Gold Price Steep Drop towards Long-term $900 Target Area

Commodities / Gold and Silver 2015 Mar 09, 2015 - 07:50 AM GMTBy: Clive_Maund

Gold did almost exactly what we expected in the last update, it bounced from oversold off the support at $1190 - $1200, only to break sharply to new lows on Friday, crushed by the strength of the dollar. We got with the plot and are doing fine with bear ETFs, one of which rose by 25% on Friday alone. The dollar is remarkably strong especially given that its COTs and sentiment readings are already bearish by normal standards, so what is going on? - and where is the dollar headed?

Gold did almost exactly what we expected in the last update, it bounced from oversold off the support at $1190 - $1200, only to break sharply to new lows on Friday, crushed by the strength of the dollar. We got with the plot and are doing fine with bear ETFs, one of which rose by 25% on Friday alone. The dollar is remarkably strong especially given that its COTs and sentiment readings are already bearish by normal standards, so what is going on? - and where is the dollar headed?

The dollar is so strong because the world economy is about to finally disappear into the deflationary vortex, which our illustrious leaders have been fighting tooth and nail for so long now, which they should as they got us all into this mess in the first place.

The game's over - everyone and everything is maxed out on credit with extend and pretend having been taken to its ultimate conclusion. The misallocated capital from the worldwide orgy of QE has powered an immense carry trade that has driven asset prices to incredible extremes, and the only thing that has kept the game going is very low interest rates, and in the case of the US stockmarket by buybacks by management intent on running up the prices of their stock options, but the situation is now so desperate that rates are at 0 and even running negative in some places. Central Banks are stuffing QE into the gullet of the world economy like they are force feeding a goose, but still they can't stop the forces of deflation, which are gathering in strength and now closing in for the kill.

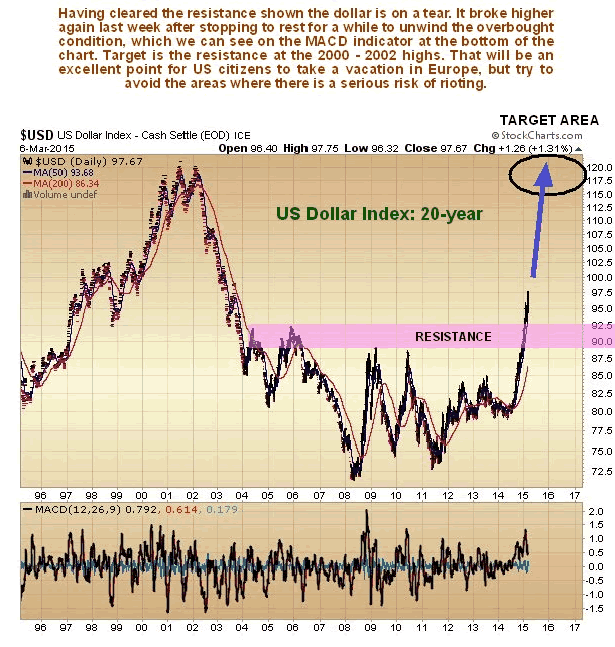

The continuing unwind of the global carry trade is what is driving the dollar higher and higher, and the higher it goes, the more it encourages money to abandon developing markets and return home to the dollar, a classic vicious circle. Where is the dollar index going to end up as a result of this? - an educated guess is the 120 area. For starters have a look at the long-term dollar index chart below which shows a projected target...

If this is what is going to happen to the dollar, then what does it mean for investors, in the simplest terms? It means that cash (the dollar) is King, for a while anyway, and just about everything else is going to collapse, including gold silver and oil, as in 2008 only much worse, because the ammunition that was available then to mount the great extend and pretend campaign ever since has been exhausted. These days, however, we can do a lot better than simply scurry to the safety of the dollar, like scared rabbits. You don't have to get out of your depth selling short or buying Puts, if you don't want to, you can simply buy bear ETFs in just the same way as you buy stocks, and by selecting either leveraged or unleveraged ones, you can choose the level of risk that you are comfortable with.

