Gold and Silver Justice For Some - Currency Wars - ECB Deposit Rates To -3%

Commodities /

Gold and Silver 2015

Mar 05, 2015 - 04:53 PM GMT

By: Jesse

Eurozone on road to deflation, and bonds remain [an] attractive asset because high demand meets scarce supply

ECB will reduce interest for cash deposits to minus 3% and the dollar [will] appreciate by 20%, reaching parity with euro in 2015.

This evening

Zerohedge reports that there is speculation that the ECB will cut interest rates paid to MINUS THREE PERCENT, and that the intention is to bring the dollar 20% higher to dollar parity. That should do wonders for The Recovery.

™

Currency wars. And your meager savings and wages will be the cannon fodder.

This is not official, but it makes a great headline and a vector of things to come. Maybe JPM is trying to make us feel better about their plans for charging us a single percent to hold our cash, ex fees. Or maybe they are just snorting the ketamine of their own moral hazard, and riding the buzz into a k-hole.

An interest rate on savings deposits of negative three percent is a euphemism for the confiscation of the middle class' remaining funds. The one percent are parked in subsidized rentier assets and tax havens.

These jokers are jumping up and down on a land mine, just to see what happens.

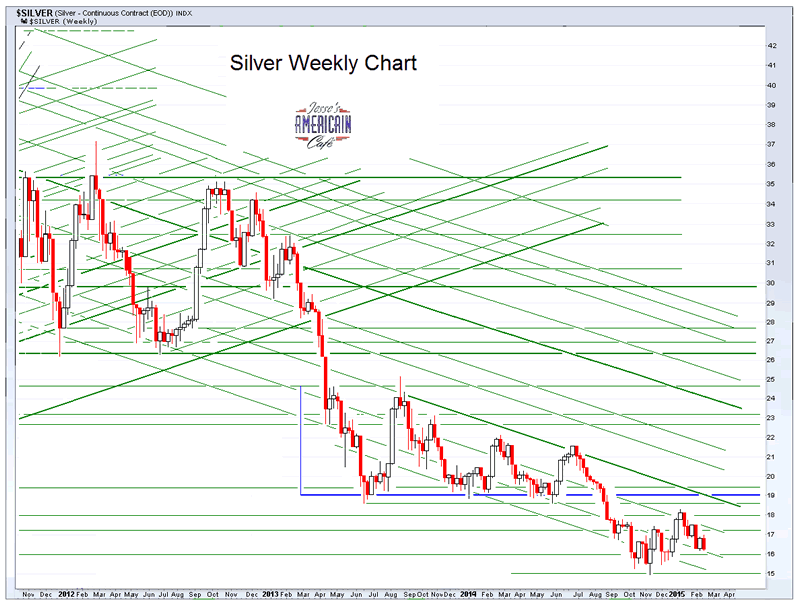

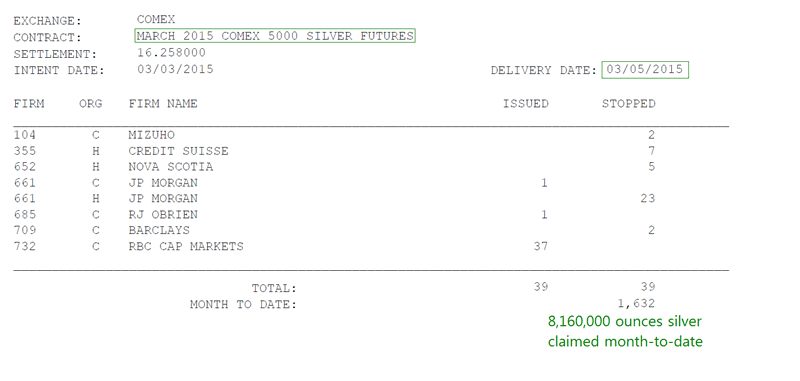

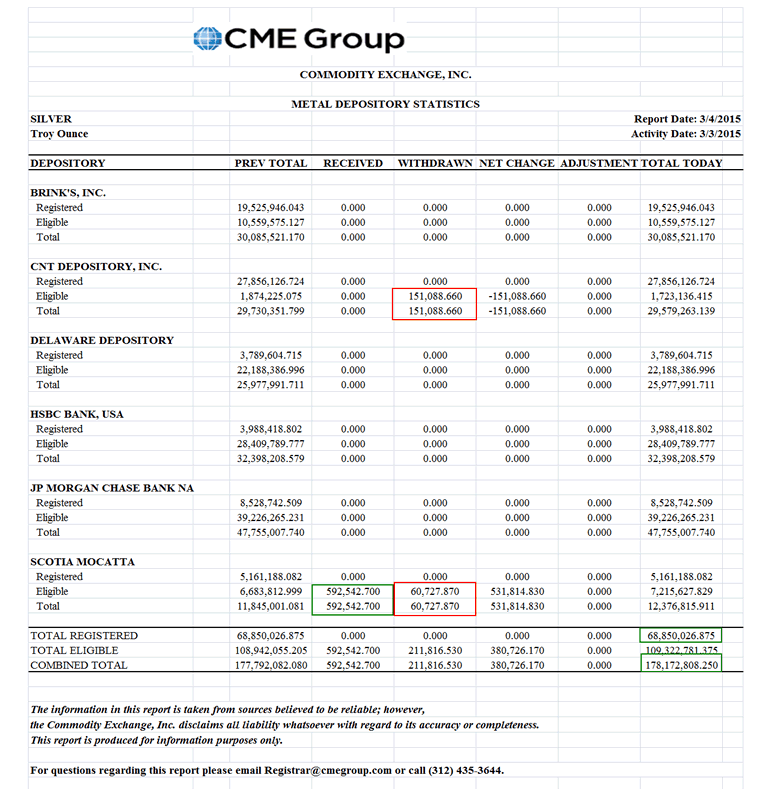

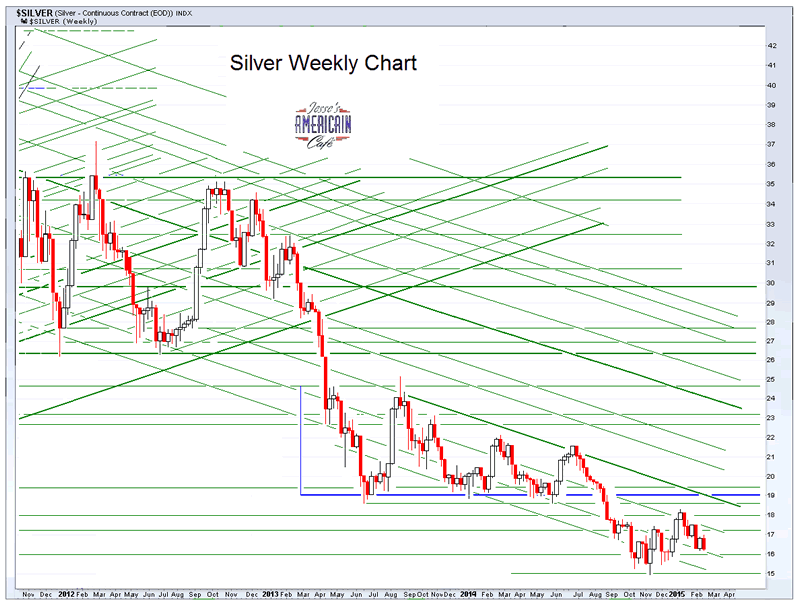

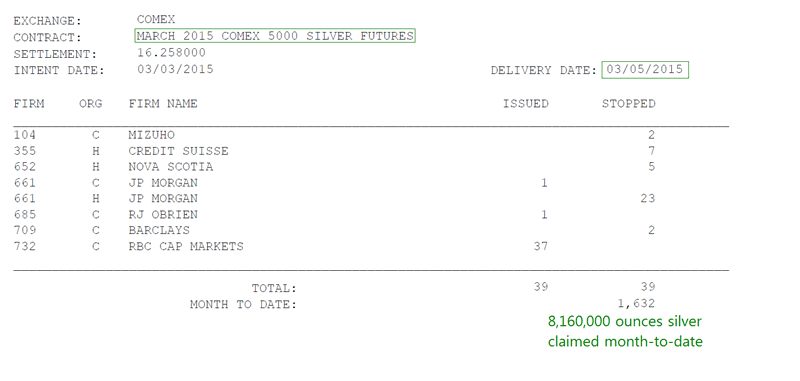

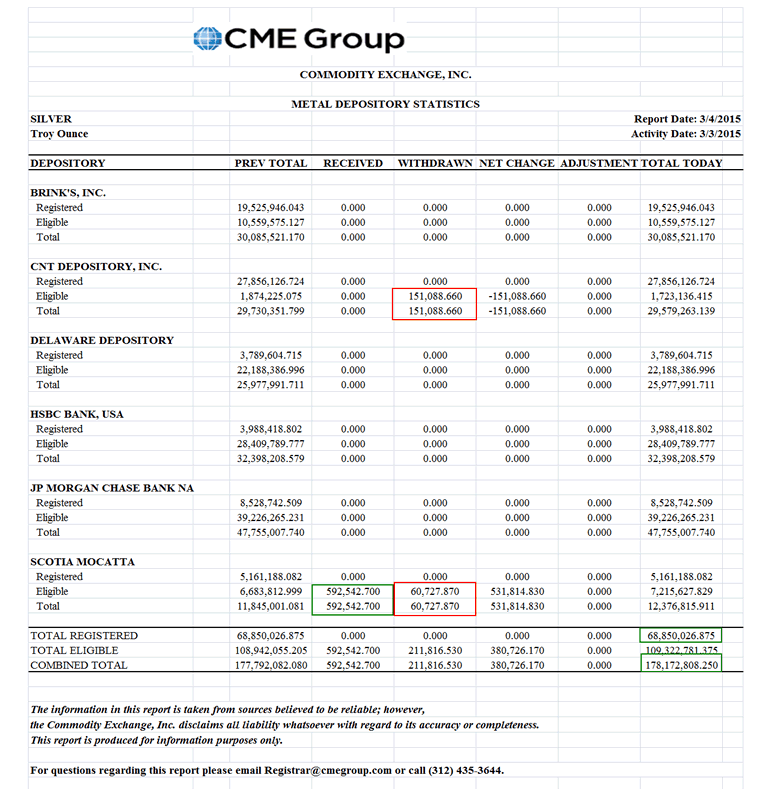

Silver continues to be the more interesting story for now in March, with the delivery notices continuing, although the warehouse inventories are more than adequate.

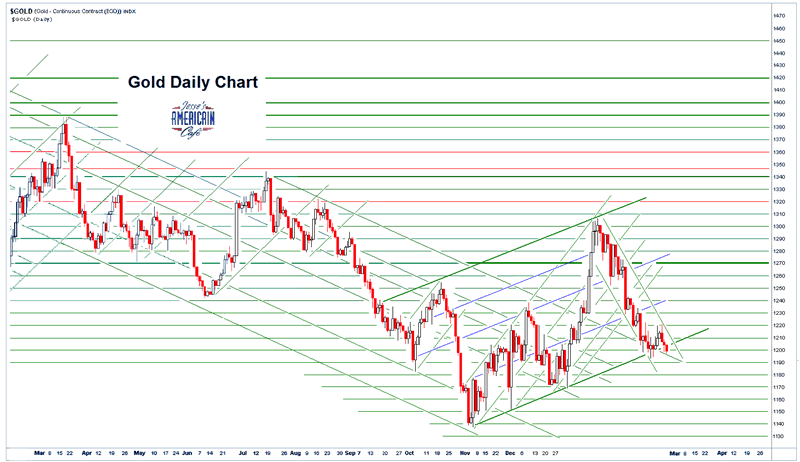

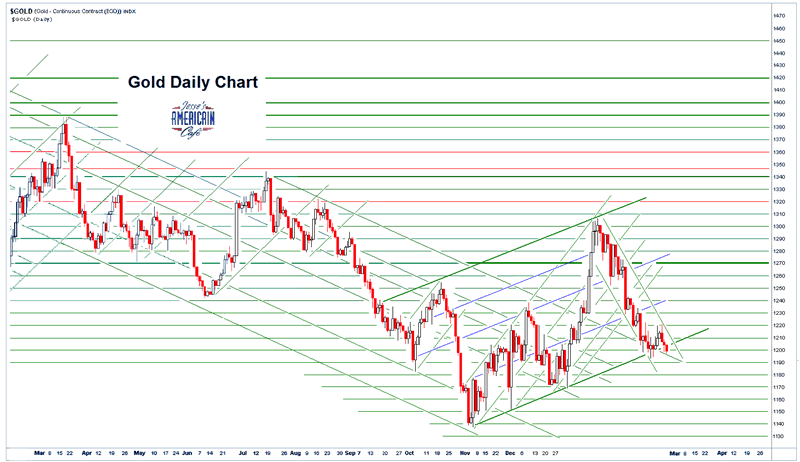

Gold is inactive this month, at least in the Comex bucket shop precincts. Asia is another story.

How interesting were the markets today? I apparently have some Greek heritage on my paternal great grandmother's side, via Italy. Bohemia and Austria, with Prussia on the maternal side, I knew about, but not the Greek. Yo, Demetrios.

That was how interesting the markets were today. I spent the afternoon perusing the old census records and family papers.

This market is t - h - i - n, and heavily gamed by the bots.

The Department of Justice report on law enforcement in Ferguson, Missouri was released today, and it was interesting. The report shows that Ferguson systematically used its law enforcement responsibilities to turn a minority, African Americans, into an ongoing revenue stream.

When you read this damning report, keep in mind that this abusive use of the law may be where the financial system is heading in its relationship with the ninety nine percent, with rents, fees, penalties, usurious loans and student debts, rigged markets, and of course, an unequal system of justice for some.

Non-farm payrolls on Friday. This is an inactive month for gold.

I am continuing to watch the Sprott Silver fund to see what they do about their cash situation for expenses. They have several options. I do not know all of them, or which one they may pursue.

And almost no one is talking about it. Or the corrosive role of the Banks.

In 1999, on signing Gramm-Leach-Bliley into law, Clinton said, “This is a day we can celebrate as an American day” and that ” the Glass-Steagall law is no longer appropriate for the economy in which we live” and “today what we are doing is modernizing the financial services industry, tearing down these antiquated laws and granting banks significant new authority” and “This is a very good day for the United States.”

Columbia Journalism Review, Bill Clinton on Deregulation

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2015 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Via Bloomberg, citing Handelsblatt:

Via Bloomberg, citing Handelsblatt: