The Raging Currency Wars Across Europe

Currencies / Currency War Jan 29, 2015 - 04:09 PM GMTBy: Gary_Dorsch

The theater of the absurd became even more bizarre on Jan 22nd, when the European Central bank <ECB,> desperate to extract the Euro-zone’s economy from the quagmire of deflation and stagnation, decided it would try its hand at the magic elixir of “quantitative easing,” (Q€). Starting on March 1st, the ECB will inject €60-billion of liquidity into the Euro-zone’s money markets, each month until the end of Sept 2016. The ECB is the last of the Big-4 central banks to unleash the nuclear option of central banking – QE, - starting about six years after the Bank of England, the Bank of Japan, and the Fed began flooding the world markets with $7-trillion of British pounds, Japanese yen and US$’s.

The theater of the absurd became even more bizarre on Jan 22nd, when the European Central bank <ECB,> desperate to extract the Euro-zone’s economy from the quagmire of deflation and stagnation, decided it would try its hand at the magic elixir of “quantitative easing,” (Q€). Starting on March 1st, the ECB will inject €60-billion of liquidity into the Euro-zone’s money markets, each month until the end of Sept 2016. The ECB is the last of the Big-4 central banks to unleash the nuclear option of central banking – QE, - starting about six years after the Bank of England, the Bank of Japan, and the Fed began flooding the world markets with $7-trillion of British pounds, Japanese yen and US$’s.

Proponents of QE argue that the UK and US-economies are among the best performing in the developed world today, and say the massive doses of money printing and near zero interest rate policies (ZIRP) are the main reasons why. Opponents of QE say the liquidity injections are mostly channeled into the bond and stock markets, - enriching the owners of financial assets, and very little of the QE-injections “trickle down” into the hands of the struggling masses. Instead, thanks to QE and ZIRP, the net worth of the world’s 400 wealthiest has mushroomed to a cumulative $4.1-trillion. The Richest 85-billionaires now control more wealth than half of the world’s population combined, or 3.5-billion persons.

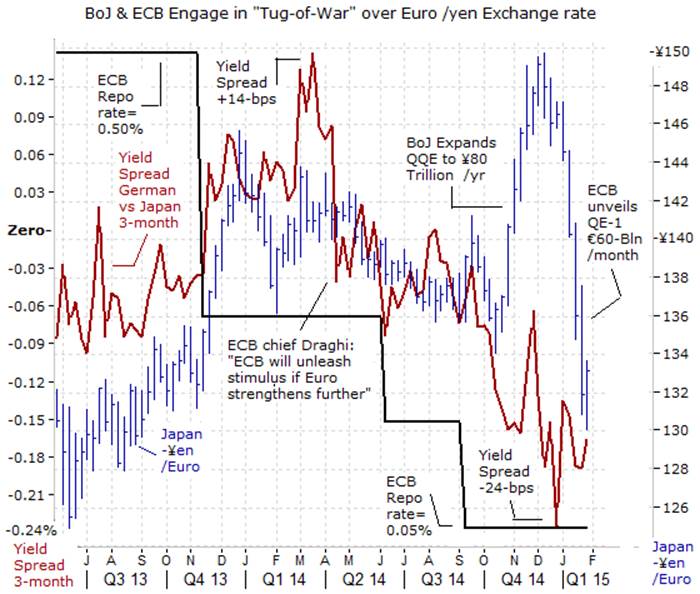

Many of the world’s ultra-wealthy were in attendance at the World Economic Forum in Davos, Switzerland this month, dining and conversing with the most powerful central bankers and finance ministers from around the world, and getting a few “hot tips.” Also in attendance, was the Bank of Japan chief Haruhiko Kuroda who welcomed the prospect of the upcoming “Tug-of-War” with the ECB over the direction of the Euro /yen exchange rate. “We very much welcome this QE action by the ECB,” Kuroda said in Davos. “The decision could end deflationary pressures and stimulate growth in Europe, which is good for the economies of Japan and the world,” Kuroda said.

However, when translating Kuroda’s jargon into plain English, what he really said to investors was; “The ECB’s decision could end deflationary pressures (ie; reduce selling pressure in the Euro-zone stock markets), and stimulate growth in Europe (ie; inflate EuroStoxx valuations and P/E multiples), which is good for Japan (ie; owners of Tokyo listed equities) and the world (ie the Richest-1%). On October 31st, 2014, the BoJ jolted the world stock markets sharply higher, when it stated its intention to buy ¥80-trillion of Japanese government bonds over the next 12-months, which means the BoJ would soak up all of the new bonds that the Ministry of Finance sells. The BoJ ramped-up its QE operations the same day the Fed mothballed its QE-3 scheme.