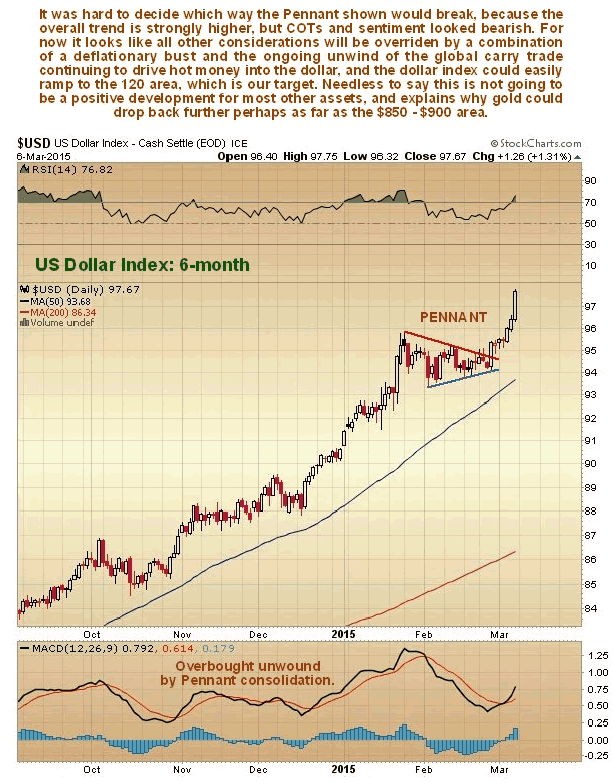

The 6-month chart for the dollar index shows that is on its way again, having broken out upside from a bull Pennant just over a week ago. The near-term target for this move, on an equal move basis, is about 102 and it could easily exceed this as it is a minimum objective.

=

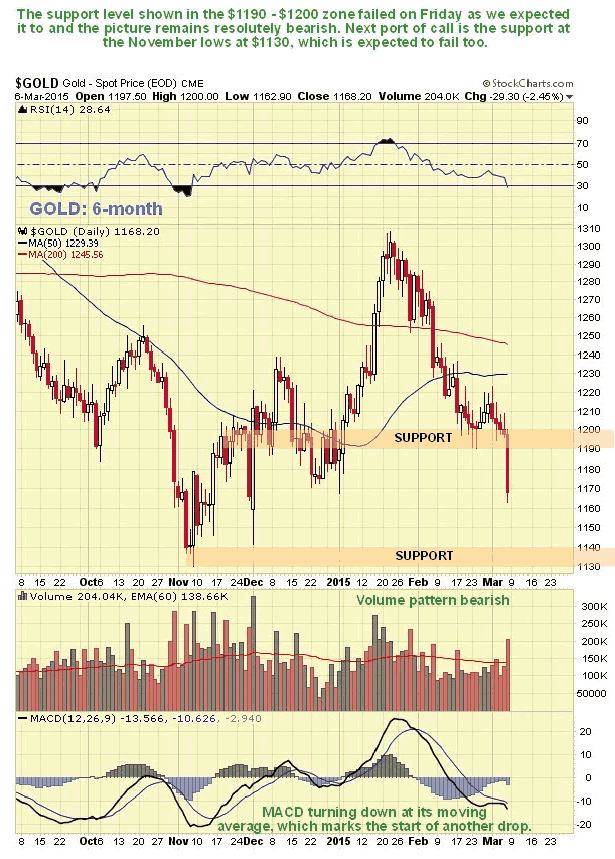

Let's now review the chart. On gold's 6-month chart we can see how it stalled for time at the support at $1190 - $1200 for a couple of weeks, which allowed its oversold condition to unwind a little, but then broke sharply lower on Friday in response to extraordinary dollar strength. It's next port of call should be the support at $1130 - $1140 at its lows of last November, which are expected to fail in due course too.

