How to Play the Big Broker Stocks When Interest Rates Rise

Companies / Sector Analysis Mar 05, 2015 - 02:31 PM GMTBy: Money_Morning

Tom Gentile writes: You don't have to be a bond trader or follow every self-appointed TV expert to keep a studied eye on interest rates. In fact it can be done much more easily by watching a bellwether ETF.

Tom Gentile writes: You don't have to be a bond trader or follow every self-appointed TV expert to keep a studied eye on interest rates. In fact it can be done much more easily by watching a bellwether ETF.

And it's a good time to pay attention. Just recently, the Federal Reserve changed the tone of its stance on rates, indicating that we could see little change into this summer or fall before it dials the rate needle upward.

How I "Watch" Rates Through ETFs

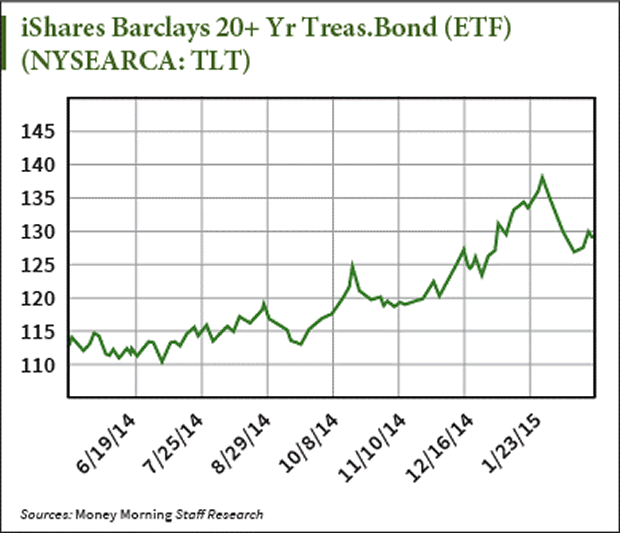

I regularly watch the iShares Barclays 20+ Year Treasury Bond ETF (NYSE Arca: TLT). This largely mimics the Treasury bond market.

This ETF acts much as a Treasury bond would, in that as interest rates fall or are expected to fall, the price of TLT will rise. If interest rates rise or the market expects monetary policy to tighten, the price of TLT will fall.

Interest rates at historic lows and an expanding economy make me believe that the bullish days for TLT will soon be behind us.

Anyone that has been in this business for very long knows the market always precedes moves in the economy, often by months.

That means if the Fed starts to tighten monetary policy in September, the impact on the bond market could start as early as this spring. If that's the case, we want to be ready with our finger on the trigger of opportunity.

The first thing the "shoot from the hip" trader would do is start selling bonds, or the TLT ETF above. If you believe the price of a particular asset is going to fall in the future you close out your long trades and/or short sell the asset. Short selling involves borrowing the asset from your broker and selling it to open a position with the intention of buying it back more cheaply if the asset's price drops.

This all makes sense, but I want you to start asking this question, "WWTD," my acronym for "What Would Tom Do?"

Find an "Inverse Correlation" to Buy

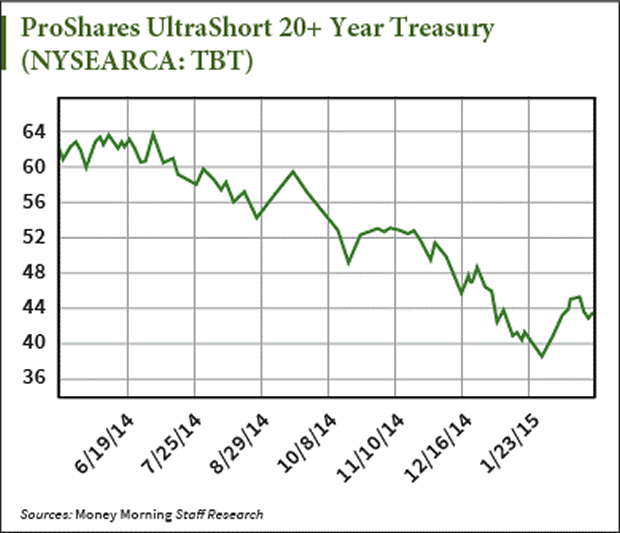

An easier approach is to invest in an instrument that is negatively correlated with TLT. One such family of products are the "Ultra Short" instruments from ProShares. A great choice is the ProShares UltraShort 20+ Year Treasury (NYSE Arca: TBT). Just to satisfy our curiosity, the chart at right is TBT using the same time frame as the TLT chart earlier in this article. TBT moves inversely with TLT, meaning that as TLT drops, TBT typically rises (depending on the correlation of the ETF's individual holdings)

