlines about Bitcoin on homepages of major finance news services which suggests that there still might be room for some more depreciation but the climate seems to be changing to a more reserved one. This might be the first indication that a major bottom might be in the cards in the future. We're on the lookout for more info about how Bitcoin is a "terrible investment." Once we see such pieces put out by major news outlets, we might face an important buying opportunity, even for long-term investors.

For now, let's turn to the charts.

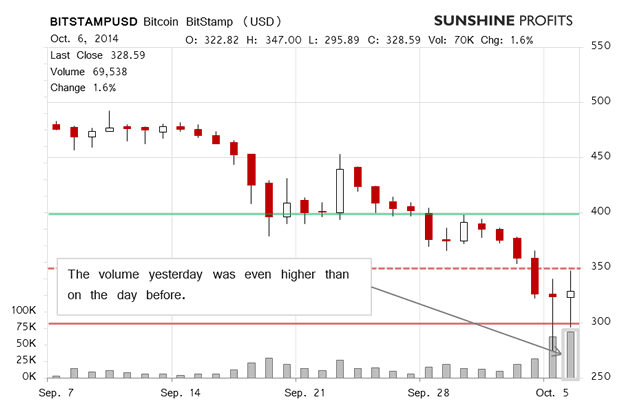

On BitStamp, we saw yet another spike in volume (fourth day of rising volume), with almost 70,000 bitcoins traded. The currency went below $300 in the day, but came back above $300 to close not far from $330. Overall, compared with Sunday, it was a day of a higher daily low, higher high and a higher close, all on rising volume. This suggests that yesterday was an important day as far as the short-term outlook was concerned.

Today, there's been a visible drop in trading volume and it seems that if the last couple of days were wild, we might be getting back to "normal" (this is written after 7:30 a.m. ET). Bitcoin is still below $350 which doesn't suggest a meaningful reversal just yet, but signs of a possible rebound are there.

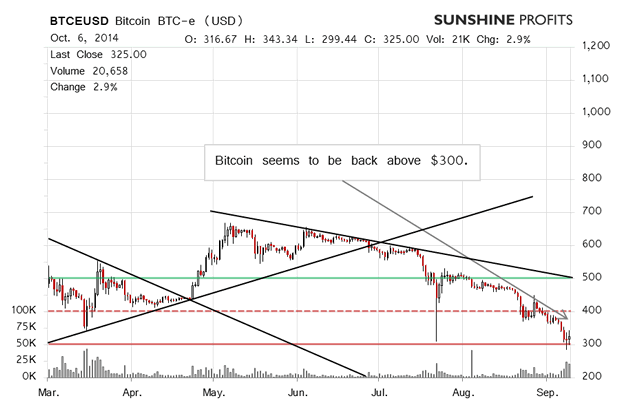

On the long-term BTC-e chart, yesterday's move is visible and so is the spike in volume we saw in the last couple of days. If you recall, yesterday we wrote:

The most important question for traders now is whether the slump has come to a halt and the rebound can be taken as a sign of strength. After two strong slides not far from one another and with Bitcoin in a downtrend, it might seem as though more depreciation is just a matter of time. On the other hand, precisely after two sell-offs of such magnitude, there might not be much selling power in the market, and the important psychological level of $350 in place it might be where market players will push Bitcoin.

Currently, our bet is on Bitcoin staying above $350 and recovering some ground after the recent declines. Because of that, we think a limit buy order might be appropriate at this time with an entry price at $360.

This is still very much up to date and coupled with the fact that we've seen an increase in negative news on Bitcoin points to the fact that a bottom, if not a long-term one than a short-term one might be in or close to being in.

If there's anything that bothers us, it's the fact that Bitcoin hasn't gone above $350 yet. In the current environment it seems that betting on rising prices might not be the way just now. Instead, we would prefer to wait for Bitcoin to go above $350 on relatively strong volume.

Summing up, we don't support any short-term positions in the Bitcoin market at present.

Trading position (short-term, our opinion): no current positions. A buy limit order with an entry price of $360, stop-loss at $337.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.