The BoJ already holds about 20% of Japan’s outstanding government bonds, and if it continues to underwrite the entire deficits of the government, it could end up owning half of the JGB market by as early as in 2018. BoJ chief Kuroda says the massive printing of yen, - dubbed “QQE” in Japan is necessary to prevent a reversal into a “deflationary mindset,” that has stymied Japan’s economy for decades. “Countering such a trend is the most important thing we can do. Whatever we can do, we will,” Kuroda said. Reading between the lines, the “deflationary mindset” that Kuroda aims to turn around is the Bearish psychology that has plagued the Tokyo Stock Exchange for more than two decades. Since the BoJ unleashed QQE in Dec ‘13, the Nikkei-225 stock index has doubled in value to above 17,500-points, - thanks to a -50% devaluation of the Japanese yen versus the US$.

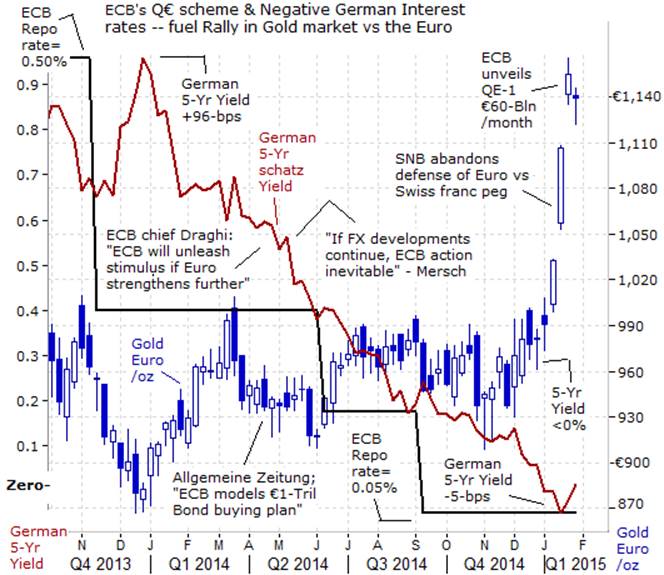

ECB Ups the Ante against the BoJ; For almost two years, inflation has been consistently below the ECB’s target rate of +2%, with each month showing a lower figure than the previous one. More than six years after the collapse of Lehman Brothers and the start of the “Great Recession,” conditions are still at Depression-like levels in the peripheral countries of Europe, with double-digit unemployment rates, and ever-lower living standards and rising poverty that have become a permanent situation. Reflecting the deeply entrenched trend of deflation, the yield on Germany’s 5-year schatz turned negative on January 15th, to as low as -5-basis points (bps), before rebounding to bps today.

As such, the ECB unveiled its most aggressive effort to date to revive the region’s ailing economy (ie; inflate the EuroStoxx index) with a QE-scheme to print 1.1-trillion Euros and purchase government and private bonds starting in March. Thus, the BoJ and ECB will engage in hand to hand combat the Euro /yen exchange rate in the year ahead. Initially, the BoJ gained the upper hand over the Euro /yen exchange rate, when it struck first, with a surprise attack, by expanding its QQE scheme to ¥80-trillion /year. That act of “shock and awe” lifted the Euro to as high as ¥150 in December. However, the ECB quickly retaliated by driving German T-bill rates to zero percent, and -16-bps below Japanese T-bill rates. And of course, the ECB has upped the ante, by playing the Q€1.1-trillion -Q€ card, and in turn, knocked the Euro sharply lower to ¥130 last week.

German firms are competing head-to-head with Japanese firms in the $3.4-trillion capital goods export market, and the central banks have the advantage of being able to move quickly. Politicians always turn to central bankers and say, “Can you fix it? Put some cheap money out there.” Together, these two heavy weight central banks are planning to inject a combined ¥10-trillion and €720-billion into the world money markets in one year’s time. But there is no quick fix.

