US Dollar Crisis Not Oil Crisis

Economics / US Dollar May 23, 2008 - 02:19 PM GMTBy: Peter_Schiff

It's unfortunate that the Supreme Court, in its ruling this week that U.S. currency is unfair to the blind, did not make the next logical step and declare it unfair to everyone who buys gasoline.

It's unfortunate that the Supreme Court, in its ruling this week that U.S. currency is unfair to the blind, did not make the next logical step and declare it unfair to everyone who buys gasoline.

In their search for explanations as to why oil has surged past $130 per barrel, Washington, Wall Street, and the financial media are as clueless as cavemen after a freak summer snow storm.

Despite the head scratching, the blame game is nevertheless in full force. Speculators and big oil companies are being trotted out as scapegoats, and increased margin requirements and taxes on windfall profits and futures trading have been mentioned as appropriate sanctions. It should be clear that this is pure farce, and that no one understands what is actually happening.

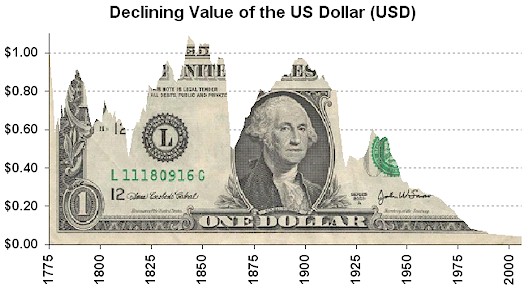

The reality is that after years of reckless consumption and dollar debasement, Americans are now being priced out of markets over which they formerly held unchallenged title. As more affluent foreigners consume more of the resources and products they previously supplied to us, Americans are being forced to cut back. The rising dollar-based price of gasoline is simply an illustration of this global trend.

The reality is that after years of reckless consumption and dollar debasement, Americans are now being priced out of markets over which they formerly held unchallenged title. As more affluent foreigners consume more of the resources and products they previously supplied to us, Americans are being forced to cut back. The rising dollar-based price of gasoline is simply an illustration of this global trend.

Poorly concealed behind contrived government statistics, the signs of America's falling standard of living are everywhere; all one has to do is look. We are unloading SUVs for less desirable compacts, and are paying more to fly on crowded planes (where we pay to check luggage and dine only on what we bring onboard). We drink our lattes at McDonalds or not at all, and we increasingly forego dining out, trips to the mall, and vacations, just so we can scrape together enough to fill our gas tanks and kitchen pantries, pay taxes and insurance, or make credit card, mortgage or car payments.

The collective belt tightening is simply the down payment on the Government's massive bailout of Wall Street investment banks and mortgage lenders. As the Fed creates money to buy bad mortgages and other shaky securities held by banks and brokerage firms, the value of the savings and wages of everyone on Main Street will continue to fall. As a result, the costs of products previously taken for granted have begun to bite.

The various housing bills and stimulus packages now passing through Congress will add significantly to the staggering final price tag. In the end, the “free lunch” currently being dished out by Washington will be the most expensive meal ever served. The cost will be borne by ordinary Americans citizens every time they open their wallets. Four dollar gasoline is just the beginning.

For all the talk of increased global demand, few seem to understand from where it actually comes. The surge in global demand is both a function of the increased purchasing power of foreign currencies and the fact that foreigners are choosing to spend more of their incomes themselves. In other words Greenspan's famous “global savings glut” is turning into a global consumption binge, with Americans unable to crash the party. This trend will only get worse as the dollar-denominated price of just about everything that is either imported, or capable of being exported, goes through the roof.

We can look for scapegoats all we want but the simply fact is Americans are going to have to get used to a much lower standard of living. Those who have been putting all the food on our tables are finally pulling up chairs themselves.

For a more in depth analysis of our financial problems and the inherent dangers they pose for the U.S. economy and U.S. dollar denominated investments, read my new book “Crash Proof: How to Profit from the Coming Economic Collapse.” Click here to order a copy today.

By Peter Schiff

Euro Pacific Capital

http://www.europac.net/

More importantly make sure to protect your wealth and preserve your purchasing power before it's too late. Discover the best way to buy gold at www.goldyoucanfold.com , download my free research report on the powerful case for investing in foreign equities available at www.researchreportone.com , and subscribe to my free, on-line investment newsletter at http://www.europac.net/newsletter/newsletter.asp

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.