China's Yuan Enters the Currency "Big Leagues" to Take on the Dollar

Currencies / China Currency Yuan Jan 21, 2015 - 03:26 PM GMTBy: Money_Morning

Peter Krauth writes: I've been following one of the biggest "stealth" stories of the year: the rise of China's yuan as it gears up to take its place on the world stage.

Peter Krauth writes: I've been following one of the biggest "stealth" stories of the year: the rise of China's yuan as it gears up to take its place on the world stage.

Towards this very goal, China has taken steady, calculated steps for some time.

It's also no secret that China and Russia have a "special relationship" that will drive this trend.

China is likely to help its neighbor in this time of need, and the longer-term global implications could well be dramatic.

The Yuan's Standout Performance in 2014

As of early December, the yuan was the only one of 31 major currencies to have gained on the dollar in the latter half of 2014.

Now, that's not a shock, given that the yuan is pegged to the dollar for now.

But what is surprising is the rise of the dollar, especially in the context of exploding U.S. debt levels.

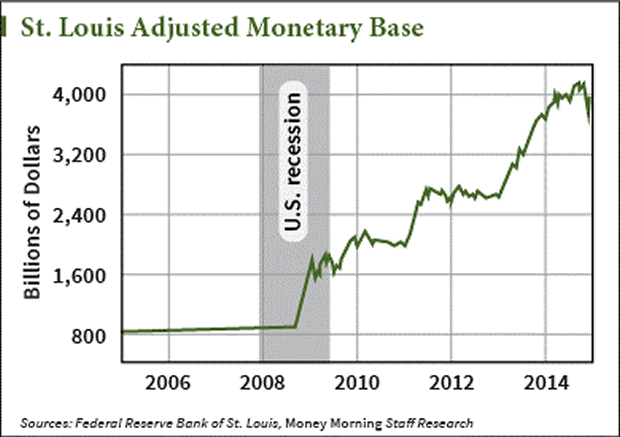

Despite the dollar's recent strength, I believe it's unsustainable in the longer term. Given the trillions of currency units created by the Fed since 2008, it's only a matter of time before it returns on the path towards its intrinsic value: Nil.

China's Makes Its Move Slowly

Meanwhile, China continues steadily checking off the items on its "currency reserve" list to gain that status for the yuan.

On December 26, 2014, the China Foreign Exchange Trade System (CFETS) indicated that China would begin trading swaps and forwards between the yuan and the Malaysian rinngit, the New Zealand dollar, and, of course, the Russian ruble.

China is determined to weaken the dollar's global dominance in international transactions and finance, an advantage it enjoys thanks to its status as the world's de facto reserve currency.

But this standing is gradually being chipped away both from inside and outside the U.S.

Having (on a purchasing power parity basis) the world's No. 2 economy, China's currency is becoming too relevant to exclude any longer. In November, we looked at how the European Central Bank (ECB) was considering including the yuan in its reserve currency mix.

As for finding the yuan attractive, the ECB is not alone…

For the Yuan, Few Obstacles Remain

Energy megadeals struck between China and Russia are well known.

Less known is Beijing's $24 billion currency swap program with Russia.

In mid-December, the South China Morning Post suggested that "Russia could fall back on its 150 billion yuan currency swap agreement with China if the ruble continues to plunge."

Meanwhile, China continues its moves to gain eventual inclusion of the yuan in the International Monetary Fund's SDR (Special Drawing Rights) currency basket, which now consists of the USD – 44%, euro – 34%, Japanese yen – 11%, and British pound – 11%.

Later this year, the IMF will perform its review (conducted every 5 years) of the currencies members can include in their official reserves.

In order to achieve inclusion for the yuan, China has to pass the IMF's economic targets; the yuan must be "freely usable," it must account for a large number of exports, and its inclusion must be supported by enough member nations.

The IMF has said that "there have been a number of developments regarding the yuan's international use, and the upcoming review would take stock of these developments."

According to the Society for Worldwide International Financial Telecommunication (SWIFT), the yuan's share of global money transfers set a record in September at 1.72%, ranking it the seventh most-used currency.

But support from the United States could remain the biggest obstacle.

A U.S. Veto May Not Be Enough

The U.S. holds 17% of IMF votes. If backing requires 85% of voting shares, the U.S. could veto China's move.

Given the implications, the IMF's 2010 Quota and Governance Reforms require Congressional approval for the United States to okay them. Congress has yet to pass these, effectively blocking IMF reforms, and still they weren't included in the recent budget legislation before Congress.

However, there seems to be significant support from IMF upper echelons.

In response to congressional unresponsiveness, IMF Managing Director Christine Lagarde said, "As requested by our membership, we will now proceed to discuss alternative options for advancing quota and governance reforms and ensuring that the Fund has adequate resources, starting with an Executive Board meeting in January 2015."

Of course the October vote at the IMF could go either way, but right now my sense is odds are good the yuan will make it into the SDR basket.

So what does this mean for you?

Limit Your Exposure

In the near term, the yuan could actually be due for some weakness, especially given the strength of the U.S. dollar. Recent action by the Swiss National Bank abandoning the franc's peg to the euro demonstrates the challenges inherent in just such policies.

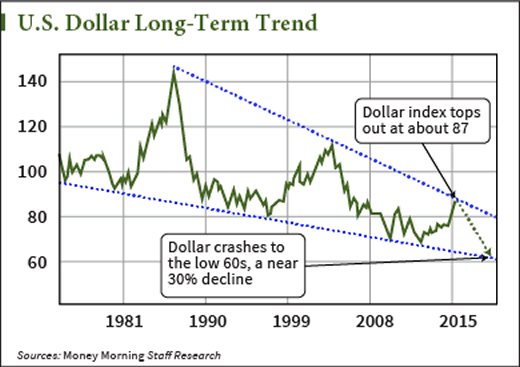

For its part though, the dollar has already experienced a dramatic rise since July, one that it truly doesn't deserve, especially when you consider the ongoing deficits and the dubious milestone of $18 trillion in debt.

Despite recent strength, the dollar is in a long term downward trend worthy of caution.

If the yuan makes its way into the SDR basket, that doesn't guarantee China will maintain the current peg to the U.S. dollar.

At the first sign of serious economic challenges, the People's Bank of China (PBOC) could choose the path of least resistance, similar to Japan, and purposely weaken its currency to make exports more attractive.

If China extends help to Russia by buying rubles to support that currency, this too could contribute to weakness in the yuan.

With all these cross currents pushing and pulling currencies in different directions, your best defense is to avoid being overexposed to any particular one. And that includes the so-called "almighty" dollar.

Join the conversation. Click here to jump to comments…

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.