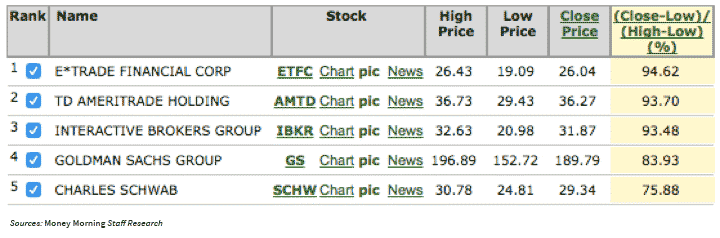

But a potentially more lucrative way to play an interest rate hike is through its effect on brokerage firms. Yes, the ones you and I use every day. When interest rates go up, who in the financial community benefits the most? Brokers, who make money on accounts where they get the interest, the interest float, and short interest. All this money adds to their bottom lines. Of the 30+ publically traded brokerage firms across various exchanges, here are the top five on my list:

- E*Trade Financial Corp. (Nasdaq: ETFC)

- Charles Schwab Corp. (NYSE: SCHW)

- Interactive Brokers Group Inc. (Nasdaq: IBKR)

- TD Ameritrade Holding Corp. (NYSE: AMTD)

- Goldman Sachs Group Inc. (NYSE: GS)

These five companies stand to benefit the most in their sector if interest rates rise. But which one makes the top of the list? I ran several scans to find out.

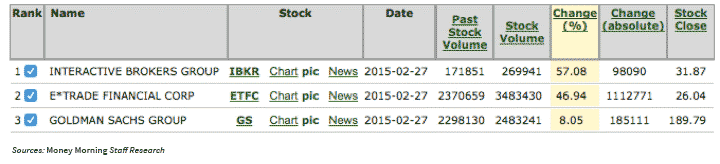

The first scan I ran was a liquidity scan, to see if any of these stocks have had positive volume change recently. Of the 5, these 3 saw volume increase in the past few weeks. Positive volume in a rising market is actually good for a stock.

Then I ranked the companies by their stock price compared to their 52-week highs. Three of the five stocks were trading in the top 10% of their yearly trading range. Another good sign….

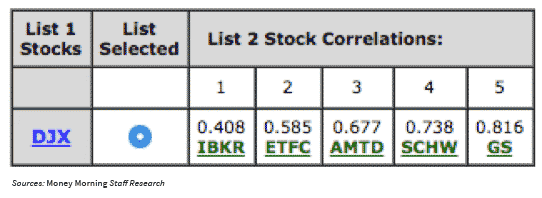

Finally, I did an inverse correlation rank. I wanted to see which stocks moved against the markets. This is how they scored when compared to the Dow Jones Industrial Index. Interactive Brokers was clearly the "inverse" leader, at .408. This rank basically means that Interactive Brokers only moves with the Dow Jones roughly 40% of the time. Pretty inversely correlated if I say so, indeed.

So who's the winner of the stakes for the best brokerage firm to buy as rates rise?

Use Options to Maximize Profits and Mitigate Risk

I like Interactive Brokers (Nasdaq: IBKR) stock. It clearly ranks better than the rest, and looks like a great long-term buy for a rising rates environment.

Right now, 100 shares of Interactive Brokers will cost about $3,200 plus commissions. Another alternative would be a September call option, granting you the right to buy Interactive Brokers at a price of $32. This call option is trading right now at a price of $2.25, which is significantly less than buying the stock for $32 a share.

If the stock were to rise to $40 by September, you would make $8 on each share, representing a 25% ROI. However, with that exact same move in the Interactive Brokers the call option would be worth a minimum of $8, and the fact that you paid only $2.25 for it gives you a better than 300% ROI.

Okay, so you might ask what if rates don't rise, and Interactive Brokers fell $8 instead of moving higher? The stock trader would see a loss of $8 a share, while the most the option trader would lose on this position is the cost of the option ($2.25), a far cry from the cost of buying the stock and having it move against us.

Either way, for those of you who are short bonds and long brokers, here's to higher rates!

Source :http://moneymorning.com/2015/03/05/how-to-play-the-big-brokers-when-rates-rise/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.