Gold Bides Time – Massive Complacency Regarding Ukraine, Greece and Debt Crisis

Commodities / Gold and Silver 2015 Feb 20, 2015 - 02:47 PM GMTBy: GoldCore

* Greek Bank Runs Accelerate as Possible ‘Grexit’ Looms

* Greek Bank Runs Accelerate as Possible ‘Grexit’ Looms

* Fatigue with Greek Crisis Breeding Massive Complacency

* Government in Kiev Forced to Take Diplomatic Approach

* Ukraine a Significant Setback for NATO

* Regional War in Eastern Europe Averted for the Moment

* Middle East, Israel and Iran Timebomb Ticking

* India Demand To Rise To 35 – 40 Tonnes This Month

* Gold Oversold – Fundamental and Technical Position Good

The Greek debt saga continues and financial tragedy seems increasingly likely as the deadlock between Greece and the Eurogroup continues today.

The two sides remain far apart during the Eurogroup meeting in Brussels. The 240 billion euro bank bailout expires at the end of this month and Greece could run out of money by the end of March without new external funds, driving it nearer to the euro zone exit.

There is already quite a lot of chatter about the possibility of another summit should today’s talks end in stalemate.

It has dragged along for so long now that a false sense of security has developed as the situation becomes the “new normal.”

This complacency is unwarranted. The situation will come to a head sooner rather than later.

There are new reports of bank runs in Greece coming into this Bank Holiday weekend. Officials in the Greek banking sector told Greek newspapers that as much as 25 billion euros have been withdrawn from Greek banks since the end of December with outflows surging this week ahead of a bank holiday.

Bank runs continue as Greek depositors rightfully fret regarding bail-ins or a return to the drachma. The prudent money is diversifying their savings so as not to be financially decimated.

Greece officially applied for a six month extension to its loan agreement, Eurogroup chair Jeroen Dijsselbloem said on Twitter of all places yesterday. U.S. Treasury Secretary Jacob J. Lew contacted Greek Finance Minister Yanis Varoufakis yesterday and warned him that failure to strike a compromise would bring further hardship on the country.

Either Greece will acquiesce to EU demands and eventually default anyway, or Greece will exit the Euro and unilaterally default causing unforeseeable consequences or Europe will cave-in which will embolden the anti odious debt factions across the European periphery.

Greece may even avail of a bail-out from the BRICS bank which would bring further geopolitical instability to Europe and further undermine the dollar system.

The final outcome of the Greek crisis is far from certain and there are no solutions presented so far which will not cause instability for the euro and the possible end of the ‘single’ currency.

Regional War in Eastern Europe Averted for the Moment

Meanwhile, the Franco-German peace initiative of Francois Hollande and Angela Merkel for Ukraine appears to be bearing fruit, though the process is still very fragile.

The landmark Minsk agreement saw France and Germany, Europe’s de facto leadership, negotiate a foreign policy independent of it’s heavy-weight NATO allies – the U.S. and Britain.

It was apparently catalysed by John Kerry’s suggestion that the U.S. would begin arming the Kiev government in its war on the separatist regions of Luhansk and Donetsk.

Such a move would have caused a reciprocal response from Russia, who insist that, to date, they have not armed the separatist groups. Foreign minister Lavrov has consistently asked Washington to back up their accusations to the contrary with evidence. No evidence has been presented.

Should Ukraine’s civil war escalate into a proxy war between Washington and Moscow it would destabilise Eastern and central Europe and possibly suck Europe uncontrollably into full scale conflict with Russia.

This is a frightening vista for all right thinking people. It would lead to a renewal of old rivalries and bitterness surfacing within former Eastern block nations and the Balkans.

The recent capture of Debaltseve is being touted as a dishonourable violation of the ceasefire agreement by Putin. It must be remembered that the separatists were not party to the Minsk agreement.

While they are consistently referred to as “pro-Russian” it is worth recalling that when they voted to secede from Ukraine they voted for independence, unlike the people of Crimea who voted to join Russia. They are predominantly ethnic Russians and wish to maintain close relations with Russia but this does not necessarily mean that Putin speaks for them.