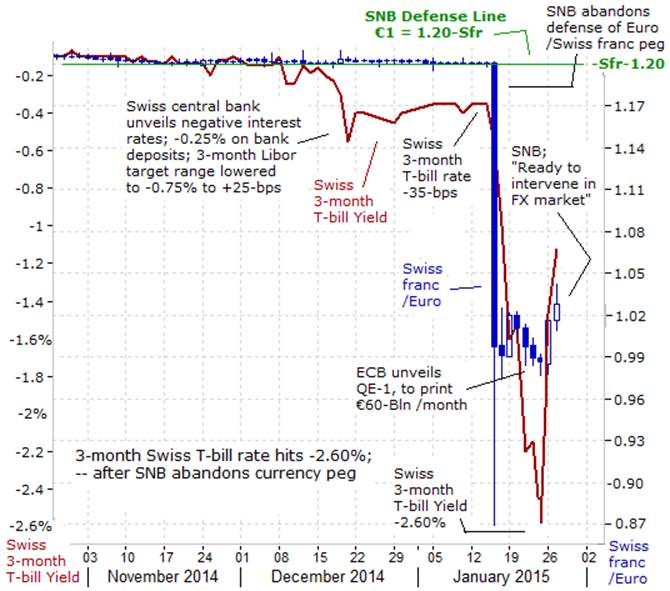

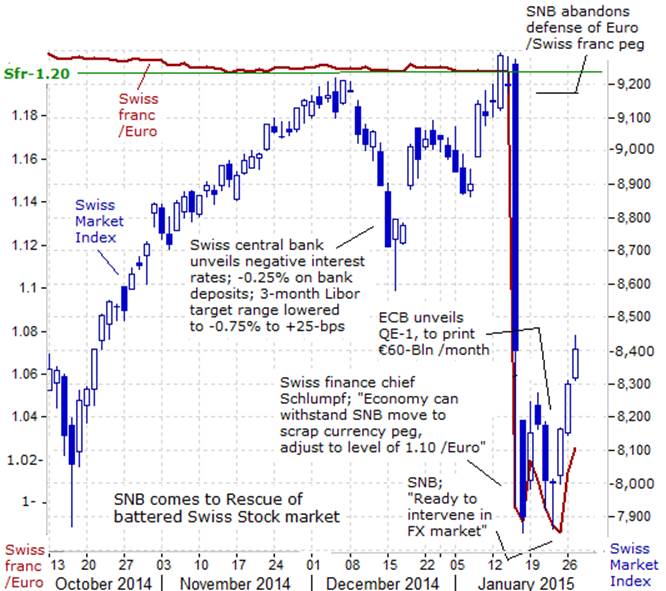

Switzerland Stuns Markets by Giving Up on Currency Peg; On January 15th, the Swiss National Bank <SNB> shocked the markets, in one of the most memorable days in the history of currency trading. The SNB swept the rug from under the feet of currency, debt, and equity traders alike, when it decided to abandon its defense of the Euro versus the Swiss franc. The SNB’s sudden withdrawal from the currency wars, sent the Swiss franc soaring by +20% within a few minutes, a move that rippled through global markets and wiped Sfr-155-billion off the value of the Swiss stock market.

The SNB scrapped its defense of the Euro at 1.20-Swiss franc, just days after SNB officials said the currency peg was absolutely necessary, to fend off deflation and a recession. SNB deputy Jean-Pierre Danthine said on Jan 12th that the 1.20 ceiling would remain a “pillar” of monetary policy. “We took stock of the situation less than a month ago, we looked again at all the parameters and we are convinced that the minimum exchange rate must remain the cornerstone of our monetary policy,” Danthine declared. Earlier, on Jan 5th, SNB chief Thomas Jordan said the currency peg as “absolutely central.”

Since introducing the currency peg in Sept ’11, the SNB had printed roughly Sfr-400-billion and used to buy Euros and US$’s. As of Jan 14th, its foreign currency reserve had increased to a record Sfr-495-billion, or equal to 85% of Switzerland’s GDP. Then, the gig was up. The SNB realized it was not possible to match the ECB’s forthcoming €1.1-trillion Q€-printing spree. To counter the ECB, the SNB would have to print Swiss francs equal to 2-times the size of Switzerland’s annual GDP.

In Zurich, the SNB’s defense of the currency peg had in essence, become a quasi QE-scheme. Much of the 400-billion of Swiss francs that were injected into the foreign currency market, filtered into Swiss bonds, (pushing the Swiss 10-year yield below zero-percent last week), and into blue-chip Swiss stocks. However, when the SNB suddenly went cold turkey on quasi-QE, and abandoned the Euro /franc peg, it triggered an instant reaction of panic. The Swiss Market Index <SMI> tumbled -15% lower to the 7,900-level. The two-day crash was the biggest since “Black Monday” in October 1987, and wiped out around 155-billion francs in market value.

