The Swiss Release the Kraken!

Currencies / Fiat Currency Jan 20, 2015 - 01:37 PM GMTBy: John_Mauldin

“Below the thunders of the upper deep,

“Below the thunders of the upper deep,

Far far beneath in the abysmal sea,

His ancient, dreamless, uninvaded sleep

The Kraken sleepeth: faintest sunlights flee….

“There hath he lain for ages, and will lie

Battening upon huge sea-worms in his sleep,

Until the latter fire shall heat the deep;

Then once by man and angels to be seen,

In roaring he shall rise and on the surface die.”

– Alfred, Lord Tennyson, “The Kraken”

"The exact contrary of what is generally believed is often the truth."

– Jean De La Bruyère

“Cry ‘Havoc!’ And let slip the dogs of war!”

– William Shakespeare, Julius Caesar, Act III, Scene I

“No mas!”

– Roberto Duran to the referee at the end of his fight with Sugar Ray Leonard, 1980

If you want evidence that central bankers play by their own rules, regardless of what they say or what conventional wisdom tells us, last week’s action by the Swiss National Bank should pretty much fill the bill. My friend Anatole Kaletsky, in a CNBC interview not long after the announcement, quipped (with a completely straight face) that just as James Bond has a license to kill, central bankers have a license to lie.

Swiss National Bank Chairman Thomas Jordan had assured us just the week before that the Swiss would continue to “hold the peg” whereby the SNB kept the value of the Swiss franc from rising higher than €1.22. “The cap is absolutely central,” he said. And SNB Vice Chairman Jean-Pierre Danthine said publicly only last Monday that the peg would remain a cornerstone of Swiss banking policy.

Early Thursday morning the Swiss abandoned that policy. Much of the press coverage in the (largish) wake of their surprise move has focused on the costs to banks and hedge funds around the world, but you have to realize that serious pain is being felt in Switzerland itself. Every bank and business that held non-Swiss-franc debt or investments took an immediate 15–20%+ haircut on its holdings. Swiss investors lost at least 10% on investments in their own stock market and more on shares they held in other stock markets. Forty percent of Swiss exports go to the Eurozone, and the Swiss franc is now over 30% higher than it was five years ago – with almost half that movement coming in one day. Those exporters just got hammered.

And this was not a painless policy decision for the SNB. Citibank estimates the SNB’s losses to be close to 60 billion Swiss francs. Let’s try to add a little perspective on that. The US is (very) roughly 40 times the size of Switzerland in both GDP and population. At today’s conversion rate, the Swiss lost something like $70 billion if Citibank is right. That’s like the US Federal Reserve’s losing $2.8 trillion. That, my friends, will leave a red mark on any central bank’s balance sheet. Not that the Swiss can’t afford it or that they’re going to be out on the corner with a tin cup, but they do have a considerable quantity of euros that are now much less valuable. And dollars and yen and pounds and renminbi. But then again, they are in the privileged position of having a currency that the rest of the world wants, so much that in order to hold it you will have to take a haircut on your deposits at the SNB, a haircut that is going to increase (more on that later).

There are also serious losses in the international banking community. We are just now beginning to learn how many funds and brokerages will have to close.

Do you think that SNB Chairman Thomas Jordan will be going into the local restaurants and getting high-fives and fist bumps? Exactly what do you think his reception will be in Davos (where he is scheduled to appear)? Christine Lagarde, the managing director of the IMF, gave a somewhat frosty reply to my friend Steve Liesman at CNBC when he asked her only a few hours after Jordan’s move (in what was clearly an already-scheduled interview) about her thoughts on the surprise announcement. She was not amused, but she kept her professional stage smile in place. (It was a very good interview.)

In Norse mythology, the Kraken was a sea monster that attacked ships unaware. In Greek mythology, it was a pet sea monster (of either Hades or Zeus) that would be released upon enemies that annoyed its master. It has been an iconic figure in comics and movies for the last 30 years. “Release the Kraken!” is the standard line prior all hell breaking loose.

In an era when central bankers are supposed to be more open, collaborative, and communicative, what would make the Swiss National Bank decide to turn on a dime and shock the markets – to release the Kraken, as it were? Note that in fact all hell did break loose. Rather than delivering hints accompanied by a few well-placed leaks, the Swiss decided it would be best to completely surprise the markets. It will be a long time before we get the full story on what must have been going through their heads as they reached the decision.

