Crude Oil Price Sinking Or Rebounding

Commodities / Crude Oil Oct 28, 2014 - 11:55 AM GMTBy: Nadia_Simmons

Trading position (short-term; our opinion): No positions.

Trading position (short-term; our opinion): No positions.

On Friday, crude oil lost 0.68% as concerns over a global oversupply continued to weigh. Additionally, soft U.S. housing data pushed the commodity below $82 per barrel. Will we see another test of the strength of the psychologically important level of $80?

Although crude oil moved sharply on Thursday on news that Saudi Arabia cut its supply to the market in September, oil investors digested that the country's overall production grew from 9.597 million barrels a day in August to 9.7 million barrels a day last month, indicating that the market will remain amply supplied. Additionally, soft U.S. housing data pushed the commodity lower as well. On Friday, the Census Bureau showed that U.S. new home sales rose in September to 467,000 units, missing expectations for an increase to 470,000 units. In this environment, the price of light crude declined after the market's open on Friday, slipping below $82. Will crude oil test of the strength of the psychologically important level of $80 once again? (charts courtesy of http://stockcharts.com).

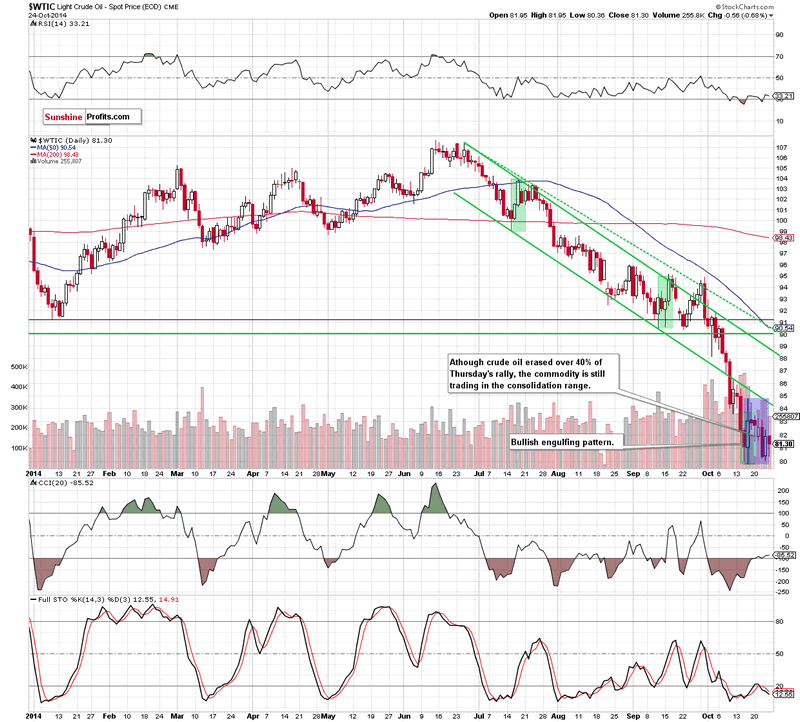

As you see on the daily chart, although crude moved lower once again, the commodity is trading in the consolidation between Oct 16 high and low (marked with blue), still above the key level of $80. Therefore, what we wrote on Thursday is up-to-date:

(...) light crude approached the recent low, which could encourage oil bulls to act and result in a post-double bottom rally. If this is the case, crude oil will rebound from here in the coming days and the initial upside target would be around $84.45, where the lower border of the declining trend channel and the lower long-term grey resistance line are. Additionally, slightly above these lines is also the upper border of the current consolidation (at $84.83). Therefore, a breakout above such solid resistance zone would be a strong bullish signal that should trigger further improvement and an increase to at least $88.50-$89, where the next resistance zone (created by the upper line of the declining trend channel and the first long-term grey declining line) is. Nevertheless, if oil bulls fail, and the commodity breaks below $79.78, they will find the next support around $77.28, where the Jun 2012 low is.

Did this short-term move affected the medium-term picture? Let's check.

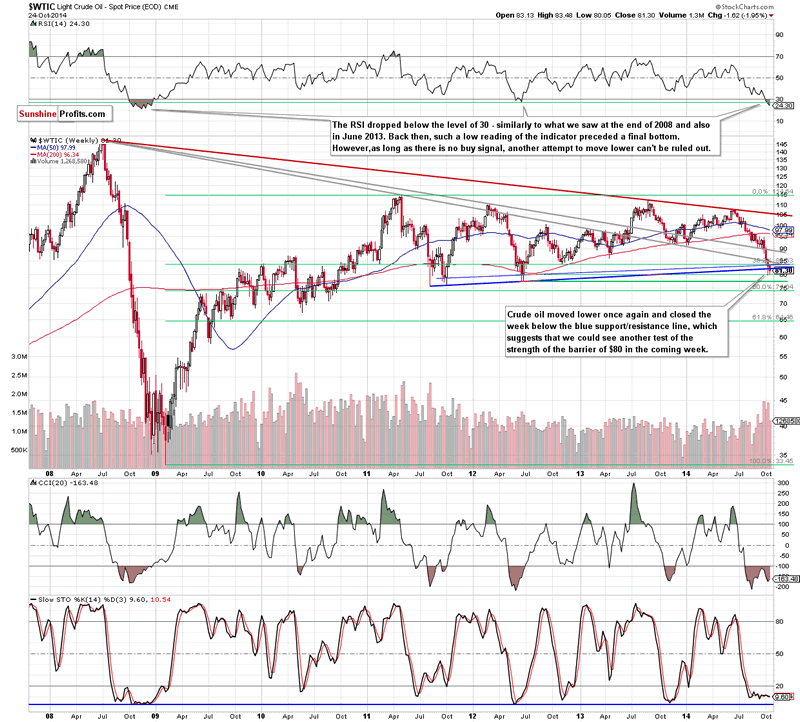

From this perspective, we see that Friday's move took crude oil below the blue rising line once again. In this way, the commodity closed the week under this resistance, which suggests that we will see another test of the strength of the barrier of $80 in the coming week. In our opinion, as long as this key support is in play another sizable downward move is not likely to be seen. On the other hand, as long as there is no breakout above the blue resistance line, further improvement is questionable.

Summing up, although the very short-term picture hasn't changed much as crude oil is still trading in the consolidation range, the situation in the medium-term has deteriorated slightly after a weekly close below the long-term support/resistance line. Such price action suggests that we'll see another test of the strength of the barrier of $80 in the coming week. Taking all the above into account, we still think that staying on the sidelines and waiting for the confirmation that the declines are over is the best choice.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Sunshine Profits‘ Contributing Author

Oil Investment Updates

Oil Trading Alerts

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.