As the Minsk talks began the separatists had already surrounded Debalseve and it’s capture was more or less a foregone conclusion. Debaltseve is an extremely important strategic target, a rail hub connecting the Luhansk and Donetsk regions. As such, from the separatist point of view it could not be left under Kiev’s control.

Now that it has been captured it is likely that the separatists will opt for a political solution.

The Kiev government is also likely to look for a political settlement. Ukraine is bankrupt. The IMF cannot fund a country who is at war. This is why Kiev consistently referred to the war as an anti-terror operation.

Referring to the conflict as a civil-war is a criminal offense in Ukraine and at least one journalist has received a harsh prison sentence for doing so.

The Kiev government and its war has grown incredibly unpopular. There has been huge resistance to the policy of conscripting young men to fight their former compatriots. There have been reports that the military is also growing impatient with the Poroshenko government.

The EU are eager to restore stability to the region and hope to cooperate with Ukraine in that objective. Russia shares this objective.

“We are already helping people in Donbass, first of all by sending humanitarian aid. I hold that Russia will not leave itself out and surely will help to restore this region.”

“However, this will be a common task shared between Russia and Ukraine and I hope that our European partners will also participate,” state Duma speaker Sergey Naryshkin has been quoted as saying.

“Members of the State Duma understand that the dialogue with our Ukrainian colleagues would be very difficult, but there is no alternative to it and we must do everything to thwart any attempts from across the ocean to obstruct this dialogue,” he added.

It is clear that Russia views events in Ukraine as a deliberate attempt by NATO to encircle and extend control right up to Russia’s borders. France and Germany may not view the crisis in the same light but seems likely they fear the possible outcome – instability in central and eastern Europe.

When the EU views the extremism and chaos that U.S. intervention has unleashed across the Middle East and North Africa – it likely gives pause for thought.

So, for the moment, we can hope that a wider war has been averted but tensions between Moscow and Washington are unlikely to abate, especially as Russia continues to extricate itself from the SWIFT payment dollar system.

Middle East, Israel and Iran Timebomb Ticking

Meanwhile, the ticking time bomb that is the Middle East continues to quietly tick. This is something we will look at in more detail next week.

The global geopolitical situation is as tense as it has ever been in living memory. This uncertainty is not supportive of the already fragile financial and monetary system.

A diversification into physical gold, the universal money at all times and in all places is strongly advised.

MARKET UPDATE

Today’s AM fix was USD 1,203.50, EUR 1,061.38 and GBP 782.51 per ounce.

Yesterday’s AM fix was USD 1,217.75, EUR 1,068.30 and GBP 788.60 per ounce.

Gold fell 0.31 percent or $3.80 and closed at $1,207.40 an ounce yesterday, while silver slipped 0.37 percent or $0.06 closing at $16.39 an ounce.