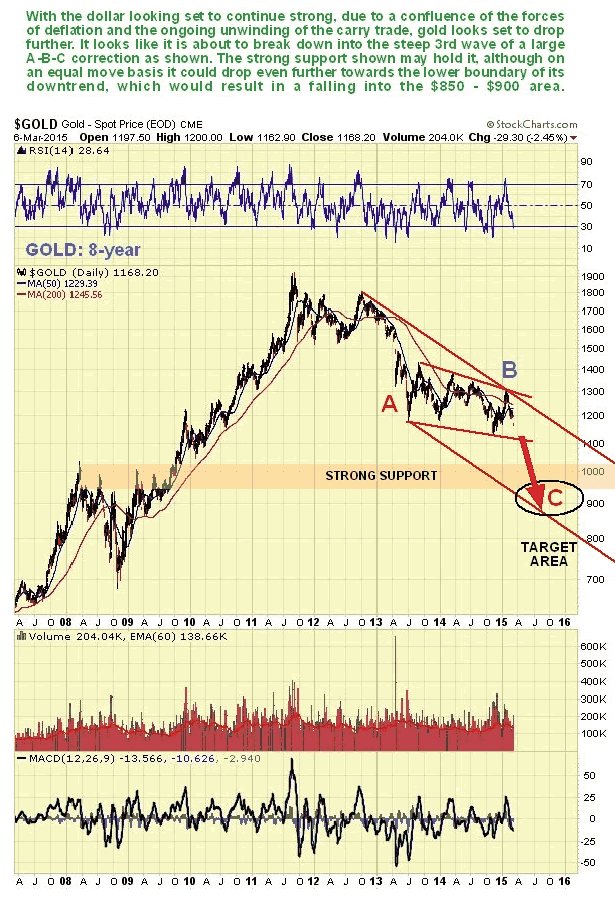

On its 8-year chart gold continues to look weak and like it is setting up for another steep drop at least to its strong support in the $1000 area and possibly lower to the lower boundary of the downtrend channel shown, which would put it somewhere in the $850 - $900 price zone. This would hardly be surprising if the dollar index continues to rally hard towards our price objective in the 120 area. We had concluded in the last update that a giant 3-wave reaction is unfolding in gold, with the C-wave expected to unfold in a similar manner to the A wave which occurred early in 2013, and nothing has happened since to change this outlook, except that it looks even more likely after last Friday's support failure and sharp drop. On the positive side this C-wave should mark the end of gold's bearmarket, although here we should note that if the deflationary collapse is really bad, gold could temporarily go even lower than our downside target detailed here. We will be watching closely to see how it pans out when we get there, as it should present an exceptional buying opportunity.

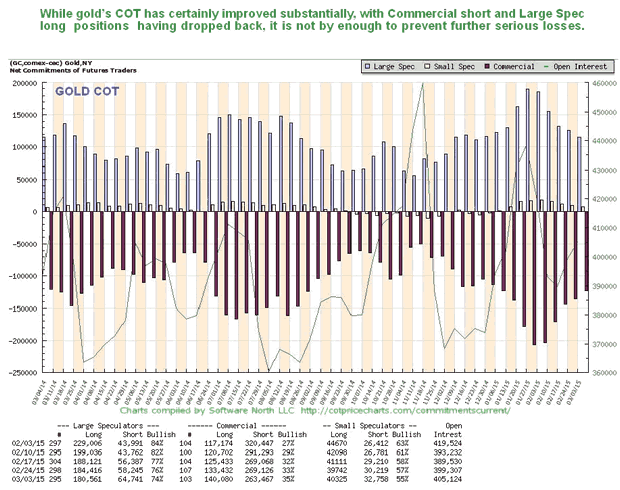

On gold's latest COT chart we see that Commercial short and Large Spec long positions have moderated, but not by enough to prevent further serious losses...

