Euro Damaged, Kiwi Panics

Currencies / Euro Mar 10, 2015 - 05:39 PM GMTBy: Ashraf_Laidi

A new 12-year low in the euro against the US dollar and another hit to the New Zealand dollar re-emerged in global markets as Greece and the EU put off talks to another day, while stock traders let the shine of Apple's iWatch presentation wane after it was revealed that the battery life of the much awaited accessory lasted no more than 18 hours.

A new 12-year low in the euro against the US dollar and another hit to the New Zealand dollar re-emerged in global markets as Greece and the EU put off talks to another day, while stock traders let the shine of Apple's iWatch presentation wane after it was revealed that the battery life of the much awaited accessory lasted no more than 18 hours.

Greek debt negotiations with creditors move to a more technical phase as Troika representatives review an updated version of reforms proposed by Varoufakis. The latest agreement reached in February to disburse an additional €7 billion from the current bailout program, but no new funds would be released before completing a full assessment of the Greek economy. The conditions required the govt to demonstrate serious measures about improving tax-collection

Euro falls ahead of Wednesday talks

Greek debt negotiations with creditors advance to a more technical phase as Troika representatives review an updated version of reforms proposed by Varoufakis. The latest agreement reached in February to disburse an additional €7 billion from the current bailout program, but no new funds would be released before completing a full assessment of the Greek economy. The conditions required the govt to demonstrate serious measures about improving tax-collection and undertaking structural changes to the economy. Suggestions have even included employing Greeks and tourists as undercover agents to bolster a tax evasion crackdown.

Finding €555 million under the sofa

The govt will claim € 555 mn in funds from the Hellenic Financial Stability Fund (HFSF), which was designed to recapitalize Greece's top 4 banks in 2012 with European Financial Stability Facility (EFSF) bonds. Athens will also tap into borrowing from pension funds and public sector entities as a way to cover its funding needs for the month.

Stick-carrot approach

Eurogroup chief Dijsselbloem is proposing a carrot-stick approach to the cash disbursement process, suggesting Greece could have access to bailout money as soon as it moves to pass laws and make those structural changes. Payments would be made in separate tranches, but only once reform steps are being implemented. Greece would receive a new payment each time it made material progress toward the goals set by creditors.

Greece is at risk of running out of money before month-end due to shrinking tax receipts and deepening economic slowdown. Greece faces €6 billion in repayment obligations this month, including around €1.5 billion to the IMF and over €3 billion in Treasury bills repayments.

Tsipras govt is exploring the possibility of calling new elections in the event that its proposals for restructuring the economy and finances are rejected by international creditors.

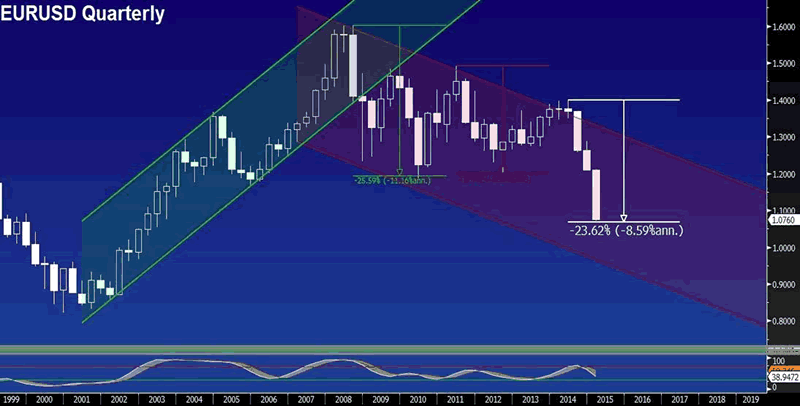

€/$ parity nearing reality

Now that the ECB has kicked off its QE program, the big question remains when will the ECB become satisfied with price stability? Will the ECB focus on a specific figure such as 1.0%, or 1.5%? Or will it address a formula involving GDP growth, inflation and new loans given by banks selling ABS? The ECB should introduce a new forward guidance related to the macro metrics requiring a change in the pace of bond purchase.

More specifically, the euro has nowhere to go but down as the ECB confirmed that asset purchases will extend to bonds with yields as low as -0.20%, implying that there will be sufficient enough bonds covered under the purchase program.

Another hit to the New Zealand dollar

NZD was dealt another overnight hit after the nation's leading dairy cooperative (and world's biggest exporter of dairy products) Fonterra received threats to contaminate baby formula if the govt did not refrain from using pesticide 1080 in controlling wild animals. A letter received by Fonterra threatened to contaminate infant and other formula with 1080 pesticide.

New Zealand dairy industry sustained a major botulism scare in 2013, prompting global recall of Fonterra products and an import ban by China NZ's biggest buyer of New Zealand dairy exports. The scare was eventually unsubstantiated but did shake up NZ's image as the leading of clean and high quality milk.

Last week, the kiwi dropped across the board on an announcement by the RBNZ exploring ways to cap property lending, which was interpreted by traders as a means to allow an impending rate cut.

The fact these two negative events occurred days apart ahead of this week's RBNZ interest rate announcement, raises speculation that the central bank may be ready to make its strongest signal towards slashing rates. NZ's overheating property sector stands as the main obstacle to a rate cut, which the RBNZ would welcome as a means of depreciating the currency. RBNZ chief Wheeler's repetitive attempts to talk down the currency have proven to be a big failure due to the currency's status as the highest yielder with overnight rate at 3.50%. But if the RBNZ sheds more detail on its plan for macroprudential measures towards property, then the currency could take another swift hit this Wednesday, without the help of a rate cut.

Best

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.