Gold Bear Market Rally or New Bull ?

Commodities / Gold and Silver 2015 Jan 24, 2015 - 01:50 AM GMTBy: Submissions

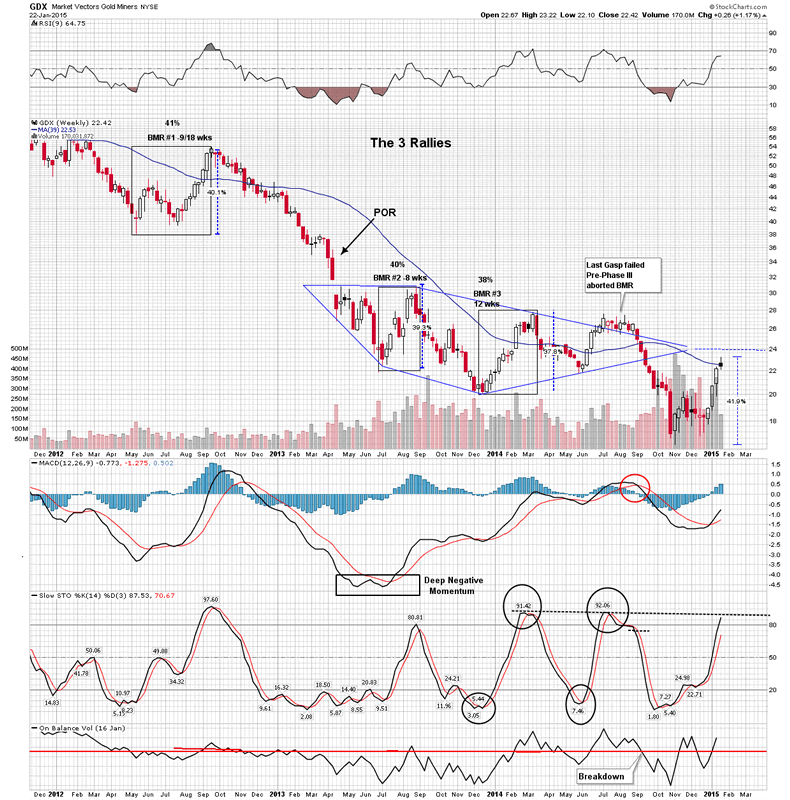

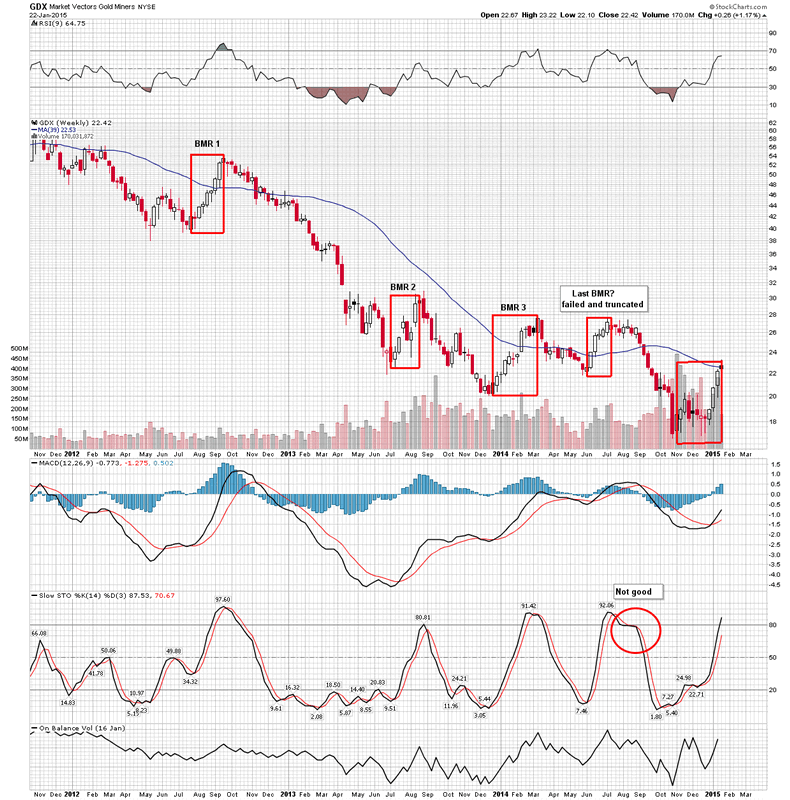

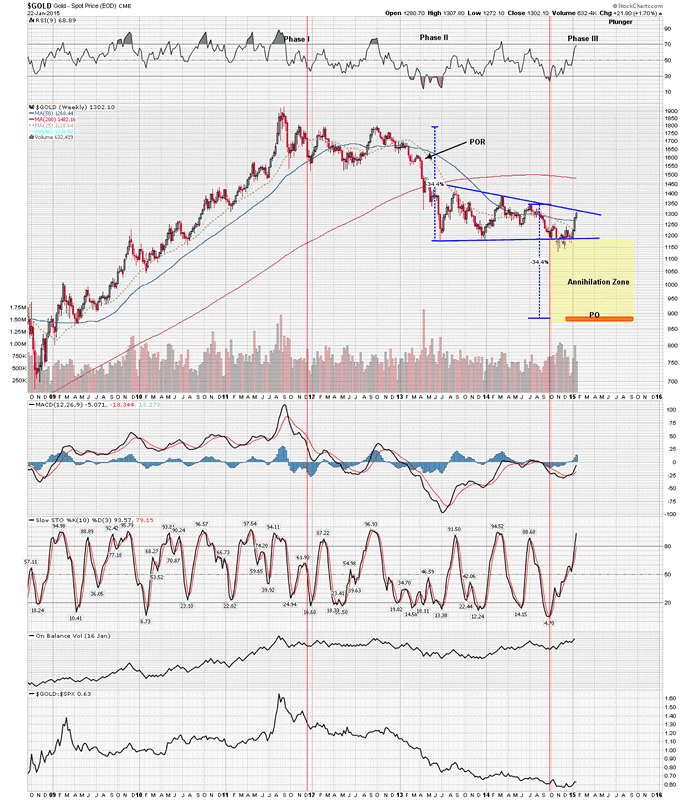

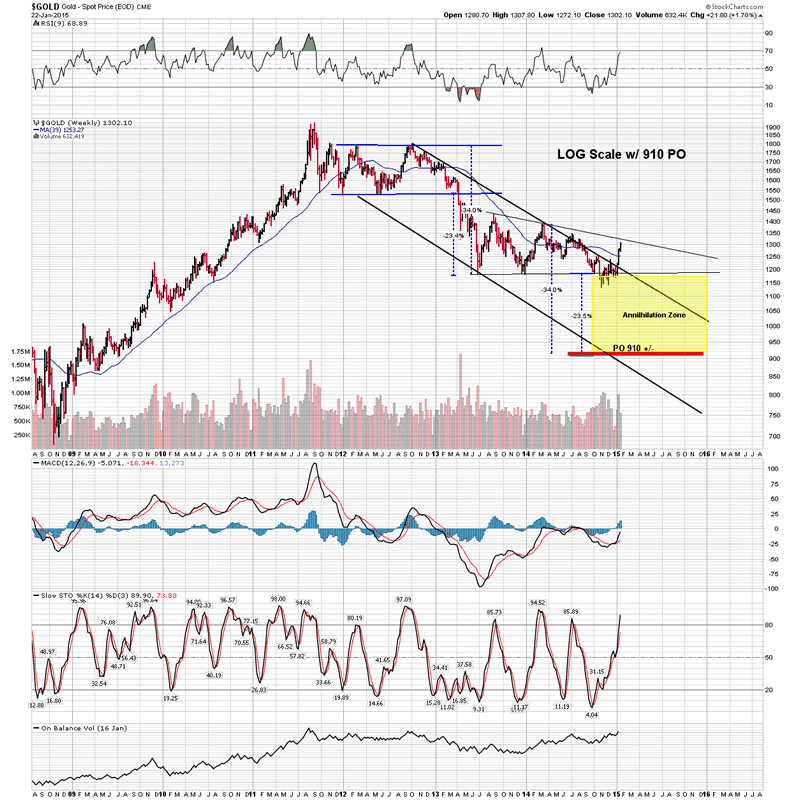

Plunger writes: Let’s step back and take a look at where we are and eyeball a few charts. I think one needs to resolve the key question with oneself. Are we in a new bull market or has this been yet another BMR within a big bad bear market that has not yet hit bottom? Rambus’ long term charts argue that the bear is not yet over. My studies with the psychology of bear markets and the categorizing of phases also argue the bear is not over. So if one was to also conclude the bottom is not yet in, then by definition this current 12 week rally is a BMR.

Plunger writes: Let’s step back and take a look at where we are and eyeball a few charts. I think one needs to resolve the key question with oneself. Are we in a new bull market or has this been yet another BMR within a big bad bear market that has not yet hit bottom? Rambus’ long term charts argue that the bear is not yet over. My studies with the psychology of bear markets and the categorizing of phases also argue the bear is not over. So if one was to also conclude the bottom is not yet in, then by definition this current 12 week rally is a BMR.

So one should ask when does it end and how high can it go? Let’s look at what we have seen so far: 3 BMR’s 8/12/18 weeks long. Amplitude of price extension has been 40% 39% and 38%. Our current BMR #4, if this is not a new bull, is 12 weeks and the biggest one yet at 42%. This alone would argue for the prudent to start taking chips off the table if you are long.

