Gold Chartography 101 - The Case for Gold Ownership in Ten Charts

Commodities / Gold and Silver 2015 Feb 07, 2015 - 12:32 PM GMT ... you will never see on CNBC.

... you will never see on CNBC.

"What's past is prologue." – William Shakespeare, The Tempest

These charts summarize gold's impressive performance during the tumultuous first fourteen years of the 21st century. Investors fearing some future Black Monday, a general bank or currency collapse, a 1930s-style economic depression, or a sudden and virulent inflation took precautions by purchasing gold coins and bullion as a form of portfolio insurance. Gold Chartography 101 is a record of that past. At the same time, though, it could very well be a glimpse of the future.

The same uncertainties that drove gold demand throughout the past decade in a half are still with us today. In fact some analysts believe that current global monetary policy is setting us up for another economic crisis far worse than the near full meltdown in 2007-2008. "Focusing all policy efforts on boosting inflation rather than on structural reforms to boost growth," says Paul Singer, the outspoken and highly respected hedge fund manager, "will potentially be seen in retrospect as one of the most inexplicably ridiculous mass delusions in the history of economic and monetary policy in the developed world." Mass delusion, it should be added, quite often precedes the black swan event.

These specially customized charts are drawn with the first-time gold investor in mind. Though the river of gold market analysis runs wide and deep on the Internet, precious little of that content is devoted directly to the most basic rationale for gold ownership. Here we fill that void in chart form – a quick reference for the first-time investor.

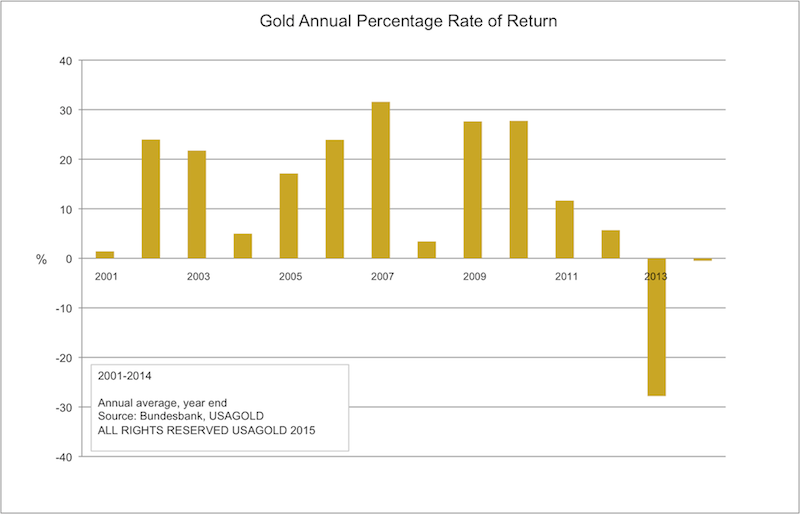

Chart 1 presents a quick overview of gold's annual rate of return from 2001 through 2014. An investment of $100,000 made in 2001 would have a market value today just under $440,000 even with the market correction of the past two years taken into account. The average annual return over the period was just over 12%. By comparison, stocks over the same period (at the 18,000 level for the Dow Jones Industrial Average), averaged a return of just under 4% annually. Also keep in mind that over the period stocks enjoyed two bull markets and gold only one! A 12% annualized return in a no yield environment represents a phenomenal return.

