BLS CPI Lie - How's That Dsflation Working Out for You?

Economics / Inflation Mar 03, 2015 - 10:14 AM GMTBy: James_Quinn

The BLS put out their monthly CPI lie last week. They issued the proclamation that inflation is dead. Did you know your costs are 0.1% lower than they were one year ago. They then used these deflation numbers to proclaim your real wages soared last month. It’s all good. The American consumer is so flush with cash, they decided to spend less money for the second month in a row. The Wall Street shysters are so happy with declining consumer spending, declining corporate profits, and a global recession, they pushed the NASDAQ up to 5,000 for the first time in 15 years. Hey!!! That was the year 2000. Things really got better after that milestone.

The BLS put out their monthly CPI lie last week. They issued the proclamation that inflation is dead. Did you know your costs are 0.1% lower than they were one year ago. They then used these deflation numbers to proclaim your real wages soared last month. It’s all good. The American consumer is so flush with cash, they decided to spend less money for the second month in a row. The Wall Street shysters are so happy with declining consumer spending, declining corporate profits, and a global recession, they pushed the NASDAQ up to 5,000 for the first time in 15 years. Hey!!! That was the year 2000. Things really got better after that milestone.

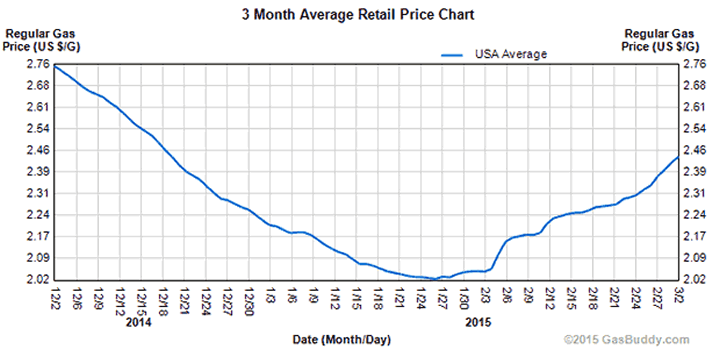

So we know gasoline prices have plummeted in the last year (but are up 20% in the last month), but I’m trying to think of other things I use in my everyday life that have declined in price. Maybe going through the BLS detailed list will jog my memory. Here is the link to their data: http://www.bls.gov/cpi/cpid1501.pdf

Let’s see how much deflation we’ve experienced in the last year for things we need to live our everyday lives.

Beef and veal +22.5%

Ground beef +21.0%

Steaks +14.9%

Pork +7.4%

Ham +11.5%

Whole Chicken +6.1%

Fresh Fish +3.5%

Eggs +8.2%

Cheese +7.8%

Fresh Vegetables +4.3%

Lettuce +12.2%

Tomatoes +9.6%

Coffee +6.7%

Butter +19.5%

Restaurant food +3.1%

Housing +2.9%

Hotels +7.6%

Owners Equivalent Rent +2.6%

Homeowners Insurance +5.6%

Electricity +2.5%

Water & Sewer +5.5%

Home Repairs +4.4%

Footwear +2.6%

Car Insurance +5.0%

Parking Fees & Tolls +2.3%

Medicinal Drugs +4.2%

Prescription Drugs +5.6%

Hospital Services +4.3%

Veterinarian Services +3.2%

Sporting Events +3.6%

Newspapers & Magazines +4.6%

College Tuition +3.6%

Educational Books & Supplies +6.5%

Grade School & High School Tuition +4.0%

Childcare & Nursery School +3.0%

Postage +3.6%

Cigarettes +2.5%

Financial Services +5.7%

Tax Return Prep +9.3%

These figures are directly from the BLS website. These are the annual price increases of things most Americans need to purchase on a regular basis. I know most of them affect me every day. My weekly grocery bill is much higher than it was one year ago, and we don’t buy nearly as much steak or beef as we did last year.

The price of oil and gas has certainly declined by the 30% or so in the BLS figures, but it doesn’t come close to covering the price increase in food and other living expenses. The BLS declares we are experiencing deflation and our wages are expanding in real terms. It’s a bold faced lie. The other items declining in price are mostly discretionary items which might be purchased every few years. Furniture, appliances, computers and TVs are falling in price. I didn’t buy any of those items in the last year, so the lower prices had ZERO impact on me.

Apparel falls in price, but is made so cheaply in Chinese slave labor camps, you only get half the use out of it before you have to replace it. I’m guessing the BLS hasn’t factored that into their little calculation.

And now for the BIGGEST LIE in the entire report. The have the balls to tell you that health insurance only makes up 0.753% of your entire annual budget and it has FALLEN by 0.5% in the last year. This must be some cruel Obamacare joke perpetrated by these government apparatchiks. I haven’t met anyone who has seen their health insurance costs go down in the last year. My premiums went up by 20% and my annual family deductible went from $0 to $2,000. How the BLS can get away with issuing this drivel is beyond my comprehension. It’s pure and utter bullshit.

I wonder if the sheep actually believe what the government peddles. Does anyone with two brain cells think their daily living expenses are declining? Do they really think their wages are going a lot farther? Evidently not, because they have stopped spending money.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.