Bitcoin Price Down 12 Percent Already 2015 – Cyber Attack On Major Exchange

Currencies / Bitcoin Jan 07, 2015 - 12:55 PM GMTBy: GoldCore

2015 has not started well for bitcoin with prices having fallen 12%, from $320 to $288. The cyber attack on a leading bitcoin exchange is the latest challenge for the fledgling digital currency.

2015 has not started well for bitcoin with prices having fallen 12%, from $320 to $288. The cyber attack on a leading bitcoin exchange is the latest challenge for the fledgling digital currency.

Bitstamp, Europe’s leading bitcoin exchange – and third largest globally – has been off-line following a breach in their system by hackers on Sunday night. The UK based company has suspended lodgements and withdrawals and reported that roughly $5.1 million, around 19,000 BTC, had been ‘lost.’ The revelation follows the disclosure that Bitstamp’s wallet system has been compromised, prompting it to halt deposits and later shut down its platform entirely according to Coin Desk.

Today, Bitstamp said it expected to resume trading within 24 hours after suspending operations because of the ‘security breach.’

The bulk of the digital currency units are in cold storage – on computers not connected to the internet – and are therefore safe from further predations, the company has said. “Bitcoin customers can rest assured that their bitcoins held with us before temporary suspension of services . . . are completely safe and will be honoured in full,” Bitstamp said.

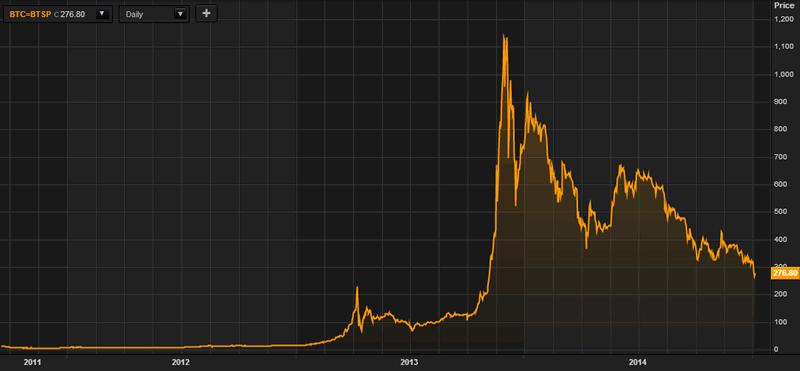

2014 was a tough year for bitcoin with prices falling from over $800 to just over $300. At its height, Bitcoin was trading at $1240. But in the run-up to and following the bankruptcy of the leading Mt Gox exchange, it has declined in value to around $285.

Bitcoin or BTC in U.S. Dollars – 5 Years (Thomson Reuters)

Some say this reflects a steady loss of faith of it’s users in their ability to trade the currency safely due to exchange and technology risk. Others say it was a speculative bubble and was destined to burst and it is healthy it did.

We see the value in owning bitcoins as a form of cash diversification and see merits in owning and having a very small allocation to bitcoin. It is slowly proving itself as a means of exchange. However, whether it will become a store of value is another matter.

Given the fact that we live in an era of currency wars and bail-ins – having a small allocation to such a liquid and fairly easily traded currency that is independent of debasing fiat currencies is not a bad idea.

When the chickens of government and central bank profligacy finally come home to roost, as they always do, alternative digital currencies may serve as an accepted medium of exchange.

But today’s news highlights the vulnerability of any form of “virtual wealth.”

By virtual wealth, we mean many of our investments and savings today which are either in digital form – deposits – or intermediated by digital platforms – most investments including gold ETFs and digital gold trading platforms.

It is imprudent to rely on any asset which derives its value from or can only be accessed through the internet and certain online platforms and websites.

This includes bank deposits in our modern digital banking system. In the event of a systemic crisis involving issues with ATMs, online bank accounts, capital controls and bail-ins – it will be prudent to own some assets that are outside of the financial system and indeed outside of the technological grid.

As tensions mount geopolitically – thankfully the consequences of military confrontation between nuclear-armed superpowers makes war a last resort – the Western bloc, Russia and China have all been experimenting with non-conventional warfare which include disabling the internet in target countries to collapse the economy.

If the internet and the financial system was brought down through unconventional warfare, criminal cyber attacks or simply a major glitch in the system – which has grown so complex that it is incomprehensible even to specialists – the assets of many people would be ‘erased’ and inaccessible.

Technology is a great enabler. But it can also be a great disabler. It is important to be aware of this.

Cyber and technology risk in the modern era is another reason to own physical coins and bars in an allocated and segregated manner, in the safest vaults, in the safest jurisdictions in the world.

Review of 2014 – Gold Second Best Currency, +13% in EUR, +6% GBP

MARKET UPDATE

Today’s AM fix was USD 1,213.75 , EUR 1,023.83 and GBP 802.37 per ounce.

Yesterday’s AM fix was USD 1,211.00, EUR 1,017.31 and GBP 797.08 per ounce.

Spot gold climbed rose $13.40 or 1.11% to $1,218.90 per ounce yesterday and silver soared $0.33 or 2.04% to $16.53 per ounce.

Gold in Euros – 5 Days (Thomson Reuters)

Gold in euros continues to eke out gains and briefly touched EUR 1,028 per ounce today as Eurozone inflation dropped below zero for the first time in five years. This increases the odds of more extensive ECB money printing. Draghi’s QE bazooka may be unleashed in the form of government bond purchases aiming to prevent interest rates rising and a deflationary spiral.

The titanic battle between Goldman’s Draghi and the Bundesbank continues. There is a disagreement and two theories of analysis on the effect of the plummeting oil prices. Draghi has warned of a dis-anchoring of inflation expectations and signaled support for QE but Bundesbank President Jens Weidmann favors not acting at this time, arguing that the drop could be a “mini-stimulus package” noted Bloomberg.

The Dutch newspaper Het Financieele Dagblad reported yesterday that ECB staff have worked on QE proposals in the past two months and ECB governors may be offered three different options to choose from at their January 22 policy meeting.

Some investors are looking for guidance from the release of the U.S. Federal Reserve’s minutes from their December 16-17 meeting. In it, they stated they would be “patient” in considering the timing of the first interest rate increase since 2006. This signals a possible further delay in rising interest rates which is gold bullish.

Bullion for immediate delivery fell 0.3 percent to $1,214.45 an ounce soon after midday in London. Silver for immediate delivery dropped 0.6 percent to $16.44 an ounce. Platinum was nearly unchanged at $1,221 an ounce and palladium slipped 0.2 percent to $802 an ounce.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.