Morgan Stanley analysts wrote: “We estimate that 85% of SMI sales come from overseas, and many of the large-cap names generate 90-95% of their revenues from sales outside Switzerland. With the franc worth around +17% more than it was a day and a half ago - the franc is now nearly at parity with the Euro. Swiss companies must face the challenge of absorbing what amounts to a -17% reduction in revenue on every item sold in the Euro-zone.” The SNB’s retreat from quasi-QE also has far reaching consequences for 550,000 Poles, 150,000 Romanians, and many Croatians, who have mortgage debts denominated in Swiss francs, and now face +17% increases in their interest and principal payments.

However, on Jan 18th, Switzerland’s finance chief Eveline Widmer-Schlumpf sought to reassure shell shocked investors that abandoning the currency peg with the Euro would not destabilize the Swiss economy. She predicted the Euro / Swiss franc rate would eventually rebound to 1.10. “I’m confident that the economy will be able to cope with this decision. Companies are in a far better position than in 2011 when the cap was introduced,” she told the SonntagsBlick and Schweiz am Sonntag newspapers.

Sure enough, on Jan 27th, the SNB backed-up the finance chief, and issued a warning that it is ready to intervene in the currency market to support the Euro against the Swiss franc. “Giving up the cap means a tightening of monetary policy. We accept this, but only up to a point. We are fundamentally prepared to intervene in the foreign exchange market,” warned SNB deputy Jean-Pierre Danthine. He said it would take some time for the foreign exchange markets to balance out, and declined to give exact levels, the SNB is aiming for the Swiss franc versus the Euro and the US-dollar.

Already, signs of stability in the Euro’s value at around parity with the Swiss franc was enough of a signal for bargain hunters to pick-up battered Swiss shares. With the SNB alerting traders that it is not completely walking away from currency intervention, traders bid-up the SMI +5% higher to the 8,400-level on Jan 27th, or +5% above the panic bottom lows. In turn, signs of stability for the Euro /franc led speculators to dump Swiss T-bills. The yield on Switzerland’s 3-month T-bill jumped to minus -118-bps on Jan 27th, from a record low of -260-bps on Jan 23rd.

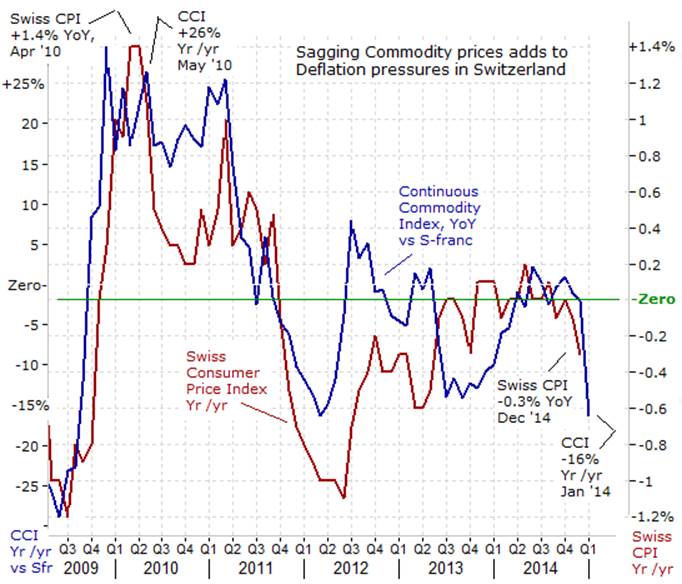

Still, the Swiss economy will have to deal with a “deflationary” shock, largely as a result of the ECB’s decision to launch Q€. The SNB might have to widen the scope of bank deposits that are affected by negative rates in order to weaken the Swiss franc, and unwind the deflationary pressures. The Swiss consumer price index <CPI> fell -0.5% in December, and compared with Dec ’13, the CPI was -0.3% lower, compared with annualized rates of -0.1% in Nov ‘14. In light of the Swiss franc’s rapid appreciation against the US$ this month, to around $1.100, the Continuous Commodity Index, including a basket of 17-equally weighted commodities, is trading -16% lower compared with a year ago, when measured in the Swiss franc. In turn, that could keep the Swiss CPI in negative territory in the months ahead. And the ability of the SNB to support the Euro /franc with sporadic rounds of interventions would be limited at best, given the expected flow of €1.1-trillion from the ECBs printing press thru Sept ‘16. In essence, the ECB is exporting the Euro-zone’s deflation problem to Switzerland.