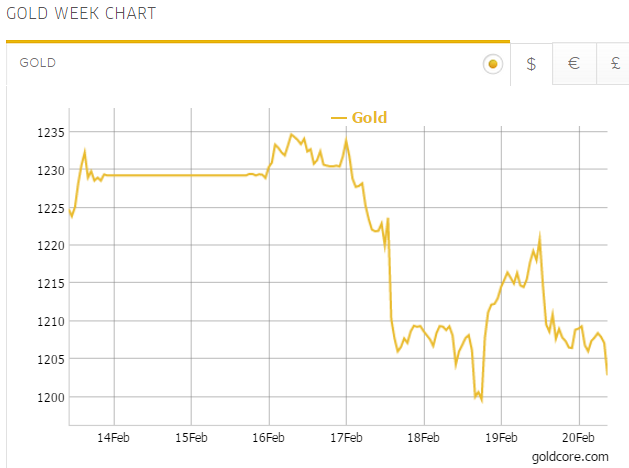

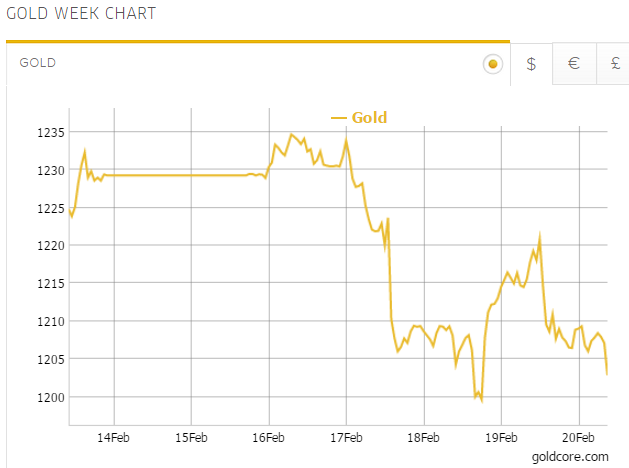

Gold in US Dollars – 5 Days (GoldCore)

Gold rose marginally this morning as the dollar strengthened and European shares climbed ahead of the eurozone meeting about Greece’s debt programme. Gold looks set for its fourth weekly fall and a fall of some 1.5 per cent in dollar terms.

Gold reached its lowest price in 6 weeks on Wednesday at $1,197.56. Comex U.S. gold futures for April delivery were up $3.50 an ounce to $1,209.20. In Singapore, gold was flat and remained above the $1,200/oz level.

Silver rose 0.2 percent to $16.40 an ounce, platinum dropped 0.8 percent to $1,158.77 an ounce, after touching a 5-1/2-year low at $1,151.50 earlier. Palladium fell 0.7 percent to $779.00 an ounce this morning.

Market liquidity is relatively thin as China, the world’s number 2 buyer, and several other Asian countries are closed for a week long Lunar New Year holiday.

India Demand To Rise To 35 – 40 Tonnes This Month

India’s gold imports are likely to rise to some 35 to 40 tonnes this February as compared to 26 tonnes in February last year, according to bullion refiner MMTC Pamp.

“The country has already imported 23.2 tonnes of gold in the first fortnight of this month. Total shipments at the end of the month could reach 35-40 tonnes,” a senior official at MMTC Pamp told the Indian News Agency, Press Trust of India.

Gold imports could see further accelerate during the wedding season, which begins in March, the official added.

In January, imports rose marginally to 36 tonnes from 31 tonnes in the same month of corresponding year.

Gold shipments have been steadily rising after the Reserve Bank in November 2014 scrapped the 80:20 rule, under which it was mandatory for traders to export 20 per cent of their imports.

The RBI has been easing import curbs on gold since November 2014 after their attempt to curb gold imports and demand failed due to a huge wave of gold smuggling.

Gold Oversold and Technical Position Good

The quite sharp sell off in the last four weeks means that gold appears oversold – including on a number of important technical criteria including the RSI and stochastic position.

In less than a month gold has fallen by more than $100 per ounce, since January 22nd, and given up much of the gains seen in January.

Gold in US Dollars – 1 Month (GoldCore)

Gold’s technical position remains quite positive with good support and physical demand at the $1,200/oz level – seen very briefly on the inter day dip on Wednesday of this week.

Independent technical analyst Cliff Green of the Cliff Green Consultancy, is worth listening to regarding the technicals of gold and silver.

He spoke to Jan Harvey in the Thomson Reuters Global Gold Forum yesterday about the chart picture for gold after the recent price slide.

Global_Gold_Forum Jan Harvey thomsonreuters.com: Welcome, Cliff!

Global_Gold_Forum Cliff Green cliff-green.com Thank you a pleasure to be here

Jan Harvey thomsonreuters.com We broke through the 100-day moving average at 1216 yesterday, to end the day down nearly 2 percent. How significant was the break of that level, and what are the new levels being targeted on the downside?

Cliff Green cliff-green.com The break down yesterday certainly did some damage and while a little support should be uncovered in and around the 1200.0/05.0 area beleive a retest of the 1170.0 egion is now possible.

Jan Harvey thomsonreuters.com Where does support come from around 1170?

Cliff Green cliff-green.com it was the corrective lows seenat the beginning of year prior to rallying imprssively to the 1308 area.

Jan Harvey thomsonreuters.com How strong do you expect support to prove there? If that gives way, how far could we fall?

