Stock Market Primary IV Wave Counter Trend Rally

Stock-Markets / Stock Markets 2014 Oct 19, 2014 - 12:20 PM GMTBy: Tony_Caldaro

What a week! After the SPX dropped 3.1% last week ending at 1906, it started off quiet enough with a push to 1912 by around noon Monday. Then the bottom fell out, as the market dropped, gyrated on Tuesday, then dropped to 1821 by early afternoon Wednesday. After that it staged one heck of a come back rally, hitting SPX 1898 on Friday then ending the week at 1887. For the week the SPX/DOW were -1.0%, the NDX/NAZ were -0.9%, and the DJ World index dropped 0.8%. Economic reports for the week were biased 8:6 to the positive. On the uptick: business inventories, industrial production, housing starts, building permits, consumer sentiment, the monetary base, plus the budget surplus and weekly jobless claims improved. On the downtick: retail sales, the PPI, the NY/Philly FED, the NAHB and the WLEI. Next week is highlighted with the CPI, Existing/New home sales, and Leading indicators.

What a week! After the SPX dropped 3.1% last week ending at 1906, it started off quiet enough with a push to 1912 by around noon Monday. Then the bottom fell out, as the market dropped, gyrated on Tuesday, then dropped to 1821 by early afternoon Wednesday. After that it staged one heck of a come back rally, hitting SPX 1898 on Friday then ending the week at 1887. For the week the SPX/DOW were -1.0%, the NDX/NAZ were -0.9%, and the DJ World index dropped 0.8%. Economic reports for the week were biased 8:6 to the positive. On the uptick: business inventories, industrial production, housing starts, building permits, consumer sentiment, the monetary base, plus the budget surplus and weekly jobless claims improved. On the downtick: retail sales, the PPI, the NY/Philly FED, the NAHB and the WLEI. Next week is highlighted with the CPI, Existing/New home sales, and Leading indicators.

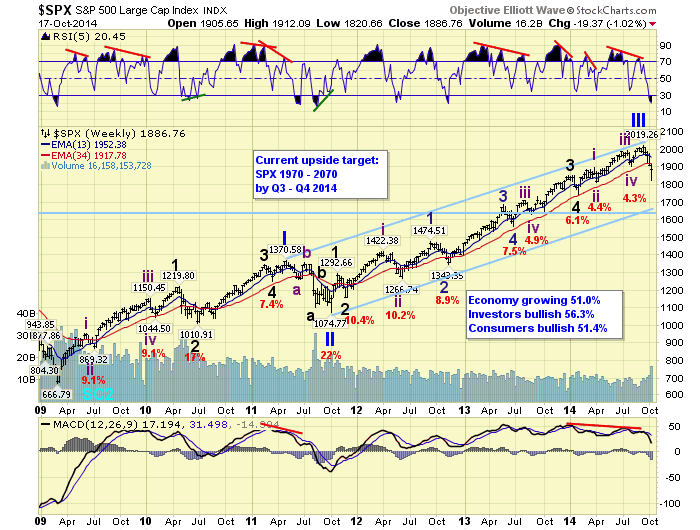

LONG TERM: bull market

The five Primary wave Cycle wave [1] bull market continues. However, the market is currently in its largest correction since 2011. Primary waves I and II completed in 2011. Primary wave III just recently completed in September 2014, and Primary wave IV is currently underway. Historically, the two most significant corrections during a five wave bull market, Primary waves II and IV in our bull market, are generally similar in the percentage of market decline. Using the DOW are a reference:

1982-1983: wave 2 -8.8%, wave 4 -8.6%. 1984-1987: wave 2 -7.9%, wave 4 -10.8%. 1987-1990: wave 2 -9.4%, wave 4 -11.3%. 1990-1998: wave 2 -10.1%, wave 4 -16.8. 1998-2000: wave 2 -7.5%, wave 4 -12.2%. 2002-2007: wave 2 -9.0%, wave 4 -10.7%. Even the lengthy 13 year bull market, 1987-2000 in OEW terms, met these parameters: wave 2 -22.4%, wave 4 -21.6%.

Since Primary wave II took fives months while the market declined 22% in the SPX. We are expecting Primary IV to take about three months with a market decline between 15% and 20%. It could be higher, but not likely lower. The rising channel in the weekly chart above looks like it will provide good support.

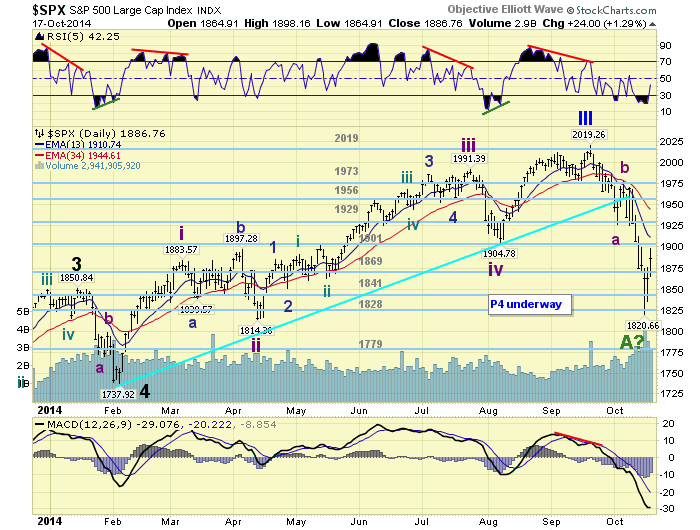

MEDIUM TERM: Major wave A may have bottomed

Primary wave III topped in mid-September at SPX 2019 after completing the five Intermediate waves of Major wave 5. All Primary waves divide into five Major waves. As the market was correcting we set five parameters to help confirm that the top was in place. By a week ago Friday all five were met, including a downtrend confirmation which had occurred a week earlier.