Loss of Confidence in Euro sparks flight for Safety into Gold; Still, the ECB’s belated Q€ scheme cannot disguise the fact that the Euro-zone economy is based upon a one-size-fits-all monetary policy that is fatally flawed. The economic divergence between Europe’s wealthy core countries and the weaker debt-saddled periphery continues to widen. On the fiscal side, Berlin has insisted instead that the big debtors in the Euro-zone push through painful spending cuts and tax increases to reduce their budget deficits, in line with its own successful fiscal model. The Irish, Spanish, Italian, and Portuguese are going along with these policies for now, but skeptics worry that in the years to come this strategy will be exposed as deeply flawed and result in long lasting stagnation and high levels of joblessness. Support for political fringe parties that want to break-away from fiscal austerity, such as in Greece, is also leading a growing numbers of citizens to conclude, that they might be better off outside the currency union.

Who says interest rates can’t go below zero-percent? While yesterday’s news centered on the fall in US 10-year Treasury yields to as low as 1.75%, the bigger news is Germany’s 5-year schatz is trading at zero-percent. On Jan 15th, it briefly fell into negative territory at -0.05%. Shorter-term German T-bill yields began to slip below zero percent in August ’14, and today, the 3-month German T-bill is yielding minus -17-basis points (bps). But why would anybody lock in a yield of zero-percent for 5-years? Perhaps, it’s a low cost “option play” – and betting on the eventual break-up of the Euro currency.

Although the Deutschemark is officially out of circulation, if in the event that the Euro does break up into the former currencies of each member state, then it would be a logical assumption that all securities would also be redenominated in those original currencies. So German Bunds would be denominated in the Deutschemark. That is one reason why the 5-year Schatz is yielding zero percent. And while the investor that buys German T-bills or notes at less than zero-percent, pays interest to Berlin, the expected payoff from big currency gains, due to the potential break-up of the Euro would far exceed the costs. In that “Black Swan” scenario, the currencies of the periphery, new Drachma, New Escudo, New Peseta and new Irish Punt could be revalued far below the Deutschemark.

It’s difficult to pinpoint exactly the reason for negative interest rates in Germany, although it certainly deserves the lowest borrowing costs in the Euro-zone. Germany balanced its federal budget for the first time in almost half a century in 2014, and even managed to pay off old debts worth 2.5-billion euros. Germany’s finance chief Wolfgang Schaeuble says Berlin won’t issue new debt in 2015 and is aiming to generate a budget surplus in 2016, helped by soaring tax revenues and record low unemployment – and negative interest rates resulting from its safe-haven status. Outside of Germany, however, there are 26-million people unemployed in the EU, including around one in every two young people in Greece, Spain and parts of Italy and Portugal.

Another possible reason for the emergence of negative interest rates in Germany is the possibility of a massive short squeeze in the German Bund market, once the ECB begins to buy sovereign bonds. The amount of eligible Euro area government bonds is €7-trillion and the estimated net government bond issuance is around €90-billion in the year ahead. If correct, the ECB would soak-up around 55% of the newly issued debts. The ECB would be reducing the amount of German Bunds in circulation, with Berlin running a balanced fiscal budget or even a small surplus.

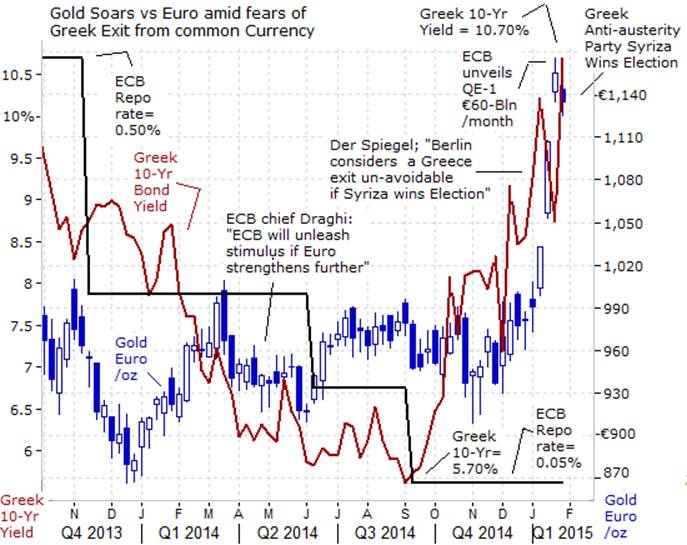

Around €1.4-trillion of Euro area government bonds are already trading with negative nominal yields, almost all of them up to 5-years maturity. Whatever the reason for the emergence of negative interest rates in Europe, it’s suddenly made the Gold market more attractive, simply because the yellow metal is yielding a higher rate of interest, or zero-percent. And with the ECB is vowing to further dilute the value of the Euro against other paper currencies, through its Q€ scheme, there has been a panicked flight from the Euro and into safer havens. And there is another wildcard in play that might explain Gold’s sudden explosive +15% rally against the Euro in the month of January ‘15, to as high as €1,150 this week. Most traders to date have concluded that the cost of Greece exiting the Euro currency union is so high that Athens would not contemplate it. However, the virtual economic collapse and high poverty level in Greece that has led the left-wing Syriza opposition party led by Alexis Tsipras to power have upset those calculations. Greece, in effect, has a lot less to lose by leaving the Euro currency.