Cliff Green cliff-green.com Think this should hold and if prices can regroup around there beleive this weakness could become a component of a broader bottoming process

Jan Harvey thomsonreuters.com I see. So you don’t think a return to last year’s low at 1131 is likely?

Cliff Green cliff-green.com However if it is decisively breached it opens up a retest of the 1133 region#

Cliff Green cliff-green.com Oscillators are beginning to look a little oversold and this should add some potency to supports around 1170

Jan Harvey thomsonreuters.com If support *does* hold there, how far would that support the view that the pull-back that began a few years ago has bottomed at 1131?

Cliff Green cliff-green.com It would add to that evidence. I think the bulls would take great encouragement from it.

Jan Harvey thomsonreuters.com If we do manage to rebound, what level would you want to see attained before calling a recovery in prices?

Cliff Green cliff-green.com Key nearby resistance waits in the 1240.0/45.0 area and a market close back above here would relieve the current downward pressure and trigger acceleration towards 1280 again

Cliff Green cliff-green.com Until/unless achieved immediate rebounds are likely to be restricted to corrective bounces only for the time being

Jan Harvey thomsonreuters.com What’s your view on silver after yesterday’s 4.1% fall? Would you say the picture is yet bearish, and if so, what levels are we targeting?

Cliff Green cliff-green.com No I would not clssify silver as bearish. I think yesterday’s falls were yet a further component of a broad consolidation pattern that started back in October of last year

Cliff Green cliff-green.com Good support should be uncovered starting at 16.20 then again around 15.50.

Cliff Green cliff-green.com Increasing evidence suggests this could be a basing development.

Jan Harvey thomsonreuters.com Thanks, Cliff! And thank you very much for joining us today

Cliff Green cliff-green.com Thanks Jan

Conclusion

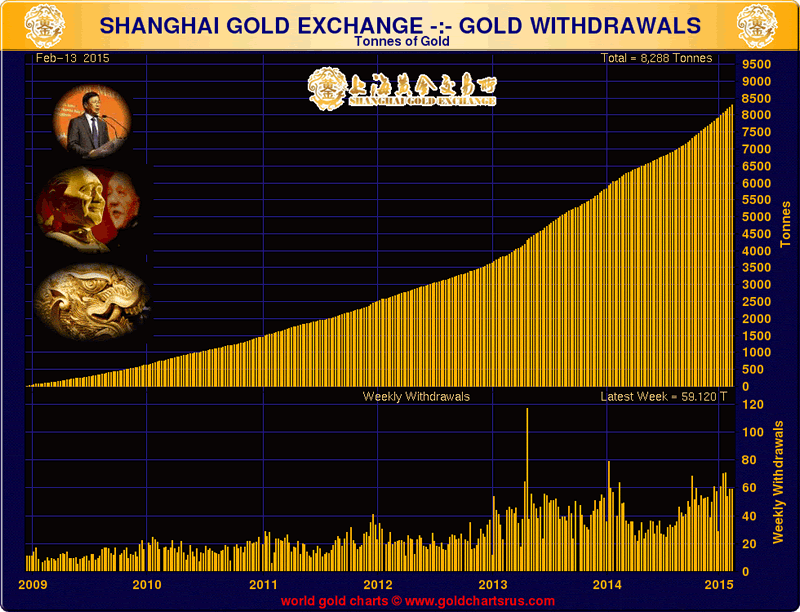

The quite sharp sell off in recent weeks of over $100 means that gold appears oversold. China will return after its New Year festivities next Wednesday and demand is expected to be remain robust. SGE weekly withdrawals were 59.12 tonnes for the week ending Feb 13th.

This allied with the increasing Indian demand makes for strong support under the market and bolsters the technical position.

Gold looks oversold and looks well supported at $1,200 per ounce given the continuing Greek debt saga, risk of ‘Grexit’

and geopolitical risk in Eastern Europe and the Middle East.

While most analysts believe that Grexit will not happen in the coming days, we believe that it is wrong to completely discount this possibility and we believe that Grexit looks inevitable now – the question is when rather than if.

Another supporting factor is the deteriorating situation in Ukraine and relations between the U.S., NATO and Russia.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.