Bitcoin Price Pause in the Decline Might Be Close

Currencies / Bitcoin Jan 14, 2015 - 06:24 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Another slide in the price of Bitcoin, another day of more negative news on the cryptocurrency. Quite interestingly, we saw the "Bitcoin crash" news on the main page of the New York Times' Dealbook. The article "As Bitcoin's Price Slides, Signs of a Squeeze" also made it into the "Most Viewed" section of the website. In the piece, we read:

The price of Bitcoin slid further on Tuesday, dipping to its lowest level since the spring of 2013. The downward spiral, which began early last year, suggests that confidence in the virtual currency may be dwindling.

Bitcoin's price dropped on Tuesday to about $224, from $267, according to CoinDesk, below where it was in April 2013 before Bitcoin gained widespread traction and started to soar in price. It reached its peak of about $1,200 in December of that year. Since then, however, prices have slumped even as transactions have increased.

With no signs of a rally in the offing, the industry is bracing for the effects of a prolonged decline in prices. In particular, Bitcoin mining companies, which are essential to the currency's underlying technology, are flashing warning signs.

Please note the bearish tone of the article. This is precisely the piece of news we would expect to see at a major bottom. We're also seeing even more similar articles in Bitcoin-oriented outlets. This might mean that at least a local bottom is close. But does it mean that the bottom is in? We don't think so. We're seeing more negative stories on Bitcoin but not yet the elevated numbers across various media we would expect to see at the very bottom. This would mean that Bitcoin could fall even lower. But would it do so right away?

We try to answer this question looking at the charts.

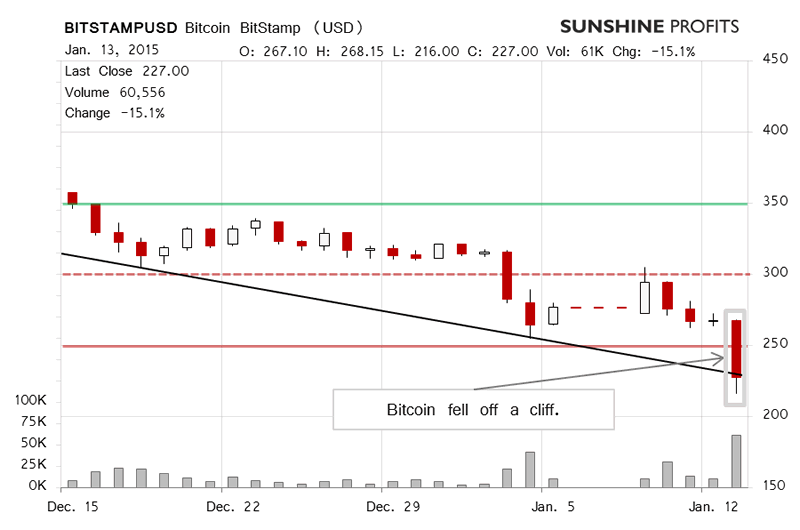

On BitStamp, yesterday ended in stark depreciation with Bitcoin losing over 15% compared with the previous close. The volume exploded to over BTC60,000, a level last seen around the local bottom in the early days of October 2014. But the move didn't really look like a bottom, rather a beginning of a further slide, as we wrote yesterday:

We still think that the gains might grow even further as we're inclined to bet on falling Bitcoin prices. However, taking into account the magnitude of the recent depreciation, we take a precaution against a possible rebound by adjusting our stop-loss levels to $257. We also move our take-profit level to $153. In this way, we lock in some of the current gains on the hypothetical position while allowing more gains should Bitcoin in fact fall deeper. It might be the case that the action tomorrow (or even later today) will clarify the situation even further. In the current volatile environment it's best to stay tuned to the market and we'll keep monitoring the market.

And, the market followed almost precisely to our take-profit today, with Bitcoin hitting $152.40. This means that the hypothetical speculative short positions in Bitcoin we suggested on Jan. 6 should be closed. These positions were suggested when BitStamp was offline but taking a short position following the reboot of the company could have meant a ride from $272.45 to $153.00. This would have meant a return of 43.8% (not including transaction costs) in 6 days. This is precisely how Bitcoin trading might look like - extreme volatility and risk (compared with other assets) but also extreme trading potential.

Bitcoin has since retraced back to around $195, hitting a daily high around $230 (this is written around 10:00 a.m. ET). In this sense, our take-profit has shielded the hypothetical positions from some appreciation. Does this mean that the bottom is in? We doubt that just yet. Bitcoin just broke below yet another possible declining trend line which might indicate a move even lower. But this doesn't necessarily mean that short positions should be reopened. Why? The volume today is representative of a possible bottom - over BTC80,000. Last time we saw volume of this magnitude was in March 2014, right at the local bottom. Add to this the fact that the currency has depreciated very far, very quickly and a rebound would seem possible. The deep depreciation might be continued (and this our best bet) but the possibility that this is in fact a local bottom is to significant to be ignored at this time, in our opinion.

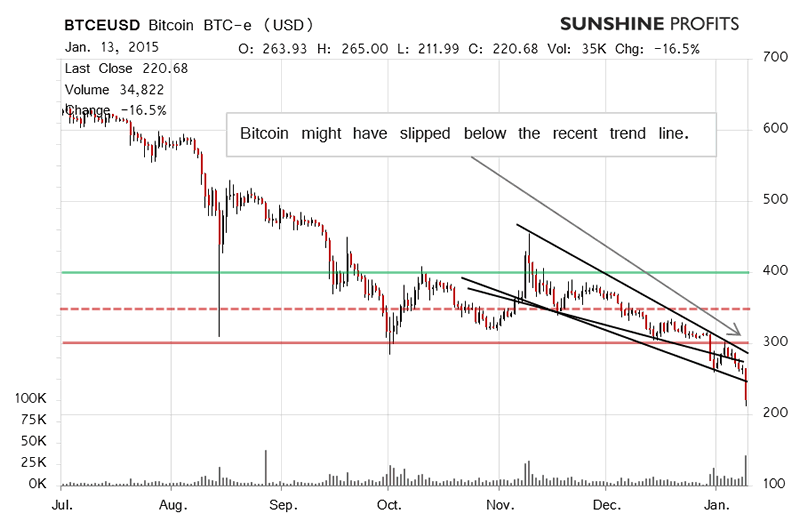

On the long-term BTC-e chart, we see a break below a possible trend line. Actually, this chart is based on daily closes so it doesn't include today's levels (we haven't seen a close yet) which are even lower. The $153 level hasn't been reached on BTC-e but we apply the take-profit (and stop-loss levels) to both BitStamp and BTC-e at the same time which means that Bitcoin hitting the level on one exchange is a general sign to close the speculative position.

If you recall, the hypothetical speculative short position was opened on Jan. 6 when Bitcoin was at 271.91 on BTC-e. At the time when Bitcoin got to $153 on BitStamp, the price on BTC-e was around $182.34. This means that our hypothetical position one could have gained around 32.9% in only 9 days (transaction costs not included).

At the moment, we think that the depreciation has been strong enough to be followed by some kind of breather. Our bet is still that Bitcoin will go down but the situation has got a lot more extreme and there is even the possibility that the current move is in fact a major bottom. Taking this into account, we think waiting for the developments of today (and tomorrow) is the way to proceed before possibly reopening short positions.

Summing up, we think having no speculative positions at the moment is the way to go.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.