Making Money While The World Burns

Politics / Social Issues Nov 20, 2014 - 12:04 PM GMTBy: Raul_I_Meijer

I was reading this letter to his fund investors by Hugh Hendry, a very intelligent and probably slightly autistic fund manager I’ve liked a lot forever and a day and have written about quite a bit in the past, and it got me thinking about how and why I see the world different from the way he does, and wondering how you see that difference.

I was reading this letter to his fund investors by Hugh Hendry, a very intelligent and probably slightly autistic fund manager I’ve liked a lot forever and a day and have written about quite a bit in the past, and it got me thinking about how and why I see the world different from the way he does, and wondering how you see that difference.

Hugh was for years known as a true bear, and then he turned around, changed his views and turned bull, only at the same time he did not. If that makes any sense. I’ll take you through the letter as posted by Tyler Durdenand try to explain what struck me in it. It’s much easier and safer not to write things like this, but I think there are things you must explore, like how do you react when realize your world is falling to bits.

Hendry, I think, is as bearish (or negative) about the – future of – world as he has been for a long time, only he’s decided to see things from his fund manager point of view, and to ride the crest of the waves the central banks have tsunamied towards our shores. He’s chosen to make a buck off of them waves, even as he’s aware of the damage they’ll will do once they hit land. In the exact same way as a surfer who sees a tsunami as merely a set of great waves to ride on. And, no value judgment involved, but that’s not what I see.

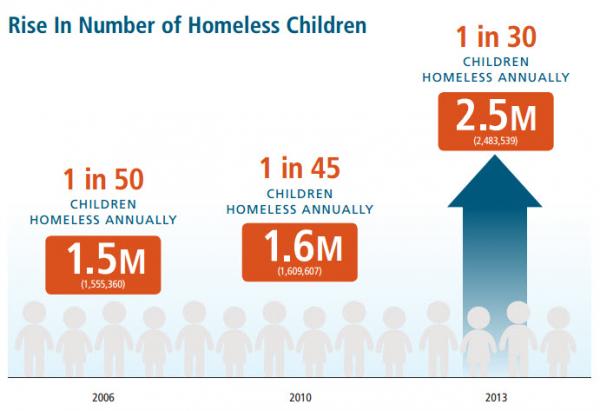

He sees the world going to hell in a handbasket (and Hendry recognizes that very much, that’s not why he shifted gears from bear to bull) and his response is to grab as much money and wealth as he can (for his investors … ). My response is different: I don’t see filling my personal coffers as a priority when I see the numbers of homeless children in the States shoot up, or the over 50% of youth without a job or a future in southern Europe for many years running, or all the other stuff that goes awfully wrong all around here behind the ‘recovery’ veil, stuff that Hendry is acutely aware of.

I simply think other people’s misery, especially when it comes in droves, is a bigger threat to my existence, my lifestyle, my society, my community, and certainly my peace of mind than having a few bucks more or less. We’re not in some market cycle move here, we’re in something much bigger. And Hugh Hendry knows that too. I don’t believe in ‘we have a world to save’, I think that’s beyond our means, but I do see a responsibility towards smaller units, a town, a society, perhaps even a country, simply for our own sakes and that of our children.

And I think viewing today’s world primarily through a fund manager’s eyes, especially if you have the brains to see more and wider and bigger, is poor and bleak. And if you’re Hugh Hendry, you don’t need the money to keep yourself from starving. It becomes more like Bill Gross who at an age when most men have long retired, moves from Pimco to some other fund to make even more money. It turns into the kind of poverty that money can not hide. Here’s Hendry:

My premise hasn’t really changed since I published my paper explaining why I had become more constructive towards risk assets this time last year. That is to say, the structural deficiency of global demand continues to radicalise the central banking community. I believe they are terrified: the system is so leveraged and vulnerable to potentially systemic price reversals that the monetary authorities find themselves beholden to long only investors and obliged to support asset prices.

However, I clearly confused everyone with my choice of language. What I should have said is that investors are perhaps misconstruing rising equity prices as a traditional bull market spurred on by revenue and earnings growth, and becoming fearful of a reversal, when instead the persistent upwards drift in stock markets is more a reflection of the steady erosion of the soundness of the global monetary system and therefore the rise in stock prices is something that is likely to prevail for some time. There is more to it of course, as I will attempt to explain, but not much.

[..] the world’s monetary authorities are targeting higher risk asset prices as a policy response to restoke economic demand. Whether you agree with such a policy is irrelevant. You need to own stocks. And yet, remarkably, the most contentious thing you can say in the macro world today is “I’m bullish”.

In a world dominated by the existentialist angst of identifying and trading qualitative value, there is profound mistrust of equity values today; macro investors see prices as overvalued and few are willing to capitalise on the opportunities to make money.

This angst and fear of big drawdowns in risky assets in part reflects astonishment that policy makers were able to rescue investors from the folly of their misallocations in the years preceding 2008 and that stocks have massively outperformed the modest rise in global nominal GDP. I should know. I, like others, became a moraliser who just couldn’t forgive the Fed for bailing out Wall Street.[..] I became a moral curmudgeon rather than a money maker.

