U.S. Housing Market San Francisco at Critical Mass

Housing-Market / US Housing Nov 05, 2014 - 05:13 PM GMTBy: Harry_Dent

The website, zerohedge.com, recently reported on an interesting indicator that makes perfect sense, but it’s one that I hadn’t seen before.

The website, zerohedge.com, recently reported on an interesting indicator that makes perfect sense, but it’s one that I hadn’t seen before.

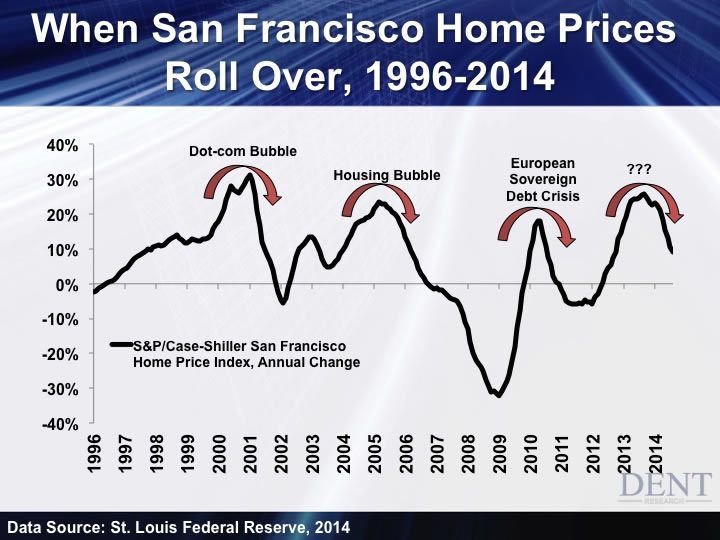

They reported that the San Francisco Case-Shiller year-over-year home price index is the primary real estate market that foreshadows when the stock market or any other major bubble will crash. In other words, it’s the bubble that best forecasts other bubbles bursting.

The reason that San Francisco is unique is that it’s very bubbly from a very limited supply… it reflects both Silicon Valley and the tech bubble… and it also reflects the “mega” bubble that is China.

The Chinese dump a lot of money into the San Francisco area and when they stop it’s a sign that something is wrong…

Trouble on the Horizon

The earliest sign of trouble is when the year-over-year price increases initially rise above 20%. That can’t be sustained for long even in such a hot market.

Note how this index led the dot-com bubble crash and the tech wreck. It was down from early 2000 into mid- to late 2001. The Nasdaq crashed 79% from March 2000 to October 2002. This was the highest bubble in San Francisco reaching 31% before caving with the biggest stock bubble burst of our lifetime to follow.

After dropping to a low of -7%, the next rise took home prices there to a high of +24% in early 2005, just before the housing bubble peaked the following year. Since that was a real estate crash in essence, San Francisco saw one of the worst declines year-over-year, dropping a staggering -33% just from late 2007 to late 2008.

Overall real estate crashed 34% from top to bottom and that number is even greater than those from the Great Depression. Stocks crashed nearly 55% from late 2007 into early 2009.

The next round of rising home price gains in San Francisco were more limited as it was a short response to the first and most massive Fed stimulus (QE1). That advance peaked at +19% gains and was quickly countered by the sovereign debt crisis in Europe.

The index fell to -6% in late 2012 and stocks in the U.S. had their only major correction of the 2009 to 2014 bull market, down 20% into late 2011.

A Peak is Coming

This latest bubble in San Francisco has been one of the largest in the U.S. since 2012 and has taken annual gains that reached a high of +26% in early 2013. Since then the index has fallen to +9%… a dramatic swing of 17 percentage points.

That would strongly suggest that this index has already peaked indicating that the next crash in stocks and the economy and real estate is going to come sooner rather than later.

A further confirmation will come when this index becomes negative which seems likely to occur in the next one or two quarters. By then the stock bubble should already be bursting.

Since I expect both a real estate and a stock crash greater than the last financial crisis, I wouldn’t be surprised to see San Francisco hit the -40%+ range sometime in the next few years and stocks down 65% or more from the top.

The lower this index falls, the more worried we’ll become… and so should you.

We’ve been warning that Germany would disappoint in 2014 due to falling demographic trends there. And it keeps doing so. The China bubble keeps showing further signs of beginning to burst. And when it does… watch out.

I saw a recent new index that forecasts China’s growth rate will slow to 4% to 5% in the next year. Almost no one was expecting that!

We’re also warning that the still strong affluent sector will slow in spending beginning in 2015, as will auto sales that are the last major durable goods sector to peak late this year due to the spending peak at age 53 for the massive baby-boom generation.

And the Fed has finally tapered to zero just in time for worsening fundamental trends ahead.

The only question now would be… when will the deaf, dumb, blind and delusional stock markets figure this out?

You should be ahead of them and selling on any rallies or slight new highs.

I keep warning that it’s better to be safe than sorry as bubbles burst rapidly when they finally do.

Now you see it… now you don’t. It’ll likely be that quick.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2014 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.