Inflation One Year Ahead - A Look at the Inflation and the Consumer Price Index

Economics / Inflation Jun 06, 2008 - 12:54 PM GMTBy: Joseph_Brusuelas

The recent rise in inflation has not yet been properly captured by the variety of inflation indexes used by the market to assess the pricing environment. The publication of the April Consumer Price Index elicited howls of derision from the market due to the very dubious -2.0% decline in the price of gasoline suggested by the report. At the time, our reaction was that it did not pass the “laugh test” and that once the seasonal adjustments made by the Bureau of Labor Statistics are “adjusted” we are quite confident that the actual increase in headline prices will be accurately accounted for and the increase in core prices that most individuals have observed will also work their way into the data.

The recent rise in inflation has not yet been properly captured by the variety of inflation indexes used by the market to assess the pricing environment. The publication of the April Consumer Price Index elicited howls of derision from the market due to the very dubious -2.0% decline in the price of gasoline suggested by the report. At the time, our reaction was that it did not pass the “laugh test” and that once the seasonal adjustments made by the Bureau of Labor Statistics are “adjusted” we are quite confident that the actual increase in headline prices will be accurately accounted for and the increase in core prices that most individuals have observed will also work their way into the data.

All of this has not been lost on the Federal Reserve, which has over the past number of weeks has moved to begin rhetorically addressing the upside risks to inflation and was one of the paramount concerns that drove Fed Chair Ben Bernanke to verbally intervene in the currency markets on June 3. The hawkish contingent at the Fed led by Dallas Fed President Richard Fisher and Richmond Fed President Jeffrey Lacker have been quite forthright in their criticism of the accommodative policy out of the Fed, with Mr. Lacker making an unusually strong critique of the unorthodox temporary auction facility put forward by Mr. Bernanke. Moreover, Mr. Lacker's pointed jab at the Fed for moving out of the monetary realm into the fiscal realm occupied by the US Congress, provides a real glimpse into not only the moral hazards created by the bailout of Bear Stearns, but the real dangers created by the very accommodative policy that has characterized Fed policy for much of the past several years.

The most obvious result of the Fed monetary policy has been the recent run up in headline inflation. Our forecast for the upcoming core inflation aggregates imply that the consumer price index and the Fed's preferred inflation gauge, the personal consumer expenditure deflator, will continue to trend towards the upside and reside in terrain above the implied target range of the central bank.

| 2008 May Inflation Forecast | |||

| Core Indexes-YoY | May-08 | April-08 | March-08 |

| Consumer Price Index | 2.299 | 2.4 | 2.3 |

| PCE Deflator | 2.143 | 2.1 | 2.1 |

| Producer Price Index | 2.814 | 3 | 2.7 |

| Import Prices | 14.936 | 15.4 | 14.9 |

Our focus on core inflation, does not suggest in any way that we discount the very real and significant increase in headline inflation. However, in our estimation to make a precise assessment of how the central bank is likely to respond over the next several months to a rapidly changing price environment, it is necessary to continue to focus on core pricing.