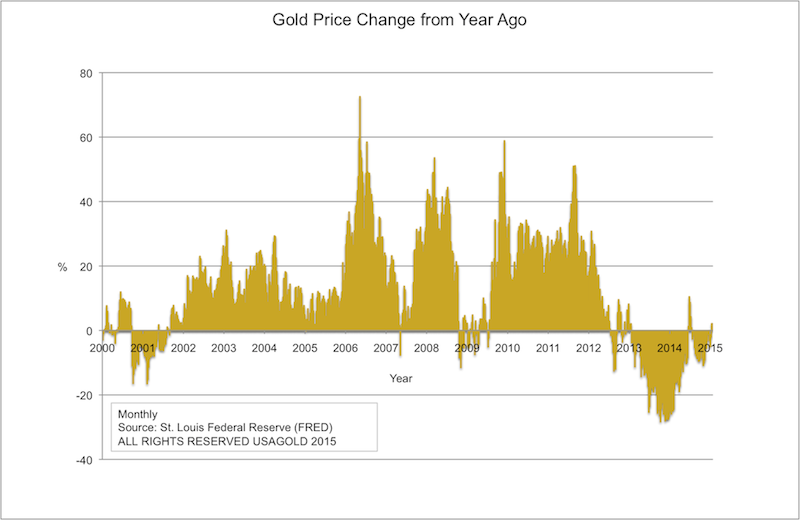

Chart 2 is a magnification of Chart 1. It shows gold's annual gain over the same month in the previous year. Its most telling features are the spikes running concurrent to times of economic and financial stress. One lesson to be drawn from this chart is that the best time to buy gold is when everything is quiet, and the market is declining or running sideways. The largest year over year gains – in some cases 60% to 70% – were realized when gold was purchased on the downslopes. These spikes were accompanied by heavy physical gold demand both in the United States and abroad with national mints and refiners running 24-hour schedules to keep up with coin and bullion demand.

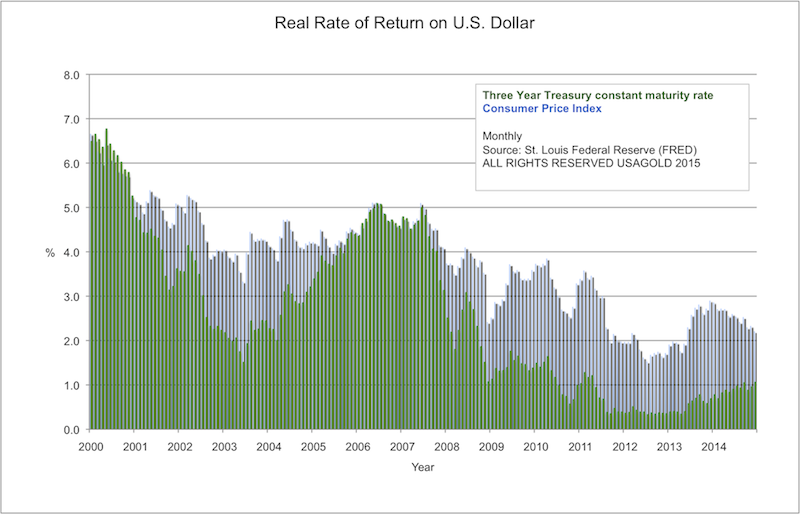

Chart 3 offers the kind of fundamental analysis that drives the thinking of professional investors and portfolio managers. A real rate of return – the gain on yields after inflation – over an extended period of time is essential to maintaining and building wealth. As you can see in this chart, there has not been a real rate of return on dollar savings and highly-rated yield instruments since the 2007-2008 financial crisis, and prior to that true yield was scant. (The blue areas reflect the negative real rate of return.) As a result, investors have been forced to raise their risk profiles – an unhealthy circumstance that also raises the prospect for significant speculative losses and argues persuasively in favor of gold diversification.

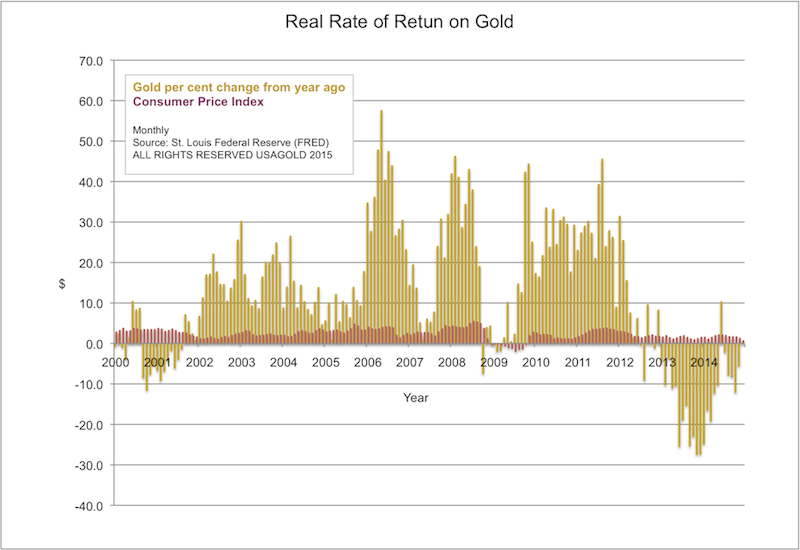

Chart 4 shows the impressive real rate of return on gold ownership since 2000. Nothing argues for a gold diversification under the current economic circumstances as forcefully as this single chart. It requires no embellishment. The gold areas above the red CPI bars reflect the real rate of return. (Please see the commentary under Chart 1.)