I have spent the last few days reading a great deal and talking with friends, trying to understand the “why” of the suddenness of the Swiss action. If we can get some insight into this question, perhaps it will give us a few clues as to upcoming global central bank policy changes in general and the problems facing Europe in particular.

While I do fully intend to try to reduce the length of my letters this year, this one is going to be longer because it will contain a significant number of charts. We’ll look at the data that made Thomas Jordan and his team at the SNB throw in the towel on their peg policy, and I think we should look at it in depth. Just as Roberto Duran walked away from Sugar Ray Leonard at the end of the eighth round of their famous fight in 1980, telling the referee “No mas,” the SNB signaled that it had had all the pain it could deal with.

The First Casualty of the Currency Wars

My last book, Code Red, was all about the currency wars that I expect to dominate the latter part of this decade, triggered by Japan’s massive quantitative easing. Jonathan Tepper and I pointed out that, going forward, it is every central banker for himself. While the world’s central bankers typically matriculated at the same schools and espouse the same beliefs, and while they regularly meet each other at conferences and BIS meetings and freely employ words like cooperation and collaboration in their dealings with one another, the reality is that they are all politically captive to the countries they serve.

While central bankers may espouse independence from their governments, they do live and work in their particular countries and are largely responsible for those countries’ economic well-being. They are going to do whatever they feel is necessary to help their governments and domestic businesses perform as well as they can, while trying to maintain the stability of their local currencies.

Japan is not going to cater to Korea with its monetary policy; neither is Indonesia really interested in helping Singapore or Malaysia; and countries like Switzerland and Sweden carve out their own paths on the flanks of the Eurozone. The US Federal Reserve has made clear on many occasions that it is not responsible for the policy decisions and outcomes of any other country. If you were the Swiss National Bank and looked at the following data, what would you do? The simple fact is that Europe and the Eurozone just don’t make sense; nor, given the recent Swiss action, do they seem to be pursuing the sorts of policies that would improve their condition.

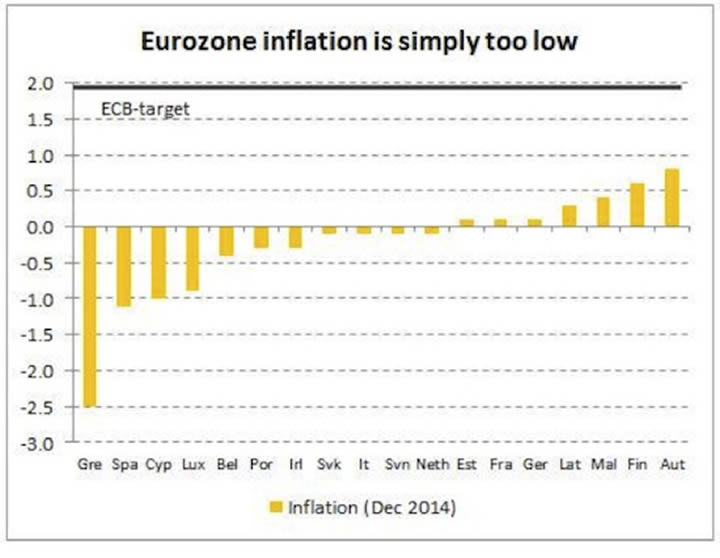

It’s not just about deflation. Switzerland is experiencing deflation and yet has full employment, a balanced budget, and a positive trade balance. Germany, France, Austria, Belgium, the Netherlands, Finland, Sweden, and Denmark are all either in deflation or close to it.

Recent central bank policy has led to the anomaly of negative interest rates. Negative rates began to show up a few years ago and are now pervasive. I’m going to post close to a dozen charts from Bloomberg. You might want to save this letter so you can show it to your grandkids in 30 years when they complain about aberrant economic conditions and volatility. “Kids, you have no idea what we went through back in the mid-teens! It was way wacko back then.”

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

The article Thoughts from the Frontline: The Swiss Release the Kraken! was originally published at mauldineconomics.com. John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.