Will New Year Bring New Bitcoin Developments?

Currencies / Bitcoin Jan 02, 2015 - 06:44 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

BitMEX, a Bitcoin derivatives exchange will post a Bitcoin volatility index, which will be a measure of the magnitude of change in the price of the cryptocurrency, we read on CoinDesk:

Derivatives exchange BitMEX will publish an index on 5th January that it hopes will become the bitcoin world's version of the VIX– the so-called 'fear index' that is used to gauge uncertainty in the wider financial markets.

The 30-Day Bitcoin Historic Volatility Index, as BitMEX is calling it, works by taking the time-weighted average price from Bitfinex's USD/BTC rate. It then calculates bitcoin's annualised volatility over a rolling 30-day period using that data. The result is a measure of bitcoin's realised volatility for that period.

True to form as a derivatives exchange, BitMEX has created a tradable instrument based on its new index, and will offer a futures contract quoted in volatility percentage points, with each point paying 0.01 BTC. Traders will receive up to five times leverage for the contract.

This might be good news for Bitcoin traders. The possibility to trade in Bitcoin volatility might be attractive for some of them. For instance, traders convinced that Bitcoin will move more violently than is generally expected might want to go long the volatility index, while traders convinced that the currency will move less than the consensus might want to short the index.

This kind of instrument will allow traders and investors to open positions without betting on the specific direction in which the currency might go. Without a bet on the direction, market players will still have the opportunity to get exposure to the Bitcoin market. The volatility index is sometimes described as the “fear index” since the volatility tends to pick up in periods of fear-driven selloffs. But the volatility index can also go up in times of great appreciation. So the index might be seen as a kind of bet on whether something important will happen in the market (volatility goes up) or not (volatility goes down).

The development of such instruments is a sign that the Bitcoin market is slowly maturing (even though it still is not mature). We expect more and more Bitcoin derivatives to be created and traded. The Bitcoin market will play catch-up with more traditional asset classes.

For now, let’s take a look at the charts.

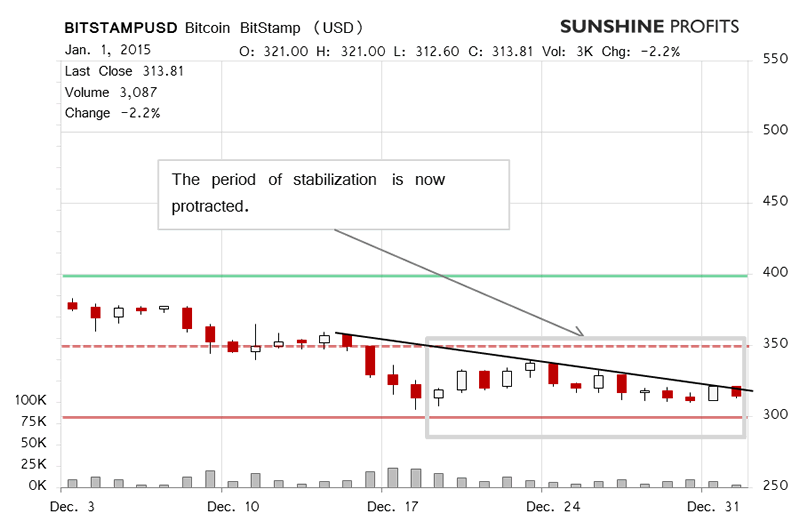

Over the last couple of days Bitcoin has stayed in the proximity of $300 but not exactly at that level. Actually not that much has changed since Tuesday, so we’ll quote our comments from that day here:

(…) Bitcoin has gone up slightly (…) but this move seems pretty much negligible in terms of the price and the volume hasn’t actually been really strong either. As such, the action today is more of a sideway move. This in itself doesn’t seem to establish a new trend but might point to the possibility of a move in line with the recent trend in the future. This would mean a move down.

So, the picture now is still of a sideway move without a clear break away from the recent trend down. Today, the currency has appreciated (this is written around 10:00 a.m. ET) but this move has been weak and the volume has been weak, visibly weaker than what we generally saw in the preceding days. A weak move to the upside seems to be a bearish indication. It is not that strong though, given the fact that this is not a rally dying out but rather a day within a sideway pattern.

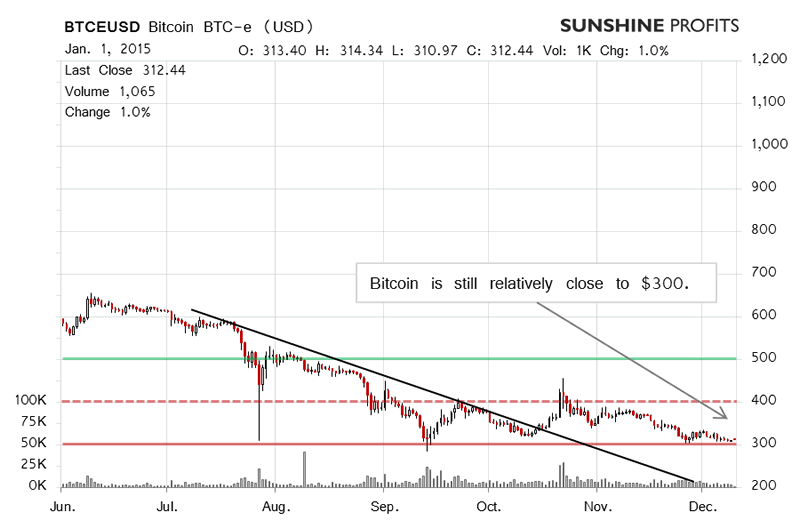

On the long-term BTC-e chart, we see that Bitcoin is closing in on the $300 level (solid red line in the chart). Bitcoin seems to be moving in line with its recent trend, which is to the downside. The main question here seems to be whether Bitcoin actually breaks below $300. This could trigger a further selloff. On Tuesday, we wrote:

At the moment of writing, it seems that the best bet is on Bitcoin moving down. In our opinion, however, it might be best to wait for a confirmation in the form of a move below $300, which could be the signal for the start of the next downswing, possibly to around $275.

In light of the recent action, this is still valid, in our opinion. We haven’t seen a stronger move in a while but Bitcoin has drifted in the direction of $300. Right now, it seems to us that the move below $300 might not be far away. Such a move would be relatively important since it could open up Bitcoin to even more significant selling. If we see a stronger move down, we might be inclined to suggest hypothetical short speculative positions.

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.