Are Gold Miners Leading Gold Price?

Commodities / Gold and Silver 2015 Feb 28, 2015 - 12:47 PM GMTBy: Jordan_Roy_Byrne

The miners will typically lead Gold at major turning points. We say typically because the trend in the relationship is hardly exact or precise. There can be times when the miners are simply showing their beta (not leading) and there can be times when the miners are leading but their leadership suddenly halts or reverses. The miners peaked five months before Gold and are now one month from the 4-year anniversary of their market. The time seems ripe for the miners to lead Gold into the next bull market.

The miners will typically lead Gold at major turning points. We say typically because the trend in the relationship is hardly exact or precise. There can be times when the miners are simply showing their beta (not leading) and there can be times when the miners are leading but their leadership suddenly halts or reverses. The miners peaked five months before Gold and are now one month from the 4-year anniversary of their market. The time seems ripe for the miners to lead Gold into the next bull market.

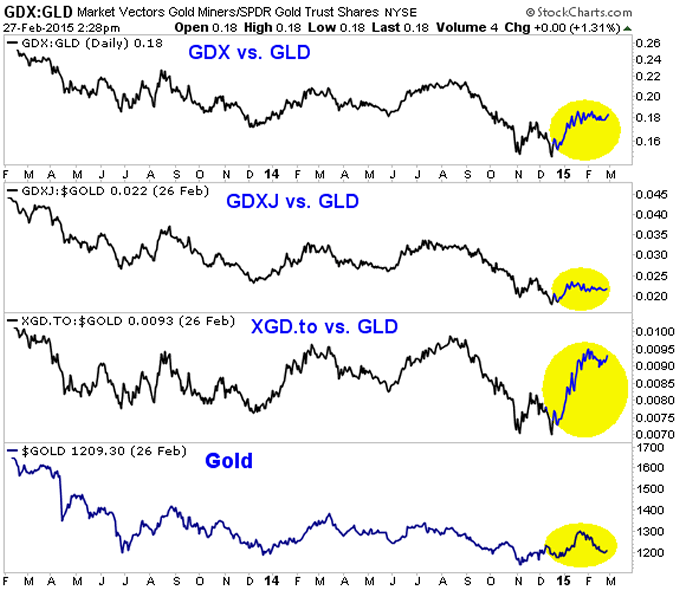

In the chart below we plot GDX/GLD, GDXJ/GLD, XGD.to/GLD and Gold. With the exception of GDXJ/GLD, these ratios climbed strongly. Of more important is that the ratios have held near their recent highs while Gold corrected nearly its entire advance in January. Gold lost roughly $100/oz and is threatening the $1100s again yet the miners have maintained most of their gains.

GDX:GLD Market Vectors Gold Miners/SPDR Gold Trust Shares NYSE

The relationship between the miners and Gold threw us a major head fake last summer. The miners were trading near 12-month highs relative to Gold and on the cusp of a major breakout. That potential head and shoulders breakout for GDX and GDXJ completely failed. Gold's relative weakness proved to be a bad omen for the miners.

Why might things be different this time around?

The miners are far more oversold now compared to then. At present the miners are just about four years into a bear market that is undoubtedly the second worst of the past 70 years. Last August the miners were eight months into a rally. If the bear had ended in December 2013 then it would have only been slightly more than two and a half years old (versus four years now).

Two other things bode well for continued leadership from the miners. First, the collapse in Oil is a huge boon for mining companies. Energy can account for 25% or even as high as 30% of a miner's costs. Second, foreign currency weakness is positive for some companies. This has to be examined on a case by case basis. If the Gold price in US$ is stable but foreign currencies such as the loonie lose value then it is another benefit to the mining company (that pays its workers in loonies).

The fact that the bear market in miners began five months before the bear in Gold and is nearly four years old gives us reason to anticipate leadership from the miners in 2015. Macro developments in the energy and currency markets have catalyzed a better fundamental environment for miners and their potential to outperform Gold. In the scenario that Gold makes a new low, GDX would have to decline 22% to test its daily low. Because of the stronger fundamentals for miners and the extreme long-term oversold condition, I don't think miners would make a new low. That means the next leg higher could take miners into a new bull market.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.