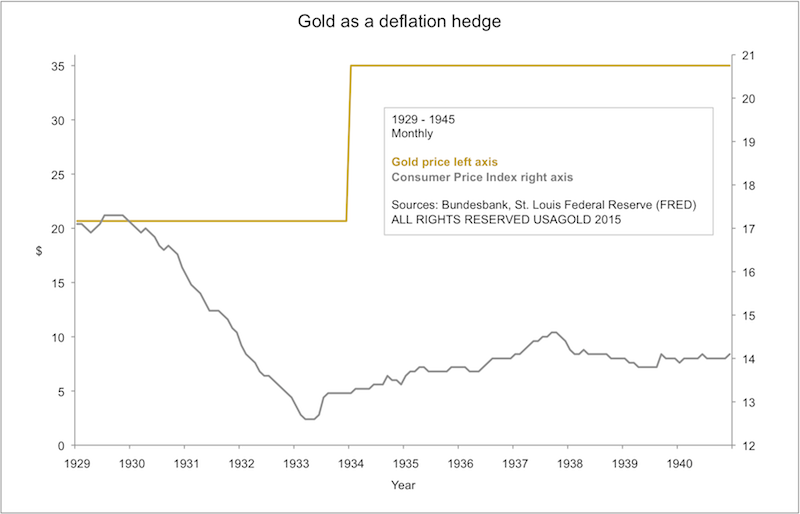

Chart 5 demonstrates gold's viability as a deflation hedge. During the Great Depression of the 1930s, the price of gold was fixed at $20.67 per ounce, and from 1933 at $35 per ounce. When the general price level fell, it gained in purchasing power simply because of the fixed benchmarks. A second advantage to gold ownership under deflationary circumstances is the metal's status as a stand alone asset that is not simultaneously someone else's liability. Because it is an asset the investor holds outside the financial system, it does not carry the attendant counterparty risk associated with bank deposits, annuities, common stocks, bonds and other financial assets. As such, it might very well be the ideal hedge and safe haven under deflationary circumstances.

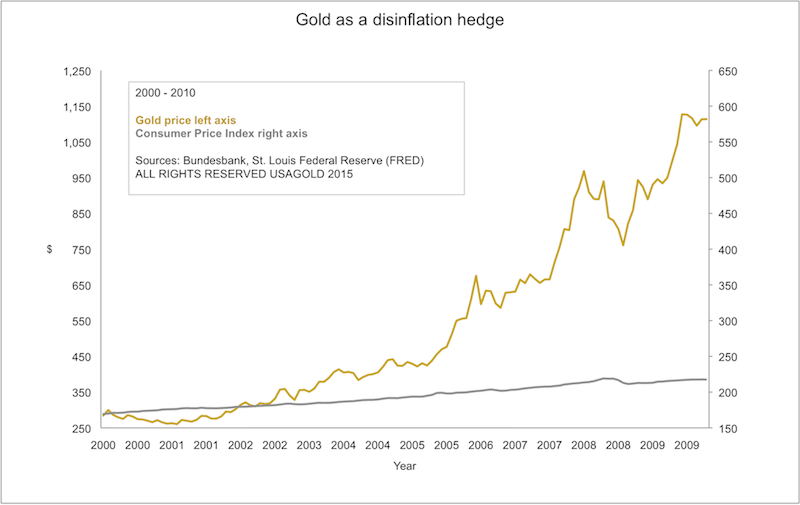

Chart 6 isolates a recently attained benefit to gold ownership not widely known or publicized – its capacity to effectively hedge against disinflation. As the past disinflationary decade of asset bubbles, financial institution failures and global systemic and sovereign debt risk unfolded, gold proved capable of consistently delivering the goods under disinflationary circumstances. During the 2000s – an era of indisputably disinflationary circumstances – gold rose from just under $300 per ounce in the early 2000s to just over $1900 per ounce by 2011, a gain of over 600%. Since then, gold has taken a breather. As this page is posted in early 2015, it is trading in the $1300 per ounce range -- still up over 400% thus far in the new "disinflationary" century.