The market then declined from SPX 2019 in three Intermediate waves: A 1926, B 1978, and C 1821. At the SPX 1821 low the market had lost 9.8% of its value. This was the largest correction since mid-2012. Refer to the weekly chart. On Thursday we posted a tentative green Major wave A label at the SPX 1821 low, when the characteristics of the market changed. Throughout most of the Major A decline we had observed seven wave declines, separated by quick one wave rallies. On Wednesday we observed a five wave advance from SPX 1821 to 1869. We knew when SPX 1869 was exceeded the characteristics had changed. This type of change often suggests a change is trend is underway.

As noted above we are expecting Primary IV to correct for about three months. We are also expecting it to unfold in three waves: Majors A, B and C. Since Primary II took the form of an elongated flat, we are expecting a simple zigzag for Primary IV. If Major wave A ended on Wednesday at SPX 1821, we should now be in a counter rally Major wave B. Typically these counter rallies during a prolonged decline retrace anywhere from 50% to 61.8% of wave A. This suggests to rally to SPX 1920, or SPX 1943. They can also retrace back to the high of the B wave of the first ABC decline. In this case SPX 1978. Since the market has already rallied back to SPX 1898 in just two days we think the 1956 and 1973 pivots should be the upside targets for Major wave B.

Medium term support is currently at the 1869 and 1841 pivots, with resistance at the 1901 and 1929 pivots.

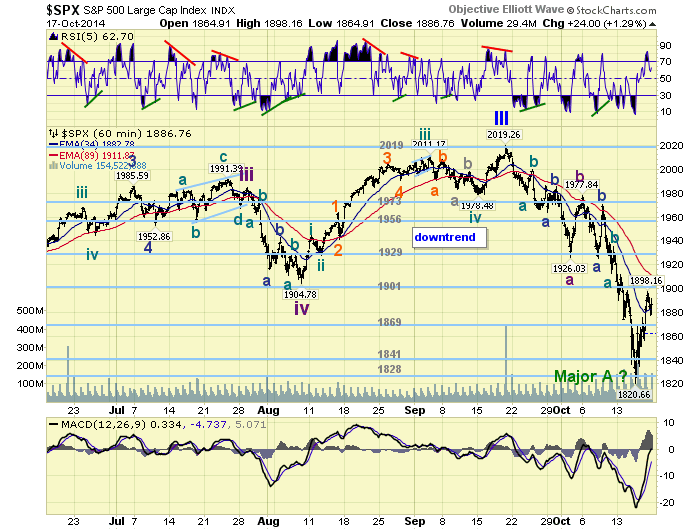

SHORT TERM

The downtrend decline from SPX 2019 unfolded in three Intermediate waves, with each of those three waves dividing into three Minor waves. The first Minor wave decline of Int. A was complex and the second simple. The first Minor wave decline of Int. C was simple and the second complex. Some alternation as the downtrend was unfolding. At Wednesday’s SPX 1821 low Int. wave C equaled a near perfect 1.618 relationship to Int. A.

If we are indeed in Major wave B we should observe a three Intermediate wave advance, with three Minor waves within each Int. wave. The same as Major wave A only in reverse. From the SPX 1821 low we have had quite a complex rally: 1869-1835-1868-1852-1876-1857-1898-1878-1892. Notice nearly all these waves overlap each other as expected. We certainly would not consider this an impulsive advance. Thus far it appears the entire rally from SPX 1821-1898 can be counted as Minor wave a of Int. wave A. The pullback to SPX 1878 is probably part of Minor wave b. Which suggests some downside early Monday, providing the market does not exceed SPX 1898 first. After Minor b completes we should get a Minor c rally to the 1929 pivot ending Int. wave A. Keep in mind this market remains quite volatile with triple digit DOW swings nearly every day. Short term support is at the 1869 and 1841 pivots, with resistance at the 1901 and 1929 pivots. Short term momentum ended the week below neutral after getting extremely overbought.

FOREIGN MARKETS

Asian markets were mostly lower on the week for a net 1.0% loss.

European markets were sharply lower all week but rebounded Friday for a net 1.9% loss.

The Commodity equity group were all higher for net gain of 0.6%.

The DJ World index lost 0.8% on the week.

COMMODITIES

Bonds had a wild week, remain in an uptrend, and gained 0.9% on the week.

Crude continues to downtrend losing 3.0% on the week.

Gold is trying to uptrend and gained 1.2% on the week.

The USD looks like it is in a downtrend, unconfirmed, and lost 0.9% on the week.

NEXT WEEK

Tuesday: Existing home sales. Wednesday: the CPI. Thursday: weekly Jobless claims, FHFA housing prices, and Leading indicators. Friday: New home sales. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2014 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.