Stock Market Probable Pop-n-Crash Today

Stock-Markets / Financial Crash Dec 15, 2014 - 03:31 PM GMT Crude oil is in the news this morning as Crude Oil futures bounced 2.5 points in the overnight session. That was only Wave (a) of [iv]. It is pulling back and Wave (c) of [iv] may take Crude as high as 63.16. This calculation assumes that Wave [iv] is the same length as Wave [ii].

Crude oil is in the news this morning as Crude Oil futures bounced 2.5 points in the overnight session. That was only Wave (a) of [iv]. It is pulling back and Wave (c) of [iv] may take Crude as high as 63.16. This calculation assumes that Wave [iv] is the same length as Wave [ii].

Based on that calculation and the Fibonacci Relationship between the declining waves, it anticipates a probable decline to 62.00. This is all conjecture at this point. We may be able to get a better handle on this as Wave [iv] completes later today, a Trading Cycle Piovt day.

ZeroHedge reports, “Speaking on oil, Brent gained more than $1, after earlier dropping to lowest since July 13, 2009. There was some bullish sentiment when Libya declared force majeure at oil ports, although that will hardly last once algos process that the combined capacity that is offline is a paltry 580k b/d capacity. WTI trades ~$58.50, climbs more $2 also off 5-yr low, on the same "catalyst." Expect both fading as the realization that OPEC isn't kidding about $40 barrel oil filters through.”

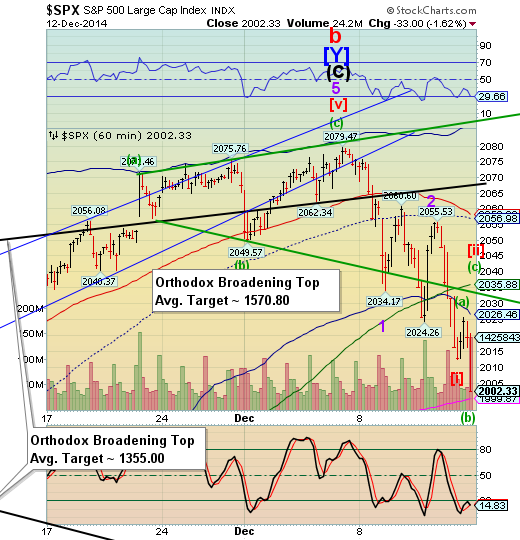

SPX Premarket rose 13-15 points in a low volume algo ramp driven by a mild USD/JPY ramp that did not break out of its trading range. Should it do so, we may see SPX ramp higher. The preliminary target appears to be 2026.00-2029.00. The 50% retracement value is 2028.96.

A rogue ramp may take SPX as high as 2033.00-2035.00. The 61.8% Fibonacci retracement value is 2035.23. This is 65 ticks away from a retest of the Intermediate-term resistance at 2035.88.

The shorter ramp may be done in 2 hours or less, since a Trading cycle Pivot occurred on Sunday. All of this is preliminary, based on the information from the Premarket. The longer ramp may continue through this afternoon. In either event, we should prepare for a super-extended third wave (Flash Crash) when the ramp is complete, whether immediately or later this afternoon.

VIX reached the target of a shallow Head & Shoulders formation on Friday while also completing a Minute Wave [i] of Minor wave 3. A pullback to the Head & Shoulders neckline is likely this morning before VIX rockets into an extended Wave [iii] of 3, or alternatively, Wave 1 of (3) at the higher neckline at 31.06. This may all be clearer at the end of day.

TNX is due for a Trading Cycle low in the next two days. It appears that there may be one more decline in this series of waves before the next rally begins.

Meanwhile, “The Empire Fed manufacturing survey collapsed to -3.6 from 10.16 , its lowest since January 2013, missing expectations of a rebound to 12.4 by the most in 4 years.”

Respectfully,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.