Greece’s economy has shrunk by -25% since the onset of the “Great Recession.” Thousands of businesses have closed, wages and pensions have been slashed and more than half of young people are unemployed. Half a million citizens have left the country. At the same time, its massive public debt has climbed to €320-billion, or 176% of GDP last year, the second highest in the world. Greece could declare bankruptcy if a solution is not found. As such, there is a flight from Greek bonds that has already doubled the yield on Greece’s 10-year note since the start of September to as high as 10.70% this week.

Yet Berlin believes that the rest of the Euro zone would be able to cope with a Greece exit if that proved to be necessary, the Der Spiegel magazine reported on Jan 3rd. Both German Chancellor Angela Merkel and Finance chief Wolfgang Schaeuble believe the “danger of contagion is limited because Portugal and Ireland are considered rehabilitated. In addition, the European Stability Mechanism (ESM), the Euro zone's bailout fund, is an effective rescue mechanism and is now available.” According to the report, the German government considers a Greece exit almost unavoidable if the leftwing Syriza opposition party led by Alexis Tsiprasto tries to cancel austerity measures and a chunk of Greek debt.

“If Alexis Tsipras of the Greek left party Syriza thinks he can cut back the reform efforts and austerity measures, then the troika will have to cut back the credits for Greece, “ warned Merkel’s chief advisor Michael Fuchs on January 3rd. “The times where we had to rescue Greece are over. There is no potential for political blackmail anymore. Greece is no longer of systemic importance for the Euro,” he said. On the other hand, many traders are bidding up the price of Gold and German bunds, fearful that a Grexit could open the way for the eventual demise of the Euro and a return to the Deutsche Mark.

On the political front, the Greek election that brought Syriza to power highlights the growing strength of anti-austerity and anti-Euro parties. It is perhaps Spain which has the strongest parallels with Greece. The Spanish economy has suffered a major economic downturn that has fuelled the rise of anti-establishment, radical left party Podemos, only founded in 2014, which is currently neck and neck in the polls with the ruling People’s Party. Meanwhile, the long established Socialist Party is trailing in third place, but might yet win power in coalition with Podemos at the next election. So after 3 years of kicking the can and pretending it is fixed, suddenly everything that is broken in the Euro-zone threatens to float right back to the surface, and the ECB’s QE-scheme might only make matters much worse.