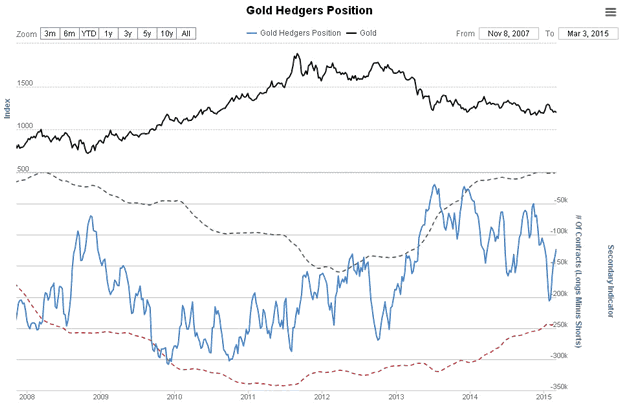

The Gold Hedgers chart is in middling ground and doesn't provide much guidance one way or the other...

Chart courtesy of www.sentimentrader.com

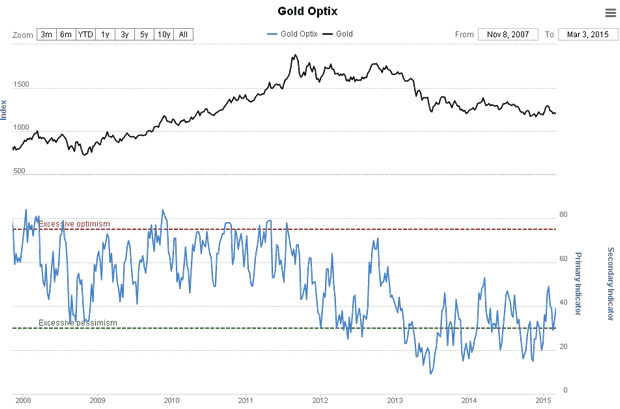

The latest Gold Optix chart is fairly bullish, but not enough to spare gold from another drop, and on any such drop it should of course improve significantly.

