Tiny Houses May Signal a Big Market Change

Housing-Market / US Housing Dec 02, 2014 - 06:37 PM GMTBy: MISES

Jonathan Newman writes: The flowering of the tiny house movement is due in large part to the most recent boom-bust cycle, which left many homeowners wondering if mountain-sized homes are worth equally sized debt or a risky gamble on future housing prices. For some, this meant moving into a house that could be smaller than their previous house’s bathroom.

Jonathan Newman writes: The flowering of the tiny house movement is due in large part to the most recent boom-bust cycle, which left many homeowners wondering if mountain-sized homes are worth equally sized debt or a risky gamble on future housing prices. For some, this meant moving into a house that could be smaller than their previous house’s bathroom.

Although definitions vary for what “tiny” means — from the hardcore enthusiasts to the more inclusive tiny-housers — most agree that any residence smaller than 1,000 square feet fits the bill (but most are less than 500 square feet). And speaking of the bill, such dwellings can range anywhere from $10k to $50k, depending on the size and amenities, and they can enjoy total monthly utilities in the double digits.

Thoreau would be proud, too, as many of the tiny-housers build on their own and/or go “off the grid” (the r/homestead and r/tinyhouses subreddits have notable membership overlap, for example). They eschew public provision of various utilities by collecting rainwater, using solar panels, and installing composting toilets. Another way the tiny-housers thumb their nose at the government is by building on trailers to skirt building codes that dictate minimum square footage or other regulations. Randy England, in an August 2014 Mises Daily article, noted how such laws hurt the poor, who would benefit greatly by accessible cheap housing.

Debt Looking Less Attractive

The tiny house movement is a natural consequence of the most recent macroeconomic swing. After a boom-bust cycle, capitalist-entrepreneurs attempt to reallocate capital into profitable lines of production. This can be a painful process for many, as workers get laid off and prices adjust. Decision-making is difficult when vital information like interest rates and other prices haven’t accurately reflected consumer demands or time preferences in the past. These necessary market corrections are made even more difficult when central banks and governments get in the way, either by revving another cycle or disrupting prices and market processes even further. In spite of the gargantuan and manifold stimulus programs and expansionary monetary policy since 2008, firms like Tumbleweed Tiny Houses and SmallWorks have grown and thrived, attracting workers, capital, and customers when the powers that be would have them fueling and refueling bubbles.

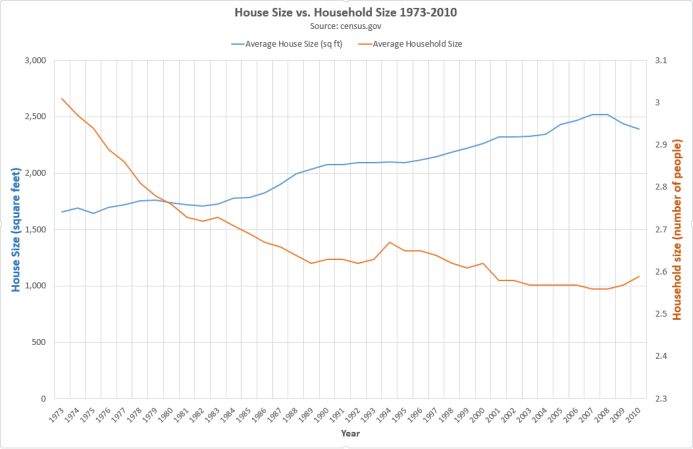

The average house size has climbed steadily over the past few decades, even though the average number of people per household has fallen over the same time period — an unorthodox sign of a growing housing bubble, albeit in hindsight. At the peak of the crisis in 2007–2008, the average household member had about 985 square feet to himself. The members of the tiny house movement suggest that much space is more than enough for an entire household of 2, 3, or even 4 people.

Volatile home prices, increased underemployment and unemployment, and a growing fear of debt seem like the perfect mix for a popular tiny house movement.

I asked a few tiny house owners about their experience and motivation, and found that avoiding debt was a major factor in their decision to go small. “I could afford this house without a mortgage” one owner observed, while another remarked “We are debt-free, and we didn't want a huge mortgage. Seeing the housing bubble definitely reinforced that view (we are now 29, and it was kind of happening when we were getting married and deciding how our lifestyle should be).”

When asked about the future of the tiny house movement, owners replied with several economic reasons for why they believe there will continue to be a demand.

“Pragmatism will be a driving force. Primarily due to financial constraints,” an owner replied. “These constraints could be external (people can't get a job that pays enough to afford ‘the American dream’) or internal (people choose this option to avoid the economic hardships imposed by buying a McMansion.)”

“I believe [there will continue to be a demand], yes,” another owner said. “Not only has the housing bubble added to the tiny house movement, I think millennials and other young folks who will have crushing student loan debt will find [traditional] home ownership to often be an unattainable dream ...”

Perhaps we can chalk up the tiny house movement as another unintended consequence of the Federal Reserve’s low interest rate setting starting around 2002, and the federal government’s similarly timed initiatives to increase homeownership. Or maybe we are witnessing the start of a major cultural change, and our conceptions of the typical family or community are readjusting in the wake of macroeconomic upheaval. Either way, the movement has urged me to reconsider installing that second bowling alley next to my two-million volume library. Rothbard was very prolific.

Jonathan Newman is a 2013 Summer Fellow at the Mises Institute and teaches economics at Auburn University. See Jonathan Newman's article archives.

© 2014 Copyright Jonathan Newman - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.