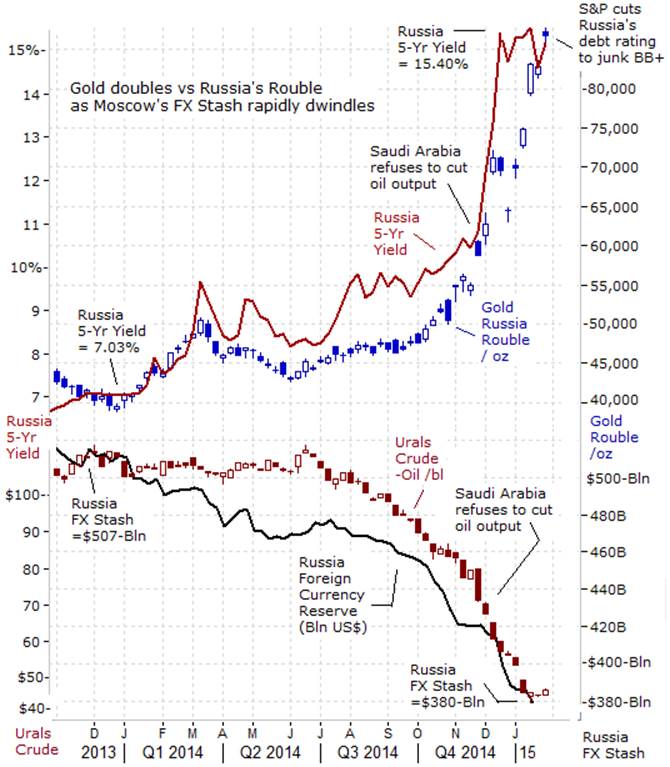

Ex-Finance chief Kudrin warns of “full-fledged crisis” in Russia; There is another currency war that is being fought in Europe, and this one has all the makings of a great conspiracy novel. There is an uncanny sequence of events that is unfolding before our eyes, that is threatening to topple the world’s 10th largest economy. For more than a decade, oil income and consumer spending have delivered growth to Vladimir Putin’s Russia. Not anymore. Russia’s economy is sliding into a severe recession. The Russian rouble has lost half of its value against the US$ compared with a year ago, and with it the faith of the country’s businessmen. Banks have been cut off from Western capital markets, and the price of oil, - Russia’s most important export commodity has plunged – 60%. Consumption, the main driver of growth in the previous decade, is slumping. Money and people are leaving the country.

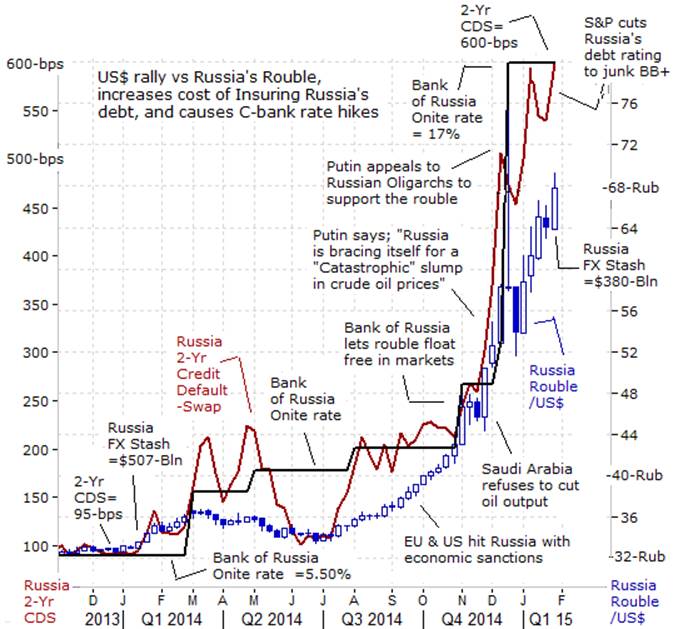

On Dec 22nd, Russia’s former finance chief Alexei Kudrin warned of mounting trouble that is spreading through the Russian economy, and what Economy Minister Alexei Ulyukayev called a “perfect storm” of plummeting oil prices, EU & US-economic sanctions related to its military action in Ukraine, and a $134-billion flight of investors’ capital last year. “Today, I can say that Russia’s economy is entering a real, full-fledged economic crisis. In 2015, we will feel it clearly,” Kudrin told a news conference on Dec 22nd. “The government has not been quick enough to address the situation.” Kudrin forecast a series of defaults among both medium and large companies -- though he said banks would probably be supported by the state -- which was likely to result in rating agencies downgrading Russia’s debt to “junk” status. The collapse of the Russian rouble will lift Russia’s inflation rate to +12% to +15% in 2015, Kudrin predicted. Russia imported $341-billion last year, so a devalued rouble quickly stokes inflation.

Long before he annexed the Crimean peninsula and began backing pro-Russian forces in eastern Ukraine, Russian kingpin Vladmir Putin created an economic system that allowed a clique of Oligarchs to grow wealthy on Russia’s vast oil and gas reserves. He did little to diversify the economy or to make it more resilient. As such, Kudrin’s outlook for Russia’s economy is bleak: “Even if the price of Russia’s Urals crude oil rebounds to $80 /barrel, gross domestic product is still likely to fall by more than -2% in 2015, Kudrin predicted. At $60 /barrel GDP would decline by -4% or more, he added.

The collapse of the Russian rouble is a mirror reflecting the crisis undermining its entire economy, which has been devastated by the plunge in oil prices to around $46.50 /barrel today. The Gazeta.ru newspaper said last month was “Black December” in Russian history. According to the central bank, capital flight amounted to $134-billion last year. Bank Rossi responded by tripling its key overnight lending rate to 17%, after it burned through $113-billion of foreign currency reserves.

On Dec 15th, nearly $10-trillion of foreign currencies traded hands in the world markets, double the daily average, when the US$ suddenly surged +30% higher to 80-roubles. Moscow reacted by ordering state-controlled exporters to sell their holding of foreign currency, and briefly succeeded in knocking the US$ down to 54-roubles a week later. On December 19th, Russian president Vladimir Putin met with 41 of the leading Russian finance tycoons and Oligarchs, and asked them to limit their sales of Russian roubles. The collapse of the rouble and the Russian stock market has wiped out $73-billion of wealth of the 20 richest Russians. The fortunes of some oligarchs have more than halved.

