The Best Way to Trade off Sony Stock's Success

Companies / Corporate Earnings Mar 11, 2015 - 05:36 PM GMTBy: Money_Morning

Tom Gentile writes: Sony Corp. (NYSE ADR: SNE) had another blockbuster on its hands with its latest movie release, "50 Shades of Grey," based on the best-selling book of the same name. While most parents justifiably didn't take their kids to this movie, adults seeking the cover of a wide release to justify their desire to watch soft-core porn have flocked to the theaters over the last 30 days.

Tom Gentile writes: Sony Corp. (NYSE ADR: SNE) had another blockbuster on its hands with its latest movie release, "50 Shades of Grey," based on the best-selling book of the same name. While most parents justifiably didn't take their kids to this movie, adults seeking the cover of a wide release to justify their desire to watch soft-core porn have flocked to the theaters over the last 30 days.

"Shades" grossed more than $81 million in its opening weekend for the largest single grossing movie opening on record. Will this propel Sony stock to new heights in 2015? Perhaps, but either way, I will tell you how to profit using a simple options strategy.

Where Sony Shares Have Been… and Where They're Going

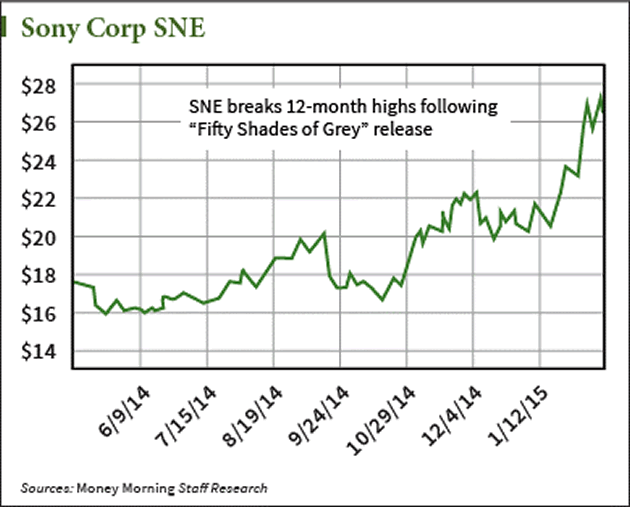

Looking at the shaded areas in the chart below, the stock has languished for most of the last 200 days before breaking out above 20 in November of 2014. This year, in part on anticipation of the movie, the stock is up 30% alone. So kudos to those of you who anticipated how the book's movie manifestation would draw in otherwise closeted soft-core porn patrons, and invested accordingly.

But where do we go from here? There's a possibility of continued gains pushing Sony stock back into price points not seen in years. So what can we expect of the stock in the upcoming months and how should we optimize our profits?

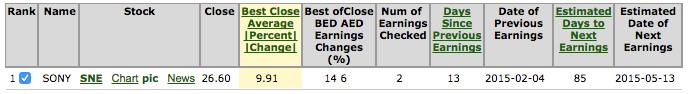

The movie will definitely help Sony's next earnings release, due out in May of this year. I did a little investigating into the last few quarters to see if any spike in price could be a one off. Not likely. Sony stock typically moves on average of just under 10% following an earnings report. The last two quarters saw both a 14% and 6% move to the upside respectively following positive earnings outlooks. So my outlook for Sony, though we may get a temporary pullback, is positive over the next three months.

What's a trader to do when armed with great bullish information on an inexpensive stock? Well, the stock is relatively cheap, so buying 100 shares of stock at the recent price will cost about $2700 plus commissions.

However, there's yet another way to gain the right to buy Sony. This way, if the stock goes up, we can profit from it. But if the price drops, we will leave it behind to those who are long the stock.

This right is called a call option. Call options give us the right to buy a specified stock, at a specified price, for a specified time. You're not bound or obligated to buy the stock. You only exercise the option if you choose. Let's walk through an illustration.

Breaking Down an Option Play on a Promising Stock

Let's take a look at a case study involving the information we have above.

Let's set a scenario for a call option play. We've done our homework, we like what we see in SNE stock for the next quarter, and then start looking at some available options for purchase.

These can be found on most brokerage websites. I am looking at the Sony July 25 calls, trading for $3. Let's break down the graphic below, by label, illustrating our purchase:

- Position - We purchased one contract.

- Num - We bought one contract, good for 100 shares of SNE.

- Option Symbol - A concatenation of option information, beginning with "SNE," the underlying stock that we want to buy options on.

- Expire – The expiration date that the options are good through. In this case, we have four months to expiration of these options (July 25).

- Type – "25 Call" means we have the right to buy SNE at $25 per share

- Entry - The cost of the options. Note: multiply the number of contracts purchased by 100 to get your dollar cost.

- Bid/Ask – The current bid/ask on the option.

What happens from here? Well the stock could go up, down, or sideways. Where the stock goes between now and its July expiration will determine how much profit or loss will be made. I like to graph this out so I can see it in picture form.

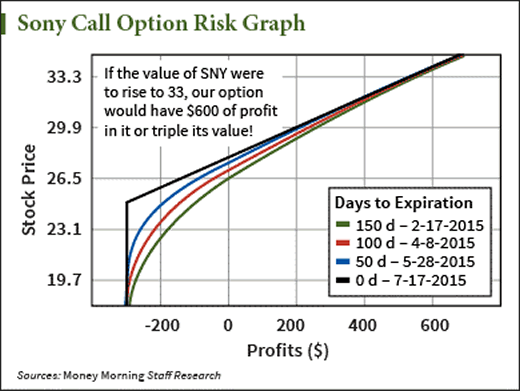

The following chart shows just that.

This is a risk graph of the SNE July 25 calls. Notice the two points in the caption built into the chart. The lower left one shows a loss if SNE were to drop to just above 21 by July, ending with a loss of the total amount spent on the option, or $300.

Now, look what happens if we are right about the promise of Sony stock. The top point shows how much the calls are theoretically worth if SNE reaches $33 by expiration. In this case, your options would have tripled in value from $3 to $9, leaving you with a $6 or $600 per contract profit!

There are many ways that options can be traded, but sometimes the simplest strategy makes the most sense.

Good Trading!

Source :http://moneymorning.com/2015/03/11/the-best-way-to-trade-off-sony-stocks-success/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.