Bitcoin Price Move to $300 Might Be Closer Than It Appears

Currencies / Bitcoin Nov 04, 2014 - 05:06 PM GMTBy: Mike_McAra

Briefly: speculative short positions, stop-loss at $377, take-profit at $307.

Briefly: speculative short positions, stop-loss at $377, take-profit at $307.

The British government is looking to have a discussion with the Bitcoin community on how to deal with the cryptocurrency, we read on the Guardian website:

The Treasury will be looking at examples of regulation in other countries, but emphasises that the lead will come from responses to its own call for information. "Digital currencies and digital currency exchanges are currently unregulated in the UK," said a Treasury spokesman.

"We're considering the potential benefits of digital currencies to customers and the technology that underpins them, and whether we should take action to support innovation in this area. We're also looking at the potential risks, and assessing whether action is required to address any concerns."

The fact-finding mission follows August's announcement by chancellor George Osborne that the government intends to focus on cryptocurrencies, and FinTech in general. "It's only by harnessing innovations in finance, alongside our existing world class knowledge and skills in financial services, that we'll ensure Britain's financial sector continues to meet the diverse needs of businesses and consumers, here and around the globe, and create the jobs and growth we all want to see in the future," the chancellor said at the time.

So, the British Treasury seems to approach Bitcoin with common sense. This is no doubt a positive development, particularly for Bitcoin companies based in the UK. We will still have to wait to see how these possible talks will look like and what the final outcome of the activities of the Treasury will be but for now it seems that the British government wants to assess how to proceed with the drafting of laws and regulations on Bitcoin.

So far we have been living in a sort of regulatory vacuum. Not much regulation on Bitcoin has been developed so much. Tax authorities were first to come up with their interpretations of how Bitcoin should be treated for tax purposes but not many more agencies actually came up with similar guidelines for other areas of law.

This is now slowly changing. In the U.S., the state of New York might implement a Bitcoin license for Bitcoin-related companies. In the E.U., the European Commission and the European Banking Authority have already set their eyes on the cryptocurrency. If this year has been a beginning or almost a beginning point for Bitcoin regulation, 2015 might see more laws being actually passed or implemented, also based on work done so far.

For now, let's turn our eyes to the charts.

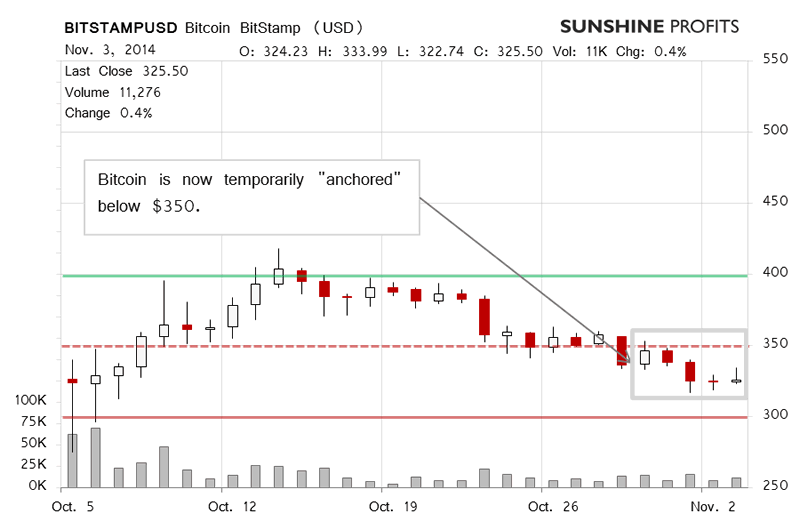

On BitStamp, we saw appreciation yesterday but the move was reversed and Bitcoin closed the day close to where it had started it. We still can consider this move just as we did it yesterday:

The first thing to consider is that the move itself hasn't been exactly strong, 1.4% up from the previous close is hardly a meaningful rebound in terms of the well-known high volatility of Bitcoin. The price hasn't reached $350, let alone stayed above this level. Also, there hasn't been a visible uptick in volume. These factors suggest that the move up we've seen today is relatively weak and we shouldn't read too much into it.

But let us consider today in conjunction with the last couple of days. On Oct. 29 we saw a slip below $350. More importantly this seems to have been the day which marked the beginning of a period in which Bitcoin has stayed below $350. As such, this suggests that there might be more weakness than strength in the market. In our opinion, the situation gets more bearish with every day Bitcoin fails to come back above $350.

The volume was up yesterday but the fact that Bitcoin failed to move even moderately suggests that our earlier comments are still up to date.

Today, we've seen some appreciation and the volume is possibly similar to what we saw yesterday (this is written after 9:15 a.m. ET). Even though the move has been up, it hasn't been strong and the currency is still below $330 at the moment of writing.

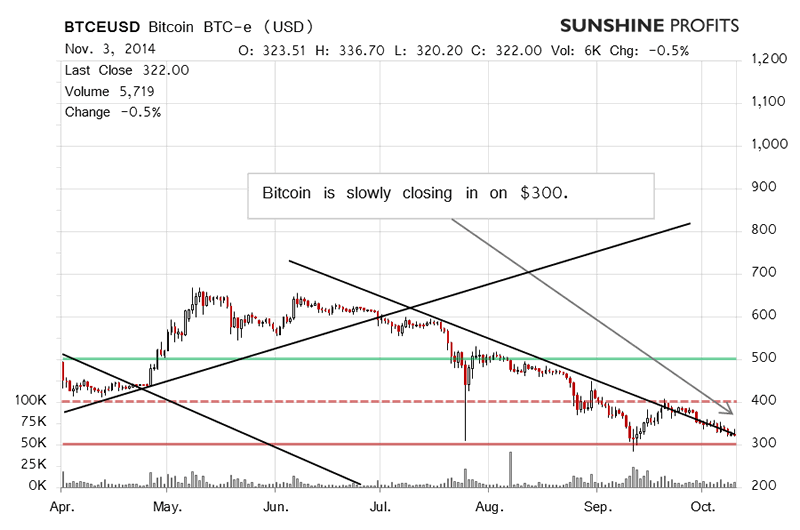

On the long-term BTC-e chart we see that Bitcoin is still moving in line with its recent trend, which is down. Yesterday, we wrote:

(...) Bitcoin went down over the weekend, hitting as low as $319 at one point. The appreciation today has also been weaker on BTC-e than on BitStamp. This might indicate that there in fact still is more selling power in the market.

Even though the recent moves don't count as a significant acceleration of the decline, they fit in with the recent trend and if this trend is to be followed, we might see more declines. We're getting closer to $300 which might prove to be a turning point as far as the short-term outlook is concerned but also from a longer perspective.

This is still the case today. Bitcoin moved as low as $318 so far but afterwards rebounded to $325. This appreciation doesn't really break with the recent trend. Bitcoin is below $330, at the moment of writing, moving in line with the trend that began in mid-October. The volume isn't elevated which suggests that the appreciation today isn't strong enough to imply a more significant rally. As a result, we still think that more depreciation might follow.

Summing up, we support short speculative positions at the moment.

Trading position (short-term, our opinion): short speculative positions, stop-loss at $377, take-profit at $307. Additionally, a buy limit order, entry at $427, stop-loss at $357, initial target at $500.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.