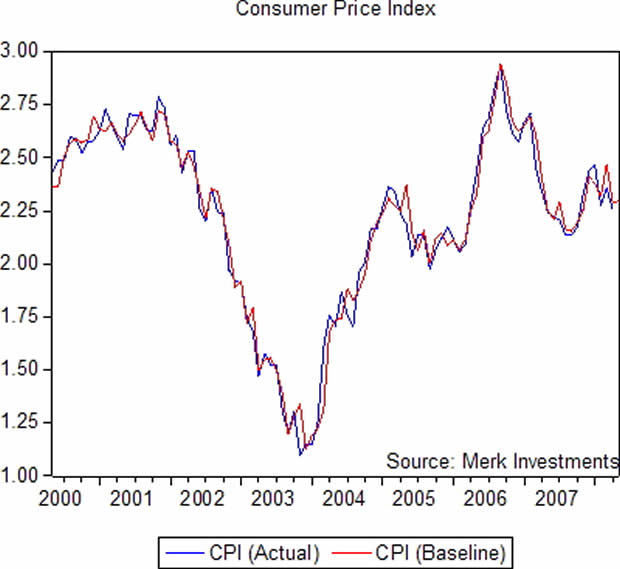

Consumer Price Index

The major driver of inflation has been the rise of food and energy. In April food rose 5.1% year over year and gasoline in estimation increase 6.0% for the month. Our point forecast for the month suggests that the index will not see any significant move higher in the May reading, but retain our bias towards the upside and expect that over time those higher headline costs will ultimately bleed through to the core. Our baseline forecast implies a core month over month reading of 2.3% and we expect that to begin climbing over the next several months. The major countervailing factor to higher prices resulting in advancing core prices is has been the falling rate of the owners' equivalent rent, which measures the change in the implicit rent, or the amount a

homeowner would pay to rent, or would earn from renting, his or her home in a competitive market. In April this stood at a 2.6% year over year increase, which is down from a 3.9% reading one year earlier. To the extent that this measure continues to ease, the overall consumer price index will continue to provide a much more benign portrait of the pricing environment that the individual truly faces. Yet, once the imputed rents that the BLS calculates begins to stabilize, the increase in headline costs and the follow on increase in core prices that are working their way through the pipeline will begin to push the data in a much more vivid fashion.

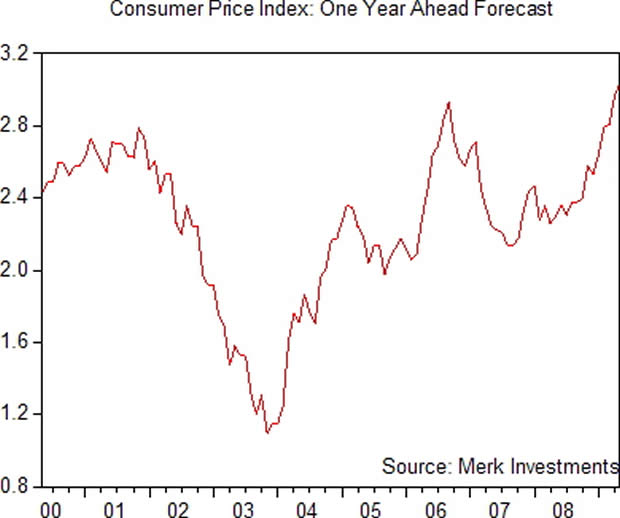

One Year Ahead Forecast

Looking forward, our dynamic one year ahead inflation forecast supports our overall view regarding the efficacy of the collection of data by the BLS, the lag time before the rise in headline prices impact the core and the necessity that the Fed continue to manage expectations with hawkish rhetoric that they may not actually back up in practice.

A look at the CPI one year out suggests that the recent surge in commodity and energy prices will result in a strong move to the upside with inflation reaching 3.038% should a non-sufficient amount of slack in the economy develop to offset the current trajectory in pricing. For the Fed this would represent a deviation in core pricing that would move consumer expectations which are currently in the process of moving towards what we think will be a long term change into the 3-5% territory. The central bank is assuming that in an increase in resource utilization (unemployment) will provide relief to the current upward move in inflation. Should the central bank have to address a further deterioration in the credit markets or move back towards accommodating a bailout of the financial system those expectations could move much higher and would represent a policy defeat for the Fed.