Chart courtesy of www.sentimentrader.com

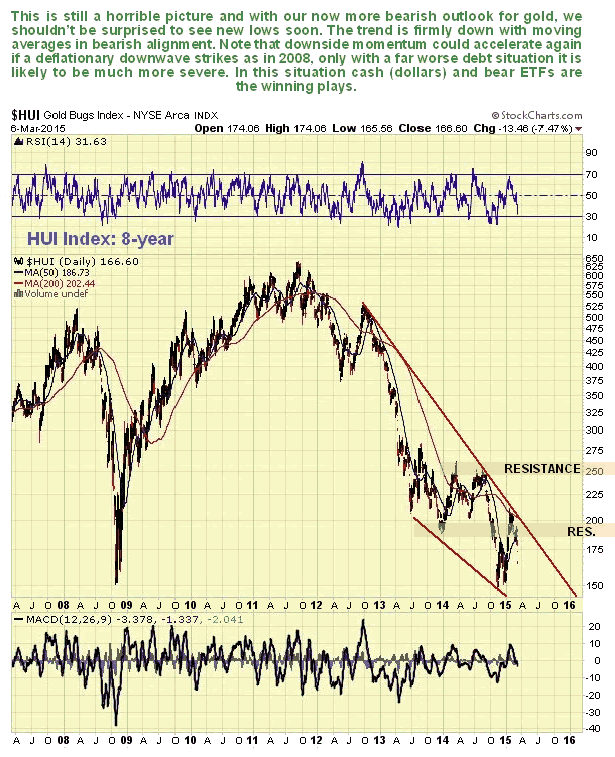

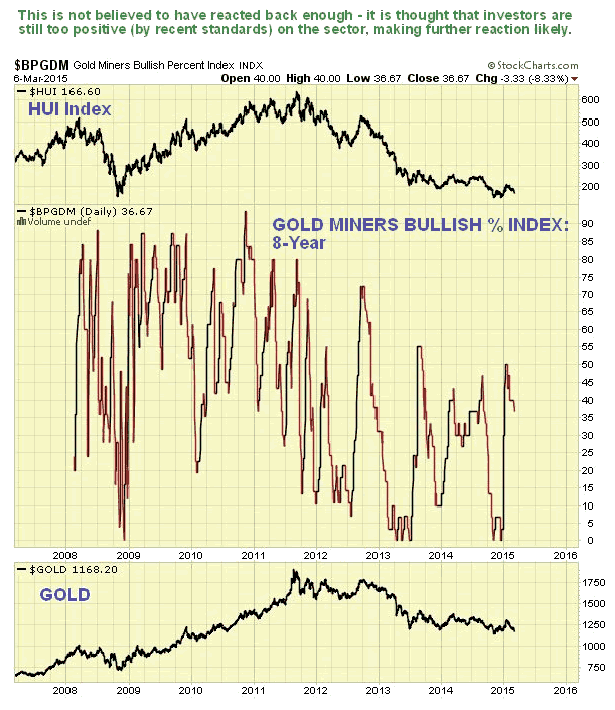

The latest 8-year chart for the HUI index still looks pretty awful, with a severe downtrend in force and its moving averages in bearish alignment. Since it is not now oversold on its MACD indicator shown at the bottom of the chart, it could easily break to new lows and plunge from here, which looks likely given the outlook for gold. The first step towards its negating this bearish scenario will be for it to break out upside from the downtrend channel shown.

The latest chart for the Gold Miners Bullish Percent Index shows that investors haven't thrown in the towel yet on PM sector stocks. They are still too bullish by recent standards, which is not a good sign.

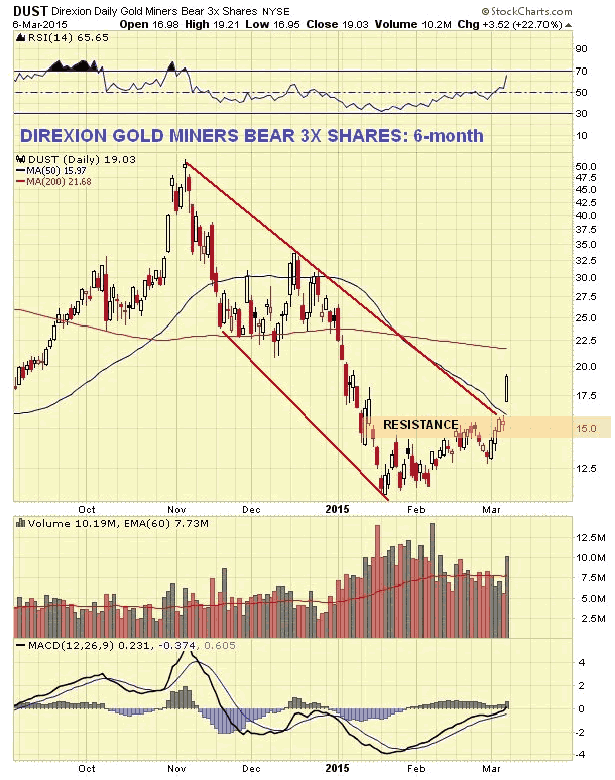

It is vitally important that no matter how much you love gold or silver, you maintain a detached and objective attitude to it, if you are to avoid losses and maximize gains. All investing is an opportunity cost game, and to the pure speculator it doesn't matter if something is rising or falling in price as long as he is on the right side of the trade. It is in this spirit that we bought a range of bear ETFs in the Precious Metals sector early last week, including this one, which rose in price by over 22% on Friday's sector breakdown...

What we would like to do with this is ditch it for a handsome profit at the bottom and reverse position to long. The challenge will be to recognize the bottom.

Finally we should not underestimate the sheer pleasure of ownership that gold bestows. Take Mr Bond in the picture below, for instance. He knows he should have sold this girl in 2011 but he just couldn't bring himself to - and who can blame him? - but he could have hedged of course. Who knows, perhaps he did.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2015 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.