However, on January 27th, Standard & Poor’s became the first of the big-three ratings companies to strip Russia of its investment grade, citing weaker growth prospects and a deterioration of fiscal buffers. Russia’s debt rating was lowered one notch to BB+ by S&P, while Moody’s and Fitch cut Russia to one level above junk this month. The country’s debt will no longer be eligible for some indexes that track investment-grade sovereigns if two of the three biggest rating companies cut it to junk. The cost of insuring Russian debt against default using credit-default swaps <CDS’s> has soared to 600-bps this week, and up sharply from around 95-bps in Dec ‘13

Russia may have to spend more than $40-billion of its dwindling FX-stash this year in order to avert a banking crisis. Last month, the state spent 130-billion roubles to bail out the first major bank to fall victim to the rouble crisis, mid-sized lender Trust Bank, then ranked 15th biggest by retail accounts and 32ndby assets. If any of Top-30 banks get into trouble, the government will have to save them at any price, as it could spark a crisis of confidence in which the population withdraws deposits en masse and interbank lending rates spike sharply higher.

Russia’s finance ministry is warning of at least a $45-billion drop in revenues this year, if the average oil price is $50 /barrel. Finance chief Anton Siluanov said all state expenditure should be cut by -10% except defense, a priority for President Vladimir Putin. “The state cannot have the kind of spending it used to have with the oil price at $100 / barrel,” Siluanov warned. Russia’s budget for 2015 was based on an oil price of $100 /barrel but prices are now close to six-year lows at just above $46 /barrel. Siluanov said Russia needs to conserve its foreign currency reserves to overcome difficulties as the price of oil looked set to continue at low levels. “We think that with the average oil price at $50 /barrel (in 2015), we will lose some 3-trillion roubles in revenues,” he said.

While Russia’s sovereign debt is just $57-billion, many Russian banks and corporations, including large oil and gas businesses, went on a borrowing spree. They increased their foreign-currency debt by $170-billion in the past two years, and are on the hook for a total of $614-billion in foreign currency debt. Most of this debt was racked up by state owned corporations and national energy companies, which gives it a quasi-sovereign status. And by the end of 2015, Russian firms will have to repay about $130-billion of foreign debt. The -50% devaluation of the rouble makes the servicing of the foreign debt twice as expensive. So instead of preparing itself for a crisis, Russia has prepared a crisis for itself.

Rosneft, Russia’s national oil company, run by Igor Sechin, Mr Putin’s close confidant, is already asking the Kremlin for a bailout, in part to help it repay $30-billion of debt which it took on when buying a successful private company, TNK-BP. If the price of crude oil stays below $50 /barrel for two years, much of Russia’s treasure chest of foreign currency reserves could become depleted. As such, the ordinary Russian citizen is able to protect his /her purchasing power by purchasing Gold, - a hedge against massive currency devaluation. The price of Gold has nearly doubled since June ’14 to above 87,000-roubles per ounce this week. Interestingly enough, the Kremlin was the world’s biggest buyer of Gold in 2014, adding 150-tons to its hoard and catapulting its holdings into the top five among nations. It stands at just shy of 1,170-tons, and worth about $50-billion at today’s prices.

Russia is facing its worst economic crisis since 1998, when the country devalued the ruble and defaulted on its debt. Putin’s popularity is partly based on his reputation for providing prosperity and stability. And so, amid a double-digit inflation rate, Russian kingdom Vladimir Putin has ordered his government to rein in rising vodka prices. Under the Kremlin’s new price control policy, the cheapest half-liter legally available will continue to cost a minimum of 220 rubles ($4).

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Global Money Trends filters important news and information into (1) bullet-point, easy to understand reports, (2) featuring “Inter-Market Technical Analysis,” with lots of charts displaying the dynamic inter-relationships between foreign currencies, commodities, interest rates, and the stock markets from a dozen key countries around the world, (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, posted Monday and Wednesday evenings, with the latest news and analysis on global markets. To order a subscription to Global Money Trends, click on the hyperlink below,

http://www.sirchartsalot.com/newsletters.php

or call 561-391- 8008, to order, Sunday thru Thursday, 9-am to 9-pm EST, and on Friday 9-am to 5-pm.

This article may be re-printed on other internet sites for public viewing, with links to:

http://www.sirchartsalot.com/newsletters.php

Copyright © 2005-2015 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.