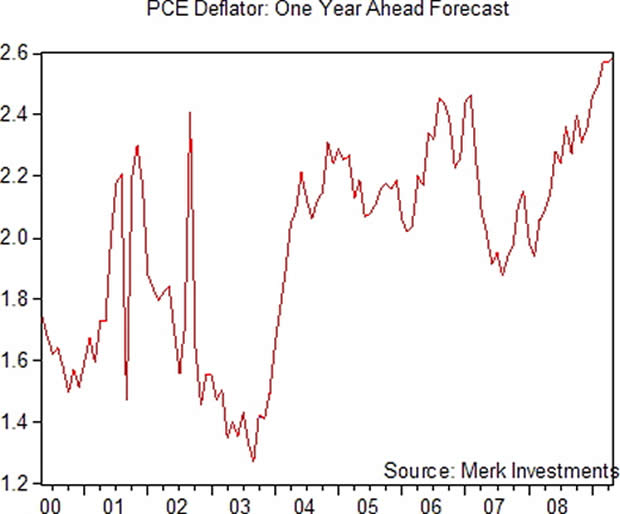

Personal Consumption Expenditure Deflator

Our look at the personal consumption expenditure deflator provides a similar reading. We anticipate that the PCE inflation reading will move well beyond the 1-2% implied inflation target that is the bedrock of market inflation expectations to 2.585% by this time next year. This will be the acid test for the Fed and their fight to prevent headline costs from seeping through to the core. Inside the PCE, the owner's equivalent rent series has a weight of roughly half the 23.9% that it has inside the CPI. The lack of a major offsetting property inside the construction of the PCE should give a much more accurate view of how firms are coping with the higher cost of production and the willingness or ability of the corporate sector to tolerate a further deterioration in profit margins. In our estimation corporate America has already begun to blink and the announcement in recent days of DuPont, Kodak and a variety of domestic airlines passing through advancing costs to the consumers is a harbinger of things to come.

Inflation Expectations

For our money, we think that the recent increase in inflation expectations among the public will prove durable. With the Conference Board's estimate of one year ahead expectations providing a painful 7.7% reading and the latest University of Michigan's one year ahead estimate suggesting 5.2% rate of inflation and the five year ahead implying a 3.4% reading of headline inflation. These public expectations have raced out ahead of the market which is pricing in a 3.08 reading at a one year interval and a 2.35 expectation over the next five years.

At our publication deadline European Central Bank President Jean-Claude Trichet provided a very hawkish set of remarks that strongly suggested the ECB may raise rates in July. This suggests that the balance or risks on a global basis have moved in the direction of inflation. The dichotomy between the Fed and the ECB could not be clearer. The ECB's fight against inflation will be based on action, whereas the Fed will have to rely on rhetoric given the weak state of the economy and the still unfolding problems in the US credit markets. In our estimation US market expectation of headline inflation is behind the curve of that of the public and given our dynamic forecast of core inflation one year out roughly matches the headline expectation of the market suggests that the mispricing of yields poses a risk for both the Fed and the dollar.

By Joseph Brusuelas

Chief Economist, VP Global Strategy of the Merk Hard Currency Fund

Bridging academic rigor and communications, Joe Brusuelas provides the Merk team with significant experience in advanced research and analysis of macro-economic factors, as well as in identifying how economic trends impact investors. As Chief Economist and Global Strategist, he is responsible for heading Merk research and analysis and communicating the Merk Perspective to the markets.

Mr. Brusuelas holds an M.A and a B.A. in Political Science from San Diego State and is a PhD candidate at the University of Southern California, Los Angeles.

Before joining Merk, Mr. Brusuelas was the chief US Economist at IDEAglobal in New York. Before that he spent 8 years in academia as a researcher and lecturer covering themes spanning macro- and microeconomics, money, banking and financial markets. In addition, he has worked at Citibank/Salomon Smith Barney, First Fidelity Bank and Great Western Investment Management.

© 2008 Merk Investments® LLC

The Merk Hard Currency Fund is managed by Merk Investments, an investment advisory firm that invests with discipline and long-term focus while adapting to changing environments. Axel Merk, president of Merk Investments, makes all investment decisions for the Merk Hard Currency Fund. Mr. Merk founded Merk Investments AG in Switzerland in 1994; in 2001, he relocated the business to the US where all investment advisory activities are conducted by Merk Investments LLC, a SEC-registered investment adviser.

Merk Investments has since pursued a macro-economic approach to investing, with substantial gold and hard currency exposure.

Merk Investments is making the Merk Hard Currency Fund available to retail investors to allow them to diversify their portfolios and, through the fund, invest in a basket of hard currencies.

Joseph Brusuelas Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.