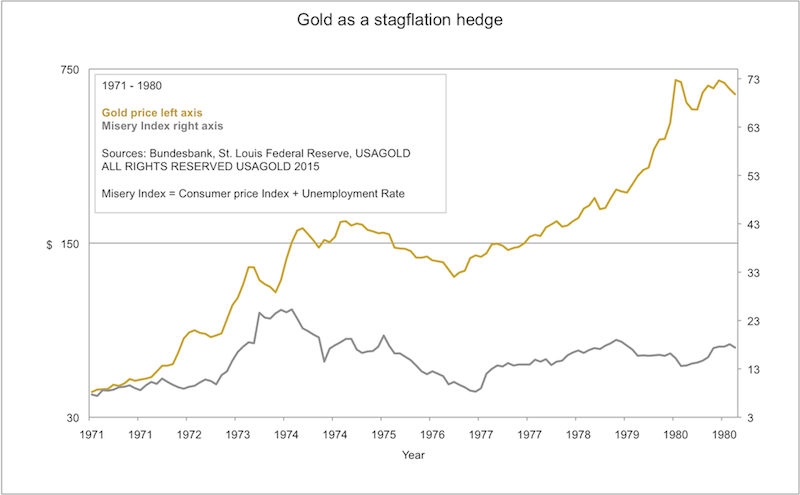

Chart 7 depicts gold's utility in the other malady that situates itself between inflation and deflation – stagflation. President Ronald Reagan famously added the unemployment and inflation rates together and called its sum the Misery Index. As the Misery Index moved higher throughout the decade so did the price of gold. At a glance, the chart establishes gold as an effective stagflation hedge to go along with its inflation, deflation and disinflation credentials. The Misery Index more than tripled in that ten-year period but gold, as the chart shows, rose by nearly 16 times.

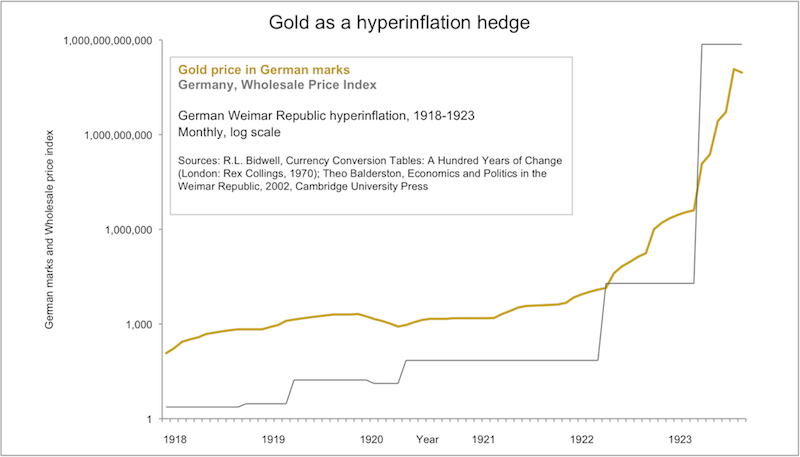

Chart 8 demonstrates the value of gold ownership during a hyperinflationary crisis. The numbers you see in the left axis are not a misprint. At the height of Germany's Weimar Republic hyperinflation, gold traded at 118.23 billion marks per ounce. In 1918, it traded at 87 marks per ounce. Wholesale prices went from 2.34 to 725.7 billion index points in the course of five years. At the height of the inflation, prices were doubling every two days – a nearly immeasurable inflation rate. An individual's life savings could not purchase a newspaper. As you can see by the chart, those who converted their marks into gold early in the process were able to hold on to their savings. Those who did not were left to the destructive forces unleashed by the hyperinflation.

