Important Development for Bitcoin Traders

Commodities / Bitcoin Dec 20, 2014 - 06:43 PM GMTBy: Mike_McAra

Briefly: short speculative positions, stop-loss at $332, take-profit at $275.

Briefly: short speculative positions, stop-loss at $332, take-profit at $275.

We read an interesting piece on Tech Crunch on how 2014 was difficult for Bitcoin:

Overall creation of bitcoin wallets is up, which is an indication of continued interest from potential buyers. Wallets are files that contain private keys used to unlock the bitcoins within the tool so that you can spend them. It's akin to a physical wallet that holds credit cards.

The number of wallets in existence at the end of the third quarter grew to 6.5 million from 1.3 million a year earlier. But according to figures obtained by Reuters, most of those wallets are empty. It's estimated that only 250,000 to 500,000 wallets actually contain bitcoins. That implies that many people are opening a wallet, but failing to actually buy any of the stuff; the process is losing its complexity as consumer-friendly tools spring up, but remains harder than picking up normal cash.

In addition, investors and the media are noticing that bitcoin was among the absolute worst investments this year, measured on a percentage-loss basis. That fact won't deter true bitcoin believers. However, it's worth noting the increasing chatter among the bitcoin classes that the underlying technology of the currency -- the blockchain -- is what matters, and not the price.

This touches upon at least two important points which we mentioned in the past. The first one is the need for more user friendly solutions in the Bitcoin market, which could actually help in expanding the active user base.

The second is what we wrote only yesterday - that the media outlets are starting to write more stories on what a terrible investment Bitcoin is. This would suggest that there is more skepticism among market observers and participants. This could mean that we are actually close to a bottom, if not a long-term than a medium-term one.

With that in mind, we focus on the charts.

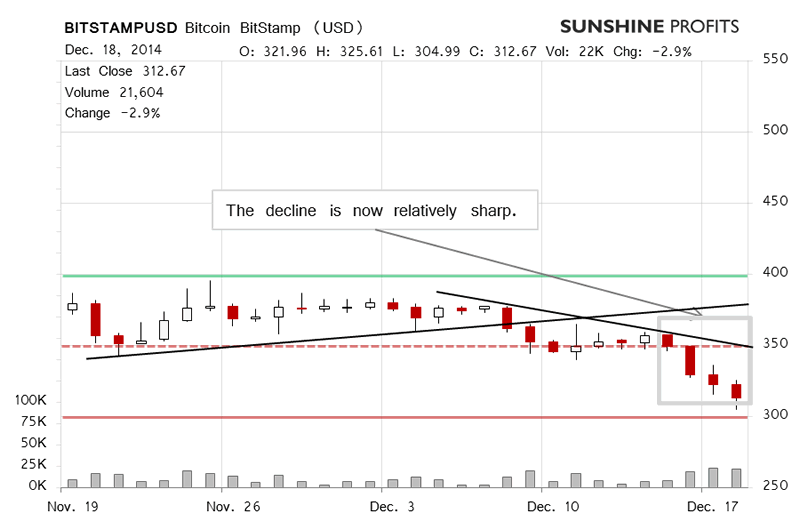

On the BitStamp chart, we see a significant decline. It started on Monday with Bitcoin closing below $350 (dashed red line) and has continued since. Yesterday was another day of declines. Bitcoin went down and on strong volume. This was characteristic of a strong move down but yesterday we wrote:

(...) the action has been further down (...). At first, this looks like a very bearish indication. But is it?

The action has been strong, but we saw a move below $305 and a pullback. This might mean that we're close enough to $300 to see a breather. The situation is still very much bearish for the short term but we've already seen relatively significant depreciation and the possible resistance is quite near. This means that the decline might not be as sharp in the next few days as it has been in the last couple.

Today, we've actually seen yet another day of depreciation (this is written around 10:30 a.m. ET) but today has so far been quite different than the two previous days and fitting very well within our scenario of a possible breather. This is mostly because the move today hasn't been deep and the volume has been decidedly down from yesterday's levels. Such developments might be signals of a possible breather. We still think that the general short-term trend is now down but the fact that there's already been quite a lot of depreciation and that we might see a pause calls for a reconsideration of the stop-loss levels.

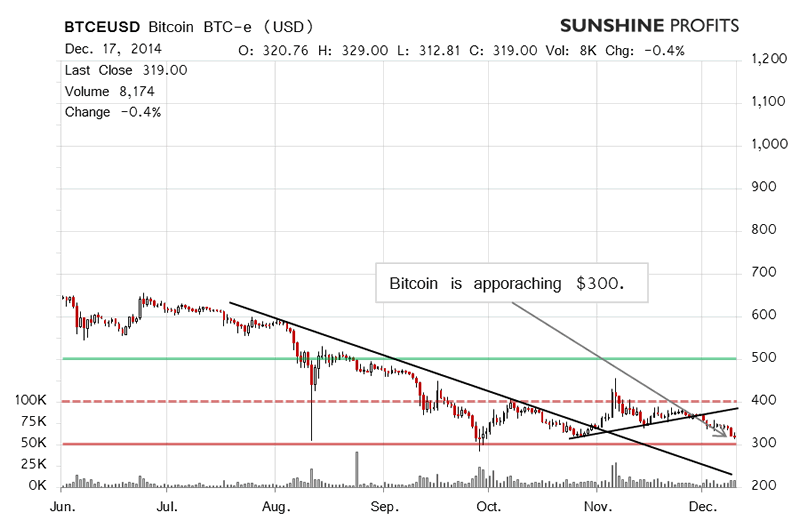

On the long-term BTC-e chart, we see that Bitcoin is relatively far away from the possible recent trend line and relatively close to $300 (solid red line). This could mean a slowdown, just as we wrote yesterday:

The general idea is that $300 might be a level at which the current drawdown would pause or end. If we in fact see a pause or a pullback, we might close the hypothetical speculative short positions. (...)

What changed since yesterday is that we saw possible first signals of a weakening of the move in that Bitcoin hasn't really declined today on BTC-e. At the moment, this is not yet a very significant indication and a breather here could be followed by a move even lower, especially if we see Bitcoin drift below $300. Because of the idea that there might be some movement to the upside, we have adjusted our stop-loss levels to lock in some of the hypothetical gains on the current position. Current position details are in the summary. Since the close of the day when we suggested a short speculative position, this hypothetical position has gained 9.6% for BitStamp and 10.1% for BTC-e. This hypothetical gain would have been achieved in 10 days only. We still keep the position open since, in our opinion, there is still a possibility that after a brief pause Bitcoin would resume its move down, breaking below $300 and possibly reaching $275.

Summing up, we still think short speculative positions might be the way to go but we've adjusted our stop-loss levels to correspond to the possibility of a reversal.

Trading position (short-term, our opinion): short, stop-loss at $332, take-profit at $275.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.