Forex Traders: The Only Question You Should Be Asking

Currencies / Forex Trading Mar 11, 2015 - 05:44 PM GMTBy: EWI

Elliott wave analysis foresaw the USDJPY's recent rally. Find out what else we're expecting for the world's leading forex markets (plus stocks, gold, oil and bonds) -- absolutely FREE

Elliott wave analysis foresaw the USDJPY's recent rally. Find out what else we're expecting for the world's leading forex markets (plus stocks, gold, oil and bonds) -- absolutely FREE

I can't help it. Whenever I read the mainstream financial news, I feel like I'm eavesdropping on a job interview at Microsoft.

In case you don't remember -- Microsoft was made famous, in part, for asking prospective employees one single question: Why is a manhole cover round?

They wanted to assess how a person approaches a question that has many answers. And, many answers are what they got, from the most practical (i.e. "Because a manhole is round") to the most philosophical (i.e. "The circle is the most aesthetically pleasing shape for the human eye.")

I'll now take you back to the world of mainstream finance where those in charge are regularly asked to answer this basic question: Why did market "X" move this way today? And, many answers are what they give.

Take, for a real-world example the March 9-10 upsurge to a 7-and-1/2 year high in the Dollar/Yen currency exchange pair. As for why the USDJPY rallied, the experts offered up these (and many more) explanations:

- A February 6 robust U.S. jobs report

- A February 9 hawkish speech by outgoing Dallas Federal Reserve President

- A February 9 triple-digit rally in U.S. stocks

- A February 8 government report showing Japan's fourth-quarter GDP was lower-than-expected

The truth is, anyone can come up with endless reasons to explain market action -- after the fact.

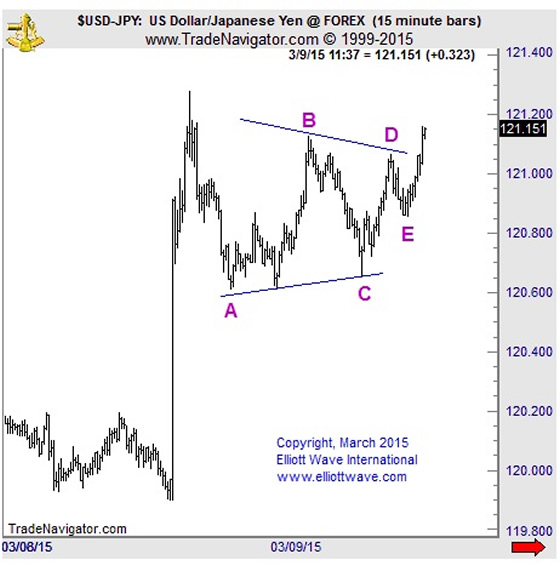

But what about anticipating the market's next move -- before it occurs? That is a question only EWI's Currency Pro Service is equipped to answer. Case in point: At 9:44 a.m. on March 9, Currency Pro Service posted intraday analysis for USDJPY that identified a bullish contracting triangle on the pair's 15-minute price chart.

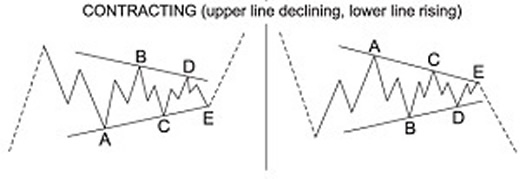

For newbies, an Elliott wave contracting triangle is a sideways pattern comprised of 5 waves, A-B-C-D-E. They most commonly form in 4th wave or B wave position. And when one ends, the resolution is usually sharp and swift. Here is an idealized diagram:

The March 9 Currency Pro Service pinpointed the contracting triangle on the USDJPY chart and set the stage for a powerful near-term rise:

"The pattern can be counted complete, which suggest USDJPY will thrust higher toward the 121.84 high established in early December."

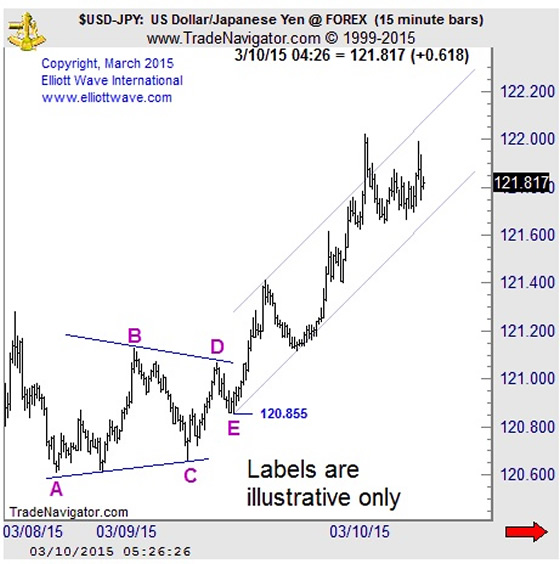

The next chart shows you how the post-triangle thrust propelled prices right into the cited upside target at 121.84.

The mainstream experts always give you plenty of reasons why a certain market did what it did.

But EWI's renowned Currency Pro Service analysts enable you to anticipate what a certain market likely will do in the coming hours, days, weeks and more.

And, there's no better time to experience the incredible resource first hand. Why? Because for the second-time only, EWI has launched a Pro Service Open House event. Open, as in you get complete, no-cost access to Pro Service's premier forecasts for not only Forex -- which Investopedia calls "the most traded market in the world" -- but also the world's leading energy, metals, interest rates, and stocks.

This article was syndicated by Elliott Wave International and was originally published under the headline Forex Traders: The Only Question You Should Be Asking. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.