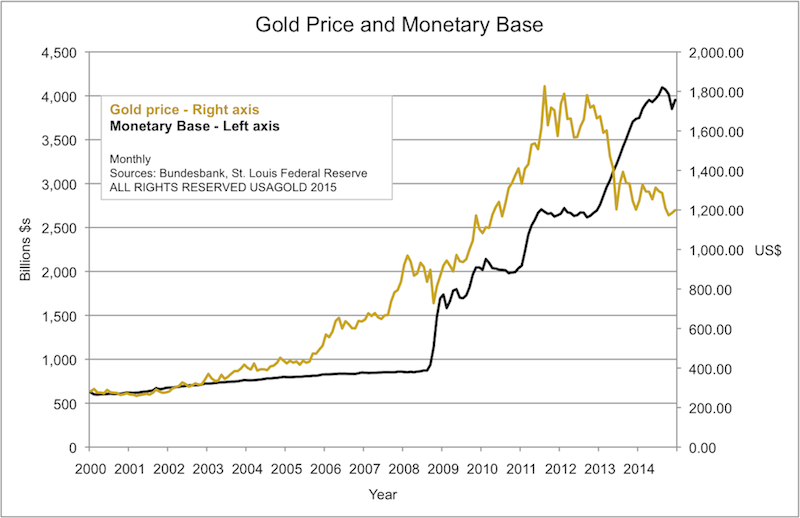

Chart 9 illustrates the relationship between growth in the monetary base (otherwise known as quantitative easing) and the gold price. Quantitative easing, as you probably already know, is the polite term for printing money, the process that ultimately and without warning unleashed the nightmare German hyperinflation described in the previous chart. The interesting feature in Chart 9 is the sudden and inexplicable divergence between the two data sets starting in 2013. This divergence, in our opinion, presents an attractive buying opportunity for the long time accumulator of gold, whether or not the money printing creates runaway inflation. Though some might see this chart as depicting a direct correlation between gold and quantitative easing, we see the two as reacting to the same stimulus, i.e., a bad economy. Central banks react by printing money. Investors react by buying gold. Though the Federal Reserve has curtailed its quantitative easing program for now, there is no indication it is off the table permanently.

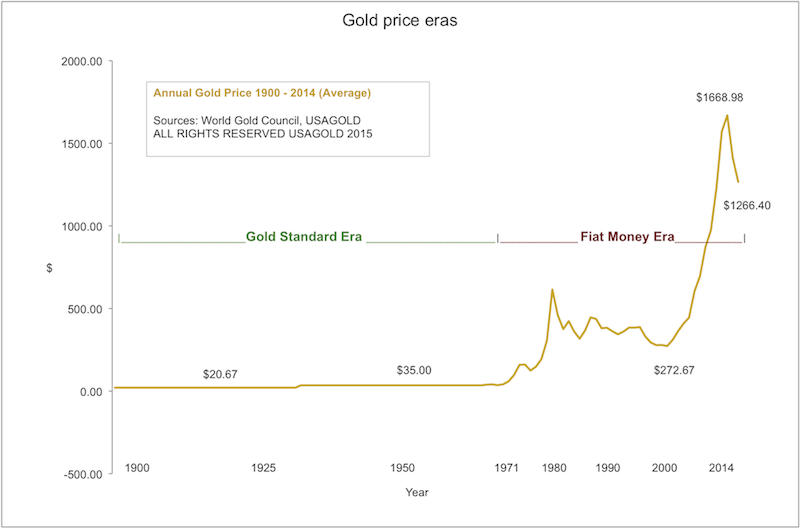

Chart 10 might be the most important of our grouping in that it helps the first-time gold investor understand what sort of an economy will govern investment portfolio choices for the foreseeable future. When the United States abandoned the gold standard in 1971 and freed currencies to float against one another, the era of central bank monetary experimentation began. We are still in that era. Predicting the course of the economy and the financial markets with any degree of reliability in a fiat money environment is problematic, if not impossible. It is this permanent aura of economic insecurity that has pushed gold demand since the 1970s and driven it to record heights since 2008. Former Fed chairman Alan Greenspan, who understands the nature of monetary experimentation better than most, recently said, "Gold is a good place to put money these days given its value as a currency outside of the policies conducted by governments." Until the monetary system is once again put on a stable footing, gold ownership will continue to be at the forefront of thinking for private and public investors alike – and on a global basis.

If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD’s Review & Outlook, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.