Note the volume in the charts above on the weekly basis. The second advance, since the beginning of December, does not have the push that the first advance had off its lows in November. That’s a red flag in my book. The stochastics have not turned down yet so we may have further to advance or at least chop sideways before its over, but it seems to me that if you are not a believer in a new bull market yet then the exit door is open here for a safe exit. I understand the main chorus of opinion is calling for 1350ish gold or higher, and we may get it, but in the past this has been a good place to exit. What I am personally looking for to signal me that the bear market is over is for the GDX to trade above 28. I would then look for a pullback followed by another move exceeding that previous high. Until this course of events occurs the weight of the evidence is that we are simply experiencing another BMR en route towards lower lows .

The current state of the gold market also seems pretty positive. Gold is starting to actually act like a pure alternative currency that it is. Providing a port in the storm against conniving governments and central banks. But the charts allow for a cycle down from current levels and may yet fulfill their measured moves as seen on the chart and fully express themselves in a phase III plunge.

I just got back last night from skiing in Telluride and couldn’t resist the metaphor of the two trails we skied down….was it prophetic? Our charts here allow us to see forever and we are headed for the Plunge!

Editor’s Note Plunger is an associate writer and Resident Market Historian at Rambus Chartology and Goldtent

His Previous work on Bear market Analysis here

http://plunger.goldtadise.com/

email the author gmag@live.ca

Copyright © 2015 Plunger - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.