As you know, I have sought to overcome this deficiency. However my risk controls, or rather my procedures for dealing with big monthly losses, seemed to anchor me to the bearish camp (against my better wishes). [..] since the end of last year I have been a bull that had to sell for lower prices. No wonder I couldn’t make you money. But perhaps you don’t need such reactive stop loss policies when the world’s central banking community is intent on protecting you; [..]

Japan was down 16% from its highs earlier this year. I was particularly long Japanese equities at the start of the year and so at some point, fearing greater losses, I swallowed my pride and booked a loss. However, the ongoing policy intentions of the BoJ meant that the stock market clawed back all of its losses. Why did I sell?

European stocks fell almost the same over the summer but again the ECB upped its ante, pushed short term rates negative, tolerated a weaker currency and promised to re-stock its balance sheet with more local risk asset purchases. Lo and behold, European stock prices recovered sharply in August and early September. So why did I reduce my holdings?

October is simply another example. US stocks fell over 10%. I don’t really know why. Was it the threat of the end of QE or a global pandemic or more misgivings as to the state of affairs in Greece and Europe’s enduringly weak economy? It doesn’t really matter. [...]

So why all this enthusiasm for upside equity risk? [..] The FX market tends to take the US Supreme Court view. Overruling an obscenity charge for showing a salacious French movie in Ohio in 1964, Justice Potter Stewart wrote that the Constitution protected all obscenity except hard core pornography. Unwilling to define the latter, the judge maintained that he would know it when he saw it. [..]

Which is a rather long preamble to describe what I believe is a very analogous central banking intervention in today’s financial markets. It would take just too long for the Fed, ECB or the BoJ to rely on a return of animal spirits in the real economy to lift their flagging economies. They need the remedy of fast moving risk asset prices. By using QE to promote more risk taking, asset values in the US have risen faster than fundamentals and, with better perceived collateral and more confidence, the demand for risk taking in the real economy has recovered somewhat. At a lag, the theory runs, so will the rate of expected inflation.

So I think we find ourselves especially in Europe (and Japan) with a situation whereby the central bank has to use all of its powers to engineer higher stock and bond prices. And I think the precarious nature of France and the election timetable in 2017 means that they need higher European stock and bond prices NOW or there will be no economic recovery, budget deficits will continue to overshoot 3% and the Euro area will get trapped in the poisonous and perpetual cycle of having to demand more and more unpopular austerity measures. This is high stakes: boost European stock prices or risk losing France and the euro. To my mind the message is simple: don’t short French bonds, buy European stocks and short the euro.

Hugh Hendry sees the world in an extremely bearish way, he sees hell, the handbasket, brimstone and far worse. But he wants to profit – in name of his investors (?!) – from the very mechanism that drives the world there: the power central banks and governments have been allotted, and the way they use it to protect the interests of investors, banks, insurance companies and uber rich individuals, all at the expense of booting the 90% who make up the real world and the real economy, ever deeper into the mud.

Seeking to profit from that is a choice. Hendry makes it, and so do many others, even many inside the 90%. Who mistakenly dream they’ll be able to hold on to those profits (they’ll wake up yet, and wish they had before). The whole idea of scraping out what you can before the tsunami hits is not my thing.

Hugh Hendry recognizes, as many other people do, that there would be no viable markets left if central banks wouldn’t have kept them standing up for years now and made us all pay. But he, and many like him, still think that the best thing to do in that situation is to grab what you can before it’s over. I think that is worth asking a question or two about.

Of course it all depends on how bad you think it will get. Well, Hendry has an idea, just look him up on YouTube, and I have an idea, and so do lots of others. None of us can be sure what the use of a few bucks more or less will be when things get as bad as we think they will get. But there’s no certainty anywhere in sight. And for me, that means what’s more important, and what is certain, are things like this Simon Black graph, that makes me wonder what on earth we’re doing around here:

You see what’s happening to these kids and your answer is let’s make as much money as we can? That’s how we think? I’m sure a lot of people, rich or poor, have pondered how to get more self-sufficient, and a few have taken great strides towards that too. But I’m also sure the successful ones in that regard would all agree that money in the end had very little to do with it.

So do or don’t we have anything better to do with ourselves than make money while the world burns? And do we think the money we might make will have much value once the fire spreads? If the ‘world of money’ is in as bad a shape as Hugh Hendry says it is, and can only be maintained by ever more desperate machinations by central banks, until it evidently can’t? There doesn’t seem to be a clear answer, to put it mildly.

Is making and hoarding as much money as you can the best answer to a collapsing financial system which may or may not leave much value in that money? Same for gold, silver et al, though many people see just that as the big answer.

In the end, the issue may be whether amassing material wealth is the right answer to the demise of a system based on material wealth. A suggestion is that perhaps growing your own food and learning how to make the things you need, yourself, is a better answer. Just because you have money, or gold, doesn’t mean you can buy things with it. Don’t mistake money and self-sufficiency.

And that’s what Hugh Hendry’s shift from bear to bull, but not really because he knows where it’s going, made me